Analysis of the balance sheet data of an enterprise gives an idea of its current economic condition. The ratio of assets and liabilities allows us to draw conclusions about the liquidity of the enterprise and its solvency. Current assets on the balance sheet refer to resources directly involved in turnover that can generate profit over a short period of time.

What are current assets

Assets are understood as all own and attracted resources that are used by the enterprise to make a profit.

The classification provides for the grouping of funds according to structural characteristics. The main types of enterprise resources are:

- Owned or rented - depending on the type of ownership.

- Tangible, intangible, financial - according to forms of functioning.

- Current (short-term) and non-current (long-term) - according to the nature of participation in the financial and economic activities of the enterprise.

- Liquid and illiquid - according to the degree of liquidity.

- Net and total - by sources of formation.

In accordance with the above classification, we will talk about the working resources of the enterprise, the period of use of which does not exceed 12 months from the moment of their acceptance for accounting, commissioning, or no more than one production cycle if its duration is more than 12 months ( clause 19 of PBU 4/99). The remaining groups of funds are classified as non-current (long-term).

Current assets on the balance sheet - fill line

The presence of current assets, their volumes, composition can be found out from the financial statements. It is enough to analyze the available working resources. In essence, current assets are in the balance sheet and there is data in Section II “Current assets”. This includes the following lines:

- 1210 ― the organization’s reserves available at the time of reporting;

- 1220 - the amount of non-written off “input” VAT during the reporting period;

- 1230 - the amount of accounts receivable, with the exception of debts of counterparties, which are characterized as long-term;

- 1240 - financial investments of an organization that are short-term in nature (loans provided to employees and other persons, shares, shares, etc.);

- 1250 - cash reserves and their equivalents owned by the enterprise;

- 1260 - other current assets, which include other settlements with counterparties, completed stages of work in progress, shortages for which no decision has been made on further write-off, amounts of excise duties and taxes that are recognized later, as well as other assets not included in the above.

How is liquidity determined?

Liquidity of current assets is the ability of short-term resources to be converted into cash.

All funds are reflected in the financial statements in increasing order of their liquidity level. Due to the fact that TAs are short-term in terms of circulation speed, they are characterized by the highest degree of conversion into cash.

To calculate the liquid level, the current liquidity ratio is used, showing the institution’s ability to use liquid resources to pay for short-term obligations that have arisen.

The index is defined as the ratio of the TA value to the total indicator of current liabilities, formed from lines 1510, 1520, 1550 of the final financial statements.

Organizational assets

The assets of an organization include all property owned by an economic entity. These include financial, material, and intangible resources. Conventionally, assets can be divided into several categories. For example, according to the degree of implementation and the speed of conversion into cash, they distinguish:

- assets with the highest degree of liquidity (cash, securities);

- quickly realizable assets (inventories, working capital, accounts receivable with a short maturity);

- slowly selling assets (long-term accounts receivable);

- hard-to-sell assets (fixed assets, intangible assets, other non-current assets).

Based on the period of circulation, available resources are divided into current and non-current. Negotiable assets have a short circulation period. This group includes materials, inventories, finished products, and cash directly. Non-current assets take an indirect part in the production cycle and are classified as long-term, for example, intangible assets, fixed assets.

Based on the above classifications, we can conclude that current assets are quickly realizable working capital, have a fairly high degree of liquidity, and are direct participants in the production cycle.

Structure of the enterprise's balance sheet

The balance sheet form used for official reporting in the Russian Federation is a table divided into two parts: the asset and liability of the balance sheet. The total amounts of assets and liabilities of the balance sheet must be equal.

A balance sheet asset is a reflection of the property and liabilities that are under the control of the enterprise, are used in its financial and economic activities and can bring it benefits in the future. The asset is divided into 2 sections:

- non-current assets (this section reflects property used by the organization for a long time, the cost of which, as a rule, is taken into account in the financial result in parts);

- current assets, data on the availability of which are in constant dynamics, accounting for their value in the financial result, as a rule, is carried out one-time.

Read more about them in the material “Current assets on the balance sheet are...” .

The balance sheet liability characterizes the sources of those funds from which the balance sheet asset is formed. It consists of three sections:

- capital and reserves, which reflect the organization’s own funds (its net assets);

- long-term liabilities, which characterize the debt of an enterprise that has existed for a long time;

- short-term liabilities showing an actively changing part of the organization's debt.

To learn about which entries are used when reflecting equity capital in accounting, read the article “Procedure for accounting for an organization’s equity capital (nuances).”

