Purpose and types

SZV-STAZH informs the Pension Fund about insured persons who are assigned to the employer. As part of the report on each of them, the following information is sent to the fund: full name, SNILS, periods of work, existence of grounds for early accrual of pensions, information about special working conditions (harmfulness, danger). This information is necessary for the subsequent assignment of pension benefits.

The SZV-STAZH form comes in several varieties:

- initial – filled out if the policyholder submits personalized reporting for the first time during the reporting period;

- supplementary – filled in if you need to enter information that is not in the original report;

- assignment of pension – filled in if the employee needs to take into account the periods of the current year to calculate the pension.

It is important to know that SZV-STAZH of any type is submitted together with the EDV-1 form. This is not an independent report, but an inventory, but without it the basic form will not be taken.

During the reorganization through the merger of the SZV-M organization, a new inspection was passed

The deadline is no later than the day when the organization submitted documents to make an entry in the Unified State Register of Legal Entities about the termination of its activities.

Nina Kovyazina, Deputy Director of the Department of Medical Education and Personnel Policy in Healthcare, Ministry of Health of Russia

organizations and their separate divisions. Including foreign organizations that operate in Russia;

TIN, if available. Therefore, if an individual does not have a TIN or it is unknown to the employer, then put a dash (clause 2.2 of Article 11 of the Law of April 1, 1996 No. 27-FZ).

To avoid mistakes when filling out the SZV-M form, check yourself and check the form with the list of common errors due to which the report on the SZV-M form will not be accepted.

For example, the deadline for the December 2016 report is January 16, 2022. January 15 is Sunday, so the deadline is postponed to the next business day.

After transferring the information to the Pension Fund, but no later than the deadline for submitting the report itself, also transfer copies of the SZV-M to employees.

This follows from the provisions of paragraph 2.2 of Article 11 and part 4 of Article 17 of the Law of April 1, 1996 No. 27-FZ, paragraph 2 of Article 9 of the Law of December 29, 2015 No. 385-FZ.

The error report from the Pension Fund arrived on the same day - February 15. The SZV-M report was also updated on the same day. The inspectors did not issue a fine.

Completed and signed by director A.V. Lvov submitted the SZV-M form to the Alpha accountant to the territorial branch of the Pension Fund of the Russian Federation.

Who submits the report and where?

Organizations must report under SZV-STAZH for their employees hired under labor and civil law contracts. In addition, the Pension Fund requires that the form be submitted for managers who are the sole founders.

Individual entrepreneurs who attract hired labor also submit the SZV-STAGE form. But individual entrepreneurs without employees do not fill out this report. Self-employed persons also do not apply.

The SZV-STAZH form must be sent to your territorial division of the Pension Fund: for entrepreneurs - at the place of residence, for organizations - at the place of registration. If the company has separate divisions that are registered as policyholders, then the form is sent to the branch at the location of such OPs. If they are not policyholders, then the necessary information is submitted to the parent organization as part of its report.

The standard deadline for submitting the form is March 1 of the year following the reporting year. If it is a weekend, the deadline is traditionally postponed to the next working day.

In addition, there are special deadlines for sending SZV-STAZH:

- when an employee applies for a form - within 5 working days;

- upon dismissal of an employee - on the last day of work;

- when assigning a pension - within 3 calendar days from the date of the employee’s application;

- in case of liquidation/reorganization of a company - within a month from the date of approval of the interim/separation balance sheet, but no later than the day of submitting documents to the tax office;

- when deregistering an individual entrepreneur - within a month from the date of the decision to terminate activities;

- in case of bankruptcy - before submitting the manager’s report to the arbitration court.

Free accounting services from 1C

SZV-STAZH upon liquidation of an organization

4. Information about the payment of insurance premiums. This indicates whether insurance premiums were transferred for a certain period of work.

5. Information about pension. A checkbox is placed indicating the payment/non-payment of pension insurance contributions and for how long the payments were made.

— Courier services when submitting documents to the Federal Tax Service of the Moscow Region (2000 p up to 80 km, 3000 p over 80 km from Moscow)

— Courier services when submitting documents to the Federal Tax Service of the Moscow Region (2000 p up to 80 km, 3000 p over 80 km from Moscow)

— Courier services when submitting documents to the Federal Tax Service of the Moscow Region (2000 p up to 80 km, 3000 p over 80 km from Moscow)

The Company takes all reasonable measures to protect the received personal data of the Subject from destruction, distortion or disclosure.

personal data - any information relating to a directly or indirectly identified or identifiable individual (subject of personal data);

automated processing of personal data - processing of personal data using computer technology;

dissemination of personal data - actions aimed at disclosing personal data to an indefinite number of persons;

provision of personal data - actions aimed at disclosing personal data to a certain person or a certain circle of persons;

3) It is not allowed to combine databases containing personal data, the processing of which is carried out for purposes incompatible with each other;

3.7. The company destroys or depersonalizes personal data upon achieving the purposes of processing or in the event of the loss of the need to achieve the purpose of processing.

