- child, incl. adopted, less than 18 years old;

- a child who is a student, postgraduate student, cadet, less than 24 years old;

- deductions are made until the parent’s annual income exceeds 350 thousand rubles;

- each spouse, including the guardian, has the right to use tax deductions (code 114 and 115);

- the employee issues a double refund if the spouse does not use this opportunity.

Payment amount

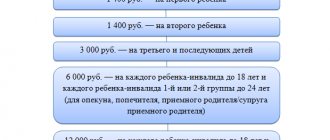

The amounts of compensation today are fixed by law and depend on family conditions:

- 1400 rubles: for the first child, standard tax deduction ( code 114 );

- 1400 rubles: for the second ( code 115 );

- 3000 rubles: for the third ( code 116 );

- 12 thousand rubles: for a disabled person ( code 117 ).

The amounts of standard tax deductions are fixed by law.

You can apply for tax deduction 114, the amount of which is the same for the second child, through the employer or the tax authority.

What does deduction code 114 mean and why is it no longer used?

The currently valid tax deduction codes were approved back in 2015 by order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/ [email protected] At the same time, without even waiting for the end of the tax period, in 2016 legislators made significant adjustments to the list codes used.

[email protected] came into force , and this happened on December 26, 2016, code 114 is no longer applied.

Why did this happen? Let us remember that in the text of the Tax Code (namely in sub-clause 4 of clause 1 of Article 218 of the Tax Code of the Russian Federation) deductions for the first child for parents, as well as their spouses and adoptive parents, are indicated separately from deductions for the first child for his guardian, trustee, adoptive parent or the spouse of the adoptive parent. But tax deduction code 114 was applied to the first child, regardless of whether he was his own child or in care, etc.

Despite the fact that the amounts of deductions indicated above do not differ, legislators decided to bring the list into conformity with the text of the Tax Code of the Russian Federation and divided this deduction into two different codes.

Nothing else has changed. The deduction amounts still amount to 1,400 rubles per child, and in the 2-NDFL certificate, new codes are indicated in the same column as previously code 114 - in the fields of section 4 the code itself and the amount of deduction with this code are indicated on an accrual basis from the beginning of the year .

New codes

As of January 2022, deductions 114–125 are no longer relevant. Instead, codes 126–149 are provided. They more fully reflect the family situation of the parents. Deduction 114, which was previously applied to adoptive and natural parents, trustees, guardians of the child, has now been replaced by codes 126 and 130.

- 126 are provided to natural parents and adoptive parents of the first child or student;

- 130 will be provided to adoptive parents, as well as to persons who have taken custody of the child (trustees, guardians).

"Children's" deduction

Income tax refunds for parents with children have the following nuances:

- It is due to both the father and the mother, who works officially and regularly transfers personal income tax in the amount of 13 percent.

- If one of the parents does not work, is on maternity leave, or is registered with the employment center, he is not entitled to a deduction.

- One of the parents can receive the entire refund amount if the other one writes a waiver of his right to a deduction.

- In addition to parents, guardians of children, trustees (from the child’s 14th birthday until adulthood or graduation), as well as adoptive parents can receive such assistance from the state.

- The maximum possible deduction amount is 280 thousand rubles. Once this amount is returned to the applicant, he will no longer be entitled to any income tax refund.

- The number of children also matters: the more there are, the higher the refund amount for the next child will be. Moreover, all children in the family are taken into account, even adults who are not entitled to a tax refund.

In 2015, the following amounts of tax benefits for children were established:

- the first and second child in the family can count on a deduction of 1,400 rubles;

- if there are a third and subsequent children, parents can count on a deduction of 3 thousand rubles;

- an additional benefit is established for a disabled child - 3,000 rubles.

How to calculate the tax amount?

It is also worth considering how you can calculate your tax if there is a tax deduction code 128? Simple enough. To do this, it is necessary to subtract the corresponding benefit amount from the salary amount. If only one deduction is applied at the moment, then three thousand rubles should be subtracted, and 13 percent should be taken from this amount.

That is, with a salary of 10,000 rubles, the tax would be 1,300 rubles. However, if a parent uses this benefit, only 7,000 rubles are taxed, that is, the tax will be 910 rubles. In the case of the above-described employees, whom we analyzed using examples, with a salary of 10,000 rubles, their tax will be 728 rubles.

