Authorized capital is part of the company’s funds contributed during its creation in the amount established by law. In the future, the company can use them in its activities along with other sources of financing.

In this publication, we will look at the operation of forming the authorized capital in 1C 8.3 Accounting 3.0 and find out what transactions are generated when contributing the authorized capital:

- to a current account;

- cash from the founder.

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Authorized capital in 1C 8.3 step by step instructions

Let's look at the postings for contributions to the management company in 1C 8.3 using an example.

GrantMebel LLC is established. According to the constituent agreement, shares in the management company are distributed as follows:

- 20% - founder Druzhnikov G.P.

- 80% - founder of Pegasus LLC.

On January 11, the state registration of the Company in the Unified State Register of Legal Entities took place.

On January 16, the founder Druzhnikov G.P. paid the share in cash to the cashier.

On January 18, payment for the management company was received to the bank account from the founder of Pegas LLC.

Authorized capital in 1C 8.3 step-by-step instructions →

How to deposit authorized capital in 1C

Contribute to the authorized capital in 1C with the document Formation of authorized capital in the section Operations – Accounting – Formation of authorized capital.

In the document, fill in the members of the company and their shares by clicking the Add . To do this, select the type of founder:

- Individual;

- Entity.

And select from the appropriate directory of the founder.

Formation of authorized capital in 1C 8.3 transactions

The document generates the posting:

- Dt 75.01 Kt 80.09 - formation of the management company.

How to print a list of company participants in 1C 8.3

In 1C, you can print information about beneficial owners by clicking the List of founders . But by default, the payment form on the printed form is set to “Cash”. If necessary, it can be edited manually directly on the printed form.

How to take into account the formation and increase of authorized capital

Account 80 is intended for accounting of transactions with authorized capital. If necessary, sub-accounts can be opened for it. Account 80 is passive, therefore it is debited when capital decreases and credited when it increases.

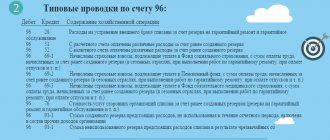

Let's look at the basic wiring.

Postings for formation

Reflect the amount of authorized capital recorded in the constituent documents as of the date of state registration of the LLC. Make records of each founder's contribution. Basis documents - Unified State Register of Legal Entities, charter.

Posting: Credit 80 Debit 75-1 “Calculations for contributions to the authorized capital” - Contribution to the authorized capital is reflected

It is necessary to reflect the receipt of contributions to the organization, taking into account what the founder contributed - property or money.

To deposit money

The cash deposit is reflected by the entry “Dt 50-1 Kt 75-1 - Founder’s contribution to the authorized capital has been received.” The primary document for recording will be the cash receipt order. Based on it, an additional entry must be made in the cash book.

For a contribution to the current account, the posting is similar to “Dt 51-1 Kt 75-1 - We receive the founder’s contribution to the authorized capital.” The basis document will be an account statement.

To contribute property

The authorized capital can also be formed with property, but only if at least 10,000 rubles have already been contributed in money. And in the constituent documents there should be no restriction on payment of the share with non-monetary property.

There is a nuance here - the transferred property must be assessed. To do this, you can invite a specialist appraiser. Then the general meeting of LLC participants approves the monetary value of the contribution: it may be less, but should not be more than the amount named by the appraiser.

To transfer property, a transfer and acceptance certificate is sufficient. Sometimes additional actions may be necessary, for example, registering the transfer of ownership of the transferred warehouse.

Let's see how the contribution is reflected in fixed assets:

- Dt 08 Kt 75-1 - We receive property in payment of the authorized capital:

- Dt 75-1 Kt 83 - If the value of the transferred property is greater than the size of the share, we reflect the share premium;

- Dt 19 Kt 83 - Reflect the restored VAT subject to deduction;

- Dt 68 Kt 19 - We accept VAT for deduction;

- Dt 01 Kt 08 - We transfer the received property to the OS.

If in order to obtain and prepare for use fixed assets it was necessary to spend money on delivery, installation and other services, then such expenses can be included in the initial cost of the fixed asset.

VAT on property that will be used in non-taxable transactions cannot be deducted. It is written off as other expenses.

The contribution of materials is reflected in a similar way, but with a number of differences. Firstly, all additional costs are included in the actual cost, and not in the original cost. If the founder himself spent money, they become part of the contribution. Secondly, materials received from an individual are accounted for at the lower of the amounts:

- expenses for the purchase or creation of materials, supported by documents;

- market value established by the appraiser.

The wiring is as follows:

- Dt 10 Kt 75-1 - We receive a contribution to the authorized capital in the form of materials;

- Dt 75-1 Kt 83 - Reflect share premium;

- Dt 19 Kt 83 - We reflect VAT for deduction;

- Dt 10 (19) Kt 60 - We reflect additional costs and VAT on them;

- Dt 68 Kt 19 - We accept VAT on materials and additional costs for deduction.

Wiring for increase

Only the already paid authorized capital is increased. This can be done through the LLC's property, attracting new members, or additional contributions from current members and third parties.

In almost all cases, for this purpose, a general meeting of participants is organized, a decision is made on the increase and changes are registered in the charter.

Accounting entries are made on the following dates:

- If the capital is increased due to contributions from new or old participants - on the date of actual receipt of the property. Wiring - Dt 75-1 Kt 80.

