Business travel expenses

A business trip is an employee’s trip by order of the employer outside the place of permanent work to carry out an official assignment (Article 166 of the Labor Code of the Russian Federation).

Only full-time employees, that is, those with whom employment contracts have been concluded, can be sent on a business trip. It does not matter where the employee works: in the office or at home. Business trips of freelancers are not business trips, and expenses for them are accepted in a completely different manner.

The employer is obliged to maintain the employee’s job and average earnings for the seconded employee, as well as reimburse him for expenses associated with the business trip:

- Travel to the place of business trip.

Such costs include tickets for all types of transport (except taxis), ticket booking fees, insurance, etc.). The possibility of reimbursement of taxi expenses is determined by the employer based on the internal documents of the organization.

- Accommodation during a business trip.

Expenses for accommodation in a hotel, private sector or rented apartment are subject to reimbursement. But the procedure for taking into account such costs depends on the employee’s availability of primary documents confirming the fact of renting housing.

- Daily allowance.

Per diem - funds allocated to an employee for current expenses during a business trip. The employee does not have to report for them, as for all other expenses. The amount of daily allowance is not limited by law, but there is a certain limit beyond which these payments are subject to personal income tax and insurance contributions.

- Other expenses.

The employer determines their list independently depending on the type and duration of the business trip, the employee’s position and other factors. The composition of such expenses, as a rule, includes the cost of a taxi or Aeroexpress, mobile communications, a VIP lounge at the airport, and entertainment expenses.

For all the above costs, the employer gives the employee an advance, for which he will be required to account for upon returning from a business trip.

If you have any unresolved questions, you can find answers to them in ConsultantPlus.

Full and free access to the system for 2 days.

“1C: Accounting 8”: cost accounts in the advance report for a business trip

In "1C: Accounting 8" edition 3.0, the process of accounting for business trips is optimized both through integration with the Smartway service and by simplifying the form of the advance report. Starting with version 3.0.72, in the “Advance travel report” document, it became possible to set up cost accounts for different types of travel expenses.

For accountable persons reporting only on travel expenses, a simple form of the Advance Report document has been developed in the 1C: Accounting 8 (rev. 3.0) program, called the Advance Travel Report. This document provides the simplest work scenario:

- only travel expenses are reflected in the advance report;

- all travel expenses are taken into account for income tax purposes;

- the accountable person is compensated only for documented expenses.

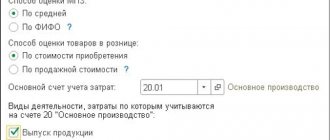

Initially, the explicit indication of invoices and cost analytics for accounting for travel expenses in the Travel Advance Report was not provided. The account specified in the Main cost account field of the Accounting Policy information register was automatically substituted as a cost account. And as a cost item - an article from the Cost Items directory, in which the default Usage field is set to Document “Advance report” (travel expenses).

However, in a number of organizations, travel expenses are recorded in different expense accounts depending on the purpose of the trip. For example, if a trip is carried out for the purpose of concluding a supply agreement, then account 44 “Sales expenses” is used. If a production worker goes on a business trip to improve his skills - account 20 “Main production”, etc. Some organizations take into account travel expenses in the context of contracts with contractors, so they need to indicate different cost items.

It happens that a posted person incurs expenses that are not taken into account for income tax purposes. Thus, despite the obvious advantages of the Business Travel Advance Report, a number of users were forced to abandon the use of this document form due to the impossibility of selecting accounting accounts and cost items in this document form.

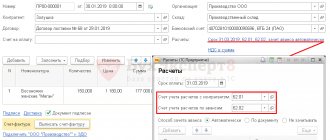

Starting from version 3.0.72, the Trip Advance Report has added the ability to change accounting accounts and cost analytics for travel expenses, installed by default by the program. To do this, in the Personal Settings form (Main section), the Show accounting accounts in documents flag must be set. Then, in the tabular part of the Advance report for business trips, the Cost Account / Division and Subconto fields will appear, where the user can specify the accounting account and cost analytics at his discretion (Fig. 1).

