When is it permissible to write off VAT on expenses?

In general, according to paragraph 1 of Art. 170 of the Tax Code of the Russian Federation, the amounts of input VAT (that which you pay when purchasing goods, works, services, rights or carrying out import transactions) are not included in the expenses taken into account when calculating income tax (or personal income tax). However, this does not apply to the situations listed in paragraphs. 2 and 5 tbsp. 170 Tax Code of the Russian Federation. VAT can be attributed to expenses if:

- the purchased goods or services are planned to be used in VAT-free transactions (confirmation of this position is in letters of the Ministry of Finance of the Russian Federation dated November 2, 2010 No. 03-07-07/72 and 04.13.2009 No. 03-03-06/1/236);

- the place of their implementation is not Russia (letter of the Ministry of Finance of the Russian Federation dated October 1, 2009 No. 03-07-08/195);

- you, as a taxpayer, are exempt from paying VAT or are not a payer of this tax due to the use of special tax regimes (letters of the Ministry of Finance of Russia dated November 11, 2009 No. 03-07-11/296 and dated September 3, 2009 No. 03-11-06/3/227 );

- acquired inventory, services or rights will be used in operations not recognized as sales;

- assets were acquired by banks, non-state pension funds, insurers, clearing companies, trade organizers, professional stock market participants and similar organizations (in strictly established cases).

NOTE! You can write off not only input VAT as expenses, but also tax calculated for payment if you paid it at your own expense, without presenting it to the buyer, or write off accounts receivable for goods shipped but not paid for.

Read about it here .

ConsultantPlus experts explained how to take VAT into account in expenses in accounting and tax accounting, as well as when calculating taxable profit. Get trial access to the system and move on to the Ready-made solution for free.

How and when to write off accounts payable

Accounts payable are formed in two cases:

- the buyer received the goods (works, services) and did not pay,

- the supplier received an advance payment, but never shipped the goods (did not provide services, did not perform work).

Such debt can be written off after the expiration of the limitation period, which is 3 years (Article 196 of the Civil Code of the Russian Federation). To ensure that tax officials do not have questions for you, you must prepare the following documents:

- inventory act,

- manager's order

- accounting information.

From January 1, 2013, unified forms of primary accounting documents approved by the Resolution of the State Statistics Committee of Russia are not required to be used.

This means that the inventory act can be developed independently, taking into account the required details. The act must contain information on all accounts payable, including those that are not overdue. The accounting certificate is compiled on the basis of data from accounting registers and other documents that confirm the amount of overdue debt. For example, this could be a reconciliation report with a lender.

For the purposes of calculating income tax, accounts payable with an expired statute of limitations are recognized as non-operating income on the last day of the reporting period (letter of the Ministry of Finance of Russia dated January 28, 2013 No. 03-03-06/1/38).

Example of writing off VAT on expenses: postings

As an example, consider the following situation: a Russian research institute purchases materials to carry out research work, and their payment is made from the federal budget.

Since according to sub. 16 clause 3 art. 149 of the Tax Code of the Russian Federation, such an operation is exempt from VAT; input tax in this case is not deducted, but is included in the cost of materials.

In postings, this operation will look like this:

- Debit 10 credit 60 (materials purchased).

- Debit 19 credit 60 (input VAT on purchased materials is reflected).

- Debit 10 credit 19 (input VAT is included in the cost of purchased materials).

“Late” invoice: is there a right to deduct VAT?

According to paragraph 2 clause 1.1 art. 172 of the Tax Code of the Russian Federation upon receipt of an invoice by the buyer from the seller after the end of the tax period in which TRUIP was registered, but before established by Art. 174 of the Tax Code of the Russian Federation, the deadline for submitting a tax return for the specified tax period, the buyer has the right to deduct the amount of VAT in relation to this purchase from the tax period in which it was registered.