Short-term liabilities

Short-term liabilities are obligations that are covered by current assets or repaid as a result of the formation of new short-term liabilities.

Short-term liabilities are usually repaid over a short period (no more than one year). Isolating short-term liabilities into a separate group is important for monitoring balance sheet liquidity.

Short-term liabilities in the balance sheet are section V “Short-term liabilities”. Current liabilities include:

- short-term loans;

- current debt on long-term liabilities;

- short-term bills issued;

- debt to suppliers and contractors;

- debt on taxes and fees;

- debt to personnel;

- revenue of the future periods;

- reserves for future expenses;

- other short-term liabilities.

Structure and types

The composition of the company's current assets includes the following types:

- Inventories, including raw materials and finished products.

- Accounts receivable.

- Cash and cash equivalents, including the company's financial investments.

- Tax requirements, including VAT on purchased assets.

- Other: future expenses.

Circulation funds included in current assets must have a maturity of no more than 1 year. The exception is when the organization is confident that these longer maturities can be quickly converted into cash without loss of value.

Accounting provides several criteria for classifying working capital.

By type:

- raw materials and materials;

- finished products;

- accounts receivable;

- cash;

- short-term financial investments;

- other: deferred expenses, VAT received, etc.

By sources of formation:

- Gross current assets (GCA), which includes the entire set of current assets formed both from own and borrowed funds.

- Net current assets (NOA), which are formed from equity capital and long-term liabilities. Calculation formula: NOA = SAI – KFO, where KFO are short-term financial liabilities.

- Own current assets (COA), which are formed exclusively at the expense of the enterprise’s own funds: COA = VOA – KFO – DFO, where DFO are long-term financial liabilities.

By liquidity level:

- Absolutely liquid, not requiring sale: that is, all money, regardless of the currency in which it is denominated.

- Highly liquid, which can be converted into cash without losing its value and used to finance current expenses. These include financial investments and receivables with short maturities.

- Medium-liquid assets that can be converted without loss of value within 6 months. This is all receivables minus short-term and hopeless accounts receivable, as well as products ready for sale.

- Low-liquidity, the conversion of which without a significant loss of value requires more than six months. These include raw materials, semi-finished products and work in progress.

- Illiquid assets that cannot be sold separately from the enterprise itself. These are accounts receivable that cannot be collected and deferred expenses.

Depending on the duration of operation:

- The constant part is the minimum that is necessary to ensure the stable operation of the enterprise.

- The variable part is the share of current assets, the value of which depends on the volume of production that has developed at a certain point in time. It may be influenced by the seasonal nature of consumption of manufactured products or general changes in market conditions.

The structure of current assets is the relationship between various elements divided according to one or another characteristic. It is inextricably linked with the specifics of the production process, existing relationships with suppliers and customers, as well as the company’s policy for managing investment processes.

Determination and analysis of the structure of the PA is one of the most important stages of the management process. Without it, it is impossible to ensure the stable development of the company.

The concept of current or current assets

The table below clearly demonstrates the company's asset structure.

Current or current assets are part of the total assets of an organization whose circulation period is less than 1 year . It can be longer, but only if this is due to the peculiarities of the production cycle of a particular enterprise. In the balance sheet these are the lines of the second section.

Current assets are divided into:

- Production assets that are completely consumed in the manufacturing process, and within just one cycle, as a result of which their cost is fully included in the price of the finished product. These are stocks of materials, objects of labor, work in progress. This also includes expenses incurred at the current time, but the purpose of which is to ensure production in the future.

- Circulation funds that do not take part in the production process. These are finished products, money, debt to customers who have been granted a deferment, etc.

Composition of balance sheet items

Balance sheet items are filled out based on data on balances in accounting accounts as of the reporting date. When filling out a report for submission to the Federal Tax Service, you must be guided by a number of rules established for the preparation of such reports (PBU 4/99, approved by order of the Ministry of Finance of Russia dated July 6, 1999 No. 43n):

- The initial accounting data must be reliable, complete, neutral and formed in accordance with the rules of the current PBU. When reflecting them, it is necessary to comply with the principles of materiality and comparability with the results of previous periods.

- In the current report, data from previous periods must be consistent with the figures in the final accounts for those periods.

- For the annual balance sheet, the presence of property and liabilities must be confirmed by the results of their inventory.

- Debit and credit balances in the balance sheet are not collapsed.

- Fixed assets and intangible assets are shown at residual value.

- Assets are reflected at their book value (less created reserves and mark-ups).

