Main elements of expenses for ordinary activities

Pay attention to the table of expenses for ordinary activities.

| What does the organization do? | What expenses are considered for ordinary activities? |

| Providing for a fee for temporary use (temporary possession and use) of one’s assets under a lease agreement | The implementation of which is related to this activity |

| Providing for a fee rights arising from patents for inventions, industrial designs and other types of intellectual property | |

| Participation in the authorized capital of other organizations |

If the expenses listed in the table are not the subject of the organization’s activities, then they are classified as other expenses.

Also see “What Other Expenses Include in Accounting.”

Also for ordinary activities there are expenses in the form of reimbursement of the cost of fixed assets, intangible assets and other depreciable assets, in the form of depreciation charges.

Accounting for expenses for ordinary activities

The expenses in question are accepted for accounting in a monetary amount equal to the payment:

- in cash and other forms;

- the amount of accounts payable (taking into account clause 3 of PBU 10/99).

If payment covers only part of the recognized expenses, then the expenses taken into account are the sum of payment and accounts payable (in the part not covered by payment).

The amount of payment and/or accounts payable is determined based on the price and conditions established by the agreement between the organization and the supplier (contractor) or other counterparty.

If the price is not provided for in the contract and cannot be established based on its terms, to determine the amount of payment or accounts payable, the price at which, in comparable circumstances, the organization usually determines expenses in relation to:

- similar inventories and other valuables, works, services;

- provision of temporary use (temporary possession and use) of similar assets.

When paying for purchased materials and other valuables, works, services on the terms of a commercial loan in the form of deferred/installment payment, expenses are taken into account in the full amount of accounts payable.

Also see “Accounting for inventories”.

The amount of payment and/or accounts payable under contracts providing for the fulfillment of obligations (payment) not in money is determined by the cost of goods (valuables) transferred or to be transferred by the organization - based on the price at which, in comparable circumstances, the company usually determines the cost of similar goods (valuables) .

If it is impossible to establish the cost of goods (valuables) transferred or to be transferred by the organization, the amount of payment and/or accounts payable under agreements providing for non-monetary settlement is determined by the cost of products (goods) received by the organization - based on the price at which a similar product is purchased in comparable circumstances products (goods).

Peculiarities:

- in the event of a change in the obligation under the contract, the initial amount of payment and/or accounts payable is adjusted based on the value of the asset to be disposed of - based on the price at which, in comparable circumstances, the organization usually determines the value of similar assets;

- the amount of payment and/or accounts payable is determined taking into account all discounts (discounts) provided to the organization in accordance with the agreement.

Also see “What is the statute of limitations for accounts payable.”

Rules for grouping expenses by ordinary activities

Further formation of expenses for ordinary activities goes towards:

- expenses associated with the acquisition of raw materials, materials, goods and other materials;

- expenses arising directly in the process of processing (refinement) of inventories for the purposes of producing products/performing work/providing services and their sale, as well as the sale (resale) of goods (costs of maintaining and operating fixed assets and other non-current assets, as well as maintaining them in in good condition, commercial expenses, administrative expenses, etc.).

When generating expenses for ordinary activities, it is necessary to group them into the following elements:

- material costs;

- labor costs;

- contributions for social needs;

- depreciation;

- other costs.

For management purposes, accounting organizes the accounting of expenses by cost items. The organization establishes their list independently.

Classification of organization expenses

As a result of production, economic and financial activities, organizations incur corresponding expenses.

Definition 1

An enterprise's expenses are a reduction in economic benefits due to the disposal of cash or other property, or the incurrence of liabilities, leading to a decrease in the level of capital.

For effective cost management, classifiers based on various criteria .

The company's cash expenses are grouped according to three main criteria:

- expenses due to profit;

- expenses not related to making a profit;

- forced expenses.

Expenses that are caused by making a profit consist of the costs of production and sale of products, works, services and investments. The costs of production and sale of products, works, services are expenses associated with the creation of goods, works or services, as a result of the sale of which the organization will receive financial profit or loss. Investments are capital investments that are intended to expand production volumes and generate income in the stock or financial markets.

Are you an expert in this subject area? We invite you to become the author of the Directory Working Conditions

Expenses that are not related to generating income are expenses for social support of employees, consumption, and charitable purposes. Such expenses are aimed at supporting the organization’s reputation, creating a positive social climate in the production team, and thereby increasing the productivity and quality of work of employees.

Compulsory expenses include taxes, social security contributions, expenses for compulsory personal and property insurance, and mandatory reserves.