Rice. 1. Accounting and cost analytics in the “Advance trip report”

Separately, you can specify accounting accounts and cost analytics for daily allowances by following the corresponding hyperlink in the Per diem field in the form of the same name, and from there, following the corresponding hyperlink in the Accounting accounts: Per diems form. If data on purchased tickets is supplied from the Smartway service, then accounting accounts and cost items can also be specified for tickets.

Organizations using the simplified tax system can also use the Advance Travel Report to simplify the accounting of travel expenses. Now all expenses specified in this document form are registered in the Income and Expense Accounting Book automatically.

Tax accounting for travel expenses 2020

An employer can take into account travel expenses as expenses for income tax and the simplified tax system (the object “income minus expenses”). The procedure for accounting for such costs for the simplified tax system and for the OSNO is similar.

Main features of tax accounting for travel expenses:

- Economic feasibility and documented cost exposure.

Costs incurred by an employee on a business trip are taken into account only if they are economically justified and confirmed by primary documents. An exception is made only for daily allowances: the employee is not required to confirm them and report on them. In the absence of supporting documents, it will not be possible to take costs into account, even if they are justified.

- Expense recognition date.

Travel expenses are recognized on the date of approval of the advance report. If on a business trip an employee paid expenses from his own funds and the company reimbursed him for them, then the date of recognition of expenses should be considered the day the funds were issued from the cash register. We will consider the date of recognition of expenses incurred in foreign currency below, in the section on foreign business trips.

- VAT on travel expenses.

Individual entrepreneurs and organizations on OSNO have the right to deduct VAT, provided that travel expenses are paid by the organization or employee and there is an invoice for them. We will consider the features of accepting VAT for deduction on certain types of travel expenses below.

- Personal income tax and insurance premiums

For most travel expenses, personal income tax and insurance premiums are not required. Personal income tax and insurance premiums are charged in excess of the established limit on daily allowances.

Let's take a closer look at the features of tax accounting for certain types of travel expenses.

VAT deduction on travel expenses

According to paragraph 7 of Art. 171 of the Tax Code of the Russian Federation, VAT deduction is allowed only for those travel expenses that are accepted for profit tax purposes. And this restriction applies not only to part of the standardized expenses (this provision was canceled as of 01/01/2015), but in general to any reasons why certain expenses may not be accepted in tax accounting.

However, there are no rules regarding travel expenses for calculating income tax. That is, if expenses are actually incurred (for activities aimed at generating income subject to VAT) and are documented, then they are recognized when taxing profits, and the corresponding VAT is deducted in the general manner.

Thus, for living expenses, the basis for deduction is, as a rule, an invoice. But you don't need an invoice to deduct travel expenses. After all, tickets, itinerary receipts for electronic air tickets or control coupons for railway electronic tickets are strict reporting forms; they themselves are the basis for a deduction. This is indicated in clause 18 of the Rules for maintaining a purchase book (approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

If the tax is not highlighted on the ticket, but is highlighted on a separately issued invoice, then from 10/01/2014 it can also be deducted. After all, clause 18 of the Rules for maintaining a purchase book now allows you to register in the book not only a strict reporting form or a copy thereof, but also an invoice. Let us recall that previously tax authorities objected to deductions on invoices in such a situation (letters from the Federal Tax Service of Russia for Moscow dated August 31, 2009 No. 16-15/090448.1, dated January 10, 2008 No. 19-11/603).

The tax is accepted for deduction after the use of the ticket and approval of the advance report in which this ticket will be reflected. Until this moment, it is impossible to confirm that transportation services have actually been provided and accepted for accounting. Well, VAT in relation to intermediary services is accepted for deduction in the general manner: on an invoice, after these services are accepted for accounting.

Daily allowance: tax accounting

Per diem - employee expenses incurred on a business trip related to living outside their place of permanent residence. In most cases, per diem is allocated to an employee for meals during a business trip.

