Error in archived help

There are errors that can be corrected by contacting the archive in person or by proxy from the citizen whose interests are represented. For example, in GUZHA, archival information about the data of a citizen who previously lived at the specified address can be corrected by providing the relevant documents. The same can happen in the registry office. But if, for example, an error was made in the lists of gardeners who privatized the land as common property, this cannot be corrected in the Administration’s archives, you will have to go to court.

If a citizen is not alive, and a mistake prevents his heirs from performing certain actions, this is only a judicial procedure for establishing the facts.

Correct an error in the certificate of ownership

It is almost impossible to do this in a certificate of land ownership from 1992-1997 Moreover, it should be noted that inside such a document there is a note “The certificate is a temporary document and must be replaced.” During a person’s lifetime, it is necessary to collect a number of supporting documents and register the entire set with the Registration Authority. After death, go to court with the collected evidence.

Correcting errors in a certificate of ownership issued by a notary involves the following procedure: prepare evidence, contact the notary, prove that you are right. If the notary categorically does not agree to the correction, or this cannot be done by law, you will have to go to court. If the notary who prepared the document that requires correction of errors cannot be found with the passage of time, call us. We will help.

Correcting an error in a property certificate after a person's death is impossible. But that’s okay, you can establish the facts in court instead. This procedure will replace the correction of an error in the old title deed.

After any actions, the corrected document on ownership of the real estate must be registered with the Federal State Property Management Committee of the city or region.

Correction of accounting documents

Errors made when preparing accounting documents must be corrected.

Correction in a paper document is made by crossing out the erroneous text or amount and indicating the corrected text or amount above the crossed out text. The correction must be accompanied by the inscription “Corrected” and contain the date of correction, as well as the signatures of the persons who compiled the primary accounting document (if such a document is corrected) or those responsible for maintaining the accounting register (if the register is corrected). Along with the signatures of the relevant persons, their positions, surnames and initials or other details necessary to identify these persons must be indicated.

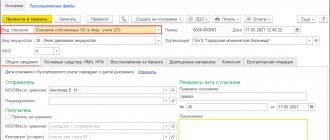

Correction of the primary accounting document and register compiled in the form of an electronic document is permitted by drawing up a new (corrected) electronic document.

In this case, the new (corrected) document must contain an indication that it was drawn up to replace the original electronic document, the date of correction, as well as the electronic signatures of the persons who compiled the primary accounting document (if such a document is corrected) or those responsible for maintaining the accounting register (if corrected). register).

Positions, surnames and initials or other details necessary to identify these persons must also be indicated. In this case, the means of reproducing the new (corrected) electronic document must ensure that it cannot be used separately from the original electronic document.

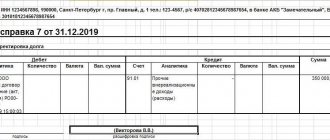

Errors in accounting accounts made in the registers can be corrected by making corrective entries in the relevant accounts.

If, when correcting an error, it is necessary to exclude an amount (part of the amount) from the register, then the error is corrected by making a reversal entry on the relevant accounts. If the register reflects an amount less than necessary, then the amount is brought to the correct amount by an additional entry in the corresponding accounts.

Correct an error in the property registration certificate

If the certificate of registration of ownership is in error, it is quite simple to correct it. It is necessary to make changes to the Unified Register of Real Estate Rights.

But if an error in the Unified State Register certificate is made due to the fact that it is also contained in the title document for the property (in the certificate of inheritance, in the marriage contract, in contracts for real estate transactions (purchase and sale, donation, privatization agreement and etc.), first of all, the title document itself will have to be corrected.

Fix state registry error

There are a lot of such mistakes today. Simple negligence or inattention of specialists from government agencies gives rise to documents with errors. You need to correct it immediately, without leaving the window for issuing documents. If you notice an error right away, you can correct it free of charge by submitting your documents back for correction. If, after a lapse of time, you submit an application for such a correction, practice indicates that the UFSGRKK (or MFC) consider this procedure to be an amendment to the state registration certificate and require payment of a state fee.

Methodology and practice

General recommendations for correction are contained in the same instructions of the Central Bank. The corrective inscription must contain:

- the date the adjustment was made;

- Full name of the persons responsible for the adjustment;

- signatures of these persons.

