In what cases may it be necessary to recalculate vacation pay?

The calculation of an employee's rest payment is based on the amount of average daily earnings and the number of vacation days.

It is logical that their change will inevitably affect not only the amount due to the employee, but also income tax. An example of reflecting vacation pay in the calculation of 6-NDFL for 2022 from ConsultantPlus On October 21, 2022, an employee was paid vacation pay in the amount of 25,000 rubles. The amount of personal income tax calculated and withheld from them was 3,250 rubles. On November 11, 2022, another employee was paid vacation pay in the amount of RUB 18,000. The amount of personal income tax calculated and withheld from them was 2,340 rubles. The organization did not make any other accruals or payments of income for 2022. In Sect. 1 calculation for 2022, data on paid vacation pay should be reflected as follows:... You can view the full example in K+, having received a free trial access.

See also our article “How to correctly reflect vacation pay in Form 6-NDFL?”

Here are the main situations in which recalculation of vacation pay is inevitable:

- Error when calculating vacation pay or average earnings.

- Additional accruals of wages that occurred after the start of the vacation (for example, a bonus was paid for the previous year).

- Making a decision to increase staff salaries after the employee starts resting.

- Employee illness while on vacation.

- Recall from vacation due to production needs.

Filling out 6-NDFL regarding erroneously paid vacation pay

As defined in clause 1.1 of the Procedure, form 6-NDFL is filled out on the basis of accounting data for income accrued and paid to individuals by a tax agent, tax deductions provided to individuals, calculated and withheld personal income tax contained in tax accounting registers.

Form 6-NDFL consists of:

- Title page;

- Section 1 “Generalized indicators”;

- Section 2 “Dates and amounts of income actually received and withheld personal income tax.”

In accordance with clause 3.3 of the Procedure, section 1 of Calculation 6-NDFL indicates, in particular:

- on line 020 – the cumulative total of accrued income for all individuals from the beginning of the tax period;

- on line 040 – the amount of personal income tax calculated cumulatively for all individuals from the beginning of the tax period;

- on line 070 “Amount of withheld tax” – the total amount of withheld tax on an accrual basis from the beginning of the tax period.

According to clause 4.2 of the Procedure, section 2 of the Calculation indicates:

- on line 100 – the date of actual receipt of income reflected on line 130;

- on line 110 – the date of tax withholding from the amount of income actually received reflected on line 130;

- on line 120 – the date no later than which the tax amount must be transferred;

- on line 130 - the generalized amount of income actually received (without subtracting the amount of withheld tax) on the date indicated in line 100;

- on line 140 - the generalized amount of tax withheld on the date indicated in line 110.

As follows from the explanations of the Ministry of Finance of Russia, set out in letter dated October 30, 2015 No. 03-04-07/62635 (communicated to lower tax authorities by letter of the Federal Tax Service of Russia dated November 11, 2015 No. BS-4-11 / [email protected] ), in the case , if the employee returns to the employer the amounts of vacation pay actually paid to him previously, such amounts will not be recognized as his income.

Thus, since the amount of erroneously paid vacation pay is not actually the employee’s income, and it was reversed in accounting by the time Calculation 6-NDFL was generated for the first half of 2016, this amount is not subject to reflection in the indicator on line 020 “Amount of accrued income” in section 1 Calculations.

It appears that line 070 sums up the total amount of withheld personal income tax related to all income reflected on line 020 of form 6-NDFL, and line 140 reflects the amount of personal income tax calculated in relation to the income indicated in line 020.

For the reasons stated above, we believe that the amount of personal income tax related to erroneously paid vacation pay should not be included in the formation of the indicator on line 040 “Amount of calculated tax,” as well as when forming the indicator on line 070 “Amount of withheld tax.”

However, since the amount of erroneously accrued vacation pay was paid to the employee and personal income tax was actually withheld from it, then such information should, in our opinion, be reflected in section 2 of Calculation 6-NDFL for the half year on the corresponding dates (date of actual receipt of income (line 100), date tax withholding (line 110), tax transfer deadline (line 120)):

- on line 130 “Amount of income actually received” - in the amount of income received by the employee in terms of erroneous payment of vacation pay;

- on line 140 “Amount of tax withheld” - in the amount of personal income tax withheld from the amount of erroneously accrued vacation pay.

In this case, the personal income tax amounts indicated in line 140 of section 2 of Calculation 6-NDFL for the six months of 2016 (in total) will differ from the personal income tax amount indicated in line 070 of section 1 of the same Calculation 6-NDFL, by the amount of personal income tax withheld from erroneously paid vacation pay.

Let us note that the letter of the Federal Tax Service of Russia dated January 20, 2016 No. BS-4-11/591, in which there was a control ratio, according to which the indicator on line 070 should be equal to the sum of the indicators on lines 140, has become invalid. Currently, the control ratios are sent by letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11 / [email protected] ; they do not provide for such equality of the indicated lines, which allows, in our opinion, to reflect the amounts of excess payment and withheld tax on lines 130 and 140 section 2 Half-year calculations.

