About legal entities

Written disclaimer First, about the shortcomings of the article, so that readers who will waste

Payment order - what is it? In the activities of a budgetary institution, most settlements with counterparties

The state at the legislative level obliges entrepreneurs to deduct part of the income from their activities

In attempts to optimize taxation, companies sometimes resort to dubious schemes that are well known to the Federal Tax Service.

2-NDFL was abolished from 01/01/2021 From 01/01/2021 the Federal Tax Service of Russia abolished the 2-NDFL form. Starting from 2021

The staffing table according to the unified form T-3 is used by companies and enterprises to organize information about

Discussions about the abolition of work records have been going on for several years. Already in 2017 it was proposed

Joint reconciliation of settlements with the Social Insurance Fund Sometimes there is a need to reconcile the information that is available to

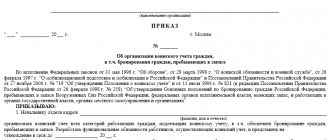

Organization of military registration and its purpose Military registration is a system of techniques and methods,

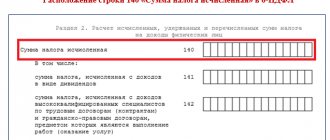

What is 6-NDFL? You must report for withheld and transferred personal income tax. To do this, every quarter