The current declaration form and new requirements for completion have been taken into account

Let us immediately note that the program in question allows you to fill out 3-NDFL for 2017, taking into account all the requirements established by the basic order of the Tax Service of Russia dated December 24, 2014 No. ММВ-7-11/671 (hereinafter referred to as Order No. ММВ-7-11/671 ) in the latest edition – dated 10/25/2017. Let us remind you that they are assigned:

- declaration form 3-NDFL for 2022;

- electronic file format with this report;

- rules for filling out the declaration form.

Thus, in the “Declaration 2017” program, it is almost impossible to fill out 3-NDFL in 2018 in violation of current requirements. After all, it contains:

- The most current declaration form, similar to the paper version.

- The corresponding filling algorithm takes into account the presence of all mandatory details, as well as the latest changes to Order No. ММВ-7-11/671.

Also see "".

What is needed to fill out the 3-NDFL declaration

First, you need to download the 3-NDFL 2022 declaration form, print it if filling it out manually, or fill out the form on a computer. The declaration using the new form can also be filled out using a special program already posted on the Federal Tax Service website.

You can download form 3-NDFL 2022, current in 2022, below.

Data should be entered into the declaration after all necessary supporting documents have been collected. Information to be filled out is obtained from “2-NDFL” income certificates issued by the tax agent, from payment, settlement and other supporting documents, as well as from calculations that are made on the basis of these documents.

What does the application from the Federal Tax Service do?

Before you fill out the 3-NDFL declaration in the program, it is important to understand that it will automatically generate the declaration sheets necessary for your case based on the information you entered.

Simply put, the final version of your 3-NDFL will include as many sheets as needed. The Federal Tax Service will automatically skip any unnecessary applications.

The standard 3-NDFL form from 2022 includes 20 sheets. The final version will include the least of them if you declare only income and do not declare deductions. But with deductions the number of sheets will be greater.

Also see “Download the 3-NDFL declaration for 2022 to fill out.”

After filling out the 3-NDFL through the program, it will generate the sheets itself:

- for all taxable income from domestic and foreign sources;

- by income from business and private practice;

- data for calculating professional deductions for royalties and civil contracts;

- property deductions;

- data for calculating the tax base for transactions with securities, financial instruments of futures transactions and taxable income from participation in investment partnerships;

- for calculating standard, social and investment deductions (+ losses on securities and financial instruments).

Most importantly, the instructions for filling out 3-NDFL through the program assure that the application has built-in:

- control of entered data for their availability (mandatory details);

- checking their correctness.

Also see “Installing the “Declaration” program for filling out 3-NDFL for 2022: instructions.”

Where to begin

Find the following icon on your desktop and launch it:

As a rule, filling out 3-NDFL in the “Declaration 2017” program does not cause much difficulty, since its interface is quite simple and understandable. For example, the main screen you will have to work with looks like this:

To understand how to correctly fill out 3-NDFL in the program, it is important to understand the general principle: first enter individual information, and then this application from the Federal Tax Service will collect it together. It's almost impossible to miss anything. After all, if some required data is missing, the program simply will not generate your 3-NDFL for 2017.

Our instructions on how to fill out 3-NDFL in 2022 in the program from the Federal Tax Service would be incomplete if we did not tell you about the main options that you will have to work with when filling out the report.

Toolbar

It looks like this:

This is access to various main menu functions. You just need to click on the desired button once. If anything, a hint under the mouse arrow will help you figure it out. Essentially, these are step-by-step rules for filling out 3-NDFL in the program.

Main menu

It looks like this:

When you select “File”, a submenu with the following content will appear:

Here the rules for filling out the 3-NDFL declaration in the program from the Federal Tax Service of Russia allow you to:

| Possibilities of the “File” submenu | |

| Option | What gives |

| Create | Generates a new declaration. At the same time, if another declaration is open at the same time and changes are made to it, but not saved, a proposal to save them will appear. According to the instructions, the 3-NDFL program begins each start with the creation of a new declaration. That is, you can enter and change data. |

| Open | Makes it possible to open a file with 3-NDFL, which was previously entered and saved. At the same time, if another declaration is open at the same time and changes are made to it, but not saved, a proposal to save them will appear. |

| Save | Allows you to save the active declaration to a file |

| Save as… | Prompts for the name and location of the file to save |

| Exit | Allows you to leave the program |

Please note: all these options are duplicated on the toolbar.

