Base for calculating insurance premiums 2022

Until 2015, the maximum base was the same for all insurance premiums. Each year, the maximum amount of payments and remunerations was indexed, which made it possible to set the maximum value of the base for calculating insurance premiums in accordance with the current economic situation. The insurance premium base changed in 2011–2022 as follows:

| Year | Pension Fund | FSS | FMS |

| 2011 | 463 000 | 463 000 | not lips |

| 2012 | 512 000 | 512 000 | not lips |

| 2013 | 568 000 | 568 000 | not lips |

| 2014 | 624 000 | 624 000 | not lips |

| 2015 | 711 000 | 670 000 | not lips |

| 2016 | 796 000 | 718 000 | not lips |

| 2017 | 876 000 | 755 000 | not lips |

| 2018 | 1 021 000 | 815 000 | not lips |

| 2019 | 1 150 000 | 865 000 | not lips |

| 2020 | 1 292 000 | 912 000 | not lips |

| 2021 | 1 465 000 | 966 000 | not lips |

| 2022 | 1 565 000 | 1 032 000 | not lips |

| Rates | 22% (over the 10% limit) | 2.9% (above the limit - no contributions are paid) | 5,1% |

Changes in legislation in 2022. Personal income tax and insurance premiums

Reporting to the Federal Tax Service

From 01/01/2017, the administration of insurance premiums (except for insurance premiums for industrial accidents and occupational diseases) was transferred to the Federal Tax Service.

Chapter 34 “Insurance contributions” has been introduced into the Tax Code of the Russian Federation. Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/ [email protected] approved the form of “Calculation of insurance premiums”, submitted to the Federal Tax Service no later than the 30th day of the month following the reporting (settlement) period.

Starting from the first quarter of 2022, the “Calculation of Insurance Premiums” is submitted to the Federal Tax Service within the following deadlines:

- for the first quarter - no later than May 2, 2022;

- for half a year - no later than July 31, 2022;

- for nine months - no later than October 30, 2022;

- for 2016 - no later than January 30, 2022.

If the average number of employees for the previous reporting/accounting period is more than 25 people, the “Calculation of insurance premiums” is submitted to the Federal Tax Service exclusively in electronic form; if the average number of employees is 25 people or less, the “Calculation” can be submitted on paper (clause 10 of Article 431 of the Tax Code RF).

The fine for violating the method of presenting the “Calculation” is 200 rubles. (Article 119.1 of the Tax Code of the Russian Federation).

Payment of insurance premiums

From 01/01/2017, payment of insurance premiums is made:

- to the Federal Tax Service at the location of the organization - insurance contributions for compulsory pension, medical and social insurance;

- to the FSS department - insurance premiums against industrial accidents and occupational diseases.

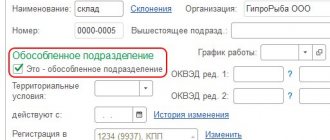

Separate divisions pay insurance premiums to the Federal Tax Service at their location if they are vested with the authority to accrue payments and other remuneration in favor of individuals (clause 11 of Article 431 of the Tax Code of the Russian Federation). The organization is obliged to inform the tax authority at its location about the vesting of a separate division established on the territory of the Russian Federation with powers (about deprivation of powers) to accrue payments and remunerations in favor of individuals (subclause 7, clause 3.4, article 23 of the Tax Code of the Russian Federation). The period for notifying the tax authority is within a month from the date of the decision to vest the separate division with the specified powers, or to deprive them of such powers. The fine for failure to provide notice is 200 rubles. for an organization (clause 1 of Article 126 of the Tax Code of the Russian Federation) and from 300 to 500 rubles. for the manager (Article 15.6 of the Code of Administrative Offenses of the Russian Federation). The deadline for paying insurance premiums has not changed - until the 15th day of the month following the billing month.

Payment of insurance premiums is made in rubles and kopecks.