Thus, deduction code 128 applies to those who have three or more children. In this case, the employee can either use deductions for two previous children or no longer have this opportunity. Previously, code 116 was used. Deduction code 128 replaced it at the end of 2016. However, the general rules for its application, the amount of the deduction, as well as the maximum amount of income of 350,000 rubles remained the same.

How to get a child benefit?

You can receive a standard child tax deduction (code 114 or 115) at your place of official employment. The required package of documents is submitted annually. If the applicant receives a double deduction (if one of the parents refuses in writing), documents and certificates will need to be submitted monthly.

The following list of documents will be required:

- an application addressed to the employer requesting a refund;

- applicant's passport;

- birth certificate of all children and marriage;

- certificate 2-NDFL about income level;

- a certificate from the child’s place of study, if he is already 18 years old.

If the employer does not make a refund or the applicant did not manage to exercise his right on time, documents must be submitted to the tax authority at the place of residence. In addition to basic documents and certificates, you will also need a completed tax return. It includes all income other than wages received by the applicant during the year in which the deduction is due.

It could be:

- income from the sale of movable and immovable property;

- profit received from performing one-time services or work under civil contracts;

- rent for rental housing and so on.

The legislation states that the taxpayer who is supporting a minor can receive a deduction (Article 218 of the Tax Code). If the child does not live in Russia, the application for a deduction must also be accompanied by the submission of supporting certificates from the state in which the minor is located.

This could be an agreement on the payment of alimony, a court decision or a writ of execution, a copy of a civil passport with a stamp on the marriage of the spouses, a marriage certificate, a certificate from the Housing Office about the joint residence of the family with the child.

Reflection of deductions in certificates

The most common are deductions for children, first and second, which are displayed in the documentation with the corresponding codes:

- Code 114 - in the 2-NDFL certificate, this code means that the tax deduction is based on the first child who has not yet turned 18/24 years old.

- Code 115 indicates that the refund is made to the parents of the second minor child, a student. Students are subject to the following requirements: training is carried out on a paid basis in an institution of any level of accreditation - institute, university, technical school, and so on.

If the deduction code is incorrectly indicated, the applicant may be refused to provide it or the calculation will be made incorrectly: the taxpayer will receive less tax or will be charged a surplus. In this situation, the employer tax agent is responsible. If an error is detected, he is obliged to notify his employee within 10 days of the fact that the code has been entered incorrectly.

If an overpayment is detected, the excess amount will be deducted from the employee's salary. The unpaid deduction amount will be credited to the applicant's bank account, and in case of delay in payment, a penalty will be charged for each day of delay.

Registration of a tax deduction under code 114 or 115 is a fairly simple and not labor-intensive procedure, especially if it takes place at the place of work of the child’s parents or one of them. It can only be used by a citizen of the Russian Federation who has resident status - officially residing in the country for at least 183 days a year.

- child, incl. adopted, less than 18 years old;

- a child who is a student, postgraduate student, cadet, less than 24 years old;

- deductions are made until the parent’s annual income exceeds 350 thousand rubles;

- each spouse, including the guardian, has the right to use tax deductions (code 114 and 115);

- the employee issues a double refund if the spouse does not use this opportunity.

Payment amount

The amounts of compensation today are fixed by law and depend on family conditions:

- 1400 rubles: for the first child, standard tax deduction (code 114);

- 1400 rubles: for the second (code 115);

- 3000 rubles: for the third (code 116);

- 12 thousand rubles: for a disabled person (code 117).

The amounts of standard tax deductions are fixed by law

You can apply for tax deduction 114, the amount of which is the same for the second child, through your employer or tax authority.

Subject code in 2-NDFL

Each subject of the Russian Federation is assigned a specific code. For Moscow it is “77”, for the Krasnodar Territory - “23” and so on. There are 85 codes in total.

2-NDFL: subject code

These are codes of regions in which enterprises, individual entrepreneurs, and organizations can be registered. They are indicated if a certificate is issued to an employee for past tax periods before 2018. In older forms, the “region code” field is present. The new ones don't have it anymore.

