Personalized accounting since 2017

From January 1, 2022, the calculation and payment of insurance premiums, except for contributions for injuries, are controlled by tax inspectorates (Chapter 34 of the Tax Code of the Russian Federation). But information about the insurance period is still controlled by the Pension Fund of the Russian Federation and its territorial bodies. In this regard, two reports must be submitted to the Pension Fund:

- monthly report SZV-M;

- annual report on insurance experience.

Until 2022, policyholders showed information about their length of service in section 6 of the quarterly calculation of RSV-1. However, from 2022, the RSV-1 calculation is no longer applied. His form has lost its power. Instead, information about your experience will need to be submitted as part of your annual reporting.

ODV-1 and SZV-STAZH: example of filling

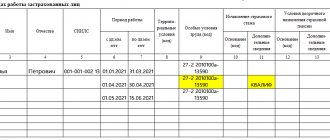

In 2022, Vesna LLC had 4 employees, from whose payments contributions to the Pension Fund were transferred. For a report on the SZV-STAZH form in 2018, the sample completion contains the following data:

- Vorobiev M.M. – worked all year and was on regular leave from 06/01/2017 to 06/28/2017;

- Skvortsov P.P. – admitted on July 21, 2017, was on sick leave from November 20, 2017 to November 27, 2017;

- Medvedeva A.I. – all of 2022 on parental leave;

- Zaitseva I.I. – accepted in 2016, from 01/23/2017 to 02/06/2017 was on study leave, and on 12/31/2017 she resigned from Vesna LLC (you can see a sample SZV-STAZH upon dismissal at the link above).

Please note that only for employees who left on December 31, as in our example, you need to fill out column 14 of Section 3 of the information. For those who were dismissed on other dates, column 14 is not filled in at all.

We have included an example of filling out an employee’s next vacation in the SZV STAZH 2022 example. Please note that when reflecting any type of paid leave, column 11 contains the code “DLOTPUSK”. In connection with this code, when checking the report with the Pension Fund of Russia program, a warning “20” may be issued, which is just a technical problem of the software developer. Pension Fund employees cannot refuse to accept SZV-STAZH in connection with this warning, since the use of the code is determined by the official rules for filling out SZV-STAZH 2017.

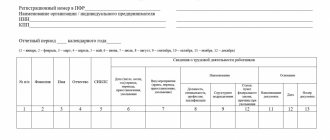

Filling out the SZV-STAZH form (filling sample):

Inventory EDV-1 - sample filling (SZV-STAZH for 2022):

What new reporting forms have been approved?

Organizations and individual entrepreneurs became familiar with the SVZ-M form back in 2016. This form was approved by Resolution of the Pension Fund Board of February 1, 2016 No. 83p. Using the SZV-M form, organizations and individual entrepreneurs are required to submit monthly information about their employees to the territorial offices of the Pension Fund:

- last name, first name and patronymic;

- SNILS;

- TIN.

Monthly SZV-M reports in 2022 must be submitted to the Pension Fund no later than the 15th day of the month following the reporting month. See “SZV-M in 2017: new deadlines for submitting initial, corrective and updated reports.”

At the same time, Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 3p approved completely new personalized accounting documents, which policyholders have not previously encountered. These regulatory documents are approved:

- form “Information on the insurance experience of insured persons (SZV-STAZH)”;

- form “Information on the policyholder transferred to the Pension Fund of the Russian Federation for maintaining individual (personalized) records (EDV-1)”;

- form “Data on the adjustment of information recorded on the individual personal account of the insured person (SZV-KORR)”;

- form “Information on earnings (remuneration), income, amount of payments and other remunerations, accrued and paid insurance premiums, periods of labor and other activities counted in the insurance period of the insured person (SZV-ISH).”

Also, Resolution of the Board of the Pension Fund of January 11, 2017 No. 3p approved the Procedure for filling out the above document forms and the format of information necessary for transmitting the forms to the divisions of the Pension Fund in electronic form.