From 01/01/2017, new BCCs* were approved for payment of insurance premiums to the Federal Tax Service.

For payment of insurance premiums against accidents and occupational diseases to the Social Insurance Fund, the former KBK is 39310202050071000160.

For periods after December 31, 2016:

- 18210202010061010160 – compulsory pension insurance (PFR);

- 18210202101081013160 – compulsory health insurance (FFOMS);

- 18210202090071010160 - compulsory social insurance (FSS).

For periods before 01/01/2017:

- 18210202010061000160 – compulsory pension insurance (PFR);

- 18210202101081011160 – compulsory health insurance (FFOMS);

- 18210202090071000160 - compulsory social insurance (FSS).

Reporting to the Social Insurance Fund and the Pension Fund of Russia

The new form 4-FSS (approved by Order of the FSS dated September 26, 2016 No. 381) is filled out only in relation to industrial accidents and occupational diseases:

- on accrued and paid insurance premiums;

- on expenses for payment of insurance coverage.

Also in 4-FSS the following sections are filled out:

- about insurers sending their employees temporarily under an agreement on the provision of labor for workers (personnel) to work for another legal entity or individual entrepreneur;

- on the results of a special assessment of working conditions (results of certification of workplaces for working conditions).

From January 1, 2017, the following reporting forms are submitted to the Pension Fund:

- SZV-M “Information about insured persons” – monthly;

- SZV-STAGE “Information on the insurance experience of insured persons” – annually.

Deadlines for submitting reports to the Social Insurance Fund and the Pension Fund of the Russian Federation

Deadlines for submitting reports to extra-budgetary funds:

- For the Federal Social Insurance Fund of the Russian Federation, the deadlines for submitting reports remain the same.

- From January 1, 2017, the deadlines for submitting monthly reports for the Pension Fund of the Russian Federation have changed.

| Reporting form | Report submission deadline | |

| On paper | Electronic | |

| 4-FSS | 20th day of the month following the reporting quarter | 25th day of the month following the reporting quarter |

| SZV-M for reporting periods 2022 | Monthly no later than the 15th day of the month following the reporting month: no later than February 15; March 15th; April 17; May 15; June 15; July 17th; August 15; September 15th; October 16; 15th of November; December 15; January 15. | |

| SZV-STAZH for 2022 | March 1 of the year following the reporting year (03/01/2018) | |

The fine for failure to comply with the procedure for submitting information to the Pension Fund in the form of electronic documents from 01/01/2017 is 1,000 rubles. (Article 17 of Law 27-FZ).

Changes to income codes and tax deductions*

Types of income have been supplemented with new codes:

| New income code | Description | Income code until 01/01/2017 |

| 2002 | Amounts of bonuses paid for production results and other similar indicators provided for by the norms of Russian legislation, labor agreements (contracts) and (or) collective agreements | 2000 |

| 2003 | Amounts of remuneration paid from the organization’s net profit, special-purpose funds or targeted income | 4800 |

From 01/01/2016, deduction codes for children have been replaced with new ones depending on the recipient of the deduction:

- for parents and adoptive parents;

- for guardians, trustees and foster parents.

New deduction codes must be reflected in 2-NDFL certificates for 2016.

* Order of the Federal Tax Service of November 22, 2016 No. ММВ-7-11/ [email protected]

New tax deduction codes

| New deduction code | Description | Deduction amount |

| Deduction for the parent, spouse of the parent, adoptive parent, who provides support for the child | ||

| 126 | For the first child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 | 1,400 rub. |

| 127 | For a second child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 | 1,400 rub. |

| 128 | For the third and each subsequent child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 | 3,000 rub. |

| 129 | For a disabled child under the age of 18 or a full-time student, graduate student, resident, intern, student under the age of 24 who is a disabled person of group I or II | 12,000 rub. |

| Deduction for the guardian, trustee, adoptive parent, spouse of the adoptive parent, who provides support for the child | ||

| 130 | For the first child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 | 1,400 rub. |

| 131 | For a second child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 | 1,400 rub. |

| 132 | For the third and each subsequent child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 | 3,000 rub. |

| 133 | For a disabled child under the age of 18 or a full-time student, graduate student, resident, intern, student under the age of 24 who is a disabled person of group I or II | 6,000 rub. |