For those who doubt it, the Ministry of Finance states: this procedure does not contradict tax legislation (see table below).

| Explanations from the Ministry of Finance | Conclusion |

| Letter dated February 14, 2019 No. 03‑07‑11/9305 | VAT deduction for services registered in September (Q3) on an invoice issued on October 5 and received before October 25 can be declared in the tax period in which the services were registered |

| Letter dated July 28, 2016 No. 03‑07‑11/44208 | VAT deduction on goods registered on March 30 (Q1) according to an invoice issued on April 1 and received before April 25 can be declared in the tax period in which the goods were registered |

Let's summarize: the period during which the right to deduct VAT under TRUIP is valid is counted from the date the acquisition is registered, regardless of whether an invoice has been received from the seller by that time.

note

One more important idea can be added to what has been said. The fact that the seller issued an invoice in violation of the established deadline (remember, this is established by paragraph 1, clause 3, article 168 of the Tax Code of the Russian Federation and is five calendar days, counting from the day of shipment of goods, performance of work, provision of services), is not the basis for refusal to accept VAT amounts for deduction by the buyer. The competent authorities give the go-ahead (see letters from the Ministry of Finance of Russia dated March 14, 2019 No. 03-07-11/16556, dated April 25, 2018 No. 03-07-09/28071).

If the invoice is received before the 25th day of the month following the tax period in which the TRUIPs are capitalized, the deduction can be claimed in the VAT return for the tax period in which they are registered. If the declaration has already been submitted by this time, you can submit a “clarification” and include in it a deduction for the “late” invoice.

If the invoice is “late” and received by the taxpayer after the end of the quarter in which TRUIP was accepted for accounting, as well as after the last day of the deadline for submitting the VAT return for this tax period, the buyer will claim a deduction in the next (when the invoice was received) tax period .

Options for writing off VAT on expenses

The moment at which VAT is written off as cost is not the same for different tax regimes. Let's consider the main cases.

- Taxpayers using UTII (before 01/01/2021) include the VAT amount in the cost of goods or materials as they are recorded.

- Taxpayers working on the simplified tax system for “income” have the right to take into account VAT in expenses at the time at their own discretion - the taxation procedure will not change. After all, expenses do not affect the object of taxation - income.

- For simplified people who use the simplified tax system “income minus expenses”, VAT on acquired assets can only be taken into account after their sale.

And of course, we must never forget that in order to write off VAT on expenses, you must have supporting documents.

To learn how VAT will be reflected in the book of income and expenses, read the article “How to take into account input VAT under the simplified tax system?” .

Next, we will consider several practical situations and the corresponding rules for writing off VAT.

Learning to work correctly with VAT in 1C

We continue the series of lessons on working with VAT in 1C: Accounting 8.3 (revision 3.0). We will look at simple examples of accounting in practice.

Most of the material will be designed for beginner accountants, but experienced ones will also find something for themselves.

Let me remind you that this is a lesson, so you can safely repeat my steps in your database (preferably a copy or a training one).

So let's get started.

Situation to consider

We (VAT payer)

bought 01/01/2016 for 11,800 rubles (including VAT 1,800 rubles)

01/05/2016 sold a chair for 25,000 rubles (including VAT 3,813.56 rubles)

Required:

- enter documents into the database

- create a shopping book

- create a sales book

- fill out the VAT return for the 1st quarter of 2016

We will do all this together and along the way I will draw your attention to the details that you need to know in order to understand the behavior of the program.

We make a purchase

Go to the “Purchases” section, “Receipts” item:

We create a new document for receipt of goods and services:

We fill it out in accordance with our data:

When creating a new product item, do not forget to indicate the VAT rate of 18% in its card:

This is necessary for convenience - it will be automatically inserted into all documents.

We also pay attention to the item “VAT on top” highlighted in the picture of the document:

When you click on it, a dialog appears in which we can specify the method of calculating VAT in the document (on top or in total):

Here we can check the “Include VAT in price” checkbox if we want to make input VAT part of the cost (attributed to 41 accounts instead of 19).

We leave everything as default (as in the picture).

We post the document and look at the resulting transactions (DtKt button):

Everything is logical:

- 10,000 rubles went to cost (debit 41 accounts) in correspondence with our debt to the supplier (credit 60).

- 1,800 rubles went to the so-called “input” VAT, which we will accept for offset (debit 19) in correspondence with our debt to the supplier (credit 60).

Total, after these postings:

- The cost of goods (debit 41) is 10,000 rubles.

- Input VAT to be credited (debit 19) - 1,800 rubles.

- Our debt to the supplier (credit 60) is 11,800 rubles.

This seems to be all, since often accountants, out of habit, pay attention only to the bookmark with accounting entries.

But I want to tell you right away that for the “troika” (as well as for the “two”) this approach cannot be considered sufficient. And that's why.