Next, we will explain why these forms are required, to whom and when they will need to be submitted to the Pension Fund units. These forms are not submitted to the Federal Tax Service. You can also download the new forms and familiarize yourself with their samples. However, this article does not contain detailed instructions. Later we will publish a special article in which we will consider all the main aspects related to the formation of new personalized reporting.

From what date do they apply?

By Resolution of the Board of the Pension Fund of January 11, 2017 No. 3p, it was registered by the Ministry of Justice of Russia on February 21, 2017 No. 45735. This document was officially published on February 22, 2017 on the official Internet platform. The document comes into force 10 calendar days after the date of publication. Therefore, it is necessary to apply new forms of individual (personalized) accounting documents from March 4, 2017.

When to take it

There is no uniform procedure for when to take EFA-1. The information will have to be submitted simultaneously with the reports SZV-STAZH, SZV-KORR and SZV-ISKH.

We submit these pension reporting forms once a year no later than March 1 of the year following the reporting year. Therefore, the next deadline for submitting the accompanying document is also March 1. For 2021 we report until 03/01/2022, this is Tuesday, a weekday, no transfers are provided.

IMPORTANT!

If representatives of the Pension Fund request information before the specified period, for example, when assigning a pension to an employee of your institution, then there is no need to generate an accompanying document.

Form SZV-STAZH

The SZV-STAZH form was approved as Appendix No. 1 to Resolution of the Pension Fund Board of January 11, 2017 No. 3p. This form is a report on work experience, which must be submitted annually - no later than March 1 after the reporting year. For the first time, such a report will have to be submitted for 2022 (subclause 10, clause 2, article 11 of the Federal Law of 04/01/1996 No. 27-FZ).

The SZV-M length of service form must be generated by insurers for all insured persons who are in an employment relationship with the policyholder (including those with whom employment contracts have been concluded) or who have entered into civil law contracts with him (clause 1.5 of the Procedure for filling out the form “Information on insurance experience insured persons (SZV-STAZH)", approved by Resolution of the Board of the Pension Fund of January 11, 2017 No. 3p). This form looks like this:

As you can see, section 3 of the new SZV-STAZH form is similar to section 6 of the RSV-1 calculation, which previously included information about the length of service of individuals. In section 3 of the SZV-STAZH report you will also need to show:

- Last name, first name and patronymic of each insured person (columns 2,3 and 4);

- work periods (columns 6 and 7);

- SNILS (column 5);

- codes for territorial and special working conditions (columns 8 and 9);

- calculation of insurance experience (columns 10 and 11);

- conditions for early assignment of an insurance pension (columns 12 and 13);

- information about the dismissal of the insured person (column 14).

Codes for experience

As before, when filling out section 6 of the RSV-1 calculation, the periods of work of insured persons in the SZV-STAZH form will need to be accompanied by various explanatory codes. Here are a few examples of acceptable “experience” encoding of section 11 of the new personalized report:

| Some codes for column 11 of section 3 of the SZV-STAZH form | |

| Code | Application |

| “AGREEMENT”, “NEOPLDOG”, “NEOPLAUT”. | These codes indicate the period of work of the insured person under a civil contract. If payment under the agreement was made during the reporting period, then the code “AGREEMENT” is indicated. If there is no payment in the reporting period, then the code “NEOLDOG” or “NEOLPAVT” is indicated. |

| "CHILDREN" | Holiday to care for the child. |

| "NEOPL" | Vacation without pay, downtime due to the fault of the employee, unpaid periods of suspension from work (preclusion from work) and other unpaid periods. |

| "QUALIF" | Advanced training with a break from production. |

| "UCHOTVUSK" | Additional holidays for those who combine work and study |

| "SDKROV" | Days for donating blood and providing leave in connection with this |

| "DLCHILDREN" | Otpksk for child care from 1.5 to 3 years |

| "DOPVIKH" | Additional days off for persons caring for disabled children. |

| "CHILDREN" | If parental leave until the age of 3 is granted to grandparents, other relatives or guardians |

Codes of territorial and special working conditions in columns 8 and 9 of section 3 of the SZV-V experience form will need to be filled out based on the Parameter Classifier used when filling out information for maintaining individual (personalized) records. Such a Classifier is drawn up as an appendix to the Procedure for filling out the form “Information on the insurance experience of insured persons (SZV-STAZH)”, approved. By Resolution of the Board of the Pension Fund of January 11, 2017 No. 3p. Next you can:

- SZV-STAZH form in Excel format;

- Classifier of parameters used when filling out information for maintaining individual (personalized) accounting.