This methodology is consistent with the norms of Federal Law-402 dated 6/12/11 “On Accounting”.

The erroneous inscription is crossed out. When entering the correct data next to each other, pay attention to the clarity of the text and readability. The register is corrected by the same employee who made the mistake. Usually this is a cashier, manager or accountant in one person in a small company. Is the director’s signature required for corrections if the organization has a chief accountant and a cashier?

Since the director certifies the cash book as a whole (numbering and number of sheets at the end of the year), it is assumed that when correcting an error, only the signature of the cashier and the chief accountant is required. If the director himself makes all the entries in the cash book, he will certify the corrections. Sheets containing corrections are marked with the inscription of the responsible person “believe corrected”, “corrected”. For each correction, if there are several of them on the sheet, a separate signature is placed.

An error consisting of omission of a cash sheet is corrected by crossing out the free field and writing “canceled.” An error that is not detected immediately leads, as a rule, to changes in the cash balance on several sheets. Each of them is corrected. It is recommended to cancel the form and fill out a new one.

Other common mistakes when maintaining a cash register are incorrect indication of the number of incoming and outgoing documents, or missing a line. They are corrected in the same way. Corrections are recorded by drawing up an accounting statement containing their main essence and data composition. It is also signed by the responsible person.

Having discovered an error in an electronic book with digital signature, they create a new document containing the correct data and re-sign the electronic signature on it.

The administrative procedure for corrections is as follows:

- if the cash book is maintained not by the manager, but by another person, a report addressed to the manager is drawn up;

- the head issues an order to create the appropriate commission;

- under the supervision of members of the commission, changes are made to the register or a new electronic document is generated.

Correct an error on a birth certificate

All information about the birth of citizens is contained in the archives at the place of birth of each person. You need to send a request to the registry office archive with a request to provide a certain document (certificate, certificate, information certificate, etc.). In different cases, you need to ask for different documents and attach different sets of evidence to your request on your part to the application for information or new evidence.

There are times when information comes from the archive that there is already an error in the archive or data that is undesirable for you. Then the facts or immediately the right of ownership are established in court on various grounds.

We are correcting an error in creating a case in which documents with different retention periods were filed

In the first quarter, according to a schedule approved by the head of the organization, the procedure for transferring cases to archival storage began according to inventories prepared by those responsible for office work in structural divisions. In the process of actually transferring cases, even after the archive has previously checked the quality of their formation and execution, errors are often identified that need to be promptly corrected. But for the complete re-registration of processed cases and signed inventories, as a rule, there are no longer any resources in the department and in the archive, and no more than 2 weeks are usually allocated for the process of receiving and transferring cases.

What to do if documents with different shelf life were filed in the file?

Option 1 – “classic”,

based on complete or partial re-registration of the case, taking into account the current Rules

for organizing the storage, acquisition, recording and use of documents of the Archive Fund of the Russian Federation and other archival documents in government bodies, local governments and organizations, approved. by order of the Ministry of Culture of Russia dated March 31, 2015 No. 526; further – Rules for the operation of archives of organizations (clause 4.20):

- documents with permanent and temporary storage periods (up to 10 years inclusive; over 10 years) must be grouped into different files;

- orders for personnel are grouped into files in accordance with the retention periods established for them.

An archive employee (or the person responsible for archival storage, if an archive has not been created in the organization), in the presence of the transferring case, looks through the documents of the case of permanent storage page by page and conducts an express examination of them.

For example, in a file with orders for core activities, orders were identified for personnel on changes in names, business trips and changes in work schedules, which have temporary storage periods and should not be in this case. A decision is made to completely remove

from the generated permanent storage file and transfer to the personnel department for formation into personnel files for the corresponding year or for possible destruction due to the expiration of the storage period. Thus, in 2022, orders on vacations and business trips for 2013 can be designated for destruction.

Return of incorrectly filed orders

carried out by an employee who directly transfers the files to the archive. In this case, the acceptance certificate is not drawn up, because the archive does not accept these documents as part of the case submitted for archival storage by this unit. And to another department (in our example, to the personnel department), the office management service and the archive must transfer the seized documents according to the acceptance certificate.