In the “Profit and Loss Statement” we have already completed coursework

Audit of the profit and loss statement in more detail costs are divided into:

- expenses for ordinary activities;

- operating expenses;

- non-operating expenses;

- emergency expenses.

Expenses for ordinary activities are associated with the manufacture and sale of products, the acquisition and sale of goods, as well as expenses associated with the performance of work and the provision of services. This group also includes commercial and administrative expenses.

Finished works on a similar topic

Course work Classification of expenses of an organization 470 ₽ Abstract Classification of expenses of an organization 220 ₽ Test work Classification of expenses of an organization 210 ₽

Receive completed work or specialist advice on your educational project Find out the cost

Operating expenses include:

- expenses associated with the provision of temporary use of enterprise assets for a certain fee;

- expenses associated with the provision of rights arising from various types of intellectual property for a fee;

- expenses from participation in the authorized capitals of other enterprises;

- expenses resulting from the sale, disposal, write-off of fixed assets and other assets, except cash (except for foreign currency), goods and products;

- interest for the provision of funds, credits and borrowings to the organization for use;

- expenses related to payment for services provided by credit institutions;

- other operating expenses.

Non-operating expenses include:

- penalties, fines, penalties for violation of contract terms;

- compensation for losses caused by the organization;

- losses recognized in the reporting year, losses of previous years;

- accounts receivable with expired statute of limitations and other debts that are unrealistic for collection;

- exchange differences;

- expenses from asset depreciation;

- other non-operating expenses.

Extraordinary expenses include expenses arising as a result of extraordinary circumstances of economic and production activities.

The composition of the costs of production and sale of products is as follows:

- material costs;

- labor costs;

- expenses incurred as a result of managing the production process;

- the cost of non-current assets used in the production process.

Material costs include expenses:

- for the purchase of raw materials and supplies that are used in production and for household needs;

- for containers, packaging materials;

- for the purchase of tools, inventory, fixtures, devices, work clothes, laboratory equipment and other property that is not depreciable;

- for the purchase of components, semi-finished products;

- for the purchase of fuel, water and energy for the production process;

- for the purchase of works and services performed by third-party companies, in particular transport;

- caused by the maintenance and operation of fixed assets and other property.

Labor costs include accruals to employees in kind and in cash, incentive bonuses, compensation, bonuses, incentives, employee maintenance costs specified by the legislative norms of the Russian Federation and employment contracts.

Expenses that are associated with managing the production process, the so-called overhead costs, include administrative, management costs, rent for premises, travel expenses, maintenance of the company's vehicles, auxiliary production costs and others.

The cost of non-current assets used in the production process is transferred to costs through depreciation. In accordance with the criterion of homogeneity, costs for core activities are grouped into the following elements:

- material costs;

- labor costs;

- contributions for various social needs;

- depreciation deductions;

- other costs.

In relation to production volume, costs are divided into two large groups:

- permanent,

- variables.

The size of fixed costs does not depend on production volume. They can exist even during plant downtime. This type of cost includes rent for leased fixed assets, depreciation of own fixed assets, salaries of administrative and maintenance personnel, utility bills, postal services, taxes and other expenses.

Variable costs directly depend on output. They increase with the growth of output and decrease with its decrease. Variable costs include: costs of raw materials and materials, semi-finished products, components, fuel and energy for production purposes, salaries of employees of main production, costs of repair and maintenance of production equipment. According to the order in which costs are allocated to the period of profit formation, they are divided into two groups:

- product costs,

- costs for the period.

The costs of a manufactured product are directly related to the production of the product and are determined by the technology of the production process. Product costs are always included in the cost of the product, service or work produced. They are associated with units of production and can be attributed to finished goods in the warehouse or shipped goods and taken into account in calculating profit later than their actual availability.

Period costs depend on the end of the period for which payments are accrued. Period costs increase the cost of goods sold in the period in which they arose and, accordingly, reduce the profit of the enterprise.

Note 1

An analogue of product costs in trade is the cost of purchased goods, in industry it is production cost. An analogue of costs for a period are general production, commercial, and administrative expenses.

Cost management is one of the important management tasks within an organization. For this purpose, classification by cost centers depending on the organizational structure of the enterprise is important. The classification of cost centers requires detail in order to determine for each division one basic indicator that takes into account the workload of a given division and reflects the dependence of costs on output.