Deadline for submitting SZV-STAZH

For the first time, the SZV-STAZH report must be submitted for 2022: no later than March 1, 2022. Before this date, you must submit a report with the “Initial” information type to the Pension Fund. This type of information means that the report for 2017 is being submitted for the first time.

You can also submit the SZV-STAZH report with the “Corrective” information type. Such a report will need to be submitted in a situation where there were errors in the report with the “Initial” type that did not allow the data to be posted to individual personal accounts of insured persons (for example, if there were errors in SNILS).

We believe it is advisable to pay special attention to the type of information “Pension assignment”. The SZV-STAZH report with this type of information will need to be submitted to the Pension Fund of the Russian Federation for a person entering an insurance pension - within three calendar days from the date the insured person contacts the policyholder. This is provided for in paragraph 2 of Article 11 of the Federal Law of 04/01/1996 No. 27-FZ.

The SPV-2 form is no longer needed

Personalized accounting documents previously included form SPV-2 “Information on the insurance experience of the insured person for establishing a labor pension.” It had to be submitted to the territorial offices of the Pension Fund for those employees who are retiring. See Form SPV-2: sample filling."

The SPV-2 form has been canceled since 2022. In fact, the SPV-2 form was replaced with the SZV-STAZH form, which contains the type of information “Pension assignment”.

Innovations in SZV-STAZH from December 2021

From December 12, 2021, it is necessary to take into account the changes in the procedure for filling out the SZV-STAZH introduced by Resolution of the Pension Fund of the Russian Federation dated September 6, 2021 No. 304p. The updated rules provide that column 11 “Additional information” of SZV-STAZH may reflect, among other things, information about downtime due to the fault of the employer (code “SIMPLE”).

SZV-STAZH form for reporting for 2022

If this code is entered in column 11, then you cannot reflect:

- in column 8 the code of territorial working conditions;

- in column 9 code of special working conditions;

- in column 12 code of conditions for early assignment of pension.

The changes also affected the application of individual codes. Thus, in the report for 2022, the code “QUALIFICATION” must be indicated in column 11 and the code of special conditions must be entered in column 9 if during the reporting year the employee underwent vocational training and new knowledge is needed to perform his job function. Provided that he did not work during training, but he retained his job. This will make it possible not to exclude the period of advanced training from the preferential length of service.

According to the updated rules, the simultaneous use of the codes “VILLAGE” (column and “CHILDREN” (column 11) in SZV-STAGE is allowed, which allows the period of parental leave of up to 1.5 years to be counted in rural experience.

Useful information from ConsultantPlus

See the full list of changes introduced by the Resolution of the Pension Fund of the Russian Federation dated 09/06/2021 No. 304p (free access).

Form SZV-KORR

The SZV-KORR form will need to be filled out and submitted to the Pension Fund of Russia divisions to adjust the data recorded on the individual personal accounts of insured persons based on previously submitted reports. This is stated in paragraph 4.1 of the Procedure for filling out the SZV-KORR form, approved by Resolution of the Pension Fund Board of January 11, 2017 No. 3p. This form has a “telling” name – “Data on the adjustment of information recorded on the individual personal account of the insured person.” This form looks like this:

The SZV-KORR form is submitted by the policyholder to make changes to previously submitted data. This form may be submitted at the initiative of the policyholder at any time. There are no deadlines for submitting this form. The SZV-KORR form can be generated with different types of information:

- CORR - if you need to adjust the information on the individual personal account of the insured person as follows (for example, replace data on earnings (remuneration), income, amount of payments and other remunerations of the insured person or supplement data on accrued and paid insurance premiums).

