UPD form and its application

Federal Law No. 402-FZ “On Accounting” simplified the forms of primary accounting documents (PUD), but determined a list of mandatory details for them (Article 9 402-FZ), each fact of economic life is subject to mandatory registration.

The PUD details are:

- Name;

- Date of preparation;

- name of the economic entity of the compiler;

- content of the fact of the operation;

- the measurement value of the operation in physical and (or) monetary terms (indicating the units of measurement);

- the name of the position of the person who completed the transaction, operation and is responsible for the correctness of its execution;

- signatures of persons indicating last names and initials or other details necessary for their identification.

The form of the universal transfer document was developed by the Federal Tax Service based on the requirements of the accounting law No. 402-FZ and Government Decree No. 1137 and proposed for use by letter of the Federal Tax Service of Russia dated October 21, 2013 No. MMV-20-3 / [email protected] Rules for filling out UPD are relevant for the supply of goods and performance of work (services).

Taking into account the specifics of primary business papers, it is clear what forms the UPD combines - it is used instead of:

- waybill;

- invoices;

- act of acceptance and delivery of works (services).

IMPORTANT!

The form developed by the Federal Tax Service is recommended. The organization has the right to develop its own and approve it in its accounting policies. It is important to follow the rules for filling out the UPD in 2022 and use all the required details listed above.

In some Russian regions, there are special requirements for filling out a universal transfer deed established by local regulations. For example, in Bashkiria, as of December 1, 2020, it has been established that the parties to a transaction must fill out the UTD in a form that contains a special column 10b, which indicates the region of origin of the Russian product. If foreign products are supplied, column 10b is not filled in.

Why was UPD invented?

The main task of UPD is to simplify document flow by replacing several documents with one.

Initially household Entities using the STS, for transactions, presented their counterparties with a package of documents, which, among others, included delivery notes, acts and invoices for them. At the same time, the information in the invoices/acts and invoices was duplicated. To correct this situation, the UPD was invented - a universal transfer document. Its versatility lies not only in combining the functions of a primary document and an invoice: in one UPD you can reflect data on the goods/products being sold, as well as simultaneously on the work performed/services rendered. That is, the UPD can replace up to 6 documents .

Let's put in the table what operations can be issued for UTD:

You can download various samples of filling out the UPD 2022 later in the article. We will also provide instructions on how to fill out the UPD regarding some of the controversial details.

Who uses UPD

Any organization, individual entrepreneurs, and even public sector employees have the right to use the universal primary system. It makes no difference which taxation regime an economic entity applies. The organizational and legal form, as well as the form of ownership, also does not matter. Use UPD when processing transactions:

- Sales (of goods, services, works).

- Transfer of property rights over the company's own assets.

- Registration of transactions regarding intermediary operations.

The list of operations and transactions is contained in the letter of the Federal Tax Service dated October 21, 2013 No. ММВ-20-3/ [email protected] UPD contains invoice details; organizations and individual entrepreneurs are allowed to use it on any form of taxation.

IMPORTANT!

Organizations and individual entrepreneurs that are not VAT payers are not required to pay this tax when applying the UTD form. For organizations that are on the general taxation system, the UTD, like an invoice, makes it possible to offset input VAT when paying to the budget.

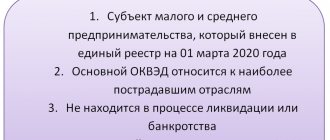

It is important to use statuses “1” or “2” correctly:

- 1 - if it is necessary for the document to replace both the invoice and the primary document;

- 2 - the UPD invoice does not replace, it is only a replacement for the primary document.

IMPORTANT!

From 07/01/2021, if a seller sells a traceable product to an individual who purchases it for personal, non-business needs, he must still issue him an invoice or UPD with the details of the product sold.

Is it necessary to use UPD?

The use of UPD is not a mandatory procedure. Transactions can be completed with any package of documents. So, it is permissible to act the old fashioned way and issue invoices and acts, or you can use UPD. It is also allowed to use one set of documents with some counterparties, and another with others.

As a rule, the composition of closing documents is specified in the contract. Therefore, you need to take care of what documents to draw up for the transaction in advance and discuss this with your partners.

Since 2013, the obligation to use unified forms of documents has been abolished. At the moment, you can develop your own forms, samples of which are approved by the accounting policy of the enterprise. The only condition is the presence of the required details . Including when filling out the UPD.