You can see a detailed line-by-line algorithm for filling out the balance sheet in the Guide to Accounting Reports from ConsultantPlus, having received free access to the system.

And below is information about on the basis of the balances of which accounts the above balance sheet items are filled in in relation to the current version of the chart of accounts, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n:

- Under the article “Intangible assets”, the residual value of intangible assets is indicated, corresponding to the difference in the balances of accounting accounts 04 and 05. At the same time, for account 04, data falling in the line “Results of research and development” is not taken into account, and for account 05 - figures related to intangible search assets.

- The article “Results of research and development” is filled in if there is data on R&D costs in account 04.

- Data on the items “Intangible exploration assets” and “Tangible exploration assets” are important only for those organizations that develop natural resources if they have information on account 08 to fill out lines for these items. Tangible exploration assets include tangible objects, and intangible assets include all others. Both types of assets are subject to depreciation, recorded in accounts 02 and 05, respectively.

- For the item “Fixed Assets”, data on the residual value of fixed assets (the difference in the balances of accounting accounts 01 and 02, while account 02 does not take into account data related to material exploration assets and profitable investments in assets) and capital investment costs (account 08, excluding the figures included in the lines of the articles “Intangible search assets” and “Tangible search assets”).

- Data for the article “Profitable investments in assets” is taken as the difference between the balances of accounts 03 and 02 in relation to the same objects.

- The item “Financial investments” in non-current assets is filled in if there are amounts with a repayment period of more than 12 months in accounts 55 (deposits), 58 (financial investments), 73 (loans to employees). The balance of account 58 is reduced by the amount of the created reserve (account 59) related to long-term investments.

- Under the article “Deferred tax assets”, organizations applying PBU 18/02 indicate the balance of account 09.

- When the line item “Other non-current assets” is used, the balance sheet reflects assets that are either not included in the above lines, or those that the organization considers necessary to highlight.

- The figure for the item “Inventories” is formed as the sum of the balances on accounts 10, 11 (minus the reserve recorded on account 14), 15, 16, 20, 21, 23, 28, 29, 41 (minus account 42, if accounting for goods carried out with a markup), 43, 44, 45, 46, 97.

- The item “VAT on purchased valuables” reflects the balance of account 19.

- To obtain the data indicated under the “Accounts receivable” item, debit balances on accounts 60, 62 (both accounts minus the reserves formed on account 63), 66, 67, 68, 69, 70, 71, 73 (minus data , recorded under the article “Financial investments”), 75, 76.

- The article “Financial investments (except for cash equivalents)” in current assets shows data on accounts 55 (deposits), 58 (financial investments), 73 (loans to employees) with repayment periods of less than 12 months. In this case, the figures in account 58 are reduced by the amount of the created reserve (account 59) for short-term investments.

- The data for the item “Cash and cash equivalents” is obtained by adding the balances of accounts 50, 51, 52, 55 (excluding deposits), 57.

- The line of the article “Other current assets” includes assets that are either for some reason not reflected in the above lines, or those that the organization considers necessary to highlight. For example, this could be a bad debt from a counterparty or the value of stolen property for which investigative actions have not yet been completed. Reflection of such data on this line with a corresponding reduction in figures for those items in which they could have been reflected if there had not been a decision by the organization to allocate them, will require notes both to the article “Other current assets” and to the second article, which will be affected such an operation.

- The data for the article “Authorized capital (share capital, authorized capital, contributions of partners)” is taken as the balance of account 80.

- The figures in the article “Own shares purchased from shareholders” correspond to the balances of account 81.

- For the article “Revaluation of non-current assets”, data on balances on account 83 related to fixed assets and intangible assets is used.

- Data for the item “Additional capital (without revaluation)” is formed as balances on account 83 minus data on the revaluation of fixed assets and intangible assets.

- The item “Reserve capital” shows the balance of account 82.

- The value reflected under the item “Retained earnings (uncovered loss)” in the annual balance sheet is the balance of account 84. For interim reporting (before the balance sheet reformation carried out at the end of the year), this figure is the sum of two balances: for account 84 (financial the result of previous years) and 99 (financial result of the current period of the reporting year). The item “Retained earnings (uncovered loss)” is the only balance sheet item that can have a negative value. At the same time, it is important that for an organization that has a loss, the total of the “Capital and Reserves” section (net assets) does not turn out to be less than the amount of the authorized capital. If this circumstance occurs for two financial years in a row, then the organization must either reduce its authorized capital to the appropriate figure (and this is not always possible, since the authorized capital cannot be less than the minimum value established by current legislation), or it is subject to liquidation.