Partial withdrawal of documents from the case

in this case, it assumes that orders for personnel to change surnames, which have a shelf life of 50 years,

can be left in the file for

a permanent shelf life.

But they should not “fall out” of the case records and inventory of cases. Therefore, to the title of this case with orders on the main activity of a permanent shelf life, an annotation is drawn up about the presence in it of orders for personnel to change specific names.

The use of annotations to the composition and content of case documents is the professional secret (approach) that allows you to save time in the process of transferring cases to archival storage.

Option 2 is an “expert” new method

used by archives of organizations that are not sources of acquisition, which is based on an assessment of the real significance of documents

and the degree to which their information is reflected in other documents.

Information about a vacation or business trip is reflected in a personal card in form No. T-2 indicating the date and number of the order, in the payroll payroll, as well as in personalized accounting documents, tax reporting and reports to the Pension Fund. Some of the listed documents, containing information about payments during vacations and business trips, have a longer, mostly 50-year shelf life, and are compiled into personnel files in the personnel and accounting departments. Certificates of a socio-legal nature may subsequently be issued on their basis. The fact that the final stage of examination of the value of documents will be carried out in the archive is also taken into account. Moreover, in the event of liquidation of the organization, a file of permanent storage with an annotation on the orders contained in them for personnel

about changes in surnames after examination, values can be transferred to the state or municipal archive along with other personnel files.

In the second option, all personnel documents available in the permanent storage file are not removed from it.

The same express examination of orders for personnel is carried out, after which

the case is not reorganized and the number of sheets in it is not renumbered. Changes are made to the case records, to the inventory of cases and to the cover of the case:

- an annotation is placed on the title of the case in the inventory and on the cover stating that it contains orders to change names;

- temporary storage periods for orders to change names, work schedules and business trips in a file with orders for core activities are indicated in the internal inventory of case documents (in the “Note” column);

- the presence in the case of a permanent storage period for documents on personnel is recorded as features of the formation of the case in the document certifying the case.

This method, associated primarily with the re-registration of accounting documents for the case, is used by organizations that are not sources of acquisition and independently organize archival storage of documents in accordance with the requirements of current legislation and the Rules for the operation of archives of organizations.

Correct an error in the work book

This procedure is most common in our practice. Incorrect entries, surnames, first names, non-existent positions and other errors in work books are corrected in two ways:

- the employer (if it still exists) issues a certificate confirming the true information, or, if possible, an entry is made in the work book about the correction of a certain error. In the absence of an employer, the matter can only be resolved in court.

- in court, proving certain facts that cannot be resolved with a simple certificate or entry in the work book.

Correct a mistake in a labor document (in court)

If you have to correct an error in a labor law through legal proceedings, we suggest that you read the pages of our website about disputes on labor and pension issues, or immediately contact our Legal Center for help from specialists.

Correction in a paper document

If the document is paper, the procedure for correcting it under the new FSB is not much different from the current one.

Incorrect text or amount must be crossed out with one line (so that the corrected text is readable) and reliable information must be indicated above. Records cannot be covered up or erased.

In the corrected document, you need to write “Corrected”, put down the date of correction and certify with the signatures of the responsible persons, indicating their full names and positions (clauses 19, 21 of FSBU 27/2021).

Read in the berator “Practical Encyclopedia of an Accountant”

How to cross out erroneous data

Correct an error in the contract

In agreements for the purchase of property, in deeds of gift, in privatization agreements (transferring an apartment or room into the ownership of citizens), agreements for shared participation in construction, investment agreements, etc., errors are corrected in different ways:

- for contracts drawn up in simple written form, additional agreements are also drawn up in simple written form (unless a notarial form has become mandatory for such contracts), by the same parties who participated in the main contract. For real estate transactions, such an agreement must subsequently be registered by the Registration Authority (not always necessary). After the death of one of the parties to the contract. will have to go to court;

- for contracts drawn up in notarial form, notarial correction of errors is mainly required, also with the need for further registration;

- Correcting an error in a contract after the death of one or both parties to the contract can only be done in court. Moreover, no corrections can be made to the document itself. It is only possible to establish certain facts or recognize the rights of successors under such agreements.