New requirements for UPD from July 1, 2022

From 01.07.2021, by Decree of the Government of the Russian Federation of 02.04.2021 No. 534, amendments were made to Government Decree No. 1137 on changing the form of the invoice. The UPD form now differs from the invoice in that a line is included in the invoice form for the purpose of tracking the goods. The invoice contains details that allow you to identify the document on the shipment of goods (on the performance of work, provision of services), on the transfer of property rights (subclause 4, clause 5, article 169 of the Tax Code of the Russian Federation).

The new procedure for issuing and receiving invoices is established by Order of the Ministry of Finance dated 02/05/2021 No. 14n. The update of the procedure is due to the introduction of a national system of mandatory traceability of goods.

If the UPD for July 2022 and subsequent months acts as an invoice (status “1”), it must be supplemented with page 5a “Shipment document No.”. Federal Tax Service specialists, in a letter dated June 17, 2021 No. ЗГ-3-3/ [email protected] , reminded that the UPD form is only recommended and taxpayers themselves make changes to it. But, for use simultaneously for the purpose of calculating income tax and settlements with the budget for VAT, it includes mandatory details.

On the new line indicate:

- number and date of the primary document (invoice or act);

- which lines this document belongs to (now in the invoice table the lines with different goods/services are numbered, column 1 with a serial number has been introduced).

If there are several lines in the tabular part of the UPD, all lines are indicated on page 5a and the details are repeated. With 10 pages of the document and number 1 dated 07/01/2021 in the UPD, page 5a is filled out as follows:

No. 1-10 N 1 dated 07/01/2021

IMPORTANT!

Organizations that, from July 1, 2021, carry out transactions with traceable goods, supplement the information in the UPD with the details contained in the invoice issued when carrying out transactions with goods subject to traceability.

In documents with status “2” a new line is not needed. When receiving an advance, you cannot use a universal transfer document, only an invoice.

replaces both the invoice and the primary document

Types of universal transfer documents

This documentation can be used in two versions:

- simultaneously as an account-f and a primary account (one is entered in the status);

- solely as confirmation of the transfer of goods and materials (a two is registered).

Depending on how exactly the application is recorded, you will have to fill out the forms differently.

Rules for filling out UPD 1

In this case, all details are required (for s/f and transfer papers). This is the only way to use the completed form to receive VAT deductions and account for income tax expenses.

UPD document with status 2

In the second option, there is no need to enter information for the invoice. This UPD form is used exclusively as transfer documentation to confirm the conduct of business transactions. And the account-f, if necessary, is generated additionally.

Recommendations for filling out individual details of the form

The table shows the details, the use of which will ensure the correct completion of the UPD: pay attention to the column of recommendations and explanations.

| № Rows, graphs | UPD details | Possible meanings, recommendations and explanations |

| lines (1) – (7) columns 1–11 | — | For UPD with status “1”, they are filled out in accordance with Appendix No. 1 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. If invoices in an organization are signed by another person authorized to do so by an order (another administrative document) for the organization or a power of attorney on behalf of the organization, then the administrative document is indicated in the invoice or the position of the authorized person who signed the specific invoice is indicated. In the document, the content of the transaction in the UPD corresponds to the invoice. It is acceptable to supplement the indicators on pages (3) and (4) with information about the TIN, checkpoint of the consignor and TIN, checkpoint of the consignee. For a universal transfer document with status “2”, it is permissible to fill out pages (1), (1a), (2), (6), (7), columns 1, 2 or 2a, 3 and 9 in order to fulfill the requirements of clause 1 Art. 9 of the Federal Law of December 6, 2011 No. 402-FZ on the presence in the document of detailed information about the content of the fact of economic life and the value of natural and (or) monetary measurement. The standard UPD does not provide for filling out column 12, but if necessary, it is added based on the specifics of the transaction. Indicators that clarify the conditions for the fulfillment of a fact of economic life are reflected in pages (2a), (2b), (3), (4), (5), (6), (6a), (6b), columns (4), (5), (6), etc. |

| line [10] | Goods (cargo) transferred/ services, results of work, license passed | The instructions tell you how to correctly sign the UPD - indicate the position of the person who made the shipment and (or) the one who is authorized to act on the transaction of transfer of work results (services, property rights) on behalf of the economic entity; his signature indicating his last name and initials. The person authorized to act in a transaction on behalf of an economic entity is determined by the norms of the relevant chapters of the Civil Code of the Russian Federation. An indicator that specifies the circumstances of the operation (transaction). If this person is the one who is authorized to sign invoices and signed the document on behalf of the manager or chief accountant (up to line [8]), then only information about his position and full name is filled in without repeating the signature. |

