For constant growth and competent formation of the enterprise’s economic strategy, the manager must have all the complete data and reporting. In this review, we will take a closer look at one of the most important indicators, on the basis of which plans for the development of the company as a whole are based. Let's look at what the turnover ratio of working capital and assets shows, the balance sheet formula, calculations in days and other related points.

We will also determine what to do next with the information received, how to use the obtained information, which of the values are considered normal for a particular structure of the company. After all, competent and, no less important, timely analysis is in almost all cases the main factor in achieving efficiency.

What are these indicators?

The fundamental element is the company's revenue. A specific period is often taken for study. The general rule is considered to be annual. But this is not the only time range.

The relationship of this figure to various expenses, such as accounts payable or the size of investments in assets, shows us the intensity of movement of the enterprise as a whole. Are there any trends towards stagnation, or is there systematic growth? Moreover, it is worth understanding that the pace of each company is purely individual.

And any manager needs to understand exactly how the working capital turnover ratio is determined - in the general case, this is the ratio of revenue to assets. That is, we literally divide the total income (not the margin, this is an important point) by the average cost of resources allocated to production or purchasing, coupled with delivery and placement.

What does the information we receive tell us? First of all, we will find out how quickly the finances are returned. How many sales cycles does this or that department manage to complete in a selected period of time? This means that we know how quickly the money will return and be ready to be sent into the circulation again. Or, based on high indicators, we can exclude part of the income volume in favor of direct capital, for example. This way we will work on the enterprise itself, we will be able to scale it, open branches, simplify and automate work, reducing personnel or increasing emissions based on innovative and more efficient equipment. Knowing which positions characterize the working capital turnover ratio, we can always say whether stagnation exists in a certain area. Is there a dependence on the season that goes beyond the established standards? Are there any delays in the movement of branches compared to each other? This is comprehensive information that will be useful at almost all stages. And it is not possible to construct an economic strategy productively without this data.

As noted, it is important to understand that the rates of different firms should not be directly correlated with each other. Speed is influenced by many individual factors. This:

- The type of product that the company has been working with all this time.

- Average value of a single transaction.

- Time of year used for analysis.

- Market behavior and demand for goods or services in the current period.

- Dimensions of the legal entity itself. Of course, it is much easier to turn around when the entire volume of purchased goods and materials in value terms fits into 10 thousand than if the value reaches 10 million.

Moreover, these are only the fundamental factors that immediately catch the eye. The working capital turnover ratio is calculated as the ratio of total revenue to a certain financial array. It does not necessarily consist only of purchases. This may be a loan, and in some cases, accounts receivable.

Now let’s move specifically to the various indicators that are calculated for further economic research, and consider turnover factors.

Assets

This is the most general research. It cannot be said that it gives a specific understanding of the performance of individual sectors of the company, departments, and areas. But it is still quite possible to construct generalized judgments on the basis.

To work, we will need to divide all income by the entire set of available assets. That is, not only those who directly went into circulation at the designated moment. And the entire amount is in full. But the average is calculated, because we need to find out the number of cycles.

This value can be easily taken from the balance sheet, specifically the balance. And, accordingly, we will receive the total amount of income from the financial report. results."

What does this value tell us? First of all, growth rates. Thus, a slowdown in the turnover of current assets will lead to a drop in traffic intensity. Fewer cycles per period means a decrease in revenue. This means that the enterprise will either roll back, or it will have to use reserve funds to maintain the dynamics at the established level. Neither option looks promising. Therefore, as soon as a negative movement is outlined, it is immediately worth taking measures for financial recovery. It may be more logical to distribute material and production resources, conduct a new marketing campaign, or even completely change the policy perspective, adjust the price tag for some types of products or the entire range as a whole. There are many options.

Working capital turnover ratio

This is a narrower concept. Now for the study we take exclusively resources aimed at acquiring goods and materials. And only in price terms. And now we do not know the general picture of the dynamics of the entire company as a whole, but only the speed of the cycles. It is worth understanding that it depends not only on how well the product sells. But also from all aspects of its use. How is delivery organized, what time frame does production take, under what conditions does storage take place, are product losses within the normal range.

To ensure automation of business processes, contact Cleverens.