Changes in the provision of social tax deductions for personal income tax

From 01/01/2017:

- A new social deduction has been introduced (clause 6 of Article 219 of the Tax Code of the Russian Federation) * - in the amount paid for undergoing an independent assessment of one’s qualifications for compliance with qualification requirements. In the 2-NDFL certificate, the deduction is reflected with code 329. The deduction is provided by the tax authority when the taxpayer submits a tax return.

- A social deduction for voluntary life insurance (deduction code 327) can be provided by the employer upon a tax notice if the taxpayer himself has paid contributions under voluntary life insurance contracts (clause 2 of Article 219 of the Tax Code of the Russian Federation) **.

* Federal Law dated July 3, 2016 No. 251-FZ ** Federal Law dated November 30, 2016 No. 403-FZ

Tariffs and maximum base for insurance premiums

Decree of the Government of the Russian Federation of November 29, 2016 No. 1255

From January 1, 2022, insurance premium rates will not change. The Law* provides for the preservation of the current insurance premium rates until 2022 for the main categories of insurance premium payers:

- Pension Fund - 22% (from exceeding the maximum base value - 10%);

- Compulsory Medical Insurance Fund – 5.1%;

- FSS - 2.9% (from remunerations in favor of foreign citizens temporarily staying in the Russian Federation - 1.8%).

| Insurance premiums | Base limit 2017 | Base limit 2016 |

| Social insurance in case of temporary disability and in connection with maternity | RUB 755,000.00 | RUB 718,000.00 |

| Pension Fund | RUB 876,000.00 | RUB 796,000.00 |

| FFOMS | — | — |

| FSS against accidents | — | — |

Calculation of insurance premiums *

The procedure for calculating insurance premiums in 2022 has not undergone significant changes (Article 431 of the Tax Code of the Russian Federation):

- The procedure for determining the base for calculating insurance premiums, established by Article 421 of the Tax Code of the Russian Federation, is generally identical to the procedure defined by Art. 8 of Law No. 212-FZ;

- the object of taxation with insurance premiums (clause 1 of Article 420 of the Tax Code of the Russian Federation) is determined according to rules similar to those established by Article 7 of Law No. 212-FZ;

- the list of amounts not subject to insurance premiums (not subject to inclusion in the base for calculating insurance premiums) has remained virtually unchanged, with the exception of daily allowances.

From 01/01/2017 on the basis of clause 2 of Art. 422 of the Tax Code of the Russian Federation, daily allowances are not subject to insurance contributions only within the limits established by clause 3 of Art. 217 Tax Code of the Russian Federation:

- 700 rub. for each day you are on a business trip in the Russian Federation;

- 2,500 rub. for each day you are on a business trip abroad.

In accordance with paragraph 1 and paragraph 2 of Art. 423 of the Tax Code of the Russian Federation, the settlement and reporting periods are:

- The billing period is a calendar year.

- Reporting periods:

- Quarter

- Half year

- 9 months.

* Chapter 34 of the Tax Code of the Russian Federation

Expenses at the expense of the Social Insurance Fund

Reimbursement of funds from the Social Insurance Fund

Offset against upcoming payments and reimbursement of insurance payments will be carried out by the tax authority on the basis of confirmation received from the Social Insurance Fund.

The payer of insurance premiums must submit an application for offset or reimbursement of funds for insurance coverage to the territorial body of the Social Insurance Fund (clause 9 of Article 431 of the Tax Code of the Russian Federation).

Reduction of insurance premiums by the amount of expenses at the expense of the Social Insurance Fund

The amount of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity is reduced by the payers of insurance contributions by the amount of expenses incurred by them for the payment of insurance coverage (clause 2 of Article 431 of the Tax Code of the Russian Federation).