- OTMN - based on the cancellation form, the data recorded on the ILS (individual personal account of the insured person) on the basis of reporting, the data of which is being adjusted, will be canceled;

- SPECIAL - a special type of information with which it will be possible to submit data on the insured person, whose information was completely absent in the previously submitted reports.

The SZV-KORR form can be submitted to the territorial division of the Pension Fund for adjustment of any period until 2022.

Next, you can create a new SZV-KORR form in Excel format.

When section 4 EDV-1 is filled out

This part of the inventory is filled out only if it is submitted together with SZV-ISH or SZV-KORR reports with the “special” type. A form with the “OSOB” type is provided for the insured person, information on which was not included in the reporting previously provided by the policyholder, with the exception of reporting in the SZV-STAZH form.

If there is a need to adjust information about accrued contributions for one employee, this entails changes in information about accruals and debts for the entire policyholder as a whole. In order for the Pension Fund to be able to correctly correct information previously submitted by the company, Section 4 is intended.

Let's show with an example how to fill out section 4 of EFA-1. The company submitted the DAM to the Pension Fund for 2022 with the following data:

| 2017 | Debt at the beginning of the reporting period, rub., kopecks. | Insurance premiums accrued, rub., kopecks. | Insurance premiums paid, rubles, kopecks. | Debt at the end of the reporting period, rub., kopecks. | ||

| Total | For 2016 | For 2022 | ||||

| For the insurance part of the pension | 100 000,00 | 2 000 000,00 | 1 950 000,00 | 100 000,00 | 1 850 000,00 | 150 000,00 |

In 2022, it was discovered that information was not submitted for one employee. According to it, for 2022, contributions were calculated for the insurance part of the pension in the amount of 10,000 rubles. The organization submits information for this employee using the SZV-ISH form and fills out section 4 of the inventory as follows:

Form SZV-ISH

The form “Information on earnings (remuneration), income, amount of payments and other remuneration, accrued and paid insurance premiums, periods of labor and other activities counted in the insurance period of the insured person (SZV-ISH)” is filled out by the policyholder only for reporting periods before 2016 year (inclusive). And only in a situation where reporting deadlines were violated during these periods. This is stated in paragraph 5.1 of the Procedure for filling out the SZV-ISH form, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 3p. We are talking about situations where an individual did not submit reports at all, and now the policyholder has decided to report for past periods. This form looks like this:

In the SZV-ISH form for past periods you will need to indicate:

- information about the policyholder;

- information about the insured person;

- reporting period;

- information on the amount of payments and other remuneration accrued in favor of an individual;

- information on accrued insurance premiums for the reporting period.

There are no deadlines for submitting the temporary storage warehouse-iskh form. The policyholder may submit this form at any time he deems necessary.

Sections that are always filled

Sections 1, 2 and 3 are completed regardless of which main report the inventory is attached to.

Section 1 reflects information on the policyholder transferred to the Pension Fund for maintaining individual (personalized) records (EDV-1):

- registration number in the Pension Fund of Russia: has 12 characters and is assigned when registering a company with the Pension Fund of Russia;

- TIN and checkpoint;

- name of the insured.

Section 2 is intended to indicate the period for which reports are submitted. It must indicate the year. And a coded designation of the time period for which the report is provided:

- quarter;

- half year;

- year;

- another time interval for which reporting was to be submitted.

The SZV-STAZH report is submitted once a year, therefore the reporting period code in EDV-1 for this report is always 0. A complete list of reporting period codes for previous years is indicated in the appendix to the procedure for filling out personalized accounting forms.

Section 3 is intended to indicate the number of persons for whom information is filed in the main report. Opposite the name of the corresponding form indicated in column 1, we reflect the number of insured persons in column 2. Only one line is filled in in this tabular part.

Form EDV-1

Form EDV-1 “Information on the policyholder transferred to the Pension Fund for maintaining individual (personalized) records” is an accompanying form. In paragraph 1.7 of the filling procedure approved by the Resolution of the Board of the Pension Fund of the Russian Federation from Resolution of the Board of the Pension Fund of January 11, 2017 No. 3p it is said “Information in the form SZV-STAZH, SZV-ISKH, SZV-KORR is formed into packages of documents. One package contains one file and is submitted simultaneously with the EDV-1 form.” At the same time, it is clarified that document packages can include documents of only one name and one type.