The amount of daily allowance is not limited by current legislation, but there is a limit beyond which personal income tax and insurance premiums must be charged for these expenses. This limit is 700 rubles for trips within Russia and 2500 rubles. - for abroad. The employer sets the daily allowance amount independently, and it may vary depending on:

- employee position (for management employees they may be higher, for ordinary employees - within the limit);

- tasks assigned on a business trip;

- business trip locations, etc.

You can learn more about the specifics of calculating, accruing and paying daily allowances in the following articles:

- Payment of daily allowances for business trips in 2022: features;

- Payment of daily allowances for the day of departure and for the day of arrival;

- Payment of daily allowances for weekends;

- Daily allowance for a business trip to your place of permanent residence.

You can write off your daily allowance as expenses in full, without restrictions. As for one-day business trips, they are not eligible for per diem allowance. This is due to the fact that the employee does not incur living expenses on such a trip and returns home on the same day.

The Ministry of Finance proposed to attribute such costs to other expenses, and not to travel expenses (Letter dated May 17, 2018 No. 03-15-06/33309). And if the employee has provided supporting documents, then there is no need to charge personal income tax and insurance premiums for the entire amount of such expenses. If there are no documents, then personal income tax and contributions should be charged in an amount exceeding the limit (700 rubles for business trips within Russia and 2,500 rubles for business trips abroad).

The employee is not required to report on daily allowance, and therefore the employer has no right to demand from the employee supporting documents on daily allowance.

Procedure for reimbursement of travel expenses

The rules for sending employees on business trips both on the territory of the Russian Federation and on the territory of foreign states are determined by the Regulations on the specifics of sending employees on business trips (approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749).

The procedure and amount of reimbursement to employees for expenses related to business trips are determined by a collective agreement or a local regulatory act of the organization (clause 11 of the Regulations on Business Travel, Article 168 of the Labor Code of the Russian Federation).

According to Article 168 of the Labor Code of the Russian Federation, if an employee is sent on a business trip, the employer is obliged to compensate him for:

- travel expenses;

- expenses for renting residential premises;

- additional expenses associated with living outside the place of permanent residence (per diem);

- other expenses incurred by the employee with the permission or knowledge of the employer. For example, telephone costs, entertainment expenses, transportation costs, etc.;

And when sent on a business trip to the territory of a foreign state, the employee is additionally reimbursed (clause 23 of the Regulations on Business Travel):

- expenses for obtaining a passport, visa and other documents;

- mandatory consular and airport fees;

- fees for the right of entry or transit of motor vehicles;

- expenses for obtaining compulsory health insurance;

- other mandatory payments and fees.

The daily allowance amount is established by a collective agreement or a local regulatory document of the organization (LND). You can set separate daily allowance rates for each country or group of countries. The maximum amounts that are not subject to personal income tax and insurance contributions for compulsory pension, medical and social insurance in case of temporary disability and in connection with maternity are 700 rubles. for each day of being on a business trip in the Russian Federation and 2,500 rubles. — outside the territory of the Russian Federation. There is no standard established for income tax and contributions for injuries (clause 1 of Article 217, clause 12 of clause 1 of Article 264, clause 2 of Article 422 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of the Russian Federation dated November 17, 2011 No. 14-03- 11/08-13985).

Payment of daily allowances for business trips outside the territory of the Russian Federation is regulated by paragraphs 18-20 of the Regulations on Business Travel:

- for a one-day business trip, daily allowance is paid in the amount of 50% of the norm for business trips abroad;

- the dates of crossing the state border of the Russian Federation when traveling from the territory of the Russian Federation and to the territory of the Russian Federation are determined by the marks of the border authorities in the passport;

- when an employee is sent on a business trip to the territory of countries with which intergovernmental agreements have been concluded, on the basis of which marks are not made when crossing the border, the date of crossing the state border of the Russian Federation is determined by travel documents (tickets);

- when an employee is traveling from the territory of the Russian Federation, the date of crossing the state border is included in the days for which daily allowances are paid according to the norm for business trips abroad. When an employee travels to the territory of the Russian Federation - on days for which daily allowances are paid according to the norms for Russia. If an employee is sent on a business trip to the territory of two or more foreign states, daily allowances for the day of crossing the border between states are paid in foreign currency according to the standards established for the state to which the employee is sent.

