When to pay personal income tax when dismissing an employee in 2020

If he has unused rest days, by mutual agreement, an order for vacation with subsequent dismissal can be prepared. In this case, vacation pay is transferred three days before the start of the vacation (Article 136 of the Labor Code of the Russian Federation). Other calculations will be listed later.

Personal income tax on vacation pay is transferred on the day of payment of vacation pay or no later than the day following the transfer of vacation pay.

IMPORTANT!

All payments to the employee are made before the start of the vacation, since the last working day before the vacation is the last day of work. This position is fixed in the ruling of the Constitutional Court No. 131-O-O and the explanation of Rostrud No. 5277-6-1.

At the same time, clause 2 of Art. 223 of the Tax Code of the Russian Federation states that the date of receipt of income in the form of wages is the last day of the month for which the employee was accrued income. In other words, if the withheld tax is transferred not the next day after the end of work, but on the last day of the month, you are not breaking the law. This conclusion is confirmed by the position of the Federal Tax Service of Russia in letter No. BS-3-11 / [email protected] , which states that the date of transfer of personal income tax upon dismissal is in 2022. in form 6-NDFL it may be indicated as the last day of the month in which the employee was paid income.

When should taxes be paid?

The deadline for paying income tax for a dismissed employee is specified in Article 226 of the Tax Code of the Russian Federation. The employer, being a tax agent, or, as they also say, a source of payments, must:

- Withhold tax on the day of payday or payment of other income, such as benefits.

- Transfer the withheld tax either on payday or the next day, but not later than this period. If we are talking about benefits and vacation pay, the employer pays until the end of the current month. A payment order for personal income tax upon dismissal in 2022 is drawn up and submitted to the bank no later than the final payment to the employee.

Tax legislation provides only general deadlines within which taxes are paid to the budget.

Therefore, it does not matter whether the employee received the money on the card or in person, the rules for withholding and payment are the same. Deadlines for payment of personal income tax on payments to employees

| Type of payment | Tax payment deadline |

| Advance and salary | The next day after the day of payment of wages for the second half of the month |

| Prize | The day following the date of payment to the employee |

| Final settlement | The next day after the last day of work |

| Sick leave and vacation pay | Last day of the month |

It must be remembered that if an employee is employed both at the head office and in one of the divisions, and then quits completely, then a personal income tax payment with compensation for unused vacation upon dismissal and other payments must be issued separately from both workplaces. Also, one employee must report to the Federal Tax Service twice.

Transfer of personal income tax upon dismissal in 2022

Let's look at the basic rules for paying taxes:

- the rules for transferring funds are specified in the Regulation of the Central Bank of the Russian Federation No. 383;

- the procedure for filling out information in the details of orders for transferring funds to the budget system of the Russian Federation is given in Order of the Ministry of Finance No. 107;

- payments to the budget system of the Russian Federation are codified by Order of the Ministry of Finance No. 65n, which specifies budget classification codes;

- The order of payments is indicated in Art. 855 of the Civil Code of the Russian Federation.

When filling out a payment order for tax payment, you must take into account the order of filling out the fields:

- 101 - payer status, code 02 (tax agent) is indicated.

- 7 - payment amount, indicated in whole rubles, that is, without kopecks.

- 21 — payment queue code 5.

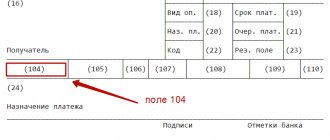

- 104 - budget classification code (KBK), 182 1 01 02010 01 1000 110 (tax payment code).

- 105 - OKTMO code, municipal formation (inter-settlement territory) where tax funds are accumulated.

- 106 — basis of payment, TP code (current period).

- 107 - period, indicate the month in which the employee was actually fired, the amount of tax was withheld and transferred to the budget.

Regardless of the chosen option, the execution of a payment order for the transfer of tax to the budget is the same.

Purpose of payment during settlement

A personal income tax payment order is a form that is often used when paying taxes and various insurance contributions to the country’s budget. It has fields responsible for all kinds of indicators. It is recommended that you fill out the document extremely carefully. This is required to ensure that the tax paid goes to its intended destination.

The purpose of payment upon dismissal of an employee in the payment order must also be filled out correctly. In this field, it is recommended to write the following: “Personal income tax on income upon dismissal of employees. Date of income – day, month, year.”

Sample payment order for personal income tax payment in 2022

Paying personal income tax is one of the integral responsibilities of most taxpayers. The fact of timely receipt of payment by the Federal Tax Service depends on the reliability of the payment document. What does a sample personal income tax payment form look like in 2022?

Tax-tax January 11, 2022 All story materials Sample payment order in 2022 - penalties with its help will be able to be paid by those who are overdue for mandatory payments (taxes, fees, contributions). In this article we will talk about the features of preparing a payment order for the payment of penalties.

If an employee is dismissed on this day, he must be paid compensation for vacation that was not used.