In this case, EDV-1 is a document containing information on the policyholder as a whole. So, for example, in this form you need to summarize information about the total amount of accrued and paid insurance premiums for the reporting period. EFA-1 includes the following sections:

- Details of the policyholder submitting the documents;

- Reporting period;

- List of incoming documents;

- Data in general for the policyholder;

- The basis for reflecting data on periods of work of the insured person in conditions that give the right to early assignment of a pension in accordance with Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”.

This form looks like this:

This form may contain the following types of information:

- original;

- corrective – submitted if you need to correct the data in section 5 of the EFA-1 form;

- canceling – submitted if it was necessary to cancel the data in section 5 of the EFA-1 form. You can find EFA-1 forms in Excel format in the “Documents” section on our website.

There is no need to talk about the deadlines for submitting the EFA-1 form, since it accompanies incoming documents. In other words, if, for example, the SZV-STAZH report is submitted, then it must be sent to the fund along with the EDV-1 form.

Instructions on how to fill out the report step by step, and examples of filling it out

Let's look at an example of how to fill out EFA-1 for 2022 section by section. Please note: you do not always have to fill out the entire form; some lines are left blank.

Step 1

We indicate the details. First, enter information about the policyholder:

- registration number in the Pension Fund of Russia;

- TIN;

- checkpoint;

- short title.

Step 2

Enter information about the reporting period and report type. The reporting period code is “0”.

Step 3

We provide information about the insured persons. The third section contains information on the number of insured persons for whom reporting is submitted.

Step 4

Section 4 must be filled out when submitting SZV-ISH or SZV-KORR with the “Special” type, but when submitting SZV-STAZH it is not filled out. It reflects information about paid and accrued insurance premiums.

Step 5

Section 5 is completed when submitting information about employees who retire early in accordance with Article 30 of Federal Law No. 400 of December 28, 2013. Served in combination with SZV-STAZH and SZV-ISKH.

IMPORTANT!

For policyholders who use special software for submitting reports, the rules for filling out the PFR program are similar. But some fields, for example, registration data for the policyholder, are already saved in EDV-1, and there is no need to fill them out again if nothing has changed.

Taking into account the rules, we will show an example of filling out EDV-1 for 2022 (don’t forget about SZV-STAZH).

Another example employers will need to fill out a report is when an employee applies for retirement.

What other forms exist for accounting?

Let us recall that quite recently officials from the Pension Fund of the Russian Federation approved another set of personalized accounting forms, which are necessary, first of all, for registration as insured persons. See “New forms of personalized accounting documents have been approved.” These forms, in fact, are not reporting. These forms are simply necessary for the policyholder to fulfill his obligation to issue insurance certificates to employees, clarify information in the personalized accounting system, etc.

Among the approved forms:

- “Questionnaire of the insured person (ADV-1)”;

- “Insurance certificate of state pension insurance (ADI-1)”;

- “Insurance certificate of compulsory pension insurance (ADI-7)”;

- “Application for exchange of insurance certificate (ADV-2)”;

- “Application for issuance of a duplicate insurance certificate (ADV-3)”;

- “Request for clarification of information (ADI-2)”;

- “Inventory of documents submitted by the policyholder to the Pension Fund of the Russian Federation (ADV-6-1)”;

- “Accompanying statement (ADI-5)”;

- “Information on the work experience of the insured person for the period before registration in the compulsory pension insurance system (SZV-K).”

What information should be included in the new experience report?

The officially approved instructions for filling out the SZV-STAZH in 2022 provide that on one page of the form the policyholder reflects the following information for each insured person:

- surname, first name, patronymic;

- SNILS;

- period of work in the organization;

- working conditions code;

- code of grounds for early retirement.

Each form is filled out by only one employee and certified by the person who filled it out. This is done both by hand in block letters and using computer technology. Fill color - any, with the exception of green and red. No corrections or blots are allowed.

The report is provided in an electronic format, which the Pension Fund provides in its resolution.