1C: Accounting 3.0, in addition to accounting entries, also makes entries in so-called registers. It is on the entries in these registers that she focuses her work.

She fills out the book of income and expenses, the book of purchases and sales, certificates, declarations for reporting... almost everything (except perhaps for such reports as Account Analysis, SALT, etc.) on the basis of registers, and not at all accounting accounts.

Therefore, it is simply vital for us to gradually learn to “see” movements in these registers in order to better understand and, when necessary, correct the behavior of the program.

So, let’s go to the register tab “ VAT Presented ”:

Income from this register accumulates our incoming VAT (similar to debit entry in account 19).

Let's check - have we met all the conditions for this receipt to be reflected in the purchase book?

To do this, go to the “Reports” section and select the “Purchase Book” item:

We form it for the 1st quarter of 2016:

And we see that it is completely empty.

The whole point is that we did not register the invoice received from the supplier. Let's do this, and at the same time let's take a look at what movements she makes through the registers (along with postings).

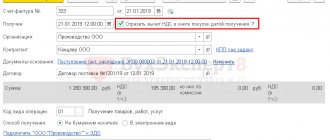

To do this, we return to the receipt document and fill in the number and date of the invoice from the supplier at the bottom of it, then click the “Register” button:

After some time, we see a link to the created invoice, open it:

Pay attention to the checkbox “Reflect VAT deduction in the purchase book by date of receipt.” This is the checkbox that is responsible for the appearance of our receipt in the purchase book:

Let's look at the postings and movements according to the registers of the received invoice (DtKt button):

The postings are quite expected:

- We subtract input VAT from account credit 19 to debit 68.02. With this operation we reduce our own VAT payable.

Total after this operation:

- As of March 19, the balance is 0.

- According to 68.02 - debit balance 1800 (the state owes us at the moment).

And now the most interesting thing, let’s look at the registers (over time you need to learn them all, along with the chart of accounts).

The “ VAT presented ” register is our old friend:

Only this time the entry was made as an expense. By doing this, we deducted the incoming VAT, similar to the credit entry for account 19.

And here is the new “ VAT Purchases ” register for us:

You probably already guessed that it is the entry in this register that is responsible for getting into the purchase book.

Book of purchases

We are trying to re-form the purchase book for the 1st quarter:

And voila! Our receipt was included in this book and all thanks to the entry in the “VAT Purchases” register.

About the invoice journal

By the way, we did not consider the third register “Invoice Journal”.

A record has been made on it, but let’s try to create this very log. To do this, go to the “Reports” section and select “Invoice Journal”:

We create this log for the 1st quarter of 2016 and... we see that the log is empty.

Why? After all, we have entered the invoice and the entry has been made in the register. And the whole point is that since 2015, a log of received and issued invoices is kept only when carrying out business activities in the interests of another person on the basis of intermediary agreements (for example, commission trading).

Our invoice does not fall under this definition, and therefore it does not appear in the magazine.

Making the implementation

Go to the “Sales” section and select “Sales (acts, invoices”):

We create a document for the sale of goods and services:

Fill it out in accordance with the task:

And again, we immediately pay attention to the highlighted item “VAT in total”.

We post the document and look at the postings and movements according to the registers (DtKt button):

Expected accounting entries:

- We wrote off the cost of the chair (10,000 rubles) as credit 41 and immediately reflected it as debit 90.02 (cost of sales).

- We reflected the revenue (25,000 rubles) on credit 90.01 and immediately reflected the buyer’s debt to us as debit 62.

- Finally, we reflected our VAT debt in the amount of 3813 rubles 56 kopecks to the state under credit 68.02 in correspondence with debit 90.03 (value added tax).

And if we now look at the analysis of 68.02, we will see:

- 1,800 rubles by debit is our input VAT (from the receipt of goods).

- 3,813 rubles and 56 kopecks on the loan is our output VAT (from sales of goods).

- Well, the credit balance of 2013 rubles and 56 kopecks is the amount that we will have to transfer to the budget for the 1st quarter of 2016.

Everything is clear with the wiring. Let's move on to registers.

The “ VAT Sales ” register is completely similar to the “VAT Purchases” register, with the only difference being that an entry in it ensures that sales are included in the sales book:

Let's check it out.

Sales book

Go to the “Reports” section, “Sales Book” item:

We form it for the 1st quarter of 2016 and see our implementation:

Amazing.

The next stage on the way to creating a VAT return.

