What is Rosstat

Organizations are required to submit:

- tax reporting,

- financial statements;

- statistical reporting.

The Federal State Statistics Service (Rosstat) is a body that produces official statistical information on the social, economic, demographic and environmental situation of the country.

Since April 3, 2022, Rosstat has been under the jurisdiction of the Ministry of Economic Development of the Russian Federation. It is a very impressive service to match the tasks performed, approximately 18 departments, each of which has from 3 to 8 departments and services in the regions, for example the following divisions:

- Department of Price and Finance Statistics (Department of Statistics of Public Finance and Monetary System, Department of Statistics of Organizational Finance, Department of Consumer Price Statistics, Department of Producer Price Statistics);

- Department of Enterprise Statistics (Department of Continuous Surveys of Small and Medium Enterprises, Department of Structural Statistics and Macroeconomic Calculations, Department of Current Small Business Statistics, Department of Production Indexes, Department of Energy Statistics, Summary Information Department, Department of Statistics of Production of Intermediate and Investment Goods, Department of Statistics of Production of Consumer Goods goods).

The statistics service is designed to collect and analyze information. We are talking about the formation of an information base on the basis of which informed management decisions can be made. It is approximately comparable to the information base of an enterprise, but on a national scale. This information is needed by authorities to improve tax, customs, and investment policies. According to statistics, you can understand how high the tax burden is on enterprises, what state this or that industry is in, how the state is developing, how the situation in certain areas of life is improving or worsening.

The activities of Rosstat are regulated by the Federal Law “On official statistical accounting and the system of state statistics in the Russian Federation” dated November 29, 2007 No. 282-FZ.

The work of Rosstat is planned by the federal plan of statistical work. The plan is regularly adjusted, the document is living.

The rules are configured by the plan:

- the names of official statistical information have been established;

- grouping of information is determined;

- the frequency of work completion and deadlines for provision to users are given;

- general economic indicators of the activities of organizations and monitoring of the most important problems of the socio-economic sphere, from the number of organizations according to state registration data to information for monitoring processes in the real sector of the economy, financial, banking and social spheres of subjects.

The plan determined the directions of Rosstat’s activities:

- population census;

- socio-demographic surveys;

- continuous statistical observations of the activities of enterprises;

- accounting for GDP, GNP and GRP;

- the presence, movement and composition of fixed assets and other non-financial assets of large and medium-sized commercial organizations;

- availability, movement and composition of contracts, leases, licenses, marketing assets and goodwill.

Why is OKPO needed?

Before we tell you how to find out the OKPO code by TIN, let’s define what kind of code it is, why it is needed and where it is used.

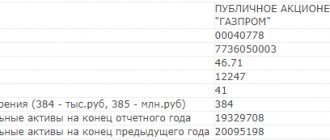

The all-Russian classifier of enterprises and organizations is assigned to each economic entity that operates in our country. Moreover, the procedure and features of assigning OKPO are strictly enshrined in Rosstat Order No. 211 dated March 29, 2017. There are online services on the Internet that allow you to quickly and free of registration find OKPO using the organization’s TIN. The code allows not only to identify a specific economic entity from numerous entrepreneurs, organizations and enterprises in Russia, but also to determine key information on it. OKPO is widely used for processing and automating statistical data and other types of reporting information.

OKPO is indicated in the following types of documentation:

- source documents;

- accounting registers and reporting;

- statistical and tax reporting;

- personnel and legal documentation.

Therefore, OKPO is an important requisite that is simply necessary in the work. It is assigned to each economic entity at the time of its registration (creation). Information about OKPO, as well as other company registration data, is contained in a special notification from the statistical authorities, which comes at the very beginning of the company’s activities.

However, a letter from Rosstat may not be available at the moment. You can find out OKPO online by TIN for free using special services.

Types and forms of statistical reporting

To implement the plan for monitoring enterprises, Rosstat carries out two types of monitoring of the activities of organizations:

A. Continuous surveillance for small and medium-sized businesses is carried out every five years. It was last held in 2021;

B. Sample observation is carried out periodically and continuously. The composition of the reporting may change from year to year. The most common forms submitted by small and micro enterprises and individual entrepreneurs are 1-IP, MP (micro) - in kind, PM, TZV-MP, etc. The basis for their confirmation is logically the financial statements, the data from which will come from the Federal Tax Service.