FSS pilot project*

The validity period of the FSS pilot project has been extended until December 31, 2019. From July 1, 2022, the participants in the pilot project will be joined by:

- Republic of Adygea

- Altai Republic

- The Republic of Buryatia

- Republic of Kalmykia

- Altai region

- Primorsky Krai

- Amur region

- Vologda Region

- Magadan Region

- Omsk region

- Oryol Region

- Tomsk region

- Jewish Autonomous Region.

Electronic sick leave certificates

From 2022, the employee will have a choice of which sick leave to issue - paper or electronic. If the employee chooses an electronic sick leave certificate, the doctor will endorse it with an electronic signature and place it in the database of the Social Insurance Unified Insurance Fund. Companies will have access to the database; they will be able to fill out their part of the form on the Internet. Pilot projects on electronic sick leave are already operating in the Astrakhan and Belgorod regions and in Moscow.

* Decree of the Government of the Russian Federation of December 22, 2016 No. 1427

Changes in minimum wages and benefits

From July 1, 2017, the minimum wage will be increased to RUB 7,800.00;

until 07/01/2017 – 7,500 rub.

From February 1, 2022, the increase coefficient for “children’s” benefits is set at 1.054:

| Type of benefit | Benefit amount until 02/01/2017 (RUB) | Benefit amount after 02/01/2017 (RUB) |

| Benefit for registering at the antenatal clinic before 12 weeks of pregnancy | 581,73 | 613,14 |

| Maternity benefit | 100% of average earnings for the 2 years preceding the insured event or based on the minimum wage for the current year (RUB 7,500.00 - until 07/01/2017, RUB 7,800.00 - from 07/01/2017) | |

| One-time benefit for the birth of a child | 15 512,65 | 16 350,33 |

| Child care benefit: | 40% of average earnings for the 2 years preceding the insured event, but not less | 40% of average earnings for the 2 years preceding the insured event, but not less |

| Minimum size | RUB 2,908.62 for the first child RUB 5,817.24 - on the second and subsequent | RUB 3,065.69 - for the first child RUB 6,131.37—on the second and subsequent |

| Maximum size | 21,554.82* (until 01/01/2017) | 23,120.66* (from 01/01/2017) |

* The maximum amount of child care benefit is not subject to indexation and is calculated using the formula: Employee’s income for the 2 years preceding the insured event / 730 x 40% x 30.4. Amount 23,120.66 rubles. applies when calculating parental leave from 01/01/2017.

The amount of state benefits for citizens with children in regions and localities where regional coefficients for wages are established are determined using these coefficients, which are taken into account when calculating these benefits if they are not included in wages.

Other changes from 01/01/2017

From October 1, 2017, the amount of penalties for personal income tax and insurance premiums for a period of delay exceeding 30 calendar days was increased to 1/150 of the refinancing rate (Part 9, Article 13 of Law No. 401-FZ of November 30, 2016).

Starting from 2022, the Federal Tax Service will collect arrears on insurance premiums, including for previous periods.

The procedure for the return (offset) of overpaid insurance premiums for periods before 01/01/2017:

- Apply for a refund to the Fund

- The Fund will make a decision on the return and send it to the Federal Tax Service

- The Federal Tax Service will return the amount of overpayment through the Federal Treasury.

From 01/01/2017 for codes according to OKVED it is necessary to use the new classifier OK 029-2014.

Starting with the report for January 2022, a new form P-4 is put into effect (Order of the Federal State Statistics Service dated August 2, 2016 No. 379).

As of 02/06/2017, amendments to the form of earnings certificate 182n come into force (Order of the Ministry of Labor dated 01/09/2017 No. 1n).

