The role of the journal

The main task of the journal is to put in order the movement of primary expenditure and receipt documents, so they must be registered immediately after creation. And only then can they be transferred to the cashier for further work (exceptions are orders for receiving wages, which are drawn up for one day, but cannot always be implemented in a timely manner).

In addition, the presence of a journal allows the management of the enterprise to avoid situations related to the unlawful use of payment documents. For this purpose, at the end of each working day, the company’s accountant must reconcile all entries made in the journal with the available stubs of “receipts” and “consumables”.

Also, a correctly completed journal in cases of tax audits allows you to quickly control the balance in the cash register (here it would be useful to remind you that when using the cash register, you should strictly adhere to the maximum allowable cash limit).

How to fill out a cash book: sample filling on paper

You can draw up a cash book either on paper or electronically. Each of these options has its own filling characteristics.

The paper form KO-4 is a journal printed in a printing house, filled out manually, or filled out on a computer and then printed, sheets of the cash book.

If the book will be filled out by hand, before starting work, you need to number and stitch all the sheets. On the back of the cover, a sheet of paper indicating the number of numbered sheets is glued to the lacing, and the seal and signatures of the manager and chief accountant are affixed. The title page indicates the name of the company and the period of use of the book.

The cash book sheet consists of two parts: the cash book loose leaf and the cashier's report, which are numbered with the same numbers. To fill out the sheet manually, carbon paper is required. The sheet is folded in half along the cut line, a carbon copy is placed in the middle, and the cashier fills in the non-tearable part (the first copy) with a ballpoint pen, and the tear-off part (the second copy) is copied.

What documents must be recorded in the journal

The journal for registering incoming and outgoing cash documents must contain:

- all documents indicating the receipt and expenditure of funds, regardless of what sources they came from or for what purposes they were spent;

- information about payroll statements accompanying the issuance of wages to employees of the enterprise (but only after the payment procedure has been completed);

- invoices for payment;

- applications for receiving funds, etc.

What is “Cash Book KO-4”

A cash book is a document that records the receipt and disbursement of cash at the company's cash desk. Filling out a cash book is mandatory for everyone, regardless of the organizational form and the applicable tax system. An exception is made for individual entrepreneurs who keep records of their income and expenses - they do not have to draw up cash receipts and expenditure documents, and, therefore, they do not need a cash book (clause 4.1 of Central Bank Directive No. 3210-U dated 03/11/2014).

The cash book is filled out (see sample below) on the current form of form No. KO-4, approved by Decree of the State Statistics Committee of the Russian Federation dated 08/18/1998 No. 88 (as amended on 05/03/2000). The paper form includes: cover, title page and pages of the cash book.

The procedure for maintaining a cash book is prescribed in Resolution No. 88 only in general terms; detailed instructions for filling it out have not been developed. Also, when filling out, you should be guided by the provisions of the Directive of the Central Bank of the Russian Federation No. 3210-U.

Is it possible to do without a logbook?

By law, companies working with cash register equipment are required to maintain cash discipline. One of its basic rules states that all documents must be registered in a special journal. Moreover, if an organization violates this norm, in the event of a tax audit it faces administrative punishment in the form of a large fine (in this case, both the legal entity itself and its director are subject to punishment).

Electronic cash book: how to properly manage 2017

Another option for maintaining a cash book is electronically using an accounting program where the company’s accounting is kept. When accounting entries for account 50 “Cash” are entered into the program, a cash book is generated automatically. The sheets of such a cash book can be printed at the end of the day and drawn up in a similar way to the previous version, or they can not be printed, but then it is necessary to provide additional protection of the document from unauthorized access and corrections after signing. The electronic cash book is signed with the electronic signatures of the chief accountant and cashier, in accordance with the provisions of the law dated 04/06/2011 No. 63-FZ.

Rules for compiling a journal for registering incoming and outgoing cash documents

Today, there are several ways to keep a journal, since there is no single unified sample that is mandatory for use. Enterprises can maintain a document in any form or according to a template developed and approved in the company’s accounting policy, or use a previously generally applicable form. In this case, the log must contain a number of mandatory information:

- name of the enterprise and structural unit whose property is the document;

- organization code according to OKPO (All-Russian Classifier of Enterprises and Organizations);

- year or other period for which it is maintained;

- personal data of the employee directly related to its filling: his position, full name.

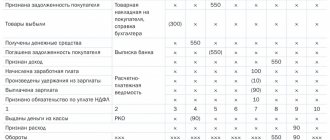

Basic information is presented in the form of a table into which data on all cash documents is entered in chronological order: on the left side about receipts, on the right side about expenses. For each of them, the following are entered in the corresponding cells:

- date of,

- number (according to the company’s internal document flow),

- the amount that passes through it

- note.

All lines are required to be filled out, including a note - it provides an explanation for a particular payment document.

Why is a cash register needed and how is its maintenance regulated by law?

First of all, the use of cash registers is prescribed in 54-FZ dated May 22, 2003 (last edition dated March 8, 2015). What this law regulates:

- Determines the types of organizations that must necessarily use cash registers in their activities. (These do not include individual entrepreneurs on “imputed” and PSN, or those who use strict reporting forms).

- Defines regulations for the use of the register of data contained in technology.

- Defines the requirements that apply to entrepreneurs and companies that use cash registers in their work.

- Indicates the rights of tax authorities and cash register inspectors.

The cashier-operator's journal is needed to keep track of cash received from the client and transferred to the cash desk of the company or entrepreneur.

All data obtained during journal maintenance will be taken into account to determine the tax base. In the case of individual entrepreneurs - personal income tax, as well as tax under the simplified tax system. In the case of a legal entity - tax under the simplified tax system and profits. Also, this data will serve for organized and simplified circulation of funds when interacting with customers (for example, when returning money for returned goods).

