The BCC for 2022 for basic taxes and contributions remained the same. But due to changes in Chapter 23 of the Tax Code of the Russian Federation, their list has expanded. New BCCs were required due to the payment of personal income tax at a progressive rate and the introduction of tax payments to municipal districts. The Ministry of Finance supplemented the list of BCCs with Order No. 236n dated October 12, 2020, and after the adoption of this order, the following codes will appear in the list of BCCs for 2022:

— 182 1 0100 110 — for payment of personal income tax, which exceeds 650 thousand rubles and relates to part of the base in excess of 5 million rubles;

— 182 1 0100 110 — for paying personal income tax on CFC profits received by individuals who have switched to a special tax payment procedure based on filing a notification with the Federal Tax Service;

— 182 1 0100 110 — for paying personal income tax on interest (coupon, discount) on circulating bonds of Russian legal entities that are denominated in rubles and issued after 01/01/2017.

- 182 1 0500 110 - tax levied in connection with the use of the patent taxation system, credited to the budgets of municipal districts;

— 182 1 0600 110 — property tax for individuals, levied at the rates applicable to taxable objects located within the boundaries of municipal districts.

— 182 1 0600 110 — land tax from organizations owning a land plot located within the boundaries of municipal districts.

— 182 1 0600 110 — land tax from individuals who own a land plot located within the boundaries of municipal districts.

For your convenience, we have grouped KBK - budget classification codes for 2022 - by main taxes and fees in tables by type of payment. The full list of BCC 2022 can be found on the Federal Tax Service website.

Please note that from January 1, 2022, part of the income exceeding 5 million rubles. per year will be subject to personal income tax at a rate of 15%.

Putin increased personal income tax to 15%

KBK for taxes for 2022: VAT, personal income tax, income tax, transport tax, property tax

| Payment Description | KBK |

| Income tax, which is charged to the federal budget (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| Income tax, which is charged to the budgets of constituent entities of the Russian Federation (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| Income tax, which is charged to the federal budget (for consolidated groups of taxpayers) | 182 1 0100 110 |

| Income tax, which is charged to the budgets of the constituent entities of the Russian Federation (for consolidated groups of taxpayers) | 182 1 0100 110 |

| VAT, excluding import | 182 1 0300 110 |

| Tax on property not included in the Unified Gas Supply System | 182 1 0600 110 |

| Tax on property included in the Unified Gas Supply System | 182 1 0600 110 |

| Simplified tax with the object “income” | 182 1 0500 110 |

| Simplified tax with the object “income minus expenses”, including the minimum tax | 182 1 0500 110 |

| UTII | 182 1 0500 110 |

| Unified agricultural tax | 182 1 0500 110 |

| Personal income tax for a tax agent | 182 1 0100 110 |

| Transport tax | 182 1 0600 110 |

| Land tax from plots of Moscow, St. Petersburg, Sevastopol | 182 1 0600 110 |

KBK for payment of penalties on taxes for 2022

The KBK budget classification codes for 2022 were approved by Order of the Ministry of Finance of Russia dated 06/08/2020 No. 99n. These codes must be indicated in payment orders when paying penalties on taxes in 2022.

| Payment Description | KBK |

| Income tax, which is charged to the federal budget (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| Income tax, which is charged to the budgets of constituent entities of the Russian Federation (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| Income tax, which is charged to the federal budget (for consolidated groups of taxpayers) | 182 1 0100 110 |

| Income tax, which is charged to the budgets of the constituent entities of the Russian Federation (for consolidated groups of taxpayers) | 182 1 0100 110 |

| VAT | 182 1 0300 110 |

| Tax on property not included in the Unified Gas Supply System | 182 1 0600 110 |

| Tax on property included in the Unified Gas Supply System | 182 1 0600 110 |

| Simplified tax with the object “income” | 182 1 0500 110 |

| Simplified tax with the object “income minus expenses” | 182 1 0500 110 |

| UTII | 182 1 0500 110 |

| Unified agricultural tax | 182 1 0500 110 |

| Personal income tax for a tax agent | 182 1 0100 110 |

| Transport tax | 182 1 0600 110 |

| Land tax from plots of Moscow, St. Petersburg, Sevastopol | 182 1 0600 110 |

Individual entrepreneur contributions for themselves in 2021-2022

Fixed contributions IP-2021/2022

If the income of an individual entrepreneur for 2022 does not exceed 300 thousand rubles, then this individual entrepreneur will only need to pay fixed contributions for himself (clause 1 of Article 430 of the Tax Code of the Russian Federation).

| Type of contribution | Contribution amount 2021 |

| on OPS | RUB 32,448 |

| on compulsory medical insurance | 8426 rub. |

That is, for 2022, the authorities have set contributions for individual entrepreneurs in the same amount as in 2022.

