How to submit the SZV-M report?

Among the many types of reporting to the Pension Fund, there is a report that recently appeared - form SZV-M (information about insured persons).

This form was needed by government agencies in connection with the suspension of indexation of pensions for working pensioners, who now need to be “tracked.” The form must be filled out by individual entrepreneurs and organizations that have at least one employee working under an employment or civil contract. Form SZV-M is submitted monthly before the 15th day of the month following the reporting month. This information can be submitted on paper by employers with fewer than 25 employees, while other employers are required to submit SZV-M only in electronic form.

The fine for late submission of the form or incorrect completion is 500 rubles for each employee. And if you submit a paper document instead of a mandatory electronic document, the fine for such a case will be 1000 rubles.

What programs are there for filling out reports to the Pension Fund of Russia 2021?

Generating reports for the Pension Fund of Russia in electronic form became relevant after 2007, due to the introduction of personalized reporting.

All programs for generating and submitting reports can be divided into 2 categories:

- “delivers” - resources with the help of which report data downloaded from a standard accounting resource (for example, 1C) are encoded, checked by software and transmitted to the Pension Fund of the Russian Federation;

- “fillers” are resources into which you need to manually transfer (fill) data in order to then generate a report.

Also, common electronic reporting systems (for example, Kontur) often combine both (contain both “fillers” and the function of importing reports from accounting programs). This applies primarily to reports to the Pension Fund, since they are often changed and supplemented. Last year, for example, the Pension Fund of Russia introduced a new report - SZV-TD. Developers of accounting programs do not always keep up with the updates necessary for generating reports, therefore, in order not to miss deadlines, accounting is often forced to use “fillers”. Let's talk about them in more detail.

Read about generating SZV-M reports in 1C here.

You will find the current list of forms and deadlines for submitting reports on personalized accounting in ConsultantPlus. If you do not already have access to this legal system, trial access is available for free.

Pension Fund programs

They can be found in the “free programs for employers” section. Several programs are suitable for preparing SZV-M: “PU 6 Documents”, “Spu_orb”, “PD SPU”, “PsvRSV”. However, in order to understand the difference between them and correctly install the selected program, you will need the advice of a specialist who understands these issues.

To create a personal account on the Pension Fund website, you will have to go through a difficult registration procedure. This can only be done without leaving the office using an electronic digital signature. Or you need to contact the Pension Fund in person and receive a registration card to enter the office.

Error codes that the program produces

If you are going to check SZV-STAZH online for free on the Pension Fund of Russia website, you should be prepared that the system will produce certain errors. As PFR employees explained, there are 5 types of notifications that the policyholder needs to pay attention to. Let's figure out what they mean.

Codes 10 and 20

If checking the information produces an error code 10 or 20, this indicates the presence of minor deficiencies. If you first submitted the document and only then figured out how to check the accuracy of the SZV-STAZH report, then you need to correct the inaccuracies by submitting the SZV-KORR form to the Fund. Do not forget that it must be accompanied by the EDV-1 inventory.

Code 30

The check sometimes gives an error code 30. It signals the presence of more serious defects. In particular, if the system detected an incorrect indication of the employee’s first name, patronymic or last name, or an incorrect SNILS.

It’s great if you first decided to check the data, found inaccuracies, corrected them and sent the report in perfect condition. But if the verification took place after you submitted the information, then if there is an error with code 30, you must send another SZV-STAZH with the “Additional” type to the Pension Fund and clarify the incorrect information.

Code 40

This code for the employer means that the program for checking the SZV-STAZH report in 2022 identified errors with which the Pension Fund of the Russian Federation accepts the form, but some data will need to be clarified. For example, correct the incorrect position code of an employee who is applying for preferential seniority.

To correct inaccuracies, you will have to prepare and submit the SZV-KORR for those employees whose data was incorrect. You can avoid submitting a corrective report by verifying that the information is correct before submitting the original form.

Code 50

The report was prepared incorrectly, and the Pension Fund of Russia will not accept it. In this case, the employer must re-generate the form with the “Original” type. But first you should check all the data, since errors are sometimes elementary, for example, an incorrect registration number of the policyholder in the Pension Fund of the Russian Federation.

