Where can I see the amount of contributions?

- Find in the table the type of economic activity for which you had the most income over the past year.

- Using the same table, determine the professional risk class of your business. The higher the class, the higher the fees.

- Look at the law for the contribution rate.

For example, for risk class 1 the minimum contribution rate is 0.2%. This means that from an employee’s salary of 20 thousand rubles you will pay 40 rubles in injury contributions per month.

Risk class 1 includes most businesses: cafes, clothing repair, hairdressers, almost all wholesale and retail trade, software development, consulting, photo services, passenger transportation, couriers, hotels, food delivery, education and other businesses.

Sending an application for confirmation of the main type of activity to the Social Insurance Fund through the State Services portal

To send documents through the State Services website, it is necessary for the organization to have an account . If it doesn't exist yet, then you need:

- register the director on the State Services portal as an individual, confirm registration;

- register the organization directly from under the manager’s account;

- obtain an enhanced digital signature (or use an existing one) at the nearest registration center in order to use it to log into the portal in the future.

Many individuals are already registered on the State Services website, and organizations have an enhanced digital signature. Before submitting confirmation to the FSS, check this so as not to do unnecessary work. Whether you have a strengthened digital signature or not, you can find out from your operator through whom you send your reports. “Tender” signatures are also suitable.

More information about registering on the portal and using site resources can be found in technical support.

It is very easy to send an application for confirmation of the main type of economic activity through the State Services service: there is no need to stand in line at the Social Insurance Fund or at the post office, and the Notification of the amount of insurance premiums will be available on the portal.

Let's look at step-by-step instructions for sending confirmation of your main economic activity to the Social Insurance Fund through the Gosuslugi portal.

Step 1. To get to the site, type gosuslugi.ru in the search bar of your browser

Step 2. Click on the link at the bottom of the Sign in using an electronic signature .

Step 3. Click on the Finish .

Step 4. Click on the field with the name of your Organization.

Step 5. Select the box with the Organization name.

Step 6. Confirmation of main activity in the search bar .

Or use the hint on the main page of the portal.

After selecting “confirmation of the main type of economic activity of the policyholder” in the search line, the screen looks like this:

Step 7. Click on the link Confirmation of the main type of economic activity of the policyholder .

Step 8. The screen will change appearance. Next, click on the Get service .

If a message appears about redirecting to the old version of the site, click “refresh data” in the search bar.

Step 9 . On the Service Registration , select the desired option - Create a new application or Draft application , if it was created earlier and has not been completed. This function is also available on the State Services portal. Click the Continue .

Step 10. Fill in the information in the appropriate fields marked with an asterisk. the name of the territorial body of the FSS of the Russian Federation from the drop-down list. Enter the remaining data in the white fields based on the completed Application.

Click " Next .

Step 11. First download the completed Application form for confirmation of the main type of economic activity from 1C and save it as a PDF.

Add forms using the Upload . If the document is on several sheets, add a new sheet using the Add .

Do the same with the Explanatory Note .

Step 12. After uploading the files, click the Submit Application .

The application has been sent and a number has been assigned to it.

Step 13. You can view the status of the Application in your Personal Account on the Notifications - Application tab.

Step 14. When the application is processed, the status will change to Service provided . Click on the status window and go to your application.

Then click on the link "". A scanned copy of the Notification in PDF format on the Service Delivery Results You can open the document, save the document, and print it.

By clicking the Save , you can open the file with the Notification and save it on your computer in a convenient place. If the notice is on two sheets, then save each sheet.

Sheet 1.

Sheet 2.

Notification about the amount of insurance premiums has been received, we have successfully completed the submission of the Application to the Social Insurance Fund!

In the received Notification check whether the data is correct (Rules for classifying types of economic activities as professional risk approved by Decree of the Government of the Russian Federation of December 1, 2005 N 713, Federal Law of December 31, 2017 N 484-FZ, Federal Law of July 24, 1998 N 125 -FZ):

- main type of economic activity;

- occupational risk class;

- insurance rate.

Here you can view the entire history - from sending the application to the provision of the service. To do this, click on the Review History . This option is useful if some technical problems have occurred, and it is necessary to prove that the Organization sent the documents on time and complied with all procedures.

How to determine the main activity?

This is the one for which you received the most income last year.