5.1.6. To protect your rights and legitimate interests, including compensation for losses and/or compensation for moral damage in court.

Filling out the form

Let's move on to how to fill out the form. The SZV-STAZH form was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2022 No. 507P. He also approved the procedure for filling out the report. It consists of only one page, but there are some nuances when reflecting data in it.

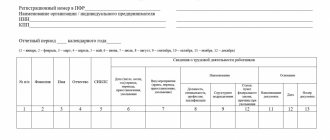

Section 1 contains information about the policyholder:

- registration number in the Pension Fund of Russia;

- TIN, KPP (only for legal entities);

- short title;

- type of form SZV-STAZH - in the block on the right you need to put an “X” next to the desired type (for initial submission - initial). Only one box must be checked.

In section 2 you need to indicate the reporting year.

Section 3 contains a table reflecting data on the length of service of employees. There should be exactly the same number as in the SZV-M report, which is submitted monthly.

The table is filled with the following data:

- Column 1 – number. It must be taken into account that one employee may have several periods of work, that is, more than one line will be filled in columns 6 and 7. In this case, the number is assigned only to the first record.

- Columns 2-4 – last name, first name and patronymic of the insured. Middle name is indicated if available. Similar to the number, if several lines of the report are filled out for an employee, the full name is indicated once.

- Column 5 – SNILS. It is also filled out once, even if several lines of the form are allocated for the employee.

- Columns 6 and 7 – start and end dates of work in the reporting period. If you need to reflect several periods of work in a calendar year, you should fill out several lines. If the employee worked all year, then January 1 and December 31 of this year are indicated. If the employee was hired in the reporting year, then the start date of the contract is entered in column 6, and December 31 in column 7. Accordingly, if an employee quits, then the beginning of the work period will be January 1, and the end will be the date of dismissal. Dates must be entered in numeric format.

- Column 8 - you need to indicate the code according to the “Territorial Conditions Codes” classifier, which is given in Resolution No. 507. When working in special territorial conditions, the right to early retirement arises. This is, in particular, work in agriculture (VILLAGE), in the regions of the Far North (RKS/RKSM) and equivalent areas (MKS/MKSR).

- Column 9 - is filled in if the employee has special working conditions that affect the assignment of a pension earlier than the generally accepted period. For example, hazardous conditions, work in hot shops or underground corresponds to the code “27-1”, work in difficult conditions - “27-2”.

- Column 10 - reflects the code of the basis of the insurance period for employees who work in conditions that give the right to early retirement. For example, VODOLAZ – for divers and other specialists who work underwater;

- Column 11 - codes for special working conditions, if any, are indicated.

- Columns 12 and 13 are filled in if the working period gives the right to early retirement. Column 12 indicates the code, column 13 - additional information.

- Column 14 - the value “12/31/XXXX” is indicated, but only if the employee is fired on the last day of the year.

There are many rules that must be followed when filling out the tabular part of the form. For example, in column 8 and column 11 the codes “CHILDREN”, “NEOPLE”, “QUALIFIED”, “SUSPENDED”, “SIMPLE”, “SCHOOL LEAVE” and some others cannot appear simultaneously.

Sections 4 and 5 are intended to be completed only if the form is submitted due to the assignment of a pension (SZV-STAZH of the corresponding type). In section 4 you need to answer whether insurance premiums for the employee were accrued and paid at the basic and additional rates in the current year. The first paragraph of this section must be completed without fail - it talks about basic contributions.

Section 5 contains information on contributions under early non-state pension agreements.

CV length of service during reorganization in the form of transformation

— merger, when a new legal entity is formed from several legal entities that cease their activities;

- merger, when one legal entity is joined by another legal entity that ceases its activities, and in the end one remains;

- separation, when another legal entity is separated from one legal entity, while both continue to conduct their activities;

Let’s consider what is meant by a change in the owner of an organization’s property and a change in its jurisdiction.

- when converting property owned by an organization into state ownership (Article 235 of the Civil Code of the Russian Federation);

A change in the ownership of the property of a state institution is, in essence, a reorganization in the form of transformation.

