Book of accounting of income and expenses: form

The fact that it is necessary to keep a simplified book of income and expenses is enshrined in Art.

346.24 Tax Code of the Russian Federation. There are two types of books for accounting income and expenses: for “simplified” taxpayers and taxpayers under the patent tax system. Both forms were approved by order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n.

The same order contains texts of instructions for filling out both types of books. The book of accounting of income and expenses used by “simplified” (organizations and individual entrepreneurs) is devoted to appendices 1 (book form) and 2 (filling out procedure, hereinafter referred to as the Procedure).

You can learn more about the rules for maintaining accounting under the simplified tax system in the article “Procedure for maintaining accounting under the simplified tax system.”

Why is KUDiR needed?

A simplified individual entrepreneur does not keep accounting records. But in order to correctly calculate the tax on the simplified tax system, an individual entrepreneur must keep tax records in a special Book of accounting for income and expenses of organizations and individual entrepreneurs using the simplified taxation system (hereinafter referred to as KUDiR).

Also, all organizations using the simplified tax system work with KUDiR.

It is worth saying that many banks in which individual entrepreneurs or organizations have a current account now provide services that keep a ledger of income and expenses automatically (without user participation). It is very comfortable. But if you want to understand in more detail the formation of KUDiR indicators, you can watch this video:

Book of accounting of income and expenses under the simplified tax system: principles of income reflection

According to Art. 346.24 of the Tax Code of the Russian Federation, the book of income and expenses is intended only for accounting for transactions under the simplified regime. From this it follows that to reflect transactions related to the receipt of funds or property, which, in accordance with Art. 346.15 of the Tax Code of the Russian Federation is not income for tax purposes under the simplified tax system; it is not required to record income and expenses in the book.

Example

The Sisyphus organization applies the simplified tax system with the object “income minus expenses”. In the 1st quarter, the organization had income in the form of revenue from the sale of goods, as well as expenses in the form of payment for the rent of occupied premises and the purchase of goods. In addition, a loan was received from the bank to replenish working capital.

The income generated as a result of the receipt of revenue, as well as expenses, should be reflected in the book of income and expenses on the dates corresponding to the transactions.

The loan amount does not need to be entered into the book, since according to subparagraph. 10 p. 1 art. 251, sub. 1 clause 1.1 art. 346.15 of the Tax Code of the Russian Federation, credit funds do not form an object of taxation.

How to fill out the KUDiR on the simplified tax system “Income minus expenses”

Reference

When using the simplified tax system with the object “income minus expenses,” the individual entrepreneur finds two values. The first is the amount of income received in the reporting (tax) period. The second is the amount of costs incurred in the same period. The second value is subtracted from the first value, and the resulting number is multiplied by the tax rate: with income of 150 million rubles. (and a staff size of 100 people) or less - 15%, over 150 million rubles. (or more than 100 people) - 20%. The cash method is used. Income is taken into account at the time of receipt of money (to the account or in the cash register), expenses - at the time of repayment of the obligation to the supplier.

Individual entrepreneurs with this taxable object fill out three sections of the book: I, II and III.

Section I (filling sample)

It reflects income that increases the taxable base under the simplified tax system, as well as expenses that reduce it.

I. Income and expenses

Please note: the certificate for Section I must be completed only at the end of the tax period. If lines 040 (taxable base) and 041 (losses) contain negative values, you do not need to indicate them.

Request a tax reconciliation report from the Federal Tax Service via the Internet Request for free

Section II

It is filled out only by those entrepreneurs who bought or built fixed assets, or acquired (created themselves) an intangible asset. In a special table you need to indicate information about each object. Including noting which part of the cost was taken into account in expenses earlier, which is taken into account in the current period, and which will be taken into account in the future.

Section III

It is intended for “simplifiers” who carry forward losses from previous periods to the current tax period.

Let us remind you: the transfer is possible within 10 years, in whole or in parts. If losses are received over several years, they are transferred in the order in which they occurred (Clause 7, Article 346.18 of the Tax Code of the Russian Federation).

Keep records and calculate tax according to the simplified tax system according to the rules of 2022 Try for free

Book of income and expenses: form for combining two modes

Some taxpayers (IP) combine two modes: simplified tax system and PSN. In this case, the book of income and expenses according to the simplified tax system should not contain either income corresponding to the simplified tax system or expenses for it. To record transactions under PSN, a different income book is maintained, also approved by Order No. 135, as we discussed above in the article.

In addition to accounting for income and expense transactions, the book calculates the tax base and determines the amount of losses from previous periods that reduce it (Article 346.24 of the Tax Code of the Russian Federation, clauses 2.6–2.11, 4.2-4.7 of the Procedure).

But the tax payable in the book of income and expenses is not calculated - that’s what the tax return is for.

Features and general information about KUDiR

The book has a unified form. It can be maintained either in paper form, entering the necessary data by hand, or electronically.

If the book is kept on a computer, after the expiration of the accounting period it should be printed, the sheets numbered and stitched using thick, coarse thread. The final page is affixed with the individual entrepreneur’s stamp (if any) and signature, and the number of pages is also indicated. The book is then registered with the local tax office.