For example, Katya has a beauty salon, an online cosmetics store and courses for hairdressers.

Her income for 2022 is 3.6 million rubles excluding expenses. Here's how income is distributed across different businesses:

- income from a beauty salon - 2.5 million rubles

- income from the online store - 800 thousand rubles

- income from courses for hairdressers - 300 thousand rubles.

Katya's main activity is a beauty salon. The share of income from this business is 69.4%.

If several types of business have the same shares of income, the main one will be the one with the higher risk class.

How to receive a notification from the FSS

To receive a notification indicating the amount of insurance payments transferred to the Social Insurance Fund, the organization must contact the specified authority to confirm the type of activity being carried out.

This application must be submitted annually, no later than April 15, providing the following documents:

- an application drawn up in the approved form;

- certificates confirming the type of activity according to a unified sample;

- copies of the explanation of the balance sheet for the past year according to the calendar.

Providing the last of these documents does not apply to small business representatives.

Article on the topic: Insurance premiums for individual entrepreneurs pensioners

Documentation can be submitted on paper or electronic media. The State Services portal or a personal account on the official resource of the fund is available to payers.

After receiving the necessary documentary evidence, the FSS must send a notification of the amount of contributions to be paid to the applicant no later than three days, excluding holidays and weekends.

This document is sent to the recipient electronically. Paper confirmation is available upon separate request. If the procedure for confirming the type of activity is not completed by the payer within the established time frame, the amount of insurance contributions and the tariff are assigned by the FSS, based on the highest class of all types of activities in which the specified company is engaged.

How to confirm the main type of activity?

From January 1 to April 15, send to the FSS at the place of registration of the LLC:

- statement

- confirmation certificate

- a letter about the absence of an explanatory note to the balance sheet is not necessary, but it is better to be safe.

If April 15 falls on a holiday or day off, the deadline is moved back to the next working day.

If you register an LLC in 2022, you will first confirm the type of activity only in 2022. For the entire year 2022, pay contributions for the main type of activity, which is indicated in the Unified State Register of Legal Entities.

Regulatory regulation

The organization's main activity must be confirmed at the end of the year, when the financial statements have already been prepared. That is, in 2022 confirmation must be made for 2022 (Order of the Ministry of Social Development of the Russian Federation dated January 31, 2006 N 55 (hereinafter Order N 55)).

Policyholders need to submit to the Social Insurance Fund:

- application for confirmation of the main type of activity; PDF

- confirmation certificate; PDF

- a copy of the explanatory note to the balance sheet (small enterprises may not submit the note). PDF

- Application for confirmation of the main type of activity in the Social Insurance Fund 2020 Word

- Certificate confirming the main type of economic activity 2020 Excel

- filling out an explanatory note to the balance sheet for the Social Insurance Fund 2022 Word

The forms of the forms remained unchanged.

If the policyholder was registered in 2022, but did not carry out does not have to submit a confirmation certificate to the Social Insurance Fund (clause 6 of Order No. 55).

Organizations registered in 2022 also do not have to . For them, the FSS independently assigns the injury rate according to the type of activity indicated in the Unified State Register of Legal Entities as the main one.

Do policyholders registered at the end of 2022 and who carried out economic activities during this period need to submit confirmation to the Social Insurance Fund?

The issue is controversial and clearly not regulated by law. There is no unity in arbitration practice either. Order No. 55 does not contain separate rules for such insurers. However, its requirements for organizations that are not obliged to submit financial statements by virtue of clause 5 of Art. 15 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting” are difficult to implement: reports are not prepared - there is no explanatory note to them.

At the same time, some arbitrators believe that the concept of “previous year”, which is used by Order No. 55, should be considered as the “reporting year”. For organizations registered in the 4th quarter of the year, it is defined as the period from the date of their state registration to December 31 of the next calendar year. This means that such insurers are not required to submit confirmation to the FSS (FAS Resolution dated 02/09/2010 N F09-187/10-C2).

But there are also directly opposite opinions of judges (Resolution of the FAS VSO dated September 22, 2010 in case No. A10-1360/2010). Therefore, in our opinion, it is not worth the risk and confirmation must be submitted, accompanied by a written explanation about the failure to draw up an explanatory note by virtue of the law.