Note. The ownership of the enterprise passes to the buyer from the moment of state registration of this right (Article 564 of the Civil Code of the Russian Federation).

It should be borne in mind that all employees, including those on vacation or sick leave, should be notified.

Quite often, when an institution is reorganized (for example, during a merger, division, spin-off), there is a reduction in the number of employees or staff.

Note! If the employee’s position is retained in the new staffing table, there are no grounds for dismissal due to staff reduction.

Note! The vacation schedule is mandatory for both the employer and the employee (Article 123 of the Labor Code of the Russian Federation).

3. Employees must be informed about any reorganization in order to exercise their right to dismissal under clause 6, part 1, art. 77 Labor Code of the Russian Federation.

4. Additional agreements to employment contracts are concluded with employees, and entries are made in their work books about the reorganization of the institution.

5. The next annual leave is provided to employees in the reorganized institution in accordance with the vacation schedule approved before the reorganization.

Fines

If you do not meet the deadline for submitting the form or submit it with errors or incomplete information, the fine will be 500 rubles for each insured person. An official may also be fined in an amount from 300 to 500 rubles.

For violating the report form, that is, submitting it on paper instead of sending it electronically, the fine will be 1,000 rubles.

So, we reviewed the SZV-STAZH report and told you how to fill out this form. We recommend that you see what the finished report should look like. However, you need to remember about different working conditions and other nuances, so it’s worth looking into Resolution No. 507P.

Where to find the SZV-STAZH report in 1C

create a SZV-STAZH :

- in the section Reporting, references - 1C: Reporting with the switch set to By category , in the report group Reporting by individuals :

- in the section Reporting, certificates – Accounting documents – Information on the insurance experience of insured persons, SZV-STAGE;

- in the section Reporting, certificates - Pension Fund. Packs, registers, inventories - Information about the insurance experience of the insured persons, SZV-STAGE.

Adjustments during reorganization

A new section of four lines has been added to the amended SZV-TD form, which is valid in cases of company reorganization. The assignee must submit updated reporting if there are adjustments to the previously submitted SZV-TD information. In this case, you need to draw up a statement to the employer’s legal successor with a request to correct errors in the SZV-TD report. And information about the company whose error needs to be corrected must be contained in the current extract of the Unified State Register of Legal Entities of your company (successor).

Note! You cannot simply correct reports for other employers at the employee’s request. The form has been supplemented only for cases of reorganization; if an error is found in the reporting of a company liquidated on the initiative of the manager, the employee can apply to the Pension Fund for correction.

The new section contains information about the former employer:

- Name;

- registration number in the Pension Fund of Russia;

- TIN;

- Checkpoint.

Information about insurance experience

Employers will have to report for the first time using the new SZV-STAZH form at the end of 2022. The deadline for submitting the report is no later than 03/01/2018.

The SZV-KORR form is submitted if it is necessary to clarify (correct) or cancel the data recorded on the individual personal accounts of the insured persons (clause 1.10 of the Procedure).

The SZV-ISH form is filled out by an employer who has violated the reporting deadlines for reporting periods up to and including 2016 (clause 5.1 of the Procedure).

- in column 6 - the start date of the vacation is indicated;

- in column 7 - end of vacation;

- in column 11 - paid leave code “DLOTPUSK”.

The paper form is filled out with ink or a ballpoint pen of any color except red and green in block letters. Erasures and corrections are prohibited.

- “AGREEMENT” – when in the reporting period there was payment under the agreement;

- “NEOPLDOG” or “NEOPLAUT” – when payment has not yet been made.

- about unworked periods, for example vacations, sick leave, etc.;

- periods of work in harmful or special territorial conditions.

- Submit the report again (If the report was NOT accepted, you must submit SZV-STAZH with the “Initial” type in section 1)

- Add information

Incorrect information about the individual. But the fund accepted them and took them into account in the personal account. To correct an error, submit the SZV-KORR form with the type “KORR”

3. A.P. Ivanov. He has been working under an employment contract since 2016. In the period from June 5 to June 25, 2022, I was on regular vacation.

- up to 1.5 years – until March 1, 2022 (inclusive);

- up to three years – from March 2, 2022 to November 30;

- went back to work December 1st

If you do not submit a report on time or submit it with incomplete or false data, then there will be penalties

Give the extract from SZV-STAZH to the employee also on the day of dismissal or termination of the civil contract.

In this case, the policyholder provides information on 25 or more insured persons working for him in the form of an electronic document.