The amendments are of a technical nature and are related to the transfer of insurance premiums to the control of the Federal Tax Service. From 01/01/2017, the administration of personal income tax for the largest taxpayers was transferred to the territorial tax authorities (letter of the Federal Tax Service dated 12/19/2016 No. BS-4-11 / [email protected] ). Starting with reporting for 2016, information on forms 2-NDFL and 6-NDFL is submitted to the territorial tax authorities, including updated reporting for past tax periods.

An example of calculating insurance premiums in 2022

An employee’s monthly income subject to insurance contributions is RUB 130,000. Accordingly, his annual income exceeds the established limits and is equal to 1,680,000 rubles. (140,000 x 12 months). We will calculate insurance premiums for the year taking into account the maximum limits for 2022.

Pension Fund: 1,565,000 rub. x 22% = 344,300 rub. – contributions from amounts within the limit. (RUB 1,680,000 – RUB 1,565,000) x 10% = 115,000 *10%=RUB 11,500 – contributions from income exceeding the limit for calculating insurance premiums for 2022. Total to the Pension Fund: 344,300 rubles. + 11,500 rub. = 355,800 rub.

FSS: RUB 1,032,000. x 2.9% = 29,928 rub. – contribution from an amount not exceeding the limit. From an amount exceeding the maximum base - 648,000 rubles. (1,680,000 – 1,032,000) social insurance contribution will not be charged.

Compulsory medical insurance: RUB 1,680,000 x 5.1% = 85,680 rub. – the health insurance contribution for 2022 is calculated on the entire employee’s income.

Total insurance contributions to the Pension Fund + Social Insurance Fund + Compulsory Medical Insurance Fund: 355800 + 29928 + 85680 = 460,274 rubles

Reduced insurance premium rates for SMEs

Organizations and individual entrepreneurs that are included in the register of SMEs can apply reduced insurance premium rates. The amount of insurance premiums in 2022 for small and medium-sized enterprises is 15% of payments in excess of the minimum wage (Article 427 of the Tax Code). From a salary within the minimum wage you will have to pay 30% (standard tariff). In order to apply preferential tariffs, it is only necessary that the organization or individual entrepreneur be in the register of small and medium-sized businesses. The right to a benefit does not depend on the type of activity and OKVED, and it is also impossible to switch to it upon application.

| Monthly income level | Pension Fund | FSS | Compulsory Medical Insurance Fund |

| Does not exceed the minimum wage | 22% (if the base limit is not exceeded); | 2.9% (if the base limit is not exceeded); | 5,1% |

| 10% (base limit exceeded) | 0% (base limit exceeded) | ||

| Exceeds the minimum wage | 10% (from the difference between salary and minimum wage) | 0% (from the difference between salary and minimum wage) | 5% (from the difference between salary and minimum wage) |

Firmmaker, November 2016 (updated annually) Anastasia Chizhova (Konatova) When using the material, a link is required

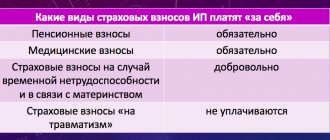

Object of taxation of insurance premiums

As previously in Law No. 212-FZ, for organizations and individual entrepreneurs making payments and other remuneration to individuals, the object of taxation of insurance premiums will be (Article 420 of the Tax Code of the Russian Federation) payments within the framework of labor relations and under civil contracts, the subject of which are the performance of work, the provision of services under copyright contracts in favor of the authors of works, as well as under contracts on the alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements on granting the right to use works of science, literature, art, including including remunerations accrued by rights management organizations on a collective basis in favor of authors of works under agreements concluded with users.

For individuals who are not individual entrepreneurs and make payments and other remuneration to other individuals, the object is payments under employment agreements (contracts) and under civil law contracts, the subject of which is the performance of work, the provision of services in favor of individuals.

For payers who do not make payments and other remuneration to other individuals, the object is recognized as a fixed amount; at the same time, the Tax Code of the Russian Federation links it with the minimum wage. The algorithm for calculating the appropriate size is given in Art. 430 Tax Code of the Russian Federation.