Cells 101 to 110 are filled in only if the payment amount will be transferred to the account of the Federal Tax Service or customs.

Regardless of the option chosen, you need to know the features of drawing up a personal income tax payment order in 2022, taking into account the latest changes in legislation.

If false information or a document filled out with errors is provided, the regulatory authority can hold the organization accountable by imposing penalties. A payment order is a document that specifies the details of a banking organization for further transfer of funds to it for payment of wages and other funds to employees. Personal income tax clause 6, article 226 “. 6. Tax agents are required to transfer the amounts of calculated and withheld tax no later than the day of actual receipt of cash from the bank for the payment of income, as well as the day of transfer of income from the accounts of tax agents in the bank to the accounts of the taxpayer or, on his behalf, to the accounts of third parties in banks.

Many people ask whether it is possible to transfer personal income tax from vacation pay and salary in one payment? The answer is yes, if the dates of receipt of income fall within the same month.

Wage

Salary is the main monetary payment due to employees for their work. The law obliges employers to pay it every six months. This rule applies to both cash and bank cards. In order for the money to arrive on the card on time, employees must write an application in advance and indicate in it the card number or bank account details.

The terms of the contract for servicing a card account in some banks provide for a certain time period during which wages are credited to the account. Most often this happens the next day after receiving a confirming payment document.

In order for the organization’s employees to receive their earned money in a timely manner by non-cash method, the employer should provide the bank with a register for the transfer of funds to employees and the corresponding payment order. It must contain the following information:

- In the “Recipient” column - the name and location of the banking organization where employee accounts are opened.

- In the “Amount” field - the total amount that should be transferred to the accounts of all recipients.

- In the “Purpose of payment” column - the purpose of the transfers. There must also be a link to the date and register number. For example, “Transfer of wages for August 2022 according to register No. 3 dated September 4, 2022.”

There are cases when not the entire staff of the company, but individual employees (freelance units, employees with a flexible schedule) receive their salaries by non-cash method.

Then the payment is filled out a little differently. In the “Recipient” field, the employee’s first, last and patronymic names are indicated, and in the “Recipient’s Account” section, the number of his personal bank account is indicated. In most companies where employees work, they are paid in two installments after 15 days. The first part is called the advance. To complete it correctly, in the “Payee” section you need to indicate the name of the financial organization involved in the transfers, and enter the employee’s full name in the “Details” column. To indicate the purpose of the payment, use the wording “Payment of wages for half of such and such a month.” As the amount, it is necessary to indicate the amount of the advance according to statement T-51.

Payment order upon dismissal of an employee: purpose of payment and sample filling

Dismissal is the termination of the employment relationship between an employer and his subordinate. After this, the employee must vacate his workplace and previously occupied position. It should be noted that this procedure does not take place without the mandatory termination of the employment contract.

If you read the Labor Code of the Russian Federation, you can find out that upon dismissal from a job, an enterprise must pay the former employee in full on the last day.

Some difficulties may be caused by the mandatory payment of personal income tax upon dismissal in the new year. Accountants are often interested in how to correctly calculate personal income taxes. In this article you can also find out what a payment order is upon dismissal.

Sample payment order for personal income tax 2022 from employee salaries

To transfer the personal income tax amount, you can contact the bank and pay the tax in cash, indicating the necessary payment details in the receipt. When paying non-cash, you must draw up a payment order.

Get started now. We will show the general requirements for filling out a payment order in 2022 with calculated amounts on a sample payment order. Fields 62 and 71 are filled in by bank employees. In field 3, enter the payment order number. In field 4 - the date the document was compiled. In field 5 - electronically (when submitting a payment through a client bank) In field 101, the tax agent company puts “02”.

At the end, you must put the date the application was written and the employee’s signature. REFERENCE. The period for consideration of the application and payment of benefits is not regulated. According to the provisions of Article 140 of the Labor Code, the manager must pay all funds due to the citizen on the last day of his work. In most situations, the employee receives wages, vacation pay, bonuses and other payments, from which already.

Sample payment order for personal income tax in 2022

If income tax is paid on several amounts within one day, for example, from vacation pay and wages, two separate payment forms are filled out. Each one contains information on the specific type of income on which personal income tax is charged.

Key indicators of the payment: If you are transferring personal income tax on vacation pay, there are not many features in the design. In the purpose of the payment, indicate that the tax is specifically on vacation pay.

The Regulations in question set a limit on the number of characters for the “Payment purpose” field – 210.

Everyone who pays employees transfers personal income tax to the budget. To avoid mistakes that lead to fines and other difficulties, carefully fill out payment orders. But there are differences in filling out payment slips for transferring taxes from wages, from vacation pay, from payments upon dismissal, as well as for paying penalties and fines for personal income tax.

The Regulations in question set a limit on the number of characters for the “Payment purpose” field – 210.