Examples of reporting to Rosstat

On the Rosstat website you can see a list of all forms of statistical observation, but it is quite difficult to parse it in relation to yourself. We do not provide a complete list of forms here; it changes regularly. There are quite a few forms of statistical reporting. We ourselves use two useful sources:

- Directory of statistical forms;

- Calendar stat. reporting.

As an example, here are the most mentioned statistical forms

annual statistical forms:

- MP (micro) - data on the main performance indicators of a micro-enterprise,

- 1-Enterprise - about the activities of the organization,

- 1-T “Information on the number and wages of employees”,

- No. 7-injuries - about injuries at work and occupational diseases,

- 12-F - on the use of funds,

- 57-T - on wages of workers by profession and position,

- 23-N - on the production, transmission, distribution and consumption of electrical energy,

- 4-TER - on the use of fuel and energy resources;

quarterly:

- P-4 (NZ) “Information on underemployment and movement of workers”,

- P-4 - on the number and wages of employees,

- P-2 - about investments in non-financial assets,

- PM - about the main performance indicators of a small enterprise,

- P-5 (m) - basic data on the organization’s activities,

- 5-Z - about the costs of production and sale of products (goods, works, services).

monthly:

- P-1 “Information on the production and shipment of goods and services”,

- P-4 - on the number and wages of employees,

- P-3 - about the financial condition of the organization.

The deadline needs to be clarified with Rosstat:

- Labor force sample survey questionnaire (form N 1-З, on the 8th day after the survey week from the report for December 2022),

- Labor force sample survey questionnaire (form N 1-З, on the 8th day after the survey week from the report for January 2022),

- Information on the activities of a collective accommodation facility (form N 1-KSR, at the end of work (season),

- Survey questionnaire for individual entrepreneurs transporting goods on a commercial basis (form N 1-IP (truck cargo),

- Sample survey of the activities of small enterprises in the field of road transport (form N PM-1 (truck).

Public services

This option was allowed for reporting as part of the general census of Rosstat in 2022. The method turned out to be quite convenient. So, most likely, it will be in demand next time. You can set up your account in advance. This is done simply:

- log in to your “Personal Account”;

- create an individual entrepreneur or organization account (you will have to fill out a form, some of the data in which is downloaded automatically from the “Personal Account”);

- find the service you need on the website, fill out the document and send the information;

- wait for the notification that the report has been accepted, which serves as confirmation that the form has been completed correctly.

Who should report to Rosstat and how?

Statistical reports must be submitted (Article 5 No. 209-FZ):

- bodies of state power and local self-government;

- legal entities of the Russian Federation;

- individual entrepreneurs;

- branches and representative offices of Russian organizations.

Further we are talking only about 2-4 categories of accountable persons. So, the law distinguishes small, medium and large businesses, which are required to submit statistical reports. Who is a small business? The law defines the categories for classifying companies and individual entrepreneurs as small and medium-sized businesses (Article 4 Categories). The basic requirements are:

- The share of participation of other Russian legal entities in the authorized capital of the LLC cannot be higher than 25%, and the share of foreign companies - 49% ;

- The number of employees should not exceed the limits established by law: for micro-enterprises no more than 15 people , for small enterprises - the maximum allowable value of 100 people, for medium-sized enterprises - no more than 250 people;

- Annual income should not exceed the limits: microenterprises - 120 million rubles ; small enterprises - 800 million rubles; medium-sized enterprises - 2 billion rubles (Resolution of the Government of the Russian Federation dated April 4, 2016 No. 265).

Companies that are not small and medium-sized businesses submit basic statistical reporting and additional ones. Here you can check the presence of a company in the small business register.

Submission of reports to Rosstat is carried out only in electronic form

Submitting reports to Rosstat on paper does not fully meet the objectives of digitalization of public administration and is associated with a decrease in the quality of work with the specified data, as well as the risk of their unreliability. In this regard, on December 30, 2020, amendments were made to Federal Law No. 282 and obligated everyone to submit statistical reporting only in electronic form with an electronic signature. Small businesses received a deferment until 2022.

However, starting with reporting for 2022, all organizations are required to submit all accounting (financial) statements to the Federal Tax Service in the form of an electronic document signed with an electronic signature.

So, respondents, with the exception of citizens, are obliged to provide Rosstat free of charge with primary statistical data and administrative data necessary for the formation of official statistical information, including data containing information constituting a state secret, information constituting a commercial secret, information about taxpayers, personal data of individuals and other information, access to which is limited by federal laws in the form of an electronic document signed with an electronic signature (Article 8 of Federal Law 282-FZ).