Reflection of the recalculation of vacation pay in 6-NDFL due to a calculation error

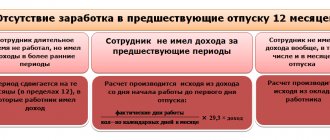

Adjustments in the calculation of average monthly earnings can lead to both underestimation and overestimation of vacation pay paid and the tax withheld from them.

The annual calculation of 6-NDFL for 2022 should be submitted on the form as amended by the order of the Federal Tax Service of Russia dated September 28, 2021 No. ED-7-11 / [email protected] Read more about this in our article.

Adjustment of 6-NDFL from 2022

If, as a result of the recalculation, vacation pay was subject to additional payment, in the reporting period when this additional payment was made, reflect in section 2 the total amounts, taking into account the additional payment. This follows, for example, from the letter of the Federal Tax Service dated May 24, 2016 No. BS-4-11/9248. It is not necessary to submit a detailed calculation for the period of vacation pay.

If the result of the recalculation is a decrease, the return of excessively withheld personal income tax must be reflected in 6-NDFL:

- in lines 030-032 of section 1 of the form for the reporting period in the last three months of which the tax refund date falls;

- in line 190 of section 2 for the reporting period in which the personal income tax was returned.

If there has not yet been a refund and vacation pay was transferred in the same tax period in which they were recalculated, you must fill out line 180 of section 2.

Important! Explanations from ConsultantPlus We believe that a different approach is possible: the amount of personal income tax paid by a tax agent on the amount of overpayment of vacation pay is not a tax withheld from the taxpayer’s income. It is the amount overpaid by the tax agent. Accordingly, if vacation pay is reduced as a result of recalculation, there is no need to fill out... For more details, see K+. Trial access is available for free.

For the period in which there was an overpayment for vacation pay, submit an update, indicating in section 2 the final indicators, taking into account the reduced amount of vacation pay.

Adjustment of 6-NDFL until 2022

If, as a result of the recalculation, the amount of payments decreased, then, taking into account the requirements of the Procedure for filling out and submitting the 6-NDFL calculation, approved by Order of the Federal Tax Service of the Russian Federation dated October 14, 2015 No. ММВ-7-11 / [email protected] , the tax agent will be required to do the following:

- Provide an update to 6-NDFL for the quarter in which the error was made, changing the indicators of accrued and received income, as well as calculated tax (lines 020, 040 and 130).

- In Form 6-NDFL for the quarter in which the tax was recalculated, it is necessary to reflect changes only in lines 070 and 140.

- If it is not possible to offset the overly withheld tax against upcoming payments, then the amount of tax returned to the individual in the recalculation quarter must be reflected in line 090.

- Neither the correction period nor the recalculation period changes the indicators on lines 100, 110 and 120.

IMPORTANT! For deductions from wages for reasons not listed in Art. 137 of the Labor Code of the Russian Federation, the written consent of the employee will be required.

Now consider the case of adjusting earnings for previous periods, which increased the amount of vacation pay. In this case, additional accruals of income and personal income tax are reflected in the recalculation period on lines 020, 040, 070, 130 and 140, and the additional payment of vacation pay will be income for the period in which it was made (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation ).

Have you recalculated your vacation pay? Should you submit the 6-NDFL adjustment or not?

If a tax agent has submitted to the regulatory authorities a 6-NDFL calculation containing information that does not correspond to reality, he must submit an adjustment calculation (clause 6 of Article 81 of the Tax Code of the Russian Federation). Is it necessary to adjust 6-NDFL when recalculating vacation pay?

To answer this question, let’s remember what is reflected in this form:

- Section 1 of form 6-NDFL is intended for entering data on an accrued basis about the accrued income of individuals and about the amounts of tax withheld or not withheld on their income.

- Section 2 of form 6-NDFL is responsible for those incomes of individuals that were actually paid, and for that personal income tax that was withheld from the amounts paid, with reference to the dates of these events (Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/450 ).

For different types of income, the dates of their actual receipt differ. For vacation pay, this is the date of their actual payment (clause 1 of Article 223 of the Tax Code of the Russian Federation).

Thus, the place of paid vacation pay in 6-NDFL is Section 1 and Section 2 of the quarter in which they were actually received by the employee.

If both events - payment of vacation pay and their recalculation - took place in the same quarter, then no clarification is necessary, since erroneous calculations simply were not submitted.

If vacation pay was paid in one quarter, and recalculation occurred in the next, then two options are possible:

It turns out that clarification 6-NDFL when recalculating vacation pay must be submitted only if vacation pay is recalculated downward and paid in the previous quarter.