Thus, the need to confirm the main type of activity in the Social Insurance Fund looks like this:

In 2022, confirmation can be submitted in the following ways:

- personally submit to the FSS (by a manager or authorized representative);

- send documents by mail or courier service;

- submit through the policyholder’s electronic Personal Account (instructions can be downloaded in the “Insured Account” section here, it is on more than 60 sheets);

- use the service Gateway for receiving electronic documents (instructions) - if the 1C: Reporting , confirmation of the main type of economic activity can be sent to the Social Insurance Fund in electronic form using the Send at the top of the screen;

- transmit through the State Services website electronically.

Individual entrepreneurs (with or without employees) can carry out the procedure for confirming the main type of activity at their own request. If the individual entrepreneur has not sent a confirmation certificate to the Social Insurance Fund, then it is considered that his main type of activity is the one indicated when registering in the Unified State Register of Individual Entrepreneurs (clause 10 of the Decree of the Government of the Russian Federation of December 1, 2005 N 713).

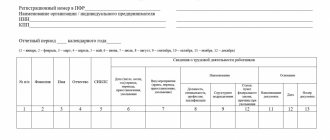

How to fill out a confirmation certificate?

Provide information about the organization: name, tax identification number, address, full name of the director and chief accountant. If the organization does not have a chief accountant, indicate the director instead. Calculate the average number of employees - read the article on how to do this.

Fill the table:

- Your OKVED codes according to the extract from the Unified State Register of Legal Entities.

- Decoding of OKVED codes is in the same wording as in the extract from the Unified State Register of Legal Entities.

- Income for each OKVED code excluding expenses. Important: indicate income in thousands of rubles. For example, write 1 million like this - 1,000 thousand rubles.

- Do not fill out the fourth column if there was no targeted income - for example, grants and subsidies.

- Calculate the share of income for each OKVED as a percentage.

- Do not fill out the sixth column, it is only for non-profit organizations.

In paragraph 10, write the type of economic activity for which the share of income is greater, indicate its OKVED code.

Sample confirmation certificate

Preparation of documents in 1C

Fill out an application to confirm the main type of activity in the Social Insurance Fund using the regulated report Confirmation of the type of activity in the Reports section - Regulated reports - Create button - form Types of reports - report Confirmation of the type of activity - Select button.

Next, select an organization in the Organization , specify Period and click the Create .

In the window that opens, click the Fill .

The data is filled in in 1C automatically. If necessary, they can also be adjusted manually .

First, check the completion of Appendix 2 - Certificate confirming the main type of economic activity in the Social Insurance Fund .

- clause 4 Start date of business... - filled in according to the Unified State Register of Legal Entities extract, line 12.

Tabular part of the document

- OKVED Code column is filled in automatically with data from the Organization , the OKVED field ed. 2 .

If in 2022 the Organization conducted several types of activities, you need to independently calculate the share for each type outside the 1C program and fill out the table manually using the Add line .

The calculation is made using the formula:

The organization carried out 3 types of activities in 2022. Let's calculate the share of income for each OKVED code.

- 2,000 / 37,000 x 100% = 5%

- 10,000 / 37,000 x 100% = 27%

- 25,000 / 37,000 x 100% = 68%

Green cells are filled in automatically based on the data entered in other cells. For example, column 5 Share of income and receipts corresponding to the OKVED code for this type of economic activity…. - this is a percentage of the share of income from column 3 .

Column 3 reflects revenue excluding VAT - data from account 90 Sales (90.01.1 minus 90.03).

See also Revenue excluding VAT to confirm the main activity in the Social Insurance Fund

Appendix 1 - Application for confirmation of the main type of economic activity is filled out automatically according to data from:

- directory of the Organization ;

- Appendix 2 - Certificate confirming the main type of economic activity .

Fill out the number of application sheets manually .

If the policyholder has the right not to submit a copy of the explanatory note to the balance sheet, you must uncheck the box in the print line 2 .

Once the Certificate of Confirmation and Statement of Confirmation of the Main Type of Economic Activity are completed and verified, save them in PDF format (JPG-JPEG/JFIF, GIF, PNG).

To do this, first send the forms for printing using the More – Print button in the upper right corner of the screen.

Then save in PDF format by clicking More - Save - In PDF Document Format (PDF).

That's it, the forms are ready for submission through the State Services website. An explanatory note to the financial statements is drawn up outside of 1C and is also saved for uploading to the portal.