When are statistics codes required?

Enterprises are not required to provide an OKVED letter. Providing an Information Letter on registration in the Statregister of Rosstat (another name is the Information Letter from the State Statistics Committee on registration in the Unified State Register of Pools of Economics, statistics codes) is not mandatory:

- at the bank when opening a current account (letter of the Central Bank dated October 27, 2011 No. 011-31-1/4394);

- in off-budget funds (Federal Law of December 23, 2003 No. 185-FZ),

- in the customs authorities (letter of the Federal Customs Service dated December 19, 2011 No. 01-18/62041),

- when licensing,

- to participate in tenders,

- during audits.

How to find out about reporting to Rosstat by TIN

It’s easy to get a list of reports to Rosstat for your enterprise:

- Find out the TIN of your company;

- We go to the Rosstat statistical reporting service , enter our details and receive a list of reports for the organization.

The service has been operating since February 2022, generating a list of statistical reporting forms that a specific legal entity must submit, indicating their name. Information on the site is updated monthly.

If questions arise (an official letter is needed, there are no indicators), then the organization can contact the territorial body of Rosstat with an official letter in free form (clause 2 of Rosstat letter dated January 22, 2018 No. 04-4-04-4/6-smi):

Application for confirmation/exclusion in full or in part from the list

Primer LLC is engaged in retail trade in food products. According to the Rosstat FSGS website, our legal entity is required to submit the following types of reporting:

- P-2 “Information on investments in non-financial assets”;

- P-2 (investment) “Information on investment activities”;

- Form 12-pipes (petroleum products) “Information on main oil product pipeline transport.”

We inform you that our organization has no relation to such activities. Primer LLC does not have the indicators to fill out the listed forms due to XXXXX.

Please:

- exclude the listed reports from the Rosstat FSGS list;

- when making changes to the list of reports, update the information on the Rosstat FSGS website;

- send an updated official list of statistical reporting for Primer LLC TIN

Please send a response to this letter to XXXX

Rosstat official answers about the statistical forms service

Answers from Rostat letters dated February 17, 2022 No. 04-04-4/29-SMI and dated July 26, 2016 N 04-04-4/92-SMI were used.

Is official data posted on the FSGS resource?

Yes, the resource contains official data.

If it says there that an organization must submit one form or another, does that mean a fine for failure to submit it will be legal?

Yes, in accordance with subparagraph c) of paragraph 2 and paragraph 4 of the Regulations on the conditions for the mandatory provision of primary statistical data and administrative data to subjects of official statistical accounting, approved by Decree of the Government of the Russian Federation of August 18, 2008 N 620.

How can you find out exactly whether a company is required to submit a form or not?

The list of federal statistical observation forms is compiled as of the end of the year preceding the reporting year, with monthly updating in connection with structural changes in business entities (liquidation of enterprises, creation of new ones, reorganization, change in the status of an organization, etc.). Existing organizations should receive information about the list of federal statistical observation forms at the end of the year preceding the reporting year; newly created organizations should check the information monthly during the first year of their creation. If the respondent is not on the list, reporting is not provided, unless the organization has been notified in writing.

Do Rosstat employees themselves use this resource to find out who is required to submit which forms?

Yes, employees of Rosstat and its territorial bodies use the above resource.

If the FSGS lists the form as mandatory, and the statistics agency has confirmed in writing that it is not necessary to submit it, does this exclude a fine for failure to submit the form?

If the organization has been informed in writing that the form does not need to be submitted, no penalties will be imposed on it.

How to use the new service?

The entrepreneur must enter his OKPO and TIN codes, as well as his state registration number (OGRN or OGRNIP). After this, a list of mandatory reporting forms is downloaded to the user’s computer automatically. The same table provides the frequency and deadline for submitting reports, as well as links to Rosstat pages where you can download their forms for filling out for free. The system works even if the user entered only one of the above search parameters, however, in this case, the list of reports may be incorrect.

Why does the information change: one day one, two days later another? Is this related to the update system? How does it update?