Analysis of VAT accounting

Go to the “Reports” section, “VAT Accounting Analysis” item:

We form it for the 1st quarter and very clearly see all charges (outgoing VAT) and deductions (input VAT):

VAT for payment is immediately displayed. All meanings can be deciphered.

For example, let's double-click the left mouse button on the implementation:

The report has opened...

... in which, by the way, we see our mistake - we forgot to issue an invoice for sale.

Let's fix this bug. To do this, go to the implementation document and at the very bottom click the “Write an invoice” button:

The invoice was created automatically and a link to it appeared immediately:

VAT Accounting Assistant

Now go to the “Operations” section and select “VAT Accounting Assistant”:

We form it for the 1st quarter of 2016:

Here, in order, we talk about the steps that need to be completed to generate a correct VAT return.

First, let’s transfer the documents for each month:

This is necessary in case we entered documents retroactively.

We skip creating purchase book entries, because for our simplest case they simply won’t be there.

Next, we make sure that the sales book and purchase book meet our expectations:

And finally, click on the item “VAT Return”.

Declaration

The declaration has opened.

There are many sections here. We will consider only the main points.

First of all, in section 1 the final amount to be paid to the budget was filled in:

Section 3 shows the tax calculation itself (output and input VAT):

Section 8 contains information from the purchase book:

Section 9 includes information from the sales book:

All we have to do is fill out the title page and other required fields, and then upload the declaration electronically.

In this lesson, I tried to show, so to speak, the general train of thought of an accountant when generating VAT in 1C: Accounting 8.3 (revision 3.0).

At the same time, I focused our attention on the registers, movements along which are formed by the program along with accounting entries. We will gradually learn these registers; knowing them will allow us to more accurately understand the behavior of the program.

Briefly

Receipt of goods

- Dt 41 Kt 60 10000 [goods (cost) received from supplier]

- Dt 19.03 Kt 60 1800 [incoming VAT (to be deducted) from the supplier]

- Receipt according to the register “ VAT presented ” 1800

Invoice received

- Dt 68.02 Kt 19.03 1800 [offset of incoming VAT]

- Expense according to the register “ VAT presented ” 1800

- Entry in the register “ VAT Purchases ” 1800

- Entry in the register “ Invoice Journal ”

Sales of goods

- Dt 90.02 Kt 41 10000 [written off the cost of goods sold]

- Dt 62 Kt 90.01 25000 [reflected revenue]

- Dt 90.03 Kt 68.02 3813.56 [accrued VAT payable]

- Entry in the register “ VAT Sales ” 3813.56

Invoice issued

- Entry in the register “ Invoice Journal ”

Account 19.03 (VAT on purchased goods)

- By debit we collect incoming VAT.

- For the loan, we include the collected VAT in debit 68.02.

Account 68.02 (VAT calculations)

- We charge outgoing VAT payable on the loan.

- By debit we read off the VAT collected on the account on 19.03.

- We transfer to the budget the difference between credit and debit, that is, the credit balance.

We're great, that's all.

Watch the lesson “Learning to work correctly with VAT in 1C. Corrected invoice."

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up

Write-off of VAT on costs under the simplified tax system

According to officials, simplifiers can write off VAT on expenses only after the sale of the acquired asset (letters from the Ministry of Finance of Russia dated February 17, 2014 No. 03-11-09/6275 and dated September 24, 2012 No. 03-11-06/2/128).

The justification for this position is that, according to sub. 23 clause 1 art. 346.16 of the Tax Code of the Russian Federation, when calculating the tax base, one should take into account the costs of paying for the cost of inventory items acquired for subsequent sale (with their reduction by VAT amounts).

In accordance with sub. 3 p. 2 art. 346.17 of the Tax Code of the Russian Federation, expenses for paying taxes of companies using the simplified tax system are accepted based on the amounts actually paid.

According to sub. 8 clause 1 art. 346.16 of the Tax Code of the Russian Federation, simplifiers who use the “income minus expenses” scheme reduce their income by expenses in the amount of VAT on paid goods and materials and services.

According to the rules established by sub. 2 p. 2 art. 346.17 of the Tax Code of the Russian Federation, expenses for paying the cost of inventory items purchased for subsequent sale are taken into account in the tax base as they are sold.

Summarizing the above, officials state that VAT on purchased goods under the simplified tax system can only be taken into account after their sale.