For example: “UFK for Moscow (Inspectorate of the Federal Tax Service of Russia No. 20 for Moscow).” Order of payment (field 21) Everything is simple here, set: - 5 - if this is a standard tax payment; – 3 – if payment is made at the request of the tax authorities (see above for a sample payment order for personal income tax 2019). KBK (field 104) For standard payment by a tax agent, KBK will be as follows: - 182 1 0100 110.

Number of characters in a payment order: purpose of payment

In the latter case, the final payment under the contract can be made not only on the final day of the person’s work, but also after this moment.

An example of filling out a payment order to a Sberbank card when transferring money to an individual employee: You can transfer not only your salary to your employee’s card, but also all payments that he receives while performing his job duties.

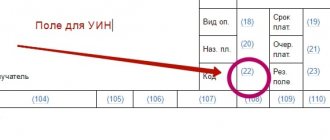

For payments based on a document with a unique payment identifier (UPI), enter 20 characters of the UIP code. Payment due date. 19 The payment term does not need to be specified.

Moreover, if you indicate the code of your Federal Tax Service in the appropriate field, then in the sample payment slips you will see the details of your tax office/your Social Insurance Fund.

Termination of labor relations between an employee and an employer can be initiated on the grounds provided for in Art. 77 Labor Code of the Russian Federation. In this article, we will consider possible types of mutual settlements with an employee upon dismissal and the features of transferring personal income tax (hereinafter referred to as tax).

How to issue a personal income tax payment order if the next day is a non-working day

The deadline for paying income tax for a dismissed employee is postponed if the date of transfer of personal income tax upon dismissal in 2022 coincides with a weekend or holiday. For example, an employee’s last working day is April 30. A full settlement has been made with him, and the calculated amount is withheld from payments. But it will not be possible to pay it, because the next day is May 1, the official holiday of all workers. May 2–5, according to the production calendar, are non-working days in 2020. As a result, the payment for personal income tax upon dismissal is dated Wednesday, May 6, the first working day after weekends and holidays.

How to fill out a payment form

Traditionally, several questions arise about what to write in a payment order when dismissing an employee: what payer status to indicate (field 101), what BCC to enter (field 104), how to reflect the period for which the tax is paid (field 107). We answer:

- In field 101 tax agent organization enters code 02; employer - individual entrepreneur - 09.

- In field 104, the tax agent organization writes 182 1 01 02020 01 1000 110; employer - individual entrepreneur - 182 1 0100 110.

- Field 107 is filled in the format MS.XX (month).2020. Please note that there is no need to enter a number, and the month data must coincide with the period when the income was actually received.

- The field “Purpose of personal income tax payment upon dismissal” contains the name of the tax and the period for which it is paid.

Sample payment form for personal income tax upon dismissal in 2020

The easiest way to correctly indicate all the data is to use the special free service of the Federal Tax Service “Filling out a payment document for the transfer of taxes, fees and other payments to the budget system of the Russian Federation.” It allows you to automatically enter all BCCs and payer status. The only thing where you cannot make a mistake in the personal income tax payment from salary and compensation for unused vacation upon dismissal is in the TIN, KPP and the name of the payer.

Tax documentation

An employer who dismisses an employee is obliged not only to hand over the papers due to him, but also to correctly fill out tax documents and make calculations upon dismissal.

The purpose of payment in the payment order must be indicated in accordance with existing standards. The payment form has numbered fields that are required to be filled out. The payer status is reflected in field No. 101. The payer can be:

- individual;

- entrepreneur;

- tax agent.

Each status is assigned a specific numeric code. If contributions to the state budget are made by an individual entrepreneur, the payment document is marked with code 09, the organization - 01. Code 08 is assigned when entrepreneurs and companies pay non-tax transfers by the Federal Tax Service.

The law requires all categories of employee payments to be reflected in payment documents. Such payments include vacation pay. Personal income tax on them must be paid before the end of the month in which they were accrued. It is allowed to make payments for several employees who have gone on vacation.

If the amount of tax withheld exceeds the established amount, the difference must be returned to the employee. He must learn about the fact of excessive deduction within 10 days from the date of deduction. Funds can be offset against future taxes or paid from the budget.

Sometimes the opposite situation arises when the tax contribution is less than required. Then the unpaid difference is designated as arrears. It happens:

- ordinary (ZD);

- according to the tax authorities' claim (TR);

- according to the verification report before the tax demand (AP).

The type of arrears should be indicated as a letter combination in field No. 106. It indicates the basis for the payment made.

Many companies practice bonuses to employees for quality work. The tax on the premium must be received on the day it is transferred to the account or on the day it is received in cash at the bank. If an employee receives a bonus at the company’s cash desk, then personal income tax must be transferred no later than the next day.

On the day of dismissal, employees are paid taxable compensation (vacation pay, overtime, etc.). The purpose of payment upon final settlement with the employee may be indicated as a reference to the law defining the requirements for settlements.