Bookmarked: 0

What are production costs? Description and definition of the concept.

Production costs are the amount of costs an enterprise incurs in the direct production of services and goods.

Production costs include direct costs that are associated with the production of services and products, indirect costs (for security and management), auxiliary costs and losses from product defects. Production costs are grouped into three blocks.

The first is based on the place of their appearance (workshop, division). Such costs are recorded in reports on economic activities. The second block is costs based on the cost of product types. And the third - by calculation items and cost elements.

Let's take a closer look at what production costs mean.

Manufacturing costs are the direct costs of materials, labor, and various manufacturing overheads.

Non-productive (periodic or reporting time expenses) are commercial and administrative expenses.

Direct and indirect costs

Direct costs are direct material costs and labor costs. They are accounted for by debit and are attributed directly to a specific product.

Description of direct material costs:

Each industrial product consists of certain materials. Basic materials are those materials that become part of the finished product, and their cost can be directly and economically attributed to a specific product without much expense.

In some cases, it is not economically feasible to take into account the material consumption for each type of product produced. For example: nails in furniture or rivets in airplanes. Such materials are classified as auxiliary, and the costs for them are classified as indirect general production costs, which are usually taken into account as a whole for the reporting time period, and then distributed using special methods between certain types of marketable products.

Direct labor costs include all labor costs that can be directly and economically attributed to a particular type of finished product. Labor costs for a job that cannot be directly and economically attributed to a specific type of finished product are called indirect labor costs. These expenses include remuneration of such specialists as mechanics, supervisors and other support personnel. Like the costs of auxiliary materials, indirect labor costs are usually classified as indirect general production costs.

The size of direct costs per unit of production is independent of the volume of production, and it can be reduced by increasing production efficiency, labor productivity, and introducing new resource- and energy-saving technologies.

Indirect costs are a set of costs that are associated with production and which are not usually attributed to specific types of products. These are also called overhead costs.

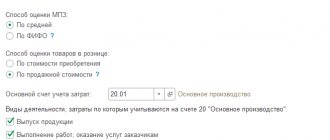

Indirect costs are distributed among individual goods in accordance with the methodology chosen by the enterprise (in proportion to the basic wages of production workers, hours worked, etc.). This methodology is indicated in the production accounting policy.

Types of indirect costs:

production – these are general shop expenses associated with the organization, maintenance and management of production;

non-production costs are used for production management purposes. They are not directly related to the production activities of the organization and are recorded on the balance sheet account.

The peculiarity of general business expenses is that within the scale base they remain unchanged. They change with the help of management decisions, and the degree of their coverage is changed by sales volume.

General production and general business expenses

All production costs are divided into general production and general business expenses; they are recorded in 25 and 26 accounts, respectively. General production expenses include costs associated with the maintenance and management of production, including the costs of main production, auxiliary and servicing.

General production expenses include:

- Salaries of workers who work in production (foremen, technologists, workers, etc.);

- Depreciation deductions;

- Necessary repairs of production equipment;

- Payment for raw materials and supplies used in production;

- Rent for production premises and other rental payments for equipment and machinery;

- Other expenses associated with the operation of fixed assets, such as: costs of fuel, electricity and others;

- Shortages, losses and damage to production property, etc.

Account 25 is active, therefore all savings are debited in correspondence with interacting accounts, such as 70 - when calculating salaries, 10 - when writing off materials from the warehouse, 02 - when calculating depreciation, 69 - when calculating contributions to extra-budgetary funds from salaries and etc.

At the very end of each month, all expenses accumulated on account 25 are written off to the debit of accounts 20 “Main production”, 23 “Auxiliary production”, 29 “Service production and facilities” in the manner established independently by the company and recorded in the accounting policy.

When we talk about general business expenses, they are not related to production; such expenses include the costs of managing enterprises, including salaries of office workers, depreciation and repair of business property, office rent, consulting, legal and other services, related to management. These expenses are accumulated in the debit of account 26 in interaction with accounts reflecting expenses - this is account 02 when calculating depreciation, 10 when writing off materials, 70 when calculating wages.

General business expenses are written off in one of two ways:

1. When using reduced cost at the end of the month from account 26 to subaccount 90.2 “Cost of sales”.

2. When using the full cost price, expenses from account 26 are written off to accounts 20, 23 or 29. The procedure for distributing expenses is fixed in the accounting policy; they can be distributed in proportion to the costs of these productions.