Our software is:

- Quick solution to the problem from the moment of purchase to integration of the software into the overall system.

- Timely service.

- Full compliance of the software with the current established standards of Russian legislation.

Now, how to find the working capital turnover ratio is calculated using the formula - K=B/C.

- K - in this version is the very indicator, everything is clear with it.

- B is the total revenue for the required period.

- C is the average value of assets.

Now let's look at how to find C. To do this, we need to add the initial cost expression with the balance at the end of the specified period and divide by two. For example, 430,000 on the 1st day of the year, 340,000 on the last. C is calculated as (430000 + 340000)/2 = 385000.

To compare the final results, it is permissible to present a competing parallel exclusively with organizations in the same field or branch of activity. After all, it is easy to understand that a huge and clumsy plant-research center in terms of economic strategy will definitely lose to a small store that operates disproportionately smaller volumes with ten times the liquidity of inventory items.

Capital asset turnover ratio

This value affects basic financial indicators. And it no longer reflects the effectiveness of marketing or the sales cycle, but the proper management of the resources of the legal entity itself. Their distribution in domestic politics, so to speak.

Based on the information, it is worth drawing conclusions about the following factors:

- the extent to which the company's movement depends on borrowed finance;

- growth of total capital;

- intensity of its use.

Indirectly, the analysis also reports data on the effectiveness and pace of sales. But it is better to use it for calculations in this area in the form of additional information. After all, the influence exists only indirectly.

Receivable

In this option, a standard formula is used, only the ratio of revenue to the average balance of receivables is revealed. It is also a very important value that shows us how quickly the organization gets rid of accounts receivable. That is, he receives payment for goods and services. The higher the efficiency in this area, the faster the goods and materials acquire monetary form. And accordingly, they are sent to their financial flows, for example, to purchase raw materials, pay for the services of intermediaries and outsourcing companies, and so on.

Creditor

This aspect already shows the speed of repayment of loan funds. It is no less important than the previous point. After all, if borrowed finances are repaid significantly late, this will cause serious difficulties. Penalties, penalties, and penalties will be imposed. And according to Russian legislation, the total amount of fines reaches three times the amount of the debt. Which often seriously impacts the financial stability of a business entity.

Reserves

In fact, the indicators characterizing the turnover of working capital are the main ones, but this one is additional. Yes, it is also used in general analysis, but in its base it explains the logic of purchase volumes in relation to the product being sold. Yes, at some points the accumulation of inventory items can play a major role if there is suddenly a shortage in the market. Or the supplier will simply freeze shipments, and you will have to look for a new one for some time. And in order to avoid stagnation at this point, it would be logical to use your own reserves. But their too high volume indicates that a significant part of the organization’s resources is simply not used at this stage and is wasted as a measure of diversification. It goes without saying that it is important to maintain a balance in this aspect.

The financial analysis

So, the formula for the working capital turnover ratio is K=B/C, this is the main and most important indicator on the basis of which most of the analytics are carried out. As we have already explained, for research we take not only the balance of production in monetary terms, but also receivables, accounts payable and inventories. As a result, we get a universal tool that always becomes the foundation for analyzing the overall level of development of an enterprise. And based on it, various industry indicators, dynamics and costs are calculated.

Accordingly, every manager, even a small one, should always be able to independently carry out work of this nature. Be able to determine the working capital turnover ratio; an analysis based on this data will be the most accurate and closest to reality.

Accounts payable turnover

To calculate the accounts payable turnover ratio, it would seem logical to take the cost of purchases instead of the cost of sales. However, such an indicator would not answer the question: “To what extent does the dynamics of changes in accounts payable correspond to the economic activity of the enterprise and its scale?” At the same time, scale is associated precisely with sales, and not with purchases. In addition, since there is no purchase indicator in the balance sheet, it is necessary to use indirect assessment methods of the form:

This method can lead to negative values of the coefficient and the need for its correct interpretation in financial analysis. Therefore, the dynamics of accounts payable are most often (and rightly so) still correlated with sales, and not with purchases. In this case, you cannot use the proceeds, because then an increase in the trade margin would increase the accounts payable turnover ratio, whereas an increase in the trade margin should not affect this ratio. Therefore, it is necessary to use the cost of sales:

It is convenient to take the balance of accounts payable at the beginning and end of the period from line 1520 of form No. 1 (balance sheet). There is no standard value for the accounts payable turnover ratio. If we work with suppliers on an advance payment basis, the accounts payable turnover ratio will go to infinity. If there are also no sales, the turnover ratio will be uncertain (zero to zero).

