About legal entities

What the Ministry of Finance of the Russian Federation says about the deduction of VAT on a cash receipt Hidden text goods were purchased

The main responsibility of every entrepreneur is to pay taxes in full and on time. Behind

In what cases may it be necessary to recalculate vacation pay? Calculation of employee's rest pay is based on the amount

Payroll and attendance number of employees The definition of payroll number is clear from the name itself - it is

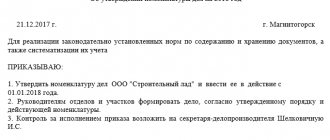

Why do we need nomenclature and an order for its approval? To fully understand the role of the order,

Deflator coefficients for UTII, personal income tax and trade tax have become known. They are recorded in the draft order

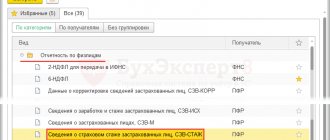

Purpose and types of SZV-STAZH informs the Pension Fund about insured persons who are assigned to the employer.

The current declaration form and new requirements for completion have been taken into account. Let us immediately note that the program in question

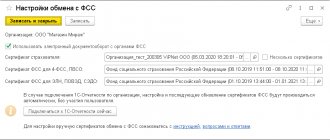

Connection to EDMS in ZUP 3.1 In the program “1C: Salary and Personnel Management 8” (starting

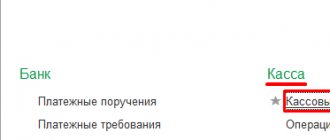

Today, almost all entrepreneurs are required to use online cash registers. Now CCP is also needed for non-cash payments