In the case when a paper version of KUDiR is used, it is registered with the tax office before filling out.

The book includes six sections that reflect all income and expenses of the individual entrepreneur made during the reporting period. It should be noted that sections are filled out depending on the area of work of the individual entrepreneur.

In other words, information needs to be entered only into those KUDiR blocks that are related to the activities of the individual entrepreneur.

Income book with simplified tax system 6%

If the taxpayer, preferring to work on the simplified tax system, chose the object “income”, the list of transactions should indicate:

- payments that are permitted by clause 3.1 of Art. 346.21 of the Tax Code of the Russian Federation to reduce the amount of tax (clauses 5.1-5.7 of the Procedure);

- expenses in the form of subsidies as part of state support for small and medium-sized businesses;

- expenses in the form of payments to stimulate the employment of unemployed citizens (column 5 of section I, paragraphs 3–6 of clause 2.5 of the Procedure).

According to para. 7 clause 2.5 of the Procedure, taxpayers with the object “income” can enter other expenses into the book of income and expenses on their own initiative. If they are absent, you are allowed not to fill out the certificate for Section. I, sec. II, sec. III, as well as column 5 of section. I (paragraph 2, clause 2.5, clauses 2.6, 3.1, 4.1 of the Procedure).

K+ experts have prepared a sample for filling out an organization’s book of income and expenses on the simplified tax system with the object “income” for 2022. Get free trial access to the ConsultantPlus system and proceed to the sample.

Filling out KUDIR under the simplified tax system Income

Since the taxpayer uses the simplified tax system for income only to take into account his own income, then in section I of KUDIR he will reflect only receipts to the current account or to the cash desk. At the same time, not any money received is taken into account as income for determining the tax base. According to Art. 346.15 of the Tax Code of the Russian Federation, the simplifier takes into account as income his revenue and non-operating income - rental of property and other income from Art. 250 Tax Code of the Russian Federation. The list of income that cannot be taken into account on the simplified tax system is given in articles 224, 251, 284 of the Tax Code of the Russian Federation.

This list is long, most of the income is very specific. Let us point out the most typical for the daily activities of most businessmen: money received from the Social Insurance Fund to reimburse the costs of child benefits and sick leave for employees, the return of advances or any overpaid amounts, the amount of loans received, or the return of a loan issued by the organization itself cannot be considered income.

Individual entrepreneurs have even more nuances when accounting for taxes on income received under the simplified system. The entrepreneur does not take into account in the KUDIR according to the simplified tax system his income as wages for hire, replenishment of the cash register of his own enterprise. The sale of property not used in business activities (for example, a car or apartment) is also not included in income when calculating the tax base.

How to conduct KUDIR with the simplified tax system of 6%? Income receipts are reflected by registering the PKO, payment order or bank statement. If you need to reflect the return of money to the buyer in KUDIR, then this amount must be entered in the “income” column with a minus sign.

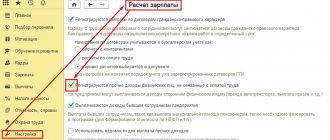

Another nuance of filling out KUDIR according to the simplified tax system for income is filling out section IV. Since the taxpayer can reduce the amount of tax on insurance premiums using the simplified tax system for income, the amount of these contributions should be reflected in section IV of the KUDIR. The book contains information about the payment document, the period for payment of contributions, the category of contributions and their amount. Entrepreneurs in this section indicate not only contributions for employees, but also their own pension and health insurance. Based on the results of each quarter, as well as half a year, 9 months and a calendar year, results are summed up.

Where to download a free book of income and expenses for 2021-2022

Starting from 2022, taxpayers using the simplified tax system must use the form of the book of income and expenses to record income and expenses as amended by Order of the Ministry of Finance of Russia dated December 7, 2016 No. 227n. This regulatory legal act supplemented the KUDIR form with section V, which reflects the amount of the trade fee, which reduces the amount of the single tax under the simplified tax system for payers of the simplified tax system with the object “income”. The same order approved changes to the Procedure for filling out KUDIR, both related to filling out this section and containing technical corrections.

Find out what the penalty (liability) is for ignorance, lack of certification (registration) and failure to submit a book of income and expenses to the tax authority. Get free access to the ConsultantPlus system.

A blank form of the book of income and expenses for 2021-2022 can be downloaded in a convenient format for free on our website using the link below.

Cancellation of KUDiR from 2022: is it fake?

Soon, individual entrepreneurs and organizations using the simplified tax system will no longer keep a book of accounts according to the simplified tax system and submit simplified declarations. This was announced by Deputy Head of the Federal Tax Service of Russia Dmitry Satin on the air of the “Taxes” program. Information about this is on the official website of the Federal Tax Service at the link .

“As a representative of the Federal Tax Service noted, now individual entrepreneurs and companies using the simplified tax system must keep a book of income and expenses and annually submit simplified declarations. This takes time and knowledge. And the new simplified tax system online regime will allow simplifiers to completely abandon current reporting under the simplified tax system. “STS-online: entrepreneurs in this special mode who use online cash registers will be able to get rid of almost all reporting as early as next year. The tax authority will independently calculate the amount of tax based on the data transmitted by the online cash register and send a notification for payment.”

