About legal entities

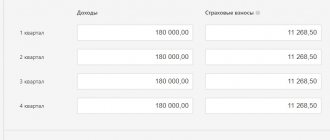

How is the amount of the quarterly advance payment calculated? The amount of the quarterly advance payment is calculated based on the actual

From January 1, 2022, you will pay VAT at a rate of 20 percent (Federal

General rules for filling out 6-NDFL in 2021 General rules for filling out the new 6-NDFL form in

When the initiative for dismissal does not come from the employee, any reason will be unpleasant to him. However, among

Base for calculating insurance premiums 2022 The maximum base until 2015 was the same for

Home / Bankruptcy / Bankruptcy of legal entities Back Published: 08/07/2019 Reading time: 5

Organizations working with VAT are most often faced with the need to create corrections in the invoice. Problem

Vacation payments and compensation - all about how to calculate the real amount. Calculation examples

The beauty salon offers haircuts and coloring, manicures and pedicures, massages and a variety of services.

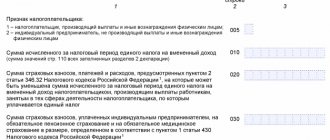

Which form to fill out The current UTII declaration form for filling out is approved by Appendix No. 1