Accounts 25 and 26 are completely closed at the end of the month; they have no balance.

Companies that provide intermediary services (agents, brokers, commission agents) keep all expenses on account 26; no accounting is kept on account 20.

Basic and overhead costs

Basic costs include all types of resources (raw materials, basic materials, purchased semi-finished products, depreciation of equipment, etc.), the consumption of which is associated with the production of goods. In every production, basic costs constitute the most important part of costs.

Overhead costs are caused by management functions, which are different in nature, purpose and role from production functions. These expenses, as a rule, are associated with the organization of the enterprise’s activities and its management. Under the carrier cost allocation method, overhead costs are indirect.

Product costing

The cost price at each enterprise is calculated in accordance with certain principles, the main one being the validity of attributing cost items to the cost price.

Important!

The cost must include all expenses - both those that directly affect its size and those that have an indirect effect.

To form the cost of production of the main production, accounting account 20 “Main production” is used, which accumulates all types of expenses of the production process.

Table 3

Analysis of account 20 “Main production” per unit of production

| Check | Cor. check | Credit | Debit |

| Beginning balance | 0,00 | ||

| Materials | Beginning balance | 0,00 | |

| 10 | 5001,80 | ||

| Turnover | 5001,80 | ||

| Con. balance | 5001,80 | ||

| Salary | Beginning balance | 0,00 | |

| 70 | 8195,49 | ||

| Turnover | 8195,49 | ||

| Con. balance | 8195,49 | ||

| Insurance premiums | Beginning balance | 0,00 | |

| 69 | 2458,65 | ||

| Turnover | 2458,65 | ||

| Con. balance | 2458,65 | ||

| General production expenses | Beginning balance | 0,00 | |

| 25 | 1298,03 | ||

| Turnover | 1298,03 | ||

| Con. balance | 1298,03 | ||

| General running costs | Beginning balance | 0,00 | |

| 26 | 2410,63 | ||

| Turnover | 2410,63 | ||

| Con. balance | 2410,63 | ||

| Total | Turnover | 19 364,60 | |

| Con. balance | 19 364,60 | ||

Expenses for raw materials and materials (account 10 “Materials”)

To control the consumption of materials, enterprises approve consumption standards, which indicate the maximum permissible amount of materials required to produce a unit of product (similar to Table 1).

Details on the consumption of materials can be found in the analytics of account 10 “Materials” (for example, see Table 4).

Table 4

Account card 10 “Materials”

| Period | Document | Analytics Dt | Analytics CT | Debit | Credit | ||

| Check | Sum | Check | Sum | ||||

| 17.01.2017 | Request-invoice 00001-000001 from 01/17/2017 12:20:00 Write-off of materials for production | Basic material costs | Beam 40×60 mm | 20 | 10 | 200 | |

| 18.01.2017 | Request-invoice 00001-000002 from 01/18/2017 17:14:00 Write-off of materials for production | Basic material costs | Edged board 400×480 mm | 20 | 10 | 200 | |

| 18.01.2017 | Request-invoice 00001-000002 from 01/18/2017 17:14:00 Write-off of materials for production | Basic material costs | Edged board 100×420 mm | 20 | 10 | 200 | |

| 18.01.2017 | Request-invoice 00001-000002 from 01/18/2017 17:14:00 Write-off of materials for production | Basic material costs | Furniture foam rubber | 20 | 10 | 1750 | |

| 18.01.2017 | Request-invoice 00001-000002 from 01/18/2017 17:14:00 Write-off of materials for production | Basic material costs | Textile | 20 | 10 | 1770 | |

| 18.01.2017 | Request-invoice 00001-000002 from 01/18/2017 17:14:00 Write-off of materials for production | Basic material costs | Self-tapping screws | 20 | 10 | 150 | |

| 18.01.2017 | Request-invoice 00001-000002 from 01/18/2017 17:14:00 Write-off of materials for production | Basic material costs | Glue | 20 | 10 | 174 | |

| 18.01.2017 | Request-invoice 00001-000002 from 01/18/2017 17:14:00 Write-off of materials for production | Basic material costs | Varnish | 20 | 10 | 70 | |

| 18.01.2017 | Request-invoice 00001-000002 from 01/18/2017 17:14:00 Write-off of materials for production | Basic material costs | Dye | 20 | 10 | 408 | |

| 18.01.2017 | Request-invoice 00001-000002 from 01/18/2017 17:14:00 Write-off of materials for production | Basic material costs | Sandpaper | 20 | 10 | 79,8 | |

| Turnover for the period and balance at the end | 0 | 5001,8 | |||||

Labor costs for key production workers

This cost item includes basic and additional wages only for production workers who are directly involved in production, manufacturing products or providing services.