- If the capital is increased at the expense of the LLC - on the date of state registration of changes in the charter. Wiring - Dt 84 (83) Kt 80.

Otherwise, the wiring is the same as for the formation.

Taxation of contributions to the authorized capital

VAT can be deducted if the organization uses the received property in activities subject to VAT. In this case, the tax must be restored by the transferring party and highlighted in the documents used to formalize the transfer of the deposit. An invoice will not be needed, and the purchase ledger will record the documents used to document the transfer of property.

Profit and loss will not appear when receiving a property contribution. The cost of this property and VAT will not be included in income. In the future, its cost can be taken into account in expenses, since the participant received a share as payment. Depreciation on fixed assets is charged, goods and materials are written off upon sale or transfer to production.

The received property becomes the property of the LLC, therefore real estate is subject to property tax if it complies with the conditions of Art. 374 and 375 of the Tax Code of the Russian Federation.

Contribution to the management company using cash transactions in 1s 8.3

Payment for a share in the management company can be made in cash to a current account or to the organization’s cash desk (Clause 1, Article 15 of the Federal Law of 02/08/1998 N 14-FZ).

Payment for the share is made by the founders in full and within the period specified in the constituent agreement. The deadline cannot exceed 4 months from the date of state registration (Clause 1, Article 16 of the Federal Law of 02/08/1998 N 14-FZ).

In the accounting system, payment for the share is taken into account in the credit of account 75.01 “Calculations for contributions to the authorized capital” in correspondence with the cash accounts.

Let's consider what transactions will be generated when paying to the cash register and to the current account.

Amount of authorized capital

The minimum amount of capital is established by the Civil Code and laws on business companies:

- for LLC - 10,000 rubles (Clause 1, Article 14 of Federal Law No. 14-FZ);

- for organizers of gambling through bookmakers or sweepstakes - 600 million rubles (Clause 9, Article 6 of Federal Law No. 244-FZ);

- for banks and credit organizations - from 90 million to 1 billion rubles (Article 11 of Federal Law No. 395-1).

The LLC must maintain the minimum amount of authorized capital throughout its activities. If the amount of net assets turns out to be less than the authorized capital for more than 2 tax periods, the company must either reduce the authorized capital, and if this is not possible, then make a decision on liquidation.

Depositing funds to LLC occurs in compliance with the following rules:

- 10,000 rubles are deposited in cash;

- anything over the minimum size can be entered as property;

- property must have an assessment if the nominal share of the property contribution exceeds 20,000 rubles;

- The deadline for making contributions by the founders is no later than 4 months from the date of state registration.

Contribution to the management company in cash transactions in 1C 8.3

Payment of the authorized capital to the cash desk in 1C 8.3 is completed with the document Cash Receipt, transaction type Other Receipt, in the Bank and Cash Desk section - Cash Desk - Cash Documents - Receipt button.

Authorized capital in money in 1C 8.3 postings

The document generates the posting:

- Dt 50.01 Kt 75.01 - payment of the management share in cash to the cashier.

Contribution to the management company through a current account posting in 1C 8.3

Payment of the Criminal Code to an account in 1C 8.3 is completed with the document Receipt to the current account, transaction type Other receipt in the Bank and cash desk section - Bank - Bank statements - Receipt button.

Authorized capital posting in 1s 8.3

The document generates the posting:

- Dt Kt 75.01 - payment of the management share to the account.

Management account and reporting

Accounting for the authorized capital is kept on account 80 with analytics:

- by founders (participants);

- stages of formation (in PJSC, JSC and HT);

- types of shares (in PJSC and JSC).

The credit balance on account 80 must be equal to the amount of the capital reflected in the charter, regardless of the fact of its payment. The first entry for accounting of the authorized capital is made on the date of registration of the legal entity. Subsequent adjustments to the accounting of the authorized capital are made according to the date of registration of changes made to the charter in relation to the size of the charter capital.

Account balance 80 is reflected in the “Capital and Reserves” section of the balance sheet on line 1310.

Increasing the authorized capital of transactions in 1s 8.3

The increase in the authorized capital is reflected on the date of state registration of changes in the charter by posting:

- Dt 75.01 Kt 80.09

If 1C 8.3 already has documents:

- Entering balances

(Dt 000 Kt 80.09); - Formation of authorized capital

(Dt 75.01 Kt 80.09),

then to reflect the increase in the capital, you must use the document Transaction entered manually in the section Operations – Transactions entered manually – Create – Transaction.

We looked at how to post authorized capital in 1C, postings for authorized capital in 1C 8.3.

To access the section, log in to the site.

Increase in capital

An increase in the amount of share capital can be made both by the decision of the founders and by legal requirements.

The company considers the issue and makes a decision to increase capital in the following cases:

- lack of working capital;

- accepting new participants;

- additional issue of shares (for joint-stock companies, joint-stock companies);

- acquisition of licenses for activities that require a larger capital amount.

The source of increase in share capital will be either the LLC’s own property, or contributions from new founders, or additional contributions from existing members of the company.

Increase in authorized capital, posting:

| Due to net profit | Dt 84 Kt 80 |

| Due to the contributions of new LLC participants | Dt 75.01 Kt 80 |

| By increasing the contributions of existing participants of the Company | Dt 75.01 Kt 80 |