Professional accounting programs

If you don't want to bother with pension fund programs or register in your personal account, you can use professional accounting software.

The most famous and popular is, of course, 1SBuhgalteriya. But there are other programs for accounting and filing tax reports. Among the domestic ones, these are “Galaktika” and “Parus”, both have been on the market for more than 20 years. Among the foreign ones, SAP is the most famous.

But often a company does not need the range of functions that these programs offer. Accounting programs with sophisticated functionality are affordable only for large companies. But there are more modern and “lighter” programs for accounting and tax accounting, aimed mainly at small ones, “My Business”, “Kontur.Extern” and some others.

Online services on an ongoing basis

Another option to fill out the SZV-M without any problems is to use online services.

There are several portals that allow you to fill out the SZV-M report online: “My Business”, “Contour”, “Sky”.

For clarity, here is a table of these services:

| Service name | Who is it aimed at? | Advantages | Price |

| My business | Individual entrepreneur on the simplified tax system and UTII | Specializes in the most popular tax regimes for small businesses. | From 3990 per year. |

| Contour.Extern | Small businesses using the simplified tax system and UTII, medium-sized businesses (including in the field of alcoholic beverages) and budgetary enterprises located in St. Petersburg and the Leningrad region. | The ability to generate reports to all government agencies, including RPN and RAR, the ability to work from different computers, free access to the promotion for 3 months. | From 2900 per year |

| Sky | Companies wishing to submit reports electronically. It is possible to draw up declarations of the simplified tax system, UTII, EUND, VAT. | There is a free tariff “Reporting only” | 100–170 rubles for one document when sending the document at the same time in the presence of the Sky ES. |

Now let's see how to fill out the SZV-M in these programs.

Review of Pension Fund programs for employers and how to download them for free

To relieve the burden on employers and optimize the procedures for their interaction with the state pension fund, Pension Fund specialists have developed special tools for submitting reports electronically. Computer programs are publicly available and can be used by an unlimited number of interested parties .

Next, we will briefly analyze the main ones, which allow us to minimize the time costs associated with the preparation of documentation and reporting for submission to the pension fund.

The programs are posted on the official website of the Pension Fund and are freely available, they can be downloaded, as well as on the websites of the territorial divisions of the Pension Fund.

It should be noted that this software also contains some third-party Internet resources. However, users should use them with extreme caution. This is due to the fact that in some cases, instead of a working program, you can download unwanted software or viruses.

In addition, some resources may require a fee for downloading programs.

In this regard, it is strongly recommended to download PFR programs only from the official website of the fund or from the websites of its structural divisions. Reference! Legal entities or individual entrepreneurs with hired employees are required to pay insurance contributions for them to the state pension fund. From the point of view of the law, they act as policyholders in the compulsory pension insurance system. Among other things, this also imposes a wide range of responsibilities related to the provision of relevant reports to the Pension Fund.

To prepare until 2014

Among the programs developed by the Pension Fund for reporting until 2014, two of the most frequently used ones should be highlighted: CheckXML and CheckXML-UFA. They serve to assess the correctness of filling out electronic documents sent to the state pension fund.

CheckXML

This software is used both by policyholders and the pension fund itself. First of all, it serves to reconcile electronic documents prepared for sending to the Russian Pension Fund.

The CheckXML program is used to check documents containing the following information:

- calculation of amounts paid as insurance premiums for existing employees;

- information about documents used in the implementation of personalized accounting.

In addition, CheckXML allows you to check the correctness of filling out information about personalized accounting when using unified forms.

Attention! When using the program in question, it is possible to scan files either individually or as a batch.

CheckXML-UFA

This program was developed to verify files that contain information about insurance premiums, both paid and payable. In addition, it can be used to check the correctness of filling out electronic files for existing requirements.

CheckXML-UFA also allows you to check electronic documents containing personalized accounting information , as well as accrued and paid insurance premiums.