The basic salary is the cost of remuneration accrued for the performance of work to specific categories of workers directly involved in the production process or provision of services, accruals of an incentive nature and remuneration for labor in conditions deviating from normal in accordance with the labor legislation of the Russian Federation.

Additional wages are accruals established by the enterprise’s collective agreement and/or other local regulations in accordance with the labor legislation of the Russian Federation.

Forms of remuneration are established individually at each enterprise for various categories of workers and are enshrined in a collective agreement, regulations on remuneration or other local regulations.

Remuneration can be:

- time-based. Depends on the actual time worked (recorded in the time sheet) and the employee’s tariff rate or proper salary. Tariff rates and official salaries of employees, depending on the position held, are approved by the head of the enterprise in the staffing table;

- piecework. Depends on the quantity of products produced (work performed or service provided) according to the piece rates approved within the enterprise per unit of product (work, service) produced.

For the main production workers of Alpha LLC, a piece-rate wage system has been established. A detailed breakdown of the cost item for wages in account 70 “Settlements with personnel for wages” is presented in table. 5.

Table 5

Explanation of the cost item “Payment of key production workers”

| Type of work | Type of work | Labor intensity and wages | ||

| Labor intensity, person-hours | Cost of one hour, rub., kopecks. | Remuneration, rub., kopecks. | ||

| Wood slicing | 4 | 6,00 | 210,40 | 1262,40 |

| 5 | 7,00 | 217,76 | 1524,32 | |

| Milling, cleaning, grinding | 5 | 6,00 | 217,76 | 1306,56 |

| 6 | 6,00 | 236,99 | 1421,94 | |

| Assembly | 5 | 5,00 | 217,76 | 1088,80 |

| Painting | 3 | 3,00 | 202,61 | 607,83 |

| 4 | 4,00 | 210,40 | 841,60 | |

| Package | 4 | 0,675 | 210,40 | 142,04 |

| Total | X | 37,68 | X | 8195,49 |

Insurance premiums

Organizations are required to pay contributions:

- to the Pension Fund of the Russian Federation (22% of the wage fund);

- for compulsory pension insurance to the Social Insurance Fund of the Russian Federation (2.9% of the wage fund);

- to the Federal Compulsory Medical Insurance Fund (5.1% of the wage fund).

Let's calculate the amount of insurance premiums of Alpha LLC:

8195.49 × 22% + 8195.49 × 2.9% + 8195.49 × 5.1% = 2458.65 rubles.

Insurance premiums are displayed in account 69 “Calculations for social insurance and security” (see Table 3).

General production expenses

General production expenses (OPC) include costs for maintenance and production management, including costs for:

- depreciation of buildings, structures, production equipment, vehicles, repairs of buildings and structures for industrial purposes, maintenance and operation of property;

- wages of the workshop management staff and insurance premiums from it;

- maintenance of vehicles engaged in the movement of goods;

- rental payments for fixed assets for workshop purposes, etc.

In accordance with the accounting policy of Alpha LLC (local regulations governing the specifics of accounting), general production expenses are distributed between individual products (services, works) in proportion to the wages of the main production employees.

These costs are reflected in account 25 “General production expenses” (Table 6).