| Subject | Code |

| Republic of Adygea | 01 |

| Republic of Bashkortostan | 02 |

| The Republic of Buryatia | 03 |

| Altai Republic | 04 |

| The Republic of Dagestan | 05 |

| The Republic of Ingushetia | 06 |

| Kabardino-Balkarian Republic | 07 |

| Republic of Kalmykia | 08 |

| Karachay-Cherkess Republic | 09 |

| Republic of Karelia | 10 |

| Komi Republic | 11 |

| Mari El Republic | 12 |

| The Republic of Mordovia | 13 |

| Republic of North Ossetia-Alania | 15 |

| Republic of Tatarstan | 16 |

| Tyva Republic | 17 |

| Udmurt republic | 18 |

| The Republic of Khakassia | 19 |

| Chechen Republic | 20 |

| Chuvash Republic - Chuvashia | 21 |

| Altai region | 22 |

| Krasnodar region | 23 |

| Krasnoyarsk region | 24 |

| Primorsky Krai | 25 |

| Stavropol region | 26 |

| Khabarovsk region | 27 |

| Amur region | 28 |

| Arhangelsk region | 29 |

| Astrakhan region | 30 |

| Belgorod region | 31 |

| Bryansk region | 32 |

| Vladimir region | 33 |

| Volgograd region | 34 |

| Vologda Region | 35 |

| Voronezh region | 36 |

| Ivanovo region | 37 |

| Irkutsk region | 38 |

| Irkutsk region (Ust-Ordynsky Buryat district) | 85 |

| Kaliningrad region | 39 |

| Kaluga region | 40 |

| Kamchatka Krai | 41 |

| Kemerovo region | 42 |

| Kirov region | 43 |

| Kostroma region | 44 |

| Kurgan region | 45 |

| Kursk region | 46 |

| Leningrad region | 47 |

| Lipetsk region | 48 |

| Magadan Region | 49 |

| Moscow region | 50 |

| Murmansk region | 51 |

| Nizhny Novgorod Region | 52 |

| Novgorod region | 53 |

| Novosibirsk region | 54 |

| Omsk region | 55 |

| Orenburg region | 56 |

| Oryol Region | 57 |

| Penza region | 58 |

| Perm region | 59 |

| Pskov region | 60 |

| Rostov region | 61 |

| Ryazan Oblast | 62 |

| Samara Region | 63 |

| Saratov region | 64 |

| Sakhalin region | 65 |

| Sverdlovsk region | 66 |

| Smolensk region | 67 |

| Tambov Region | 68 |

| Tver region | 69 |

| Tomsk region | 70 |

| Tula region | 71 |

| Tyumen region | 72 |

| Ulyanovsk region | 73 |

| Chelyabinsk region | 74 |

| Transbaikal region | 75 |

| Trans-Baikal Territory Aginsky Buryat District | 80 |

| Chita region | 75 |

| Yaroslavl region | 76 |

| Moscow | 77 |

| Saint Petersburg | 78 |

| Jewish Autonomous Region | 79 |

| Nenets Autonomous Okrug | 83 |

| Khanty-Mansiysk Autonomous Okrug - Ugra | 86 |

| Chukotka Autonomous Okrug | 87 |

| Yamalo-Nenets Autonomous Okrug | 89 |

Procedure for registering a deduction: information

The employer calculates the tax deduction (code 114 in the declaration) automatically after submitting the application and documents:

- marriage registration paper;

- child registration documents;

- certificates, certificates of adoption, acceptance of guardianship, etc.;

- confirmation of disability;

- a certificate from a technical school, university, etc., if the child is over 18 years old.

Certificates for deduction code 114

Tax deduction 114 depends on the level of wages, therefore, when applying for a job, it is worth obtaining a 2-NDFL certificate. If double compensation is issued, additional information about the second parent will be required:

- written refusal to receive, a certificate from the employer confirming this fact;

- death certificate;

- a document from the Ministry of Internal Affairs regarding the initiation of a missing persons case.

Certificates for deduction code 115

It is possible to receive tax deduction 115 according to a similar procedure. This will require information about both children. When changing the family structure, it is necessary to provide the employer with confirmation of the fact with the appropriate document:

- a newborn appeared;

- the child has entered training;

- the student has completed the course of study;

- the child died;

- second parent died;

- etc.

The amount of tax deduction 114 has not changed since 2012

It is permissible to return tax deduction code 114, the amount of which has remained unchanged since 2012, for three years, if it was not returned previously. To do this, you need to submit forms 2-NDFL to the accounting department, which can be requested at previous places of work if the employee has not worked for the company for a significant period of time.

Registration in 2022

Tax deduction 114 in 2022 can also be issued through the tax authority. To do this, you need to collect the documents listed above. It will need to be supplemented with information about income. In the application, indicate your data, request (in accordance with Article 218), data about children, the amount of compensation due (the tax deduction code is not indicated: 114, 115) and the total amount to be transferred. Also indicate the issuance option - account number or details of the company through which the transfer is made.