About legal entities

Organizational provisions To formulate tax accounting regulations, the company discloses data that allows more accurate

Grounds for closing an individual entrepreneur Grounds for closing an individual entrepreneur can be divided into two categories:

We issue standard deductions. The law allows employees with disabilities, participants in military operations, persons,

How to work according to the new rules of PBU 18/02 from 2022? In what ways can you take into account

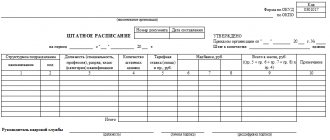

The staffing table is an official document of a legal entity, which is drawn up by the personnel department, accounting or

Concept and classification of assets Assets are the property of an enterprise that should bring profit in the future.

Understanding of direct and indirect taxes Taxes levied on taxpayers can be divided into the following

TIN is a taxpayer identification number that the tax office assigns to individuals and legal entities.

USN, OSNO, PSN, NPD, Unified Agricultural Tax: for some this is a meaningless set of letters, but

Absolute liquidity ratio: economic meaning of the indicator The absolute liquidity ratio can also be called the cash ratio