Table 6

Analysis of account 25 “General production expenses”

| Expenditures | Cor. check | Credit | Debit |

| Depreciation of fixed assets | Opening balance | ||

| 02 | 110 967,63 | ||

| Turnover | 110 967,63 | ||

| Closing balance | |||

| Property rental | Opening balance | ||

| 60 | 47 000,00 | ||

| Turnover | 47 000,00 | ||

| Closing balance | |||

| Salary | Opening balance | ||

| 70 | 708 457,61 | ||

| Turnover | 708 457,61 | ||

| Closing balance | |||

| Occupational safety and health | Opening balance | ||

| 10 | 14 943,91 | ||

| 60 | 1694,92 | ||

| Turnover | 16 638,83 | ||

| Closing balance | |||

| Maintenance and operation of transport | Opening balance | ||

| 10 | 4380,87 | ||

| 60 | 31 485,05 | ||

| Turnover | 35 865,92 | ||

| Closing balance | |||

| Maintenance and operation of buildings, premises, territory | Opening balance | ||

| 10 | 624,26 | ||

| Turnover | 624,26 | ||

| Closing balance | |||

| Insurance premiums | Opening balance | ||

| 69 | 212 537,28 | ||

| Turnover | 212 537,28 | ||

| Closing balance | |||

| Fare | Opening balance | ||

| 60 | 45 250,00 | ||

| Turnover | 45 250,00 | ||

| Closing balance | |||

| Turnover | 1 177 341,53 | ||

The amount of general production expenses (in our example - 1,177,341.53 rubles) is distributed among all works (goods, services) of the analyzed period and goes to the debit of account 20 “Main production” (Table 3). In this case, after distribution, the cost of producing one wooden chair is 1298.03 rubles.

General running costs

This cost item includes costs for production management and maintenance, namely:

- labor costs of the administrative and managerial staff (accounting, economists, lawyers, managers, marketers, engineers, etc.) and insurance premiums from it;

- travel expenses;

- postage;

- expenses for purchasing office supplies;

- information and consulting costs;

- telephony services, Internet providers;

- rental of premises not related to direct production, etc.

Like general production, general business expenses, according to the accounting policy of Alpha LLC, are distributed in proportion to the wage fund of the main production workers.

To display this category of expenses, account 26 “General business expenses” is used (Table 7).

Table 7

Analysis of account 26 “General expenses” for the month

| Expenditures | Cor. check | Credit | Debit |

| Property rental | Opening balance | ||

| 60 | 87 000,00 | ||

| Turnover | 87 000,00 | ||

| Closing balance | |||

| Depreciation | Opening balance | ||

| 02 | 52 000,00 | ||

| Turnover | 52 000,00 | ||

| Closing balance | |||

| Internet | Opening balance | ||

| 60 | 7770,44 | ||

| Turnover | 7770,44 | ||

| Closing balance | |||

| Office expenses | Opening balance | ||

| 10 | 14 831,36 | ||

| Turnover | 14 831,36 | ||

| Closing balance | |||

| Travel expenses | Opening balance | ||

| 60 | 23 668,90 | ||

| 71 | 46 931,00 | ||

| Turnover | 70 599,90 | ||

| Closing balance | |||

| Salary | Opening balance | ||

| 70 | 1 494 957,37 | ||

| Turnover | 1 494 957,37 | ||

| Closing balance | |||

| cellular | Opening balance | ||

| 60 | 10 860,00 | ||

| Turnover | 10 860,00 | ||

| Closing balance | |||

| Insurance premiums | Opening balance | ||

| 69 | 448 487,21 | ||

| Turnover | 448 487,21 | ||

| Closing balance | |||

| Turnover | 2 186 506,28 | ||

Then all general business expenses (RUB 2,186,506.28) are distributed among all work (goods, services) of the analyzed period and are debited to account 20 “Main production” (see Table 3). In this case, after distribution, the cost of producing one wooden chair is 2,410.63 rubles.

As a result, after distribution, we should receive the same percentage of distribution of costs per unit of production:

- general business: 2410.63 / 2,186,506.28 = 0.11%;

- general production 1298.03 / 1,177,341.53 = 0.11%.

What other expenses should be included in the cost?