ATTENTION! With the reporting campaign for 2022, changes to PBU 18/02, 16/02, 13/2000, FSBU 5/2019 “Reserves” come into effect. And starting with reporting for 2022, the new FSBU 25/2018 “Lease Accounting”, FSBU 6/2020 “Fixed Assets”, FSBU 26/2020 “Capital Investments” should be applied. You can start applying new accounting standards earlier. This decision needs to be fixed in the accounting policy of the enterprise.

Read more about the reformation of the balance sheet in the article “How and when to reform the balance sheet?” .

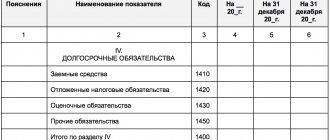

- The article “Borrowed funds” in the “Long-term liabilities” section is filled in if there is debt on loans and borrowings, the repayment period of which exceeds 12 months (account balance 67). In this case, interest on long-term borrowed funds must be taken into account as part of short-term accounts payable.

- Under the article “Deferred tax liabilities”, organizations applying PBU 18/02 indicate the balance of account 77.

- The value under the item “Estimated liabilities” in the section “Long-term liabilities” corresponds to the balance in account 96 (reserves for future expenses) in relation to those reserves whose useful life exceeds 12 months.

- The item “Other liabilities” in the section “Long-term liabilities” shows liabilities with a maturity of more than 12 months that are not included in other lines of long-term liabilities.

- The article “Borrowed funds” in the “Short-term liabilities” section is filled in if there is debt on loans and borrowings, the repayment period of which is less than 12 months (account balance 66). At the same time, this includes interest on long-term borrowed funds, recorded in account 67, and debt on long-term loans and borrowings, recorded in account 67, if there are less than 12 months left until its repayment.

- The data for the “Accounts payable” item is formed as the sum of credit balances for accounts 60, 62, 68, 69, 70, 71, 73, 75, 76.

- For the item “Deferred income” the value is taken as the sum of balances on accounts 86 (target financing) and 98 (deferred income).

- The value under the item “Estimated liabilities” in the section “Short-term liabilities” corresponds to the balance in account 96 (reserves for future expenses) in terms of those reserves whose useful life is less than 12 months.

- Under the item “Other liabilities” in the section “Short-term liabilities”, liabilities with a maturity of less than 12 months are shown that are not included in other lines of short-term liabilities.

Read about one of the most frequently created short-term reserves in the material “Creating a reserve for vacation pay in accounting.”

Accounting of enterprise assets

Assets in accounting are owned real estate, goods, raw materials, products, money and monetary claims to counterparties, and other accounting objects that are reflected on the left side of the enterprise’s balance sheet.

For accounting of enterprise assets and transactions carried out with them, data from the following main accounting accounts is used: 01–26, 29, 40, 41, 44, 45, 50–58, 60, 62, 68–73, 75, 76, 97. Assets are divided into:

- negotiable and non-current;

- tangible and intangible (hereinafter referred to as intangible assets);

- high-, medium-, low-liquid and illiquid.

Current assets are those items that are consumed in the course of business activities (for example, inventories, cash, etc.). And non-current assets do not directly participate in the economic turnover of the enterprise (for example, fixed assets, long-term investments, etc.), but are capable of generating profit for it. A complete list of those objects that are included in current and non-current assets is reflected in paragraph 20 of PBU 4/99:

- Non-negotiable:

- Intangible assets (business reputation, patents, know-how, licenses, etc.);

- OS (land, buildings/structures, machinery/equipment, unfinished capital investments, etc.);

- investments in assets that generate income (property for rental/leasing);

- Deferred tax assets;

- financial investments (long-term loans issued, investments).

- Negotiable:

- inventories (raw materials/materials, work in progress costs, deferred costs, goods, finished products);

- VAT on acquisitions;

- debts of debtors (debts, bills receivable, advances issued, debts of founders on deposits in the management company);

- financial investments (short-term loans to companies; company shares purchased from its own shareholders);

- money (cash and non-cash, in domestic and foreign currency).

You can learn more about non-current assets by studying the article “Non-current assets on the balance sheet (nuances)”.

Assets can be tangible or intangible. Unlike tangible assets, intangible assets include those objects that do not have a tangible form (for example, property rights, business reputation of an enterprise, intellectual property). Despite the fact that intangible assets do not have a form, they can be easily identified (distinguished from other types of property). Moreover, the rights to such assets are confirmed exclusively in documentary form.

You can learn about what assets are classified as fixed assets from the article “What are the fixed assets of an enterprise?”