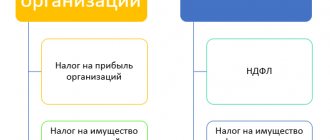

About legal entities

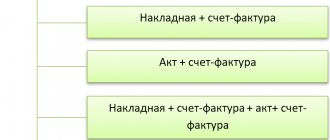

UPD form and its application Federal Law No. 402-FZ “On Accounting” has simplified the forms

Is there a deduction for medicines? A tax deduction for medicines is provided in accordance with subparagraph.

Home • Blog • Blog for entrepreneurs • How to calculate the simplified tax system if you have worked

child, incl. adopted, less than 18 years old; a child acting as a student, graduate student, cadet, less than 24

The concept of cash discipline The rules for conducting cash transactions in an organization are enshrined in the instructions of the Central Bank of Russia No.

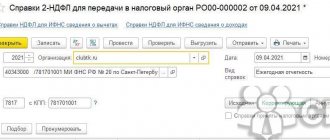

In what cases is adjustment necessary? Reporting on personal income is submitted by a tax agent in

What are the general rules for forming line 110 (formerly line 020) From reporting for 2022

How to submit the SZV-M report? Among the many types of reporting to the Pension Fund, there is something wrong

What needs to be done before switching from UTII to simplified tax system in 2022 Simplified in its own way

Basic concepts A sick leave is a document that is issued to an employee to confirm the legality of absence