The considered list of cost items included in the cost of production is not final and complete. Each type of activity has its own specific expenditure items. Let's look at some of them:

- costs of mastering production: costs of ensuring the readiness of workshops and units for the production of a new type of product, design of a new product, development of a technological process, design of tooling, equipping with new equipment, information and consulting services, redevelopment of workshops, etc.;

- costs of special technological equipment - for the manufacture, acquisition, repair and maintenance in working condition of technological equipment for a specific purpose, directly related to the production of specific products;

- costs for services of third-party organizations (displayed in account 60 “Settlements with suppliers and contractors”) arise if the enterprise resorts to the help of third-party organizations (there is no opportunity to perform the work independently, there are no specialists or there are not enough of them, urgent work, low qualifications of workers, loaded equipment, etc.);

- travel expenses of key production employees. Travel expenses of the main workers, if they have a large share in the cost price, can be taken out of overhead costs into a separate item, for example, if work is performed not in a stationary workshop, but on the road. In accounting, this category of expenses is displayed in account 60 “Settlements with suppliers and contractors” (when purchasing travel tickets or paying for a hotel through an intermediary organization and paying by bank transfer) and account 71 “Settlements with accountable persons” (generated according to advance reports for daily allowance, accommodation and travel in case of cash payment by the posted employee);

- other production costs - for experimental work, standardization, for payment for environmental pollution within the established standards, etc. They are distributed among the cost of all types of products produced at the enterprise in proportion to the sum of all previous cost items;

- depreciation expenses. From the composition of indirect expenses, depreciation on fixed assets directly used in the main production can also be distinguished and classified as direct expenses. In accounting it is accounted for in account 02 “Depreciation of fixed assets”;

- losses from defects (defects - products or semi-finished products that do not meet quality or technical specifications and cannot subsequently be sold or can be sold only after correction). In accounting they are displayed under account 28 “Defects in production”;

- fare. The costs of delivering finished products can also be allocated as a separate independent cost item;

- costs associated with improving technology and production organization carried out during the production process, improving product quality, increasing its reliability, durability and other operational properties;

- costs for improving working conditions and safety precautions, improving the qualifications of production workers.

All considered categories of costs, whether basic, directly related to the production of products, or overhead, indirectly related to production, form the production cost, i.e., current costs in monetary terms, due to the use of natural, labor, material and financial resources for the production of products (works, services), calculated as the sum of all considered cost items.

But there are also non-production (commercial) expenses - a category of expenses that are associated with the shipment, storage and sale of products, as well as expenses for advertising, marketing research, etc.

The sum of production costs and non-production expenses is the total cost of production.

Variable, fixed, semi-fixed costs

Variable costs increase or decrease in proportion to the volume of commodity production, in other words, they depend on the business activity of the company. Both production and non-production costs can be variable. Examples of manufacturing variable costs are direct material costs, direct labor costs, auxiliary materials costs, and purchased intermediates.

Variable costs characterize the cost of the product itself, all others (fixed costs) characterize the cost of production itself. The market is not interested in the cost of production, it is interested in the cost of the product itself.

Total variable costs have a linear dependence on the indicator of business activity of production, and variable costs per unit of production are a constant value.

Non-production variable costs include the cost of packaging manufactured products for shipment to the consumer, costs associated with transport that are not reimbursed by the buyer, and commission to the intermediary for the sale of products, which directly depends on the total sales volume.

Production costs, which ultimately remain unchanged during the reporting period, are not dependent on the business activity of production and are called “fixed production costs”. Even if production (sales) volumes change, they do not change. Fixed production costs include expenses associated with the rental of production space and depreciation of fixed production assets.

Total fixed costs are a constant value and do not depend on the volume of business activity, however, they may change under the influence of other reasons. For example, if prices rise, then total fixed costs also rise.

A type of variable costs are proportional costs. They are growing at the same rate as business activity in manufacturing.

Another type of variable costs are digressive costs. Their growth rate is less than the growth rate of the company's business activity.

In reality, it is practically impossible to encounter costs that, in their essence, will be exclusively constant or variable. Economic factors and associated costs are much more complex from a maintenance point of view, and therefore, in most cases, costs are semi-variable or semi-fixed. In this case, fluctuations in the business activity of the enterprise are also accompanied by changes in costs, while, unlike variable costs, the relationship is not direct. Conditionally variable or conditionally fixed costs include both variable and fixed elements. As an example, we can cite payment for using a telephone, which consists of a fixed subscription fee, which is a constant part, and payment for long-distance calls, which in this case will be a variable component.

Composition of production costs

In accounting and economics, it is customary to divide all expenses into homogeneous groups or so-called nomenclature. It can be found in clause 8 of PBU 10/99. A manufacturing company usually always has:

- labor costs;

- costs of materials for production;

- depreciation of fixed assets;

- expenses for administrative and economic management (AHU);

- contributions to funds;

- taxes;

- others.