But in 2022, individual entrepreneurs will have to pay more for themselves.

| Type of contribution | Contribution amount 2022 |

| on OPS | 34445 rub. |

| on compulsory medical insurance | 8766 rub. |

Individual entrepreneurs must transfer contributions for themselves for 2022 no later than 01/10/2022. According to the Tax Code of the Russian Federation, the deadline for paying fixed contributions is December 31 of the year for which these contributions are transferred to the budget (clause 2 of Article 432 of the Tax Code of the Russian Federation). However, in 2022, December 31 was declared a day off (Resolution of the Government of the Russian Federation of October 10, 2020 N 1648), accordingly, the last day of payment is postponed to the first working day following this weekend (clause 7 of Article 6.1 of the Tax Code of the Russian Federation). In accordance with the calendar for transferring weekends to 2022, the New Year holidays will last from January 1 to January 9 (Government Decree dated September 16, 2021 N 1564). And the first working day following them is January 10.

The deadline for paying fixed individual entrepreneur contributions for 2022 cannot yet be clearly determined. Since 12/31/2022 falls on a Saturday, which means the deadline will be postponed again. But it is not yet possible to calculate exactly what date.

Individual entrepreneur contributions 1 percent

If the income of an individual entrepreneur for 2022 exceeds 300 thousand rubles, then the entrepreneur, in addition to fixed contributions, will need to pay an additional contribution to compulsory pension insurance in the amount of 1% of excess income (clause 1, clause 1, article 430 of the Tax Code of the Russian Federation). At the same time, the legislation establishes a maximum amount of the contribution to compulsory pension insurance paid by an individual entrepreneur for himself - it cannot exceed 8 times the size of the fixed contribution to compulsory pension insurance. Therefore, in 2022, the total contribution to the compulsory pension insurance (fixed contribution + 1% contribution) cannot exceed RUB 259,584. (RUB 32,448 x 8).

Similarly, in 2022, the maximum contribution amount for compulsory pension insurance is 275,560 rubles. (RUB 34,445 x 8).

By the way, individual entrepreneurs using the “income-expenditure” simplified tax system are finally officially allowed to reduce income for expenses in order to calculate the 1% contribution (Letter of the Federal Tax Service dated September 1, 2020 No. BS-4-11/14090).

Deadline for payment of 1% IP

Entrepreneurs must transfer the additional 1% contribution for 2022 to the budget no later than 07/01/2022. But the 1% contribution for 2022 will need to be paid no later than 07/03/2023. Because July 1st in 2023 is Saturday.

KBK contributions for individual entrepreneurs for themselves

When paying contributions, entrepreneurs must indicate the following BCCs in the payment order.

| Type of contribution | KBK |

| for mandatory pension insurance (including 1% contributions) | 182 1 0210 160 |

| on compulsory medical insurance | 182 1 0213 160 |

The indicated codes are also relevant for 2022 (Order of the Ministry of Finance dated 06/08/2021 N 75n).

KBC for payment of tax fines for 2022

BCC for 2022 was approved by order of the Ministry of Finance of Russia dated 06/08/2020 No. 99n. These codes must be indicated in payment orders when paying tax fines in 2022.

| Payment Description | KBK |

| Income tax, which is charged to the federal budget (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| Income tax, which is charged to the budgets of constituent entities of the Russian Federation (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| Income tax, which is charged to the federal budget (for consolidated groups of taxpayers) | 182 1 0100 110 |

| Income tax, which is charged to the budgets of the constituent entities of the Russian Federation (for consolidated groups of taxpayers) | 182 1 0100 110 |

| VAT | 182 1 0300 110 |

| Tax on property not included in the Unified Gas Supply System | 182 1 0600 110 |

| Tax on property included in the Unified Gas Supply System | 182 1 0600 110 |

| Simplified tax with the object “income” | 182 1 0500 110 |

| Simplified tax with the object “income minus expenses” | 182 1 0500 110 |

| UTII | 182 1 0500 110 |

| Unified agricultural tax | 182 1 0500 110 |

| Personal income tax for a tax agent | 182 1 0100 110 |

| Transport tax | 182 1 0600 110 |

| Land tax from plots of Moscow, St. Petersburg, Sevastopol | 182 1 0600 110 |

KBK Compulsory Medical Insurance Individual Entrepreneur “for oneself” to pay penalties and fines

For late payment of insurance premiums to the Federal Compulsory Medical Insurance Fund, tax authorities impose sanctions, for which separate BCCs are provided:

- When transferring penalties on compulsory medical insurance contributions “for themselves,” entrepreneurs enter KBK 18210202103082013160 in the payment document.

- When paying a fine, a separate KBK is used (FFOMS - fixed contributions) - 18210202103083013160.

If sanctions on contributions to the FFOMS relate to periods before 01/01/2017:

- Penalty – 18210202103082011160;

- Fines – 18210202103083011160.

An incorrect BCC can lead to arrears not only on the insurance premiums themselves, but also affect the amount of tax under the applicable taxation regime.

This is due to the fact that paid contributions are usually either included in expenses (with OSNO, simplified tax system “income minus expenses”), or directly reduce the accrued tax (with a patent, simplified tax system “income”). The error can be corrected by sending an application to the Federal Tax Service to clarify the payment. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

KBC for payment of insurance premiums for 2022

The Ministry of Finance of Russia approved new budget classification codes for payment orders for insurance contributions by order No. 99n dated 06/08/2020.