The software can be used by both policyholders (employers) and employees of territorial bodies of the Pension Fund of the Russian Federation when receiving reports associated with personalized accounting data and paid insurance premiums.

PU_RSV

Using this software, it is possible to maintain documents in the RSV-1 form, including for use in printed form. In general, the program is used to enter special data on accrued insurance premiums , and is also used to calculate them.

The ability to fill out the RSV-1 form using PU_RSV is provided for both one and several organizations. Thus, the program is convenient for use in branches and separate structural divisions of a particular insurer.

Documents PU-5

This software package allows you to generate personalized accounting documentation , which is subject to transfer to the territorial bodies of the Pension Fund of the Russian Federation.

Its functionality is quite wide and allows you to generate documents of various forms (ADV, SZV, DSV).

Important! This software allows you to send files both electronically and print documents for subsequent submission to the Pension Fund.

PD SPU

PD SPU software is used to prepare personalized accounting information.

Spu_orb

This software is used by policyholders to submit accounting information to the pension fund. The program is suitable for working with the vast majority of unified forms.

Psv_RSV

At its core, this software package is a tool for entering data from standard reporting forms into the Pension Fund of Russia, which have been used since 2010.

The solutions discussed above allow you to use them on almost any workplace equipped with a computer running the Windows operating system (from MS Windows 98 and later). Internet access is required to submit reports electronically. In addition, to create printed documents in A4 format you will need a printer.

After 2014

First of all, the most popular among employers are programs that are designed for generating electronic documents and submitting reports to the Pension Fund. Among them, special mention should be made:

Spu_orb

This software allows you to work with the vast majority of unified forms. Here you can enter data, upload documents, and print them if necessary.

Reference! Spu_orb allows you to work with several databases simultaneously, which is convenient when serving several organizations at once.

PsV_RSV

This tool allows you to enter the necessary data to generate reports on the most common reporting forms.

PC "PERS"

The software package can be used to prepare documents on personalized accounting for the periods from 1997 to 2013. In addition, the PC "PERS" is also used to generate reports in the RSV-1 form, which is still used today.

Documents PU 5

The software package is a powerful tool for generating documents and reporting on almost all available unified forms. This program is in greatest demand among policyholders. It should be noted that the complex was developed by the territorial department of the Pension Fund for the Komi Republic.

In addition to programs that help generate various documents for submitting them to the state pension fund, tools for checking the reporting itself are no less important for employers.

For this purpose, the CheckPFR tool has been developed and is widely used. It is used to check all reports that are sent to the Pension Fund for compliance with the legislation on compulsory security.

Attention! In addition, this software is also used by the pension fund itself when checking reports submitted by employers regarding accrued insurance contributions and personalized accounting information.

To prepare personalized accounting documents

In general, to prepare the necessary documentation, employers can use the following programs, described above:

- CheckXML;

- PsvRSV;

- Documents PU 5;

- PD SPU;

- Spu_orb.

These programs can be used by business entities without any restrictions.

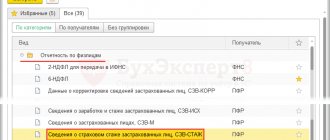

Checking SZV-M

Before sending a document to the Pension Fund, it must be checked. This can be done in two ways:

- verification in Pension Fund programs;

- checking SZV-M online for free in online accounting services.

1. Pension Fund programs that allow you to fill out the SZV-M also allow you to test it. The CheckXML and CheckPFR programs are especially popular. To check the form, you must first install it on your computer.

2. It is almost impossible to check SZV-M online without registering in online services, but the registration procedure will not take much time.

Characteristics, pros and cons of “stuffers”

The main nuance of “fillers” is that they can be paid or free. Free versions are produced mainly by Pension Fund branches. An example is Spu_orb. Version 2.113, currently posted on the PFR website, allows, among other things, the generation of SZV-M reports. The program for reports 2022, including SZV-M, must be downloaded and installed on a work computer in order to enter and print information, as well as upload files for submission to the Pension Fund.