Read about the general rules for reporting vacation pay in 6-NDFL in this article.

Extension of vacation will not affect 6-NDFL

In accordance with Art. 124 of the Labor Code of the Russian Federation, annual leave is subject to extension for the period of such circumstances as:

- illness confirmed by sick leave;

- performance of government duties, for the period of which a release from work is provided;

- other cases provided for by industry legislation or internal regulations.

In such cases, there will be no consequences for personal income tax accounting, since payment for all vacation days has already been made, and no recalculation is made. As for disability benefits, the amounts of income and personal income tax on sick pay are reflected in 6-NDFL in the period in which they were paid.

ConsultantPlus experts spoke in detail about the nuances of reflecting sick leave in 6-NDFL. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

Upon agreement with the employee and in order to ensure the normal operation of the enterprise, vacation days unused due to illness or other reasons can be postponed to another date, and then the recalculation of vacation pay in 6-NDFL will be necessary.

We correct form 6-NDFL for vacation pay

Experts from the GARANT Legal Consulting Service examined the following situation. The employee was mistakenly paid vacation pay twice. Accordingly, personal income tax was also overpaid. The amount of accrued vacation pay was reversed in June 2016. There was an overpayment of tax on the amounts transferred to the employee. The organization plans that next month the employee will receive less (minus the excessively transferred vacation pay). How to reflect this in form 6-NDFL? Is it necessary to include overpayment of tax in 6-NDFL for the six months?

An employing organization that makes payments to an employee (including vacation pay) in accordance with an employment contract, by virtue of clause 1 of Art. 226 of the Tax Code of the Russian Federation is recognized as a tax agent and is obliged to calculate, withhold from the employee and pay to the budget the amount of personal income tax (hereinafter also referred to as tax) calculated in accordance with Art. 224 of the Tax Code of the Russian Federation (taking into account the features provided for in Article 226 of the Tax Code of the Russian Federation).

Based on paragraph 3, clause 2, art. 230 of the Tax Code of the Russian Federation, from January 1, 2016, tax agents submit to the tax authority at the place of their registration a calculation of the amounts of personal income tax calculated and withheld by the tax agent (hereinafter referred to as the Calculation), for the first quarter, half a year, nine months - no later than the last day of the month following the corresponding period, for the year - no later than April 1 of the year following the expired tax period, according to form 6-NDFL, approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. MMV-7-11 / [email protected] The same order approved the procedure for filling out and submission of 6-NDFL (hereinafter referred to as the Procedure) and format for filing 6-NDFL in electronic form.

We correct the report during a shortened vacation

When an employee leaves vacation ahead of schedule, as a rule, it is associated either with his illness during vacation, or with a recall due to production needs.

In both cases, the amounts of overpaid amounts and withheld personal income tax can be counted against other income for the reporting period. In the calculation of 6-NDFL, the method of adjustment will depend on the period in which the vacation interruption occurred.

If the employee’s vacation began and was interrupted in the same reporting period, then the amount of overpaid income is counted as wages, and the amount of vacation pay is reflected taking into account the adjustment. But in the case when the recalculation affected the previous quarter, it is necessary to act similarly to the situation with the adjustment when reducing the amount of accrued income.

We reflect sick leave in 6-NDFL

All types of hospital benefits are subject to personal income tax. An exception is maternity benefits, which do not need to be reflected in 6-NDFL (Clause 1, Article 217 of the Tax Code of the Russian Federation).

Like vacations, sick leave is included in the total income and tax amounts of section 1, and in section 2 they are reflected in separate lines, depending on the timing of personal income tax payment.

An employee can bring sick leave in one period and receive benefits in another. Such sick leave is included in the calculation of 6-NDFL according to the date of its payment to the employee.

For example, an employer received a sick leave certificate from an employee on March 26. The benefit was paid to the employee along with the next salary - April 5. The tax was withheld on the same day, and the deadline for payment to the budget was the last day of April. Obviously, this sick leave should be reflected in section 2 of 6-NDFL not for 1 quarter, but for half a year.

6-NDFL with an example of sick leave and vacation

In April the company paid 4 employees:

- 04/05/2018 March salary – 100,000 rubles. (personal income tax 13,000 rub.),

- 04/05/2018 sick leave – 5,000 rubles. (personal income tax 650 rub.),

- 04/05/2018 vacation pay – 10,000 rubles. (personal income tax 1300 rub.),

- 04/26/2018 vacation pay – 12,000 rubles. (personal income tax 1560 rub.)

In the 6-NDFL half-year, these amounts will be shown cumulatively on the corresponding lines of section 1, and in section 2 they will be reflected on lines 100-140 as follows:

- salary – separately from other payments,

- sick leave and vacation pay paid on 04/05/2018 - together, since the terms of their payment, withholding, and tax transfer coincide,

- vacation pay from 04/26/2018 – separately from other payments.