The list of payments that in any case are not considered subject to insurance premiums has not changed.

As explained in the letter of the Ministry of Health and Social Development of Russia dated March 23, 2010 No. 647–19, payments to employees that are not directly stated in their employment contracts are nevertheless subject to insurance premiums as those made within the framework of the labor legal relationship of employees with the employer and therefore related to their employment contracts (except for the amounts specified in Article 9 of Law No. 212-FZ).

These conclusions are also applicable by analogy to the determination of the object of taxation of insurance premiums after January 1, 2022.

In this regard, the object of taxation with insurance premiums includes all types of payments and other remuneration accrued (paid) by payers of insurance premiums in favor of individuals working under employment contracts, regardless of the presence or absence of an indication of these payments directly in the employment contract.

The Ministry of Health and Social Development of Russia indicated that in a number of cases, insured individuals can perform a labor function in an organization and receive payment for work without concluding labor or civil contracts with them for the performance of work, provision of services (for example, state civil servants, municipal employees, persons filling government positions of the Russian Federation, a constituent entity of the Russian Federation, municipal positions on a permanent basis, members of production cooperatives).

Payments and other remunerations accrued by the organization in favor of individuals subject to compulsory social insurance, with whom, in accordance with the law, neither employment nor civil law contracts are concluded, for the performance of their labor function, work, services, are subject to insurance premiums.

Payment of insurance premiums for these insured persons is carried out by those organizations that are insured in relation to them: for example, for state civil servants - the public authorities in which they serve, for members of production cooperatives - production cooperatives, for clergy - religious organizations .

Payments made to such individuals by other organizations that do not have relevant legal relations with them are not subject to insurance premiums.

The list of amounts not subject to insurance premiums given in Art. 422 of the Tax Code of the Russian Federation, is somewhat different from the list that was enshrined in Art. 9 of Law No. 212-FZ.

Thus, the new list does not indicate employer contributions paid in accordance with the legislation of the Russian Federation on additional social security for certain categories of employees who are not subject to insurance contributions until January 1, 2022.

Now the Tax Code of the Russian Federation contains a provision that when payers pay expenses for business trips of employees, daily allowances will not be subject to insurance contributions, only those provided for in paragraph 3 of Art. 217 Tax Code of the Russian Federation.

Previously, when paying for travel expenses for employees, daily allowances were not subject to insurance contributions, regardless of the amount.

From January 1, 2022, when an employer pays an employee for business travel expenses both within the country and abroad, the income subject to insurance premiums does not include daily allowances paid in accordance with the legislation of the Russian Federation, but not more than 700 rubles. for each day of a business trip in the Russian Federation and no more than 2,500 rubles. for each day you are on a business trip abroad.

In the letter of the FSS of the Russian Federation dated April 14, 2015 No. 02-09-11/06–5250 it was explained that in Art. 9 of Law No. 212-FZ, employees-guardians are named among the persons who can be provided with one-time financial assistance, and therefore the amount and period of payment of such material assistance in order to avoid the accrual of insurance premiums on it were also applied to payments to employees who received guardianship over minors children.

At the same time, Law No. 212-FZ, although there is an indication of payments to guardians, does not provide conditions for making such payments for the purpose of not charging insurance premiums to them.

From January 1, 2022, it is expressly stated that the amount of one-time financial assistance provided to guardians when establishing guardianship over a child, paid during the first year after establishing guardianship, but not more than 50,000 rubles, is not subject to insurance premiums. for each child.

As part of tax audits, tax authorities will check amounts not subject to insurance premiums for insurance premium payers making payments and other remuneration to individuals for compliance with Art. 422 of the Tax Code of the Russian Federation.

It is necessary to keep in mind that the list of expenses the payment of which is not subject to insurance contributions, established by Art. 422 of the Tax Code of the Russian Federation is exhaustive, and payment of expenses not specified in it is subject to insurance premiums in the generally established manner.