Upon returning from a business trip, the employee, within three working days, is obliged to provide the employer with an advance report on the amounts spent in connection with the business trip and make a final payment for the advance payment issued to him for travel expenses, attaching documents confirming the expenses (clause 26 of the Business Travel Regulations).

The supporting documents on expenses associated with the business trip attached to the advance report must be translated into Russian (clause 9 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n). The translation can be done either by a professional translator or by a full-time employee of the organization (letter of the Ministry of Finance of Russia dated April 20, 2012 No. 03-03-06/1/202).

1C:ITS

For more information on the procedure for reimbursing employees for travel expenses, including the calculation of daily allowances, see the “HR Handbook” in the “Legal Consultations” section.

Payment for travel to the place of business trip: features of cost accounting

Travel expenses to the place of business trip can be included in expenses in full (subclause 12, clause 1, article 264 of the Tax Code of the Russian Federation). There is no need to charge personal income tax and insurance premiums for such expenses. To accept travel expenses for accounting, the employee must provide supporting documents:

- when traveling by regular transport - a travel ticket with the details, signature and seal of the carrier;

- when traveling by taxi - an order for the provision of a vehicle for transporting passengers and luggage and a receipt for payment for taxi services;

- for air travel - a ticket and boarding pass. If the ticket is electronic, then you will additionally need to provide an itinerary receipt;

- when traveling by railway transport - railway ticket, control coupon, electronic ticket, boarding pass;

- when traveling by personal or official transport - a waybill, check, receipts for the purchase of fuel and lubricants and other accounting documents confirming the employee’s location on the road;

- when driving a rented vehicle (car sharing) - a car rental agreement and documents confirming the expenses incurred and the fact of using the car for business purposes.

If an employee has lost travel documents, you can confirm expenses:

- a duplicate of the document;

- a copy of the ticket left with the transport company;

- a certificate from the transport company indicating the details allowing to identify the person who made the trip, his route, the cost of the ticket and the date of the trip.

Tickets: how to reflect them in accounting

To complete the employer’s task, the employee must travel to and return from the business trip. The employer must either compensate the employee for travel expenses or pay for them himself.

It’s easiest for an accountant when an employee purchases tickets on his own. Then they are indicated in the advance report, and their cost, after approval of the advance report, is included in travel expenses. In accounting, in this case, only expenses are reflected on the basis of the advance report.

However, if employees travel regularly on business, it is cheaper for the company to purchase tickets on its own behalf. The accounting procedure in this situation changes. A purchased ticket is a monetary document, which must be reflected in the organization’s records at the time of receipt. At the same time, its cost cannot be immediately attributed to expenses: paying for a ticket is actually an advance payment to the carrier for a trip in the future.

To make a trip, a ticket is issued to an employee. In accounting at this point, the cost of the ticket must be included in settlements with the employee as an accountable person, since the ticket is also issued to the employee for reporting, and after returning from a business trip it is included in the advance report. In this case, expenses are recognized on the date of approval of advance accounting (including in tax accounting).

This scheme also applies to electronic tickets. After all, these are also documents confirming the passenger’s right to travel. Moreover, the route receipt and control coupon are strict reporting forms (part “a”, paragraph 2, paragraph 1 of the appendix to the Order of the Ministry of Transport of Russia dated November 8, 2006 No. 134; paragraph 2 of the Order of the Ministry of Transport of Russia dated August 21, 2012 No. 322) .

Will anything change if the ticket is purchased through an intermediary? In this case, the accounting for the ticket itself remains the same as described above. But the costs of paying the intermediary’s commission, if they are paid separately from the cost of the ticket, can be written off immediately after receiving the relevant documents from the intermediary.