The essence of the phenomenon

Reorganization refers to the transformation, restructuring of the organizational structure of the company while maintaining the production potential of the enterprise. It can be carried out in various forms. Depending on which form is chosen and the specified reporting is prepared. Thus, SZV-M, when reorganized in the form of annexation, is surrendered according to different rules than, for example, a merger.

For your information

- A merger is a reorganization when several organizations, enterprises or institutions are combined into one group.

- Division is a reorganization of a legal entity, in which its rights and obligations are transferred to newly established legal entities in accordance with the separation balance sheet.

- Spin-off is the creation of one or more companies with the transfer to them of part of the rights and obligations of the reorganized company without cessation of the latter’s activities.

- Transformation is a change in the organizational and legal form of a legal entity. For example, a joint stock company can be transformed into an LLC, business partnership or production cooperative.

Thus, reorganization can be very diverse and SZV-M during reorganization in the form of transformation differs from reporting during merger.

For your information

The report in the SZV-M form is submitted according to the form approved by Resolution of the Pension Fund Board of February 1, 2016 No. 83p.

It includes four sections:

- details of the policyholder;

- reporting period;

- form type;

- information about employees.

Information for filling out these forms is contained in individual cards created for each insured person (clause 4 of article 431 of the Tax Code of the Russian Federation). At the bottom of the form, the policyholder (the head of the organization, an entrepreneur or an authorized person by power of attorney) puts the date of preparation and signature.

Who should be added to SZV-STAZH?

The report includes all insured persons, namely:

- employer's employees, incl. sole founder;

- individuals with whom GPC agreements have been drawn up;

- authors of works with whom agreements have been drawn up on the alienation of exclusive rights to created works, publishing license agreements granting the right to use created works.

Attention! SZV-STAZH based on the results of the year is filled out even in the case when an employment or civil employment contract has been drawn up with the insured person, but payment under it has not been made during the period of generation of the report.

SZV-STAZH: detailed instructions from the Pension Fund of Russia

Along with the SZV-STAZH form, you must submit the EDV-1 . When submitting reports electronically, forms SZV-STAZH and EDV-1 are generated in one file.

The last time RSV-1 had to be submitted by February 15/20, 2022 (in paper/electronic form) for 2016.

Termination of the insured-employer's status as a lawyer and the powers of a notary engaged in private practice

For individuals officially recognized as unemployed , the SZV-STAZH form is submitted by the employment service.

If an employee leaves during 2022 and the dismissal is not related to retirement, there is no need to submit the SZV-STAGE form early.

The calendar year is indicated in full, with four digits, and has a value equal to or greater than “2017” .

The number of insured persons presented in the SZV-STAZH form must match the number of insured persons presented in the SZV-M.

In column 1 of section 3 of the form, the numbering is continuous, in ascending order, without omissions or repetitions .

If it is necessary to reflect several periods of work for one person, each period is indicated on a separate line.

Operating Period - Dates must be within the reporting period specified in Section 2 of the form.

For forms with the “Pension assignment” type, the “Period of work” column is filled in until the date of expected retirement.

- “AGREEMENT” - if payment under the agreement was made during the reporting period;

- “NEOPLDOG” or “NEOPLAVT” - if there is no payment for work under the contract.

The simultaneous combination of the codes “RKS”, “ISS” in column 8 and the codes “NEOPLDOG”, “NEOPLAVT”, “AGREEMENT” in column 11 is allowed.

Sections 4 and 5 - to be completed only for SZV-STAZH forms with the information type “ appointment of pension ”.

Section 5 is completed after the adoption of federal legislation on occupational pension systems.

If the form should be sent via TKS, but this order is violated (27-FZ), the fine will be 1000 rubles .

Along with the SZV-STAZH form, you must submit the EDV-1 . When submitting reports electronically, the SZV-STAZH and EDV-1 forms are generated in one file.

In the SZV-STAZH form, errors were identified in the information on the insured person (for example, in the date of employment) and the information was taken into account on the ILS ZL

It is necessary to cancel the information on the insured person previously submitted in the SZV-STAZH form

SZV-STAGE for a part-time worker in 2022

The form for submission to the Pension Fund includes information about all insured persons who are in an employment relationship with the organization.

Employees working part-time must be shown in SZV-STAZH. SZV-STAZH must be taken for both internal and external part-time workers (clause 1.5 of the Procedure, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p).

Data on part-time workers in the SZV-STAZH form is reflected as for regular employees. The period of work under normal conditions is reflected in section 3 of SZV-STAZH in the general manner, in one line.