Grouping by cost objects is implemented depending on the goods, services or work produced, on which these costs fall. The cost object can be a product, type of service, type of work that is intended for implementation. Semi-finished products are an object of accounting if it is necessary to monitor their profitability and evaluate changes in their inventories. In serial, continuous production, when producing products according to individual orders, the cost object is the order.

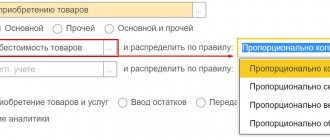

Expenses are divided into direct and indirect according to the method of attribution to the cost of accounting objects. In accounting, direct expenses include those expenses that can be directly attributed, according to primary documents, to the cost of a unit of product. Indirect costs include those costs that cannot be correlated with a specific type of product at the time of their occurrence. Such expenses are first accumulated in certain accounts, and then at the end of the reporting period are distributed in proportion to the selected base between types of products.

Picture 1.

The Tax Code also classifies expenses into direct and indirect for income tax purposes. Direct costs, in this case, include material costs, depreciation and labor costs. All other costs are indirect. It should be noted that the Tax Code does not provide for accounting for the cost of a unit of products, but only a method for forming the total costs of an enterprise for the tax period. That is why you cannot use the Tax Code classification for planning and managing an enterprise. It must be used only to calculate the tax base for income tax.

Figure 2. Classification of expenses

There are many other classifiers that help you manage costs consciously, effectively and in a timely manner.

Note 2

Classification of costs allows the use of cost management methods, divided into administrative and economic.

Administrative methods help prevent unreasonable, unauthorized expenses, theft and abuse. Economic methods of cost management include planning and budgeting.

Get paid for your student work

Coursework, abstracts or other works

Subsequent analysis of expenses for ordinary activities

To form a financial result from ordinary activities, the cost of goods, products, works, and services sold is determined. It is formed on the basis of:

- expenses for ordinary activities recognized in the reporting year and in previous reporting periods;

- carryover expenses related to the receipt of income in subsequent reporting periods;

- adjustments depending on the characteristics of production and sales.

At the same time, selling and administrative expenses can be recognized in the cost of goods sold in full in the reporting year and recognized as expenses for ordinary activities.

The rules for accounting for the costs of production/sale of goods/performance of work/provision of services in the context of elements and items, cost calculations are established by separate regulations and Methodological Guidelines for Accounting (for example, if the MPZ is the order of the Ministry of Finance dated December 28, 2001 No. 119n).

Also see “How expenses are recognized in accounting.”

Income

In accordance with paragraph 5 of PBU 9/99, income from ordinary activities includes revenue from the sale of what the organization specializes in:

- for a trading organization, this is income from the sale of goods;

- if the organization is engaged in leasing property, this will be rent;

- if the enterprise specializes in performing work or providing services, this will be income from the performance of such work;

- if an enterprise is engaged in providing rights to use intellectual property, income from the provision of such rights will be normal;

- if an organization is engaged in participation in the authorized capitals of other organizations, i.e. with financial investments, accordingly, this will be income from such investments.

All income from ordinary activities of the organization is recognized subject to the conditions provided for in clause 12 of PBU 9/99, regardless of their type, are called revenue and are reflected in the credit of account 90 “Sales” (Order of the Ministry of Finance dated October 31, 2000 No. 94n).

In accounting, income from ordinary activities is reflected in account 90 “Sales” minus the turnover in the debit of the VAT subaccount to account 90.

| D 62 - K 90 | Revenue is reflected, including VAT |

| D 90 - K 68 | VAT charged |

Income from other types of activities that are not revenue is reflected in account 91 “Other income and expenses”.

In accordance with Law 402-FZ, this indicator is reflected in accounting on the basis of primary documents (invoices, certificates of work performed or services provided) and is determined in the following order:

- when cash receipts fully cover the amount reflected by entries Dt 62 Kt 90 (accounts receivable), then income from ordinary activities will be equal to the amount of receipts in payment for goods (work, services) sold, that is, credit turnover on account 90 “Sales”, equal to the volume shipped products;

- when proceeds from sales cover only part of the income from ordinary activities, revenue is equal to the debit turnover on the cash receipts accounts and the difference between the amount reflected in the entries Dt 62 Kt 90 (accounts receivable) and the credit turnover on account 62 (Dt 50.51 Kt 62 );

- in the absence of receipts on account of shipped products (works, services), revenue is accepted for accounting in the amount of all receivables reflected in the entries Debit 62 Credit 90.

Conclusion: revenue is the credit turnover on account 90, regardless of whether the products (work, services) are paid in full, partially or not paid at all.