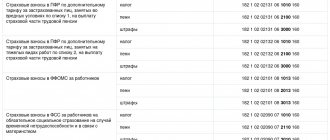

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 1) | 182 1 0220 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 2) | 182 1 0220 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

Decoding KBK 18210202140061110160

Individual entrepreneurs are often registered without employees and therefore pay insurance contributions for themselves separately. There are also codes for businessmen. Thus, KBK 18210202140061110160 means the deduction by the entrepreneur of funds in a fixed amount, which are aimed at forming an insurance pension. Moreover, the amount is calculated for the billing period from January 1, 2022.

The encoding contains 20 characters, divided into seven blocks, each of which has a meaning. The combination of numbers allows you to determine the type of budget to which the money is sent, the category of the payer, the purpose of the payment and the general group of deductions. Detailed transcript:

- 182 - department to which contributions are sent: Federal Tax Service Inspectorate.

- 1 - type of budget profit: tax payments.

- 02 - subcategory of income from an entrepreneur: insurance contributions for the formation of a pension.

- 02140 - payment category, budget type and payer: fixed deductions for oneself to the regional budget from a businessman.

- 06 — budget category: regional.

- 1110 — purpose of payment: standard.

- 160 - income subgroup that determines the type of payment: insurance contributions for compulsory social insurance.

Deductions for compulsory insurance are sent to the tax budget, since insurance funds from 2022 are administered by this service, and not by separate funds. The exception is contributions for injuries and sick leave.

KBC for payment of penalties on insurance premiums for 2022

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 1) | 182 1 0200 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 2) | 182 1 0200 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

KBK FFOMS IP “for yourself”

The cloud service Kontur.Accounting helps generate payment orders with current BCCs for paying taxes. Get free access for 14 days

Individual entrepreneurs must pay contributions separately for their employees, and separately for themselves. For 2022, for individual entrepreneurs, the payment for compulsory medical insurance is 8,426 rubles. KBC for payment of fixed medical contributions, as well as penalties and fines for late payments for individual entrepreneurs in 2022:

| Payer | Amount of contributions | Penya | Fine |

| IP "for yourself" | 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

Debts, penalties and fines accrued before 2022 for medical payments are repaid by individual entrepreneurs for themselves according to the KBK, in which units are placed on 16-17 acquaintances - 182 1 0211 160. Otherwise, the codes are identical to those indicated in the table.

Unlike contributions to compulsory medical insurance for employees, which must be transferred within 15 days after the end of the reporting month, personal medical contributions of individual entrepreneurs are required to be paid before the end of the reporting year. In this case, the payment can be divided into parts or the entire amount can be transferred at a time - this is decided by the entrepreneur. If an individual entrepreneur divides the amount into several payments, then each time in the payment order he must indicate the BCC for fixed medical payments.

KBC for payment of fines on insurance premiums for 2022

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 1) | 182 1 0200 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 2) | 182 1 0200 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

Code Features

Part of it is occupied by numbers indicating the recipient. We can also understand, by looking at the KBK, whether we transfer penalties for insurance premiums for compulsory health insurance, a fine or the main payment.

Four numbers will indicate this to us - from 14th to 17th:

- 1000 - directly SV;

- 2000 - penalties for arrears;

- 3000 - fine for late payment.

It remains unclear how the Federal Treasury will understand that money is owed specifically for medicine. Numbers seven through eleven will help us here. In our case, this is 02101. You can verify this by checking Order of the Ministry of Finance No. 132n dated 06/08/2018.

KBC penalties for insurance premiums for compulsory health insurance, fines and basic payments.

| Code by payment type (for employers) | ||

| Insurance premiums | Penalty | Fine |

| 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

IMPORTANT!

Codes for compulsory medical insurance payments for individual entrepreneurs are different!

| Code by payment type (for individual entrepreneurs - for yourself) | ||

| Insurance premiums | Penalty | Fine |

| 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

BCC for individual entrepreneur contributions for 2022

Individual entrepreneurs pay the BCC on their own. If an individual entrepreneur simultaneously works as an employee, he still must pay contributions for himself - as an individual entrepreneur.

Entrepreneurs are required to pay mandatory contributions to their own pension and health insurance until they are “listed” as individual entrepreneurs and have a Unified State Register of Entrepreneurs (USRIP) entry about them. The age of the entrepreneur and occupation does not matter. And most importantly, contributions must be paid even if the individual entrepreneur does not receive any income.

KBK for payment of fines

If an entrepreneur refuses to pay pension contributions in a fixed amount for himself and accrued penalties, then the Federal Tax Service will apply other sanctions in a larger amount. A fine is assessed for each offense: non-payment of the fee, penalty, or the fine itself. The amount increases with each day of delay. The individual entrepreneur is recommended to pay the sanction as soon as possible, indicating KBK 18210202140063010160 in the payment slip.

The specified codes for the payment of penalties and fines are valid for pension contributions from individual entrepreneurs in 2022 in a fixed amount, which are calculated for the period from January 1, 2017. Payments calculated before this period are determined by different codes.