Appendix 3 - Application for separating divisions of the insured into independent classification units within the insured - is filled out only if the separate divisions carry out types of economic activities that are not core to the parent organization.

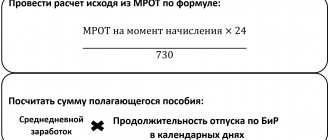

How to determine your insurance premium rate yourself

The payer can independently determine the tariff for insurance premiums. But this does not negate the need to provide the necessary documentation within the time limits established by the administrative act of the Ministry of Labor.

The insurance rate depends on the field of activity, in accordance with the list approved in December 2016 by Order No. 851n of the above department.

To determine the main direction of work for organizations operating in the commercial field, it is necessary to analyze the origin of most of the profits received over the previous year. This area is the main one.

For non-profit organizations, the number of employees engaged in certain functions is taken into account.

Depending on the class (out of 32 provided), which affects the degree of professional risk for the organization’s personnel, the likelihood of an accident and the scale of injury, the rate for contributions to the Social Insurance Fund can range from 0.2 to 8.5 percent.

Examples of filling out the documents required to receive a notification from the Social Insurance Fund can be found on thematic resources on the Internet or you can obtain the required explanations from fund employees.

Title page

Everything is standard here, you need to specify:

- TIN of the entrepreneur;

- code of the tax authority where you purchased the patent. These are the first four digits of the patent number;

- full name entrepreneur;

- calendar year of the patent validity period. That is, if you are reducing the fee for a patent valid in 2022, indicate “2021”;

- the total number of notice sheets and attachments to it, if any;

- data of the representative, if the notification is submitted by the representative of the individual entrepreneur, and not by him personally;

- contact details, signature and date.

Sample of filling out the title page

How much to pay for work-related injuries in 2022

In total, there are 32 insurance tariffs for social insurance against industrial accidents and occupational diseases in Russia. They range from 0.2 to 8.5% of the employee wage fund. To determine which value to apply, the employer must know his occupational risk class, which is assigned to him by the FSS annually after sending a notice of confirmation of the main type of activity (sent annually before April 15 to the territorial body of the FSS).

The employer can determine this class of professional risk independently. To do this, it is enough to use the Classification approved by Order of the Ministry of Labor dated December 30, 2016 No. 851n. It lists the types of activities and the corresponding OKVED codes by type of activity, grouped into 32 occupational risk classes. So you can find your OKVED and already know the base rate. True, when calculating, the FSS uses not only these values, but is also guided by data from a special assessment of working conditions, as well as the presence of employed disabled people.

For the latter, preferential rates are provided. And the standard ones can be seen in the table:

| I | occupational risk class | 0,2 |

| II | —II— | 0,3 |

| III | —II— | 0,4 |

| IV | —II— | 0,5 |

| V | —II— | 0,6 |

| VI | —II— | 0,7 |

| VII | —II— | 0,8 |

| VIII | —II— | 0,9 |

| IX | —II— | 1,0 |

| X | —II— | 1,1 |

| XI | —II— | 1,2 |

| XII | —II— | 1,3 |

| XIII | —II— | 1,4 |

| XIV | —II— | 1,5 |

| XV | —II— | 1,7 |

| XVI | —II— | 1,9 |

| XVII | —II— | 2,1 |

| XVIII | —II— | 2,3 |

| XIX | —II— | 2,5 |

| XX | —II— | 2,8 |

| XXI | —II— | 3,1 |

| XXII | —II— | 3,4 |

| XXIII | —II— | 3,7 |

| XXIV | —II— | 4,1 |

| XXV | —II— | 4,5 |

| XXVI | —II— | 5,0 |

| XXVII | —II— | 5,5 |

| XXVIII | —II— | 6,1 |

| XXIX | —II— | 6,7 |

| XXX | —II— | 7,4 |

| XXXI | —II— | 8,1 |

| XXXII | —II— | 8,5 |

Sheet A

Here you can find information about patents that reduce insurance premiums. There is space on the sheet to fill in data for only two patents. If you have more, fill out additional sheet A.

On line 010, enter the patent number.

Lines 020 and 025 contain the start and end dates of the patent.

In line 030 - the taxpayer’s identification. For employers this is “1”, for individual entrepreneurs without employees - “2”.