The information retrieval system was developed in 2016 in order to promptly inform business entities about their provision of statistical reporting forms. The list of federal statistical observation forms posted in the specified system for respondents is compiled as of the end of the year preceding the reporting year, with its monthly updating. The monthly updating of lists of forms in the system is due to ongoing structural changes in business entities (liquidation of enterprises, creation of new ones, reorganization, change in the status of an organization, etc.), as well as the frequency of providing statistical reporting forms (monthly, quarterly, semi-annual). Existing organizations should receive information about the list of federal statistical observation forms at the end of the year preceding the reporting year; newly created organizations should check the information monthly during the first year of their creation. Considering the importance of this service for respondents, in the first half of 2022 Rosstat will make significant improvements to the interface aimed at optimizing and increasing the stability of its operation.

Why are “unnecessary” forms included in the lists? What should companies do?

Lists of federal statistical observation forms to be submitted by respondents are formed on the basis of statistical methodology, taking into account the types of economic activities of the organization, including all those declared during state registration. A number of federal statistical observation forms, according to instructions for filling them out, are provided only in the presence of an observed event. Providing “zero” reports for the reporting period on such forms is not required, and the absence of a report is qualified as the absence of a phenomenon by the respondent. For federal statistical observation forms, the instructions for completing which do not contain a requirement to provide data only if a phenomenon exists, it is possible for respondents to inform the territorial bodies of Rosstat in the constituent entities of the Russian Federation with an official letter about the absence of indicators for specific forms of statistical reporting instead of providing “zero” reports (in case of absence of the phenomenon).

Which companies does Rosstat send letters with a list of reports to? To those who were included in the sample?

In accordance with paragraph 4 of the Regulations on the conditions for mandatory provision of primary statistical data and administrative data to subjects of official statistical accounting, approved by Decree of the Government of the Russian Federation of August 18, 2008 No. 620, territorial bodies of Rosstat are obliged to inform (including in writing) respondents about carrying out federal statistical observation in relation to them. Informing respondents is carried out by posting lists of reporting forms in the information retrieval system. The sending of an information letter about the conduct of federal statistical observation in relation to an economic entity is, as a rule, carried out to respondents included in sample surveys.

What should those who received a letter from statistics with a list of forms do, but some of the reports from the list are not on the site? Submit a report or clarify information with a statistics agency? How can I clarify?

Organizations included in sample surveys may be notified in writing by state statistics bodies about the provision of specific forms of federal statistical observation. If the list of reporting forms published for the respondent at statreg.gks.ru differs from the one sent to the organization in writing, the written notification should be followed. If it is necessary to clarify questions about filling out and submitting federal statistical observation forms, organizations can contact the territorial body of Rosstat in the constituent entity of the Russian Federation at the location of the organization.

What should companies do to avoid fines? Should I contact the statistics agency in writing? How to prove that we did not miss the deadline, but did not know about the report, since it was not on statreg.gks.ru?

If the organization is not on the list, penalties under Article 13.19 of the Code of Administrative Offenses of the Russian Federation are not applied, except in cases where the respondent, in the manner provided for in paragraph 4 of the Regulations, was informed (including in writing) about the conduct of federal statistical observation against him on specific Federal statistical observation forms are required to be submitted. “Screenshots” are only valid evidence if they contain certain data, i.e. they indicate the date and time of receipt of information from the site on the Internet, contain data about the person who displayed it on the screen and subsequently printed it, data about the software and computer equipment used, the name of the site, and affiliation with the applicant. Thus, if these requirements are met, “screenshots” can serve as supporting documents.

Firmmaker, February 2017 (updated annually) Evgeniy Morozov When using the material, a link is required

Application of OKATO

The OKATO code is used for tax accounting and reporting. The tax authorities need it to determine in which administrative territory the organization is located and where it pays taxes. OKATO allows state statistical bodies to take into account and systematize economic entities, with its help government agencies:

- automate information exchange;

- sum up the collection of payments in each region;

- determine the standard of living of citizens;

- Welfare coefficients are recorded.

For us, OKATO is important as a document requisite. Until 2014, it was used in reporting, payment documents for tax purposes, tax returns, and government forms. But since January 2014, it was replaced by the OKTMO code, which now replaces OKATO in documents. It was introduced to clarify the classification; the OKTMO code specifies the locality in which the company operates.

If instead of OKTMO in the document details you indicate the OKATO code, then using the correspondence tables the tax authorities will determine the OKTMO code and credit the payment to it. But this will lead to the transfer of funds to another budget, then you will need to submit an amendment.

Organizations registered in 2014 and later are issued an OKTMO code upon registration. And each obsolete OKATO code corresponds to an OKTMO code.