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Calculation

To quickly carry out calculations, special software is often used. All the necessary formulas are filled in in advance. This is especially useful if the company has many industries and branches, and research is carried out based on various time factors.

Cycle duration

This value should not be understood as a factor that determines the stability of the company. On the contrary, it only shows the specifics of the enterprise. It is obvious that larger legal entities and huge holdings operate large amounts of inventory and materials. And make a full circle of tasks for them in the long term. Therefore, always make allowances for the scope and general array of values intended for implementation. Do not compare micro-projects, all of whose cash revenue per cycle easily fits in one wallet with full-fledged industry flagships.

Remember that this is only a relative point - the turnover of current assets; the formula on the balance sheet shows the dynamics in existing conditions. And each organization should have its own personal standard. But getting it out is actually a much more difficult task. And this is exactly what financial analysis is needed for. And at a minimum, a comparison of asset growth rates relative to their cycle speed.

Loading funds in circulation

An auxiliary element that allows you to evaluate the effectiveness of cash flow injections. The dependence on investments is directly visible. That is, information about how much finance needs to be contributed in order for the total revenue to reach 1 ruble.

Used for assessment, standards for different business entities, again remain purely individual. But the correlation can be traced with our desired formula. That is, the turnover ratio of material working capital characterizes and shows the pace of cycles, and this value demonstrates the effectiveness of each of them separately. And usually, the more of them, the lower the effectiveness of an individual, and with growth the effect decreases, accordingly.

Turnover ratios

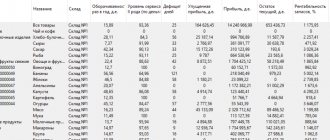

The turnover ratio of a certain entity characterizes the ratio of sales to the size of the entity. Using this formula you can calculate the turnover ratio of anything:

Turnover ratio = Sales for the period ——————————————————— Turnover entity for the period

When using this formula, it is important to pay attention to a number of nuances.

The dimension of the turnover ratio is dimensionless (scalar). In standard solutions on the 1C platform, you can see that it is measured in Revolutions, but this is some freedom of the developers.

Sales for a period can be either Revenue or Cost of Sales, depending on the turnover entity and ratio. If we are talking about revenue, then it makes no sense to include VAT in the revenue amount, since this is not the money of the enterprise itself. For the same reason, it makes no sense to include excise taxes in the amount of revenue. Thus, in the income statement of sale:

- or Revenue (excluding VAT and excise taxes) – line 2110 in form No. 2;

- or Cost of sales – line 2120 in form No. 2.

The turnover entity for the period , if it is a cost (for example, inventory), is correlated with Sales at cost. In other cases, it is correlated with Revenue.

The period for the numerator and denominator must be the same.

How to calculate the turnover of an entity for a period if it changes every day (for example, the balance of inventory)? One simple (and incorrect) option is to average the value of the entity being wrapped. To do this, textbooks and popular articles on the Internet suggest calculating the average of two extreme values - at the beginning of the period and at its end:

For a long period (for example, a quarter, a year), the method of averaging over two extreme values is a significant problem, because this can significantly impact your turnover ratio. Therefore, it is worth using not averaging over two extreme values (far from reality), but more accurate methods for estimating a variable (or distributed over a time interval) value.

Range of values. In a formula, neither the numerator nor the denominator can be less than zero. Consequently, the turnover ratio can only take positive values (and zero) in the described methodology. At the same time, the query “negative turnover ratio” still appears in Internet search engines. This can happen with certain methods (which should be avoided) for calculating the turnover ratio. In addition, the case cannot be ruled out when the coefficient can go to infinity. These cases will be mentioned in the section “Accounts Payable Turnover Ratio”.

Interpretation. The higher the ratio, the higher the turnover (a positive sign) or the greater the return on investment (also a positive sign), with the exception of the accounts payable turnover ratio, where the opposite is true.