Is it possible for simplifiers to deduct VAT paid at customs when importing goods into Russia? Find out in ConsultantPlus. If you don't already have access to the system, get a free trial online.

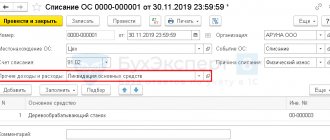

Restoration of VAT on fixed assets and intangible assets

Here there will be a slightly different picture: VAT (the one that was accepted for deduction when purchasing property) is not restored in full, but only from its residual value. At the same time, the restored VAT on these assets, in accordance with Art. 264 of the Tax Code of the Russian Federation, must be taken into account as another expense that reduces taxable profit (letters of the Ministry of Finance of Russia dated 04/01/2010 No. 03-03-06/1/205, dated 01/27/2010 No. 03-07-14/03).

Example

A company switching from 01/01/2022 from OSNO to simplified taxation system has a car with an initial cost of 3 million rubles, while depreciation was accrued on the date of transition in the amount of 1 million rubles. The amount of VAT that was previously declared for deduction is RUB 600,000. In this example, we first need to calculate the residual value of the car (it will be equal to 2 million rubles), after which we can determine the amount of VAT attributable to this cost:

600 000 × 2 000 000 / 3 000 000 = 400 000.

Now let’s reflect the calculations made in the transactions:

Dt 19 Kt 68 – 400,000 – VAT on fixed assets, previously deducted, has been restored;

Dt 91 Kt 19 – 400,000 - restored VAT is charged to other expenses.

Do simplifiers need an invoice to write off VAT as expenses?

From 10/01/2014, sellers are allowed not to issue invoices to simplified buyers. However, for this it is necessary to sign a special agreement stating that invoices will not be issued (subclause 1, clause 3, article 169 of the Tax Code of the Russian Federation). This is also evidenced by letters from the Ministry of Finance (in particular, dated 09/05/2014 No. 03-11-06/2/44783).

See the material “Additional agreement on the abolition of the obligation to issue invoices when executing a contract for the supply of goods to a person who is not a VAT payer .

In this case, such an agreement can be executed electronically.

If there is no such agreement, then the issue of the availability of an invoice is resolved ambiguously, and the opinions of officials are divided.

Thus, in the letter of the Federal Tax Service of Russia for Moscow dated June 28, 2006 No. 18-11/3/ [email protected] it is reported that in order to include VAT as an expense, an invoice is required (along with supporting documents for payment, acts, invoices). Moreover, letter No. 03-11-04/2/147 of the Ministry of Finance of the Russian Federation dated September 24, 2008 states that the invoice must not only be available, but must also be filled out correctly.

However, earlier in a letter from the same department dated October 4, 2005 No. 03-11-04/2/94, it was stated that the document confirming the costs of paying VAT for simplifiers is a payment order.

As for the courts, they believe that in this case not only invoices, but also other primary documents are suitable (for example, the resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated September 19, 2005 No. A31-8435/19). And the tax authorities themselves admitted in their later letters that in order to take into account the amounts of VAT paid in expenses, bills and invoices would be sufficient (letter from the Federal Tax Service of Russia in Moscow dated July 19, 2011 No. 16-15/ [email protected] ).

And yet, since today the law officially allows simplifiers not to issue invoices, it is more advisable to draw up an agreement on the non-issuance of these documents. It will take a little time, but in the future you won’t have to guess how officials and judges will once again calculate.

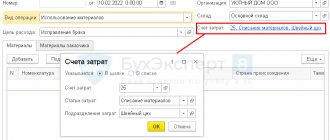

In what cases is the VAT write-off document used?

To account for VAT on expenses, a special 1C program is used. In it you can create a “Value Added Tax Write-off” form. It reflects the acceptance of the submitted fee for reimbursement by the counterparty. The exclusion of payment may be relevant if goods and other valuables are purchased by an accountable person.

The document is generated by entering based on receipts or using the transaction log for tariffs and creating a new form. In addition, you will need to display the dates of compilation, indicate the type of value, and the amount excluding tax.

Results

From the general rule about the impossibility of including VAT in expenses, the Tax Code of the Russian Federation makes several exceptions, which include the further use of the purchased item in transactions not subject to VAT. In particular, VAT can be included in expenses when applying special regimes. With a number of features under special regimes, the moment of inclusion in expenses is determined.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.