But these groups are also divided according to articles. After all, if, for example, we are talking about production costs, then wages must be divided into the earnings of workers directly involved in the manufacture of products and the earnings of other personnel. Payments for electricity, water, utilities and even depreciation charges are also divided. This is due to the fact that one organization can involve several areas of economic activity, and production can be:

- main;

- auxiliary;

- additional.

Accordingly, for each of them it is necessary to calculate costs separately. In addition, costs can be direct and overhead. Typically, direct costs are calculated in relation to production volume, and overheads are taken as a percentage. Subaccounts and analytical statements help accountants with this. There are two global goals:

- Calculate all expenses incurred for tax purposes.

- Accurately determine the cost of production.

More deeply, production costs can be divided into sectors of their occurrence: workshops, departments, sections of a factory, plant or company as a whole. In addition, they can be current, for example, like depreciation, wages, etc., and one-time, for example, the purchase of necessary raw materials or additional equipment.

Costs taken into account and not taken into account in estimates

In the process of making a management decision, it is assumed that several alternative options are compared with each other with a specific goal - choosing the best one.

option. The indicators compared in this way can be divided into two categories: the first remain unchanged under all alternative options, the second fluctuate depending on a particular decision. When considering a large number of alternatives that differ from each other in many respects, the decision-making process becomes significantly more difficult. This means that it is advisable to compare not all indicators in full, but only the indicators of the second group, and these are precisely those that vary from option to option. These costs, which distinguish one alternative from another, are usually called relevant costs in management accounting. They are taken into account when making certain decisions. Indicators of the first group, on the contrary, are not taken into account when searching for options.

The accountant-analyst provides management with initial information for choosing the optimal solution, preparing his reports in such a way that they contain only relevant information.

Fixed and variable costs

Over the short term, one part of the resources will remain unchanged, while the other will be adjusted in order to reduce or increase total output. Short-term expenses can be constant or variable. Fixed costs are those expenses that are not affected by the volume of goods produced by the enterprise. These are the costs of fixed production factors. They include the following costs:

- Payment of interest accrued as part of lending at a banking institution.

- Depreciation charges.

- Interest payment on bonds.

- Salary of the head of the enterprise.

- Payment for rent of premises and equipment.

- Insurance charges.

Variable costs are expenses that depend on the volume of goods produced. They are considered the costs of variable factors. Includes the following costs:

- Salary to employees.

- Transportation costs.

- Expenses on electricity necessary to ensure the functioning of the enterprise.

- Costs of raw materials and materials.

It is recommended to monitor the dynamics of variable costs, as they reflect the efficiency of the enterprise. For example, as the optimal scale of a company’s operations increases, transportation costs increase. More carriers need to be hired for the increased volume of products. Raw materials must be promptly transported to headquarters. All this increases transport costs, which immediately affects variable costs.

Opportunity costs

This category is present only in management accounting. The financial accountant cannot afford to “imagine” any costs, since he strictly follows the principle of their documentary validity.

In management accounting, in order to make a decision, it is sometimes necessary to accrue or attribute costs that may not actually occur in the future. Such costs are called imputed. Essentially, this is lost profit for the enterprise. It is an opportunity that is lost or sacrificed in favor of an alternative management decision.

Incremental and marginal costs

Incremental costs are additional and arise as a result of manufacturing or selling an additional batch of products. Incremental costs may or may not include fixed costs. If fixed costs change as a result of a decision, then their increase is considered as incremental costs. If fixed costs do not change as a result of the decision, then incremental costs will be zero. A similar approach is applied in management accounting to income.

Marginal costs and revenues represent additional costs and revenues per unit of output (good).

Regulated and non-regulated costs

Regulated expenses depend on the influence of the responsibility center manager. However, it cannot influence non-regulated expenses. A manager's performance is assessed by his ability to manage regulated costs.

For example, a manufacturing department overused material. Are these costs regulated by the shop manager? The answer is unclear. In the case where overexpenditure is associated with a violation of labor or technological discipline in the department, then these costs are controllable. When the reason is the low quality of the purchased materials, then these unproductive expenses are considered as not regulated by the head of the production department, and the head of the supply department will be responsible for this.

We briefly examined what production costs are, their types and their impact on the state of production. Leave your comments or additions to the material.