Important instructions when filling out 3-NDFL in the program: if, after selecting the Create/Open/Save/Exit options, the request to save changes was confirmed, but you did not enter a file name, a dialog will still appear asking for the name and location of the new file. That is, the entered data will not disappear anywhere.

When you select the “Declaration” item, the following submenu will appear:

| Possibilities of the “Declaration” submenu | |

| Option | What gives |

| View | Preview of the generated declaration in the form and volume in which it will be printed if “Print” is selected |

| Seal | Printing the selected 3-NDFL |

| Export | Moves the data of the current declaration to a file in the format approved by the Federal Tax Service (xml) for sending to the Federal Tax Service |

| Check | Analysis of the generated declaration for completeness and compliance of the entered data |

Please note: all these options are duplicated on the toolbar.

When you select “Settings” you will see:

It allows you to enable or disable:

- show toolbar;

- displaying labels under buttons on the toolbar.

When you select Help, a submenu will appear:

Here:

- “Help” – call up comments to the program (can also be opened with the F1 key);

- “About the program” – its version and technical support contacts.

Navigation bar

It shows the topic section you are completing. Just click on it once.

Please note that according to the instructions for the 3-NDFL “Declaration” program, some buttons may not be available. This depends on what conditions you initially set (“Set Conditions”).

Main window

It is here that you need to enter and edit the basic information that will go into the 3-NDFL report:

Note that, compared to last year’s version of this program, in 2022 a field for indicating OKTMO has appeared (see above).

Also see “Which OKTMO to indicate in 3-NDFL”.

The internal instructions for filling out the 3-NDFL declaration in the program indicate that when launched, the application automatically generates an “empty” declaration. And at any time you can:

- save the entered data to disk;

- load a previously saved declaration;

- create a new one.

The title will show the name you gave to the file with 3-NDFL.

Entering basic information

Now about how to fill out 3-NDFL for 2022 in the program. The instructions suggest starting from the main window (see picture above). Here the main conditions (reason) for filling out this declaration are introduced.

If you are submitting the primary 3-NDFL report, put “0” in the “Adjustment number” field. In the opposite situation, the instructions for the program for filling out 3-NDFL for 2022 require you to enter the number for which you submit the updated declaration.

The OKTMO field was introduced in 2013 instead of the OKATO field. Its meaning can be found in your Federal Tax Service.

The “Income available” panel logically separates the information input. For her, detailed instructions for filling out 3-NDFL in the program are shown in the table below.

| How to fill out “Income available” | |

| Option | Explanation |

| Choose the first option if you have income: • according to 2-NDFL certificates; • under civil contracts; • royalties; • from the sale of property, etc. | This is data on income that is taxed at rates of 13, 9 and 35% (in the case of a non-resident - 13, 15 and 30%). The exceptions are: • income in foreign currency; • income of individual entrepreneurs; • profit from private practice; • income from participation in investment partnerships. |

| If you have income in foreign currency | Check the box next to “In foreign currency” |

| If you have income from business activities | Check the box next to “From business activity” |

| When there are income from participation in investment partnerships | The checkbox next to “Invest. partnership" |

Keep in mind: the step-by-step filling out of 3-NDFL in the program is organized in such a way that each of these points allows or denies access to entering the relevant information. If you have not selected any of the options, you will only be able to enter information about yourself.

Now let’s talk about how to correctly fill out the “Inspection Number” field in the program for 3-NDFL. There shouldn’t be any particular difficulties here either. The current list of all Russian tax inspectorates (at the time of release of your version of the program) is already attached to this field (see the figure below). Just press the “…” button:

However, how to fill out 3-NDFL using the program if your tax authority is suddenly not on this list? The Federal Tax Service assures that it can be edited independently in any text editor.