Errors in documents: safe correction

The answer to the question of how to correct it depends on whether you managed to accept the erroneous document for accounting or not.

If you don’t have time, then we simply draw up a new document and accept it for accounting. We can consider ourselves lucky in this case: you don’t even need to prepare an accounting certificate.

The real headache comes when the document is completed. If the tax authorities find an error in the primary document, they have the right to invalidate the document and deduct the company’s expenses, as well as impose a fine.

According to the Tax Code - a company

According to the Code of Administrative Offenses of the Russian Federation - officials

The list of primary accounting documents depends on the characteristics of a particular transaction. The standard list of primary documents that companies use in practice is an invoice for payment, payment documents, an acceptance certificate for work performed (services rendered), and a delivery note.

A contract as a paper is traditionally not considered a primary document. But it regulates the rights and obligations of the parties to the transaction. In addition, Federal Law No. 163-FZ of July 18, 2022 allows you to take into account any tax expenses and deductions, but if two conditions are simultaneously met: the main purpose of the transaction is to make a profit and not to reduce taxes, and the obligation under the transaction was fulfilled by the person specified in agreement So it is better to conclude an agreement in writing so that, if necessary, you can present it to inspectors.

Of course, there are many more documents. And among them there are those that tax authorities check with particular passion.

For example, those that show signs of counterfeit

Or those that can be made to formalize an imaginary or feigned transaction, or rather, to cover up the real meaning of the transaction. After all, when making a deal just for show, the parties correctly draw up all the documents, but do not strive to create real legal consequences.

See an example of an imaginary transaction

Now let's return to ordinary documents, in which errors occur quite often.

Among them is a waybill. Don't underestimate its importance. This is the main source document for monitoring vehicle mileage, fuel write-offs, driver remuneration and tax calculations.

Here, for example, is a unified form of waybill according to the 4-P form

Order of the Ministry of Transport of Russia dated September 18, 2008 No. 152 approved the mandatory details and procedure for filling out waybills. Moreover, you know that from time to time this department issues orders that add the mandatory details of the waybill. This is how they were introduced:

- a note on pre-trip control of the technical condition of the car and cancellation of the seal (Order of the Ministry of Transport of the Russian Federation dated January 18, 2017 No. 17);

- additional information about the owner of the car (Order of the Ministry of Transport of Russia dated November 7, 2022 No. 476).

Please note that no changes are made to the unified form, assuming that vehicle owners will independently adjust it.

See how this can be done using the example of a truck waybill according to Form 4-P

The form of the waybill, as well as the absence or non-filling of one of the required details most often causes complaints from inspectors. Of course, the safest way is to fill out the waybill without errors.

But it is possible that in case of omission you will be able to defend yourself against claims

Errors and distortions in the delivery note can lead to the transaction being considered unrealistic.

See how NOT to fill out a delivery note

The procedure for correcting errors in primary documents accepted for accounting should be prescribed in your accounting policy or, as controllers say, developed independently.

It is known that in practice accountants correct primary accounts in three ways:

- draw up a new (corrected) document in the same way as the seller does when he issues corrections to the invoice to the buyer; cross out the error in the original;

- replace the erroneous original with a new document with correct data.

Let's say right away that the first method is considered the simplest, but it is prohibited. This means that documents need to be corrected differently. The other two methods are more labor-intensive, but it will be difficult for inspectors to find fault with you.

You need to cross out according to the rules. See strikethrough example

And replacing an erroneous document with a new one does not simply mean drawing up a new one. See an example of the correct replacement

Write down the correct methods for correcting primary documents in the accounting policy for accounting.

You can create a fragment of an accounting policy about correcting primary documents like this:

How to correct errors in other documents

For our lawyers, any procedures for correcting errors are absolutely known and understandable. Citizens may have difficulty taking independent steps to correct errors when:

- determining the authority to contact;

- ignorance or misunderstanding of information for requests or corrections of data;

- searching for an organization in connection with a move, or searching for an archive when liquidating an organization;

- impossibility of establishing the data required to correct errors, etc.

Experience plus various information channels give us the opportunity to solve such problems quickly and efficiently. Contact us for help.