The new tax regime of the simplified tax system online was planned to be introduced from July 1, 2020. After this date, those who simplified the “income” object, using online cash registers, hoped to forget about submitting declarations and maintaining KUDiR. However, before the introduction of a new special tax regime, the book must be kept. It was never introduced in 2022.

Also see: Cancellation of declarations under the simplified tax system.

Results

All simplifiers, regardless of the chosen object of taxation, fill out Section I of the KUDIR. Filling out other sections of KUDIR is determined by what object of taxation, “income” or “income minus expenses,” is applied by the simplified tax payer. For simplifiers with the object of taxation “income”, from 01/01/2018 KUDIR has been supplemented with another section, which reflects the paid amounts of trade tax.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated October 22, 2012 N 135n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Book form 2022

KIDiR can be maintained both on paper and electronically. For each new calendar year, a new KUDiR is opened.

The paper KUDiR must be laced and numbered, on the last page the total number of pages contained in it must be indicated and certified with the signature of the head of the organization and seal. The individual entrepreneur certifies the Book with his signature and seal, if the individual entrepreneur has one.

The “electronic” KUDiR must be printed at the end of each quarter. At the end of the year, such KUDiR is also laced, numbered and certified with a signature and seal.

KUDiR for individual entrepreneurs on OSNO

The procedure for filling out the Book for individual entrepreneurs under the general taxation regime was approved by joint Order of the Ministry of Finance No. 86n and the Ministry of Taxes of Russia No. BG-3-04/430 dated 08/13/02.

We have prepared a sample document for the OSNO “Book of Expenses and Income of Individual Entrepreneurs”; you can download it for free at the end of the article.

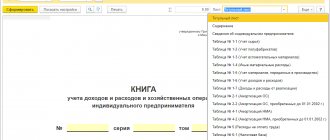

The book of income and expenses for individual entrepreneurs on OSNO consists of a sheet with information about the individual entrepreneur, a sheet with contents and 6 sections:

- Accounting for income and expenses.

- Calculation of depreciation of fixed assets.

- Calculation of depreciation for small business enterprises not written off as of 01/01/2002.

- Calculation of depreciation of intangible assets.

- Calculation of accrued and paid wages.

- Determination of the tax base.

Several tables have been developed for each of them; they must be filled out for each type of activity separately.

The sheet “Information about the individual entrepreneur” indicates the registration data of the individual entrepreneur, his bank accounts, license numbers, cash register numbers, types of business activities, place of business, telephone numbers.

The “Contents” sheet lists all completed tables with page numbers.

6.1 reflects the summary data on the basis of which the declaration is filled out.

Book of accounting of income and expenses, sample of filling out section 6.1

KUDiR for individual entrepreneurs on the simplified tax system

The document for the simplified tax system is much simpler, and it is filled out not only by individual entrepreneurs, but also by organizations that use the simplified taxation system.

The book of income and expenses for the simplified tax system 2022 consists of a title page and 4 sections:

- Income and expenses.

- Accounting for the costs of acquiring fixed assets and intangible assets taken into account when determining the tax base.

- Calculation of the amount of loss that reduces the tax base under the simplified tax system.

- Expenses that reduce the amount of the calculated simplified tax system.

The title page indicates: name of the individual entrepreneur, INN, object of taxation, bank account details, tax period, OKPO code.

In section 1, the amounts of income are recorded in chronological order as payments are received from clients.

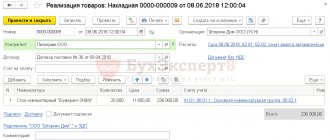

Sample of filling out KUDiR 2022 “income minus expenses” (hereinafter referred to as “D minus R”):

This is what section 1 of KUDiR 2022 of the simplified tax system looks like, you can find excel at the end of the article.

The last, 5th, column is filled out only for the simplified tax system with the taxable object “D minus R”.

The figures reflected in the first section of KUDiR are summed up quarterly on an accrual basis, and based on the data obtained, the taxable base for the simplified tax system is determined.

Sections 2 and 3 are filled out only with the simplified tax system “D minus R”.

Section 4 is filled out only for the object of taxation “Income”, it shows paid insurance premiums and other things determined by clause 3.1 of Article 346.21 of the Tax Code of the Russian Federation.

The amounts specified in section 4 reduce the amount of the accrued simplified tax system in full for individual entrepreneurs without employees and by no more than 50% if the individual entrepreneur makes payments of remuneration to individuals.

General requirements of KUDiR for all tax regimes

Every year a new document is opened.

At the end of the year, it is printed, stapled, the pages are numbered, the total number of pages is certified by the signature of the individual entrepreneur.

All information is recorded in chronological order based on primary documents and only after payment (cash method).

For transactions with settlements through a cash register, it is allowed to fill out the Book at the end of the working day using the Z-report.

KUDiR and primary documents on the basis of which records are made must be stored for 4 years.

If there is no activity, a “zero” KUDiR is printed and stitched.