In line 040 - the amount of tax on the patent that you are reducing, i.e. the full cost of the patent so far without deductions.

In line 050 - the amount of insurance premiums that you deduct from the cost of the patent.

Let's dwell on this line in more detail, because... there are nuances.

Let us remind you that you can reduce the cost of a patent by contributions of individual entrepreneurs for themselves and their employees, sick leave for the first 3 days of an employee’s illness, voluntary insurance contributions of individual entrepreneurs for employees, 1% contributions on income over 300 thousand rubles. In a letter dated 06/02/2021 N SD-4-3/ [email protected] the Federal Tax Service explained that it is also possible to reduce the cost of a patent by the amount of repaid contributions for past periods. You can also deduct 1% of contributions from income over 300 thousand rubles paid for 2020.

Employees must be engaged only in patent activities. If personnel are engaged in work related to another taxation system, then contributions must be distributed in proportion to the income from each regime.

The amount in line 050 for individual entrepreneurs without employees should be no more than the cost of the patent, and for individual entrepreneurs with employees - no more than 50% of the cost.

If you have already partially reduced the patent for contributions this year, indicate this in the next line 060 , subtract this amount, and in line 050 enter the contributions minus this amount.

Example:

Individual entrepreneur L.V. Yartsev, who has hired workers, took out a patent for the entire year 2022. The cost of the patent was 64,000 rubles. In March 2021, the individual entrepreneur already submitted a notice to deduct insurance premiums from the patent in the amount of 18 thousand rubles, and in just 6 months he paid contributions for himself and his employees in the amount of 54,000 rubles. Because there are workers, the patent can only be reduced by half, i.e. for 32,000 rub. 18,000 rubles, already deducted. In the notification, in line 060 you need to indicate “18,000”, and in line 050 - “14,000” (64,000 / 2 - 18,000).

Sample of filling out sheet A

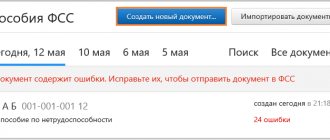

Accounting 3.0. How to receive notifications from the FSS.

Almost everyone knows that sick leave is now accrued by the Social Insurance Fund. The pilot project started quite a long time ago in several territories of the Russian Federation, was considered successful, and now all regions operate according to a single standard. Payroll specialists and accountants are already accustomed to the fact that from time to time they have to solve problems with changing Social Insurance Fund certificates, sending and receiving information for calculating sick leave.

Recently, the Social Insurance Fund, in order to speed up the process of information exchange, including in the case of the transfer of incorrect or incomplete data by the policyholder, has introduced a Social Document Management System (SDMS). At the moment, all modern versions of 1C software products, which include salary functionality, are already able to exchange notifications with the FSS about the submission of missing documents.

In this article we will look at how you can receive notifications from the Social Insurance Fund in the 1C: Accounting 3.0 software product.

If you are already using electronic exchange with the FSS of the Russian Federation in 1C: Accounting, then additional settings are not needed. Otherwise, you must first set up electronic document management with the Social Insurance Fund. You can do this in two ways:

- Connect to 1C-Reporting. We take care of the entire procedure for preparing documents and connecting.

- If you do not plan to do this, then you need to manually make settings for exchange with the FSS for ELN. We'll talk about this next time.

After connecting, you will be able to download data on electronic certificates of incapacity for work (ELS), send ELN registers and applications for payment of benefits. In addition, the FSS Notifications workplace will become available in the program (section Salaries and Personnel - FSS Notifications).

Let's take a closer look at the operating principle:

- In the Organization , you must indicate the organization for which notifications are received (if multi-company accounting is maintained in the database).

- To hide notifications that have already been processed, you need to check the Notifications in progress (they are marked in the list with a green flag).

- To receive notifications, use the Receive from FSS .

Picture 1.

4. Click the Open FSS notice (in the header of the workplace) or from the FSS Notice , opens the notice sent by the FSS. The specialist needs to familiarize himself with it, understand what the FSS requires. You can then confirm receipt of the notification. The employer must confirm receipt of the notice electronically within one business day from the date of receipt of such notice. If confirmation does not occur, the fund within 3 working days from the date of expiration. Within 5 working days after sending the confirmation, you must send the register with the missing information. The FSS Notification workplace indicates that the confirmation has been sent, as well as how many days are left to provide information that requires clarification (Fig. 1).