To correctly fill out the report, the employer will need the following information about the insured person:

- information about wages and other income, payments and other remuneration in favor of the employee;

- information on accrued, additionally accrued and withheld insurance premiums;

- information about the citizen’s period of work, including corrective information.

How to register SZV-STAZH in 1C:ZUP 8 (ed. 3)

Let's look at an example of filling out SZV-STAZH in the 1C:ZUP program.

Employees of Arbuzov E.Yu. work in and Vesnushkina L.S. They submitted an application to the employer to submit information to the Pension Fund to establish a pension. It is necessary to form a SZV-STAGE for March 15, 2021 to send to the Pension Fund.

In the 1C: ZUP 8 program (rev. 3), SZV-STAZH is formed through the document “Information on the insurance experience of insured persons, SZV-STAZH”. To do this, the user goes to the “Reporting, Certificates” section and then selects “PFR. Packages, registers, inventories" or "Accounting documents". In addition, you can generate a document through the 1C-Reporting workplace, for which you need to go to the “Reporting, certificates” section.

By clicking the “Create” button, the user selects the required document.

The “Organization” column is filled in automatically. If the program keeps records for several companies, then the user selects the one he needs.

In the “Date” column the date of generation of the document for sending to the Pension Fund is indicated. By default, the current date of the computer is indicated there.

The “Year” column indicates the current year, also by default.

In the “Type of information” column you need to indicate “Pension assignment”.

In the “Employees” tab, in the table, select the employee for whom information will be filled in (via the “Selection” button). In the table you need to indicate:

- “Employee” - full name of the employee;

- “SNILS” - number of the employee’s insurance certificate;

- “Retirement date” is the expected date when the pension will be established, i.e. the expected date for the employee to submit documents to the Pension Fund. By default, the same date is indicated here as in the “Date” column.

SZV-STAZH can be printed - there is a special button above the document table.

The checkboxes “Contributions for compulsory pension insurance have been accrued” and “Contributions have been accrued at the additional rate” are checked automatically if these insurance contributions were accrued in the specified period for the employee. Checkboxes can be removed manually.

The columns “Manager” and “Position” are filled in automatically based on information about the responsible persons of the company. They are entered into the “Organizations” directory - you can check or correct the information through the “Settings” section, then “Organizations”, then the “Accounting policies and other settings” tab and the “Responsible Persons” hyperlink.

To go to the completed information, you need to double-click or use the Enter button on the line with a specific employee. In this case, the “Experience Information” form will open.

This contains information about the employee’s length of service from the beginning of the calendar year to the date that precedes the date of expected retirement. If during this period the employee had special periods of service, for example, illness, leave without pay, etc., then they must be indicated. If they are recorded in the program, they are indicated in SZV-STAZH automatically. If the information is added or changed, you need to click the “OK” button.

Then the document is written through the corresponding button in the top command bar of the form. Then it is printed, if not transmitted via TKS. To print, use the corresponding “Print” button - not only the SZV-STAZH report itself is generated, but also an inventory according to the EDV-1 form.

The “Upload” button is used to upload the package to the specified directory in electronic form. File names are assigned automatically. Uploaded files can be checked for compliance with the requirements of the Pension Fund of Russia, for which the user clicks the “Check” button and selects “Check upload”.

The check is carried out according to an algorithm that is built into the 1C: ZUP program. The check can also be carried out using third-party software products, but for this they must first be installed on the PC. To do this, the user clicks the “Yes” button in the message displayed on the screen after the built-in information check. If any requirements are violated, the user receives a corresponding notification.

If you have a connection to the 1C-Reporting service, documents can be transferred directly from the 1C: ZUP program. Before sending them, you need to carry out format and logical control of filling out the forms. To do this, use the “Check” button and then “Check on the Internet”. To send reports, use the “Submit” button.

When the Pension Fund accepts the information, it is recommended to protect the sent document from changes. To do this, you need to check the “Document accepted by the Pension Fund (not edited)” checkbox. After this it can be carried out. And then the document can no longer be corrected - only if you remove the specified checkbox.