Inspections reorganize quite often, so they change their code. If a year ago you applied to the Federal Tax Service (conditionally with code 7777), this does not mean that you should add it to the list. First, find out if she has changed the name and code. Perhaps it is already in the directory, but under its new code - conventionally 7778.

The second approach to filling out 3-NDFL through the “Declaration” program in this part is to use the built-in mode for updating the list of inspections. True, it is more complicated: you need to download the archive from the Internet yourself and unpack it to the appropriate location.

Also see “How to correctly indicate the Federal Tax Service in 3-NDFL”.

The following is information about the declarant and his address:

Please note that, unlike last year, it is not necessary to indicate the exact address of residence, including abroad, from 2022.

In general, how to fill out the 3-NDFL declaration through the program using these columns is fully consistent with the design of the title page of this form in paper form.

If you were previously able to fill out 3-NDFL using the “Declaration” program of previous versions (2002 - 2016) and there was a file left with information about yourself, you have actually freed yourself from the need to fill out most of the information about yourself. Simply open the old file in the new program: past earnings will be ignored and personal information will be extracted. This will save time filling out the report.

Please provide the country code according to the All-Russian Classifier of Countries of the World (OKSM). If there is no citizenship/nationality at all, then in the “Country Code” field, indicate the state that issued the identity document.

The TIN field must be filled in only for individual entrepreneurs. Other individuals may not do this.

The next main tab is “Income received in the Russian Federation”. There are 4 screens for input. Switching between them occurs using the number buttons with personal income tax rates at the top of the main window (see figure below).

Please note that the screens are divided by rates: 13, 9, 35% (Sheet A of the declaration). At the same time, dividend income, which since 2015 has been at a rate of 13%, is shown on a separate screen (“13” in green).

And for non-residents there is a different set of tax rates: 30, 15 and 13 percent.

Add a payment source using the “+” button, remove “-”, and edit using the lowest button (see figure).

Also see “Sources of payment in 3-NDFL: revealing the cards.”

The “…” button opens the income directory (deductions, if a deduction is allowed for this income, otherwise this button is not available). Selecting a deduction will automatically add the corresponding sheets to 3-NDFL.

The success of how to work with the program for 3-NDFL largely depends on the quality of filling out 2-NDFL certificates. The Federal Tax Service advises not to forget to fill out the total amounts by source of payments (these are points 5.2 – 5.4 of the certificate form). When the source of income did not calculate taxable income and tax, you need to do this yourself.

Also see “What is the difference between 2-NDFL and 3-NDFL”.

Where to start

Step 1

To approach the sample form in the 3-NDFL program for 2017, you must first click on the program icon on your desktop and enter the data in the required fields.

Also see “Instructions for filling out 3-NDFL in 2022 in the “Declaration 2017” program.

Step 2

We immediately set the conditions for the subsequent generation of only the necessary sheets of the 3-NDFL declaration. Choose:

- declaration type – “3-NDFL”;

- number of the tax office at the place of residence/stay (their full list is attached to the right of this field);

- adjustment number – “0” (for this transaction Shirokova submits 3-NDFL for the first time);

- OKTMO (can be found on the Internet or on the Federal Tax Service website);

- payer attribute – “Other individual”;

- type of income - from the sale of property;

- who is responsible for authenticity – “Personally”.

The OKTMO code must correspond to the municipality where the applicant lives (registered) according to the 3-NDFL declaration. You can find out its exact value using a special service on the official website of the Federal Tax Service of Russia. Here is the exact link (Moscow city index is given):

https://www.nalog.ru/rn77/service/oktmo/

Step 3

Next, go to the tab with information about the declarant. Here you need to enter some personal information, as well as a contact phone number by which the Federal Tax Service can quickly find you. From 2022 you no longer need to indicate your address!

Keep in mind: ordinary individuals (not individual entrepreneurs) may not indicate their TIN. The program will not consider this an error.

It is better to indicate who issued the identity document exactly as it is written on it. There is no separate list for selection in this field.

Step 4

Then we go to the tab with income received in Russia. For our situation, we choose a rate of 13% (the button with this number is yellow). Next, by clicking on the green plus, you need to fill in 2 sub-windows:

- Source of payment.