Since the cost of a ticket is a payment under the contract of carriage, it cannot be included in expenses before the carriage has taken place. And the services of the agent through whom the ticket was purchased will be considered fully provided at the time of receipt of the ticket, which means that his remuneration can be immediately included as an expense in both accounting and tax accounting.

Let's look at an example.

The employee was sent on a business trip from April 6 to April 9. To do this, the employer (trade organization) purchased electronic air tickets through an intermediary at a cost of 11,800 rubles. (including VAT 1,800 rubles), which he received on March 30 and handed over to the employee on the same day. The agent's remuneration was 590 rubles. (including VAT 90 rubles), the agent’s report is approved simultaneously with receipt of tickets. VAT is highlighted in the itinerary receipt of each ticket as a separate line, and an invoice for his fee was received from the agent. The advance report was approved on April 10.

How to reflect the situation in accounting, see the table. In tax accounting, travel expenses are recognized on April 10 (the date of approval of advance accounting), and expenses in the form of agent remuneration are recognized on March 30 (the date of provision of his services).

Reimbursement for accommodation on a business trip

Costs for accommodation on a business trip are also subject to inclusion in expenses under the simplified tax system (the object “income minus expenses”) and income tax, subject to their documentary confirmation. These travel expenses are not subject to personal income tax and insurance contributions. Accommodation costs can also include services provided by hotels, except for saunas and fitness centers, bars and room service.

Documents confirming the employee's expenses for accommodation on a business trip:

- cash receipt or BSO - when staying at a hotel;

- an apartment rental agreement, a receipt for payment of rental payments and other supporting documents - when an employee lives in a rented apartment.

In the absence of supporting documents, it will not be possible to take into account living expenses. They will also need to charge personal income tax and pay insurance premiums from them:

- Personal income tax is charged on expenses exceeding 700 rubles. for business trips in Russia and 2,500 rubles. - for business trips abroad;

- Insurance premiums must be charged on the entire amount of expenses.

Paying for food on a business trip: tax accounting

Payment of food expenses on a business trip is at the discretion of the employer. Neither the Labor Code of the Russian Federation nor the regulations on business trips mention such costs. Accordingly, the employer is not obliged to pay for them.

By default, food must be paid for by the employee from the daily allowance, but at its discretion, the employer can additionally compensate the employee for such costs.

Food costs are not taken into account as expenses under the simplified tax system and income tax; personal income tax must also be charged on them and insurance premiums must be paid on them.

An exception is the situation when food costs are included in the cost of accommodation. But if the cost of food in the check is highlighted as a separate line, then these expenses cannot be included in the income tax costs (Letter of the Ministry of Finance of Russia dated May 20, 2015 No. 03-03-06/2/28976).

Accounting for travel expenses under other tax regimes

Individual entrepreneurs on the simplified tax system “income” and entrepreneurs on a patent cannot take travel expenses into account as expenses. This is due to the fact that individual entrepreneurs on PSN do not keep track of expenses and cannot reduce the cost of a patent by any costs other than insurance premiums.

Although individual entrepreneurs on the simplified tax system must keep “income” in KUDiR, they enter into it (in addition to income) only data on one expenses - paid insurance premiums for themselves and employees. Despite this, the Ministry of Finance believes that simplifiers at an income facility in general should draw up primary documents for business trips, including expenses incurred, including an advance report (Letter of the Ministry of Finance of Russia dated October 30, 2013 No. 03-11-11/46198). The reason, according to the financial department, is that for simplifiers, regardless of the object used, the current procedure for conducting cash transactions is maintained.

According to this procedure, the accountable person is obliged, within a period not exceeding 3 working days after the expiration date for which cash was issued on account, or from the day the employee goes to work, to present to the chief accountant (accountant) or manager an advance report with attached supporting documents (p 6.3 The procedure for conducting cash transactions, approved by Directive of the Bank of Russia dated March 11, 2014 No. 3210-U).