It is necessary to take into account that if you do not send a confirmation of reading, the FSS may disconnect you from the EDMS. Therefore, you need to send confirmation on time!

Figure 2.

5. In the document Notification of the FSS :

in the Type , No. , from: field the type of notice and details of the incoming document are reflected; in the section Previously sent information that requires clarification, documents that require clarification are indicated; after the missing information is prepared in the program and the new register is sent to the FSS, in the section Information prepared based on the notification, the sent information is automatically displayed and the Notification processed, information sent to the FSS . If you do not need to fill in such information automatically, uncheck the Detect automatically (Fig. 3).

Figure 3.

A notification has been added about the presence of FSS notices that have not been received by the organization in the FSS EDMS. This will help you not to miss requests from the Social Insurance Fund to clarify documents for direct benefit payments (Fig. 4).

General information on EDMS with the FSS and its connection

The EDMS mechanism was announced by the developers at a partner seminar in March 2022 - FSS EDMS for working with electronic sick leave

The FSS EDMS is an electronic document management service of the FSS, which can be used to exchange data on sick leave between a medical organization, the FSS and the employer. In this case:

- A sick leave certificate appears in the EISS SOTSSTRAKH system as soon as it is opened by a medical organization

- As soon as the sick leave is closed by a medical organization, it can be received for payment to the employer

- After the employer has collected all the necessary documents for calculating and paying sick leave and determined the average earnings, this data can be transferred to the Social Insurance Fund

Transfer of sick leave can be done through the FSS EDMS.

The EDMS mechanism is connected in the organization's card on the EDI the Social Document Flow Settings link by checking the Receive messages about changes in ETN states .

If electronic exchange from 1C with FSS is already used, then it turns out that all the necessary certificates have already been installed and no additional certificates will be needed.

In ZUP 3 in EDMS with FSS, the possibility of obtaining:

- FSS messages about changes in ENL

- Notifications about the submission of missing documents to the Social Insurance Fund (starting with ZUP 3.1.14.265 / 3.1.15.96)

In terms of using the functionality regarding changes to the ENL, you will need to request an “Agreement with the regional branch of the FSS” (the text is published on the FSS page). There are restrictions on entering into an agreement. It can be concluded by policyholders who have at least 2,000 employees.

Only after the Agreement has been concluded and Consent has been received for notifications about the employee’s personal information (more on this below) will notifications about the employee’s personal information be received. Working with ELN alerts is currently available in pilot mode .

In terms of using the functionality of Notices, there is no need to enter into an Agreement. Documents begin to arrive automatically when they are sent to the FSS registration number.

After connecting the ability to work with EDMS, three jobs will appear Personnel

- FSS messages about changes in ENL - information about what ENL there are for an organization and how their status changes

- Notifications to the FSS - information on Notifications about the submission of missing documents to the FSS (starting with ZUP 3.1.14.265 / 3.1.15.96)

- Consent to notifications about ELN - to collect the consent / refusal of employees to receive / stop receiving information about ELN from the Social Insurance Fund system and sending this information on employees to the Fund

Current Affairs panel on the Home page receives notifications:

- that a new employee has been hired, so his consent / refusal to exchange with the Social Insurance Fund should be obtained;

- about a dismissed employee, that it is necessary to close his consent to exchange data with the Social Insurance Fund;

- that the ENL has changed its status and needs to be downloaded.

This panel is customizable, for which in the main menu you should select Settings - Setting up the home page.

And, for example, in the right column of the initial page, configure the display of the Current Affairs .

Which current cases will be displayed is configured by calling the Configure and checking the boxes for the cases required for display.

To use the FSS EDMS service in relation to an employee, the employee’s consent will be required, since information about the health status of an individual is a special category of personal data in accordance with Law 152-FZ (i.e., the employee’s consent to the processing of personal data, which is taken upon hiring the employee, is not sufficient, separate consent is required).

The Consent to ELN notifications workplace (HR – Consent to ELN notifications) allows you to:

- Get a printed consent form

- Consider the consent signing status

- Enable/disable subscription to changing employee's electronic personal identification status

Information about the need to enable/disable subscription to changes in employees' E-LN states is also displayed on the Current Affairs .