- Income information.

If you received income from an ordinary individual, then in addition to your full name. you need to indicate his TIN. Then the tax authorities will be able to identify it. If you do not enter the TIN or enter an incorrect number, the system will immediately issue an error warning. And you no longer need to indicate the buyer's address.

Also see “Sources of payment in 3-NDFL: revealing the cards.”

Step 5

The income window includes 2 attached lists:

- With income codes.

- With deduction (expense) codes.

Please note that these codes in their meanings do not coincide with the general personal income tax codes, which are approved for filling out 2-NDFL certificates and 3-NDFL declarations not through the program.

Please note that if the law does not allow you to make deductions for your income, the field with them will remain inactive.

The big plus is that the application from the Federal Tax Service will automatically issue the amount of the required deduction, which will reduce taxable income (see below in gray). And selecting a deduction will automatically add the corresponding sheets to the final 3-NDFL.

The window shown above has changed since 2022. Tax officials have added here new fields with cadastral data for property acquired by an individual after 01/01/2016. They correspond to Appendix to the 3-NDFL declaration, which appeared in 2018.

The bottom line is that since 2016, the tax base for income from the sale of real estate of an individual is determined taking into account Art. 217.1 Tax Code of the Russian Federation. According to its paragraph 5, if the income from the sale is less than the cadastral value multiplied by a reduction factor of 0.7, then for personal income tax purposes the income is recognized as equal to the cadastral value.

According to Shirokova’s condition, she inherited the apartment, so she did not incur any special expenses for its acquisition. Therefore, it is more logical to declare a personal income tax deduction in a fixed amount of 1 million rubles. Select 901:

Step 6

This is what we get as a result:

Shirokova can preview her example of filling out the 3-NDFL program for 2022 by clicking the “View” button with a magnifying glass. This version of the declaration fit on 7 sheets:

The scale here can be adjusted. Also, don't be put off by the pluses on the sides of the sheets. Assessors need them when they scan your 2022 income statement form.

For more information about this, see “Save and print 3-NDFL for 2022 from the Federal Tax Service program “Declaration 2017”.

Features for individual entrepreneurs

Businessmen fill out 3-NDFL for 2022 in the program according to the same principle, but in different windows. According to the principle of Sheet “B” of a paper declaration:

Pay attention to the option “There are documented expenses.” It allows you to enter data on them. There are 2 options:

- Costs supported by documents.

- Calculation of expenses at the standard (20%) rate relative to income.

In addition, individual entrepreneurs must indicate their OKVED code. It is selected from the directory attached to the program. When searching for the required code, some sublevels for a particular type of activity may not be provided.

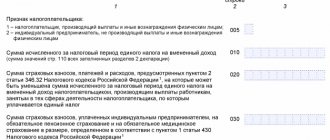

Sample design of sheet A

We propose to consider, as a sample for filling out the new form of the 3-NDFL certificate for 2022, the page of the form marked with the Russian letter “A”. This sheet is dedicated to profits received by individuals in Russia. Sheet A is divided into several parts, each of which contains information regarding a separate source of profit. The taxpayer will need to enter the following parameters on this page of the form:

- Bet size. Since personal income tax payments do not always imply the withdrawal of thirteen percent from the income of individuals, in a separate field you need to note the tax rate relating to the specific source of payment.

- Codes. Since profit can be received not only as a result of an individual fulfilling his direct duties, but also as a result of donation, sale of real estate, as well as other circumstances, it is necessary to indicate the type code. In addition, the identification code of the Russian source of payment, its OKTMO code and the reason for registration code are written.

- Name. Also, the taxpayer must write the name of the source of his profit, if it is an organization, and if it is an individual, then indicate his full name.

- Amounts. The last thing to do is write down the four amounts. In line 070 - the total amount of profit, in line 080 - the amount of income subject to tax withholding, in line 090 - the calculated personal income tax, and in line 100 - the withheld tax.

You can familiarize yourself with all the other nuances regarding how to fill out the 3-NDFL certificate for submission to the tax service using the special instructions published for order No. ММВ-7-11/552.