The Tax Code of the Russian Federation does not make any exceptions for the preparation of primary expenditure documents for travel expenses for simplifiers at the “income” facility. This means that they, along with others, must prepare these documents, although they cannot take such costs into account as expenses.

Accounting for travel expenses of individual entrepreneurs without employees

According to the Ministry of Finance, accounting for travel expenses of individual entrepreneurs on the simplified tax system without employees is also unreasonable. The tax authority explains its position by the fact that a business trip is a trip by order of a manager to perform an official task. The individual entrepreneur with whom he has an employment relationship does not have an employer, and therefore the individual entrepreneur cannot send himself on a business trip (Letter of the Ministry of Finance of Russia dated August 16, 2019 No.

There is no judicial practice on this issue yet, and therefore it is impossible to predict which side the court will take. Therefore, it is better not to take risks and it is better not to include the costs of a business trip for an individual entrepreneur without employees as part of the expenses for the simplified tax system “income minus expenses”.

Accounting for expenses for business trips abroad

Accounting for expenses for foreign business trips has its own characteristics:

- The daily allowance limit for business trips abroad is: 700 rubles. when moving across the territory of the Russian Federation and 2,500 rubles. – when crossing the Russian border;

- daily allowances issued in foreign currency are converted into rubles at the rate in effect on the day the funds were issued to the employee;

- if daily allowances are issued in rubles, and expenses are made in foreign currency, they are converted into rubles at the rate in effect on the day the currency was purchased. If the document on the purchase of currency is lost, the rate in effect on the day the advance was issued to the employee is taken;

- the balance of the advance payment returned to the cash desk is recalculated into rubles on the date of refund;

- overexpenses paid in foreign currency are reimbursed to the employee in rubles, recalculated as of the date of approval of the advance report;

- if the primary documents confirming expenses are drawn up in a foreign language, they must be translated into Russian;

- the part of the daily allowance exceeding the limit for the purpose of paying personal income tax must be recalculated into rubles at the rate on the last day of the month in which the advance report was approved.

What requirements apply when issuing accountable money?

Accounting must strictly control the amounts issued for reporting. There are several main requirements for transactions with accountable persons:

- Money can only be given to company employees;

- You can issue money by transfer to an employee’s account or corporate card or from the company’s cash desk - the method is fixed in the accounting policy;

- the maximum amount of money is limited by order of the manager;

- the daily allowance limit for travel expenses is approved by a separate provision;

- the deadline for submitting the report is fixed in the accounting policy or regulation;

- all calculations must be confirmed - the employee must attach tickets, checks, invoices, receipts, and so on to the advance report.

They issue money at the request of the employee or by order of management.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Accounting for travel expenses: postings

The issuance of an advance to an employee for travel expenses is accompanied by the following posting:

- Dt 71 Kt 50 - if the advance was issued in cash;

- Dt 71 Kt 51 - if the advance is transferred to the employee’s bank card.

When writing off travel expenses, the purpose of the trip is key:

- Dt 20 Kt 71 - the employee is sent on a business trip to perform work on the instructions of the customer;

- Dt 44 Kt 71 - business trip is associated with the sale of goods;

- Dt 08 Kt 71 - business trip is related to the acquisition of property for the company;

- Dt 28 Kt 71 - the employee goes on a business trip to return the defect.

If the company applies OSNO and VAT is separately allocated as an expense, the following entries are applied:

- Dt 19 Kt 71 - VAT is included in travel expenses;

- Dt 68 Kt 19 - VAT is included as part of the tax deduction.

If an employee on a business trip spent his own funds and the employer reimbursed him for them, the following entries are made:

- Dt 71 Kt 50 - if funds were issued to the employee in cash;

- Dt 71 Kt 51 - when transferring funds to the card.

If an employee spent less than he was allocated, a posting is selected depending on how the refund occurs:

- Dt 70 Kt 71 - debt is withheld from the employee’s salary;

- Dt 50 Kt 71 - the employee returned the money to the cash register;

- Dt 51 Kt 71 - the employee returned the money to the employer’s bank account.