About legal entities

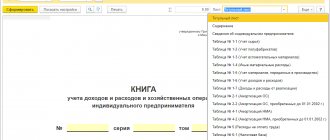

Why is KUDiR needed? Individual entrepreneur KUDiR is recognized as a tax accounting register, although it contains an accounting

Error in archived help There are errors that can be corrected by contacting the archive in person or

Draws: Ilya Alekseev Federal Law of July 27, 2006 N 152-FZ “On Personal Data” (Law on

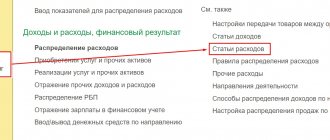

List of LLC expenses for OSNO List of income tax expenses for OSNO, which

Why calculate profitability? Financial profitability of the project is one of the key indicators in the analysis

Home / Taxes / What is VAT and when does it increase to 20 percent?

Legislative basis Rules for hiring, rights and obligations of the parties to the employment contract are regulated by the Labor Code

Medical services In Art. 149 of the Tax Code lists all goods and services that are not

What expenses are taken into account under the simplified tax system? A closed list of justified and documented expenses associated with

What types of tax audits are there? Usually they are afraid - and this is logical - of on-site audits. Many