Also, data from the log is often linked to a warehouse accounting program. This allows you to quickly see the departure of goods and leftovers.

Requirements for maintaining a journal for a cashier-operator

Firmware. There are two options - either stitching the sheets, or the entire magazine.

Manager's signature. Placed on a check sheet with a transcript. When a company or entrepreneur uses a seal, it is placed on the signature (it should also be on the piece of paper).

Numbering. The number is placed on each sheet. In this case, there is no need to put page numbers; it is enough to number the sheets themselves.

Entry at the end. It is done on the last sheet, and part of it ends up on the control sheet. The entry should sound something like this: “In the journal, such and such a number of sheets are numbered, laced and signed (if there is a seal, then we write “and seal”).” Naturally, instead of “such and such” we write the final number of sheets.

Requirements for the cashier who fills out the journal

- Write with dark ink.

- Stick to chronological order.

- Take data according to the Z-report from the cash register tape.

- Calculate the final amount using a calculator (not yourself).

- Use different lines in the log if two reports were taken per day.

- Sign every day for entries. This should also be done by the manager or another person with authority.

- There is no right to make mistakes, erase what has already been written or correct it. Therefore, if a mistake was made, the entry is crossed out. The correct data is written next to it, or slightly above. And be sure to indicate the date when the corrections were made. After the error is corrected, the certification signature is again affixed by the cashier who previously made the error, as well as by the manager.

Only if the corrections are completed correctly, no punishment is provided.

Title page

You need to fill it out at the new journal, as already mentioned above, before you submit it in a package of documents to the Federal Tax Service. There you need to indicate information about the company, as well as information about the cash register, which you will have to take from the device’s passport.

Also, the title page should have information about the beginning and end of the magazine. The person responsible for filling out the data is also indicated. Typically, this person is appointed as a cashier who manages the cash register.

Note: a person’s responsibility is also indicated in his employment contract. And in addition to it, a document is signed on the financial responsibility of the appointed employee.

The procedure for filling out the cashier-operator log

- The first entry is the checksum. It is taken from the zero check that begins the Z-report and the act of starting to use the cash register.

- The checksum - 1.11 rubles - fits into column number six.

- The balance at the end of the shift will also be 1.11 rubles.

- At the end of the next working shift of the machine, the cashier will need to reduce the amount of receipts exactly by the size of the check sum.

- Columns in the cash journal:

- Change date.

- The serial number of the department or section (does not need to be entered if there is no division into sections).

- Last name of the filling cashier with initials. If the journal is constantly filled out by one cashier, you can only enter at the beginning of the page. The remaining lines already use the “-/-” sign.

- Serial number of the KKM fiscal memory report. It should also be taken from the Z report.

- Control counter readings. This value indicates the number of sales completed. This column should be filled out in cases where the cash register is sent for repair. The first data will be entered by an employee of the company that carries out the repairs. Subsequently, the cashier simply duplicates the information. Most often the column will be empty.

- Information about the cumulative total, which is displayed at the beginning of the shift.

- Cashier's signature.

- Signature of the shift supervisor or administrator.

- Cumulative counter information at the end of the day (report-Z).

- Revenue for the current day. Here you need to take into account both cash and non-cash amounts. But deduct the amounts of refunds, in cases where they exist. You can calculate this amount yourself or use the report.

- Cash deposited at the company's cash desk. To determine the figure, you need to subtract the acquiring receipt and return amounts from the amount of proceeds.

- The number of completed payments made using documentation.

- Non-cash payment amount.

- Cash deposited into the company's cash desk.

- Amount of refunds according to customer statements

- Signatures of the cashier (column number 16), administrator (17), manager (18).

Features of filling out a cash register

In case of cash refund

The main thing to remember is that the funds received from the client using the cash register go to the cash desk of the company or individual entrepreneur. And accordingly, they are not stored longer than one shift, and certainly cannot be used in another shift.

Therefore, when a client comes with the desire to issue a return, you must definitely look at the expired period. When everything happens within one cash register day, the cashier issues money for the return from the cash register cash register. In this case, an act is drawn up in the KM-3 form.

In other cases, when the buyer comes to another cash register shift, the funds are returned only from the company’s cash register, and not from the cash register.

Important points:

- The client has every right to return the product if it does not suit him according to one of the parameters (range, size, color).

- The law regulating return transactions is “On the Protection of Consumer Rights”.

- There is a list of goods that cannot be returned.

- If the client wants to return the money for the goods, then he should write a statement addressed to the head of the company. The company then has 14 days for this application to be considered and the money returned.

Magazine design rules

The journal can be maintained both electronically and in paper form. Moreover, if it is carried out “live” at the enterprise, then all its pages must be numbered, fastened with a special strong thread and certified with a signature. It is not necessary to endorse the journal with a stamp, because it relates to the company’s internal document flow; moreover, starting from 2016, legal entities are legally exempt from the requirement to use stamps and seals in their work.

During the maintenance period, the journal must be kept in a certain place, access to which must be strictly limited. After losing its relevance, it should be transferred for storage to the archive of the enterprise, where it should be kept for the period established by law.

Procedure, rules and sample filling

To correctly fill out the title page of this document, you need to pay attention to the following columns.

“Organization” - here, in fact, you need to enter the name of your company or the full name of the entrepreneur.

“OKPO code” - enter the OKPO code.

Don’t forget to indicate in the center of the sheet the start date of keeping the journal and the full name of the person who is responsible for keeping it.

Next we move on to the design of the loose leaf. It is important to understand that the first 4 lines are necessary for recording incoming cash orders, and the next 4 - for recording outgoing orders.

It should be remembered that the paper journal must be stitched and sealed, and all sheets in it must be numbered.