Paid “fillers” are usually an online program that you can use by paying for access. The fee rarely exceeds 1,000 rubles. for the report, so many enterprises incur these expenses, avoiding fines for late submission and errors in the report.

In addition, there are a number of free services. There are quite a lot of online “fillers”, so as an example we will name only a few that are popular and allow you to generate an SZV-M report:

- "Bukhsoft";

- “My business” (“Internet accounting”);

- “PF-report” (“Comfort-soft”);

- “PFR Partner”;

- “Taxpayer Legal Entity” (the program was released by the Federal Tax Service of Russia, but contains functionality for generating reports to the Pension Fund of the Russian Federation, free of charge).

Dispatch SZV-M

After you have checked the SZV-M report online or with the Pension Fund of Russia program, you need to make sure that the file is generated in the required format. The file must be converted to the required format. The Federal Tax Service accepts documents in xml format. If your document is in excel format, you need to tinker to convert the file to xml. You will have to understand the non-ordinary functions of Excel.

If the form is generated in pdf format, you can use an online file converter from pdf to excel. Then we save the excel file in xml format using the “save as” function.

But to avoid mistakes when saving a file in the required format, it is better to initially fill it out in a program or online service specially designed for this.

Sending SZV-M in electronic format

The Pension Fund does not provide employers with the opportunity to send a report from their personal account on the Pension Fund website, so you can send the form electronically through an electronic document management (EDF) operator.

EDF operators are specialized companies that provide services not only for generating reports, but also for sending them to tax authorities via secure communication channels using an electronic digital signature.

To do this, you will need to enter into an agreement with the EDF operator in order to connect to its service and receive an electronic digital signature, and notify the Pension Fund of the Russian Federation about the submission of documents electronically.

Description of the Spu_orb program

Spu_orb is a program designed to prepare and verify documents that the company submits to the territorial division of the Pension Fund as reporting. It helps to find errors in reporting and correct them at the stage of preparing accounting information for sending to the department.

To start using the program, you must enter primary information about the company. Then, using the application, you can quickly generate reporting documents, eliminating errors in them.

Reporting is created in electronic format, but if necessary, it can be downloaded and printed.

Important! Spu_orb is a service integrated with other applications, so using the program you can import information from the Pension Fund of the Russian Federation and transfer information from other programs.

Sending SZV-M on paper or in person

To send a document by mail, you need to print it out, put a stamp (if there is one), fill out two copies of the list of attachments and fill out an envelope (PFR address and sender's address). Take the unsealed envelope with the report and two copies of the inventory to the post office. The branch employee will stamp and sign the second copy of the inventory and issue a payment receipt, which will indicate the shipment ID. Keep these documents in case the Pension Fund loses your report.

Submitting SZV-M in person

To personally submit the SZV-M form to the Pension Fund of the Russian Federation, print it out in two copies (with signature and seal, if any), take a passport and/or power of attorney from the organization to submit reports. Give both copies of the report to the Pension Fund employee. The inspector will keep one copy for himself, and on the second (yours) he will put an acceptance mark.

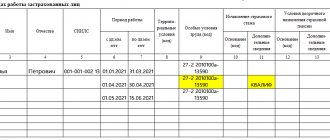

SZV-STAZH for pension assignment

To assign a pension, information must be submitted using the SZV-STAZH form, which is regulated by Pension Fund Resolution No. 507p. The report is filled out for those insured individuals who are retiring. They need the information to establish a pension in order to take into account periods of work in a calendar year for which reporting has not yet been submitted. For example, if an employee retires in 2022, then the annual report will be submitted only until March 1, 2022, and information for this year will be required upon retirement.

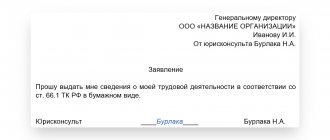

The employer is given only 3 calendar days to submit SZV-STAZH for the assignment of a pension. The count starts from the moment the employee submits the relevant application. It does not have any approved form, and therefore is compiled in any form.

Together with SZV-STAZH, you also need to create an inventory of EDV-1 (Appendix No. 2 to PFR Resolution No. 507p).