| Line [13] | Responsible for the correct execution of the transaction, operation | The position of the person responsible for the correct execution of the transaction, operations on the part of the seller, his signature indicating the surname and initials. An indicator that allows you to determine who is responsible for processing the transaction. If the person responsible for processing the transaction is the one who made the shipment and (or) is authorized to act on the transaction on behalf of the economic entity (page [10]), then if there is a signature in line [10], only information about the position is filled in and full name without repeating the signature. If the person responsible for processing the transaction is the person authorized to sign invoices and signed the document on behalf of the manager or chief accountant (up to line [8]), then only information about his position and full name is filled in without repeating the signature. If, due to the document flow established in an economic entity, several persons are simultaneously responsible for the correct execution of the transaction, then an additional line must be entered into the document, for example, [13a] to indicate the position, full name and signature of the second person in charge. |

| Line [15] | Goods (cargo) received/ services, results of work, rights accepted | It is permissible to indicate the position of the person who received the cargo and (or) authorized to accept services, work results, rights under the transaction of transfer of work results (services, property rights), who put mandatory signatures in the UPD on the part of the buyer indicating the surname and initials. The person authorized to act in a transaction on behalf of an economic entity is determined by the norms of the relevant chapters of the Civil Code of the Russian Federation. An indicator that specifies the circumstances of the operation (transaction). |

| Line [18] | Responsible for the correct execution of the transaction, operation | The position of the person responsible for the correct execution of the transaction, operations on the part of the buyer, his signature indicating the surname and initials. An indicator that allows you to determine the person responsible for processing the transaction. If the person responsible for processing the transaction is a person authorized to act on the transaction on behalf of the economic entity (line [15]), then only information about the position and full name is filled in without repeating the signature. If, due to the document flow established in an economic entity, several persons are simultaneously responsible for the correct execution of the transaction, then an additional line must be entered into the document - for example, [18a] to indicate the position, full name and signature of the second responsible person. |

| M.P. | Seals of economic entities who compiled the document. This requirement is not legally required. The absence of a seal in the presence of all the mandatory details provided for in Article 9 of Law No. 402-FZ is not a basis for refusing to accept a document for tax registration. |

A sample form will help us understand how to fill out the form. Let's consider 2 examples: the first - when performing work and providing services.

How to find out?

The Commodity Nomenclature Code for Foreign Economic Activity is traditionally determined by the declarant. It is important to approach this issue with full responsibility, since incorrect independent code generation can lead to unwanted disagreements with customs representatives. To avoid such troubles, proceed as follows:

- Get technical documentation. This can be obtained from the supplier or product manufacturer. At this stage, it is necessary to correctly identify the main properties of the product. By the way, some manufacturers make life easier for those with whom they cooperate and themselves write the product code in the technical documents for it.

- Go to the classifier, it is presented below (section of the classifier of TN VDED codes). Alternatively, you can use the customs website.

- Consistently select sections that most accurately reflect the characteristics of the goods being transported. Move from general qualities to more specific ones. As a result, you should get a ten-digit code.

You can also request determination of the HS code directly from the customs authority. This option requires filing an application, paying a state fee and waiting a long time for a decision, so it is not particularly preferable.

Examples of completed forms

When performing work and providing services

IMPORTANT!

Added line 5a “Shipping Document”.

When shipping goods

The second example of filling out the UPD is when shipping goods. To fill out a universal transfer document instead of a consignment note (TORG12), you need to change the status from “1” to “2” and leave the pages “Consignor and his address” (3) and “Consignee and his address” (4) blank.

IMPORTANT!

Line 5a is not added to such a document.

What it is?

The Commodity Nomenclature of Foreign Economic Activity is an official classifier that contains the information required for declaring goods. The customs code includes ten digits containing characteristics of the product class, its variety, subgroup, etc. The HS codes we now know were developed in parallel with the creation of the EurAsEC Customs Union. Since then, they have been actively used by customs officers and participants in foreign trade activities in customs operations. The HS Classifier is essentially a domestic variation of the Harmonized System, which is widely used in Europe. Thanks to HS codes, customs authorities compile trade statistics. Based on the code, the customs duty for the goods is determined, and a set of permits required for its successful transportation across the border is generated.