In every organization, sooner or later there comes a time when it is necessary to get rid of old documents and make room for new ones. But there is no concept of “old documents” in archiving. There are only documents that have expired. You can get rid of them, but not immediately and not all of them. First, you will have to review the documents and select those that can be safely destroyed.

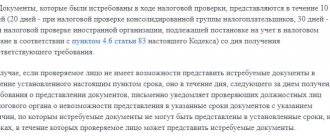

No matter how great the temptation may be to take all the “old” documents anywhere out of sight, you should never do this - no one has canceled liability for violating the requirements of the law on storing documents. In accordance with Art. 13.25 of the Code of the Russian Federation on Administrative Offenses (hereinafter referred to as the Code of Administrative Offenses of the Russian Federation), the fine for a legal entity can range from 200 to 300 thousand rubles. In practice, liability for an organization may arise if it does not provide any document at the request of a regulatory authority, citing the fact that it is lost or destroyed. This is why thoughtlessly destroying documents is risky.

What documents can be destroyed?

When deciding to destroy documents, you must be guided by the main criterion - the storage period. If it has expired, then the document can be sent to the shredder (or oven) provided that you have correctly determined the expiration date.

Guided by this rule, you can make a list of documents of different “ages” that are subject to destruction in 2022:

| Year of completion in office work | Shelf life |

| 1941 | 75 years old |

| 1971 | 45 years |

| 2006 | 10 years |

| 2011 | 5 years |

| 2013 | 3 years |

| 2015 | 1 year |

It is impossible to immediately select documents for destruction. First, a value assessment must be conducted. In this case, shelf life will be the determining, but not the only selection criterion. An expired document may be useful in future work. It is possible that it may be of scientific, even historical value. This can be established, and therefore the shelf life can be extended, only by a value examination (VE), which is carried out by an expert commission (EC).

Results

Even if the company is small and there are not very many documents, there is no point in storing them for decades, but you also cannot get rid of them all indiscriminately. the audit has passed , it is really better not to destroy anything.

What should be destroyed is what is permitted by law, but annual tax reports, as well as balance sheets and reports, are untouchable forever .

To destroy papers, you need to create an expert commission , which will allow you to destroy some of the files whose storage period has expired. The destruction act includes a list of to-dos, with mandatory approval by the manager. The fact of destruction should also be recorded and documented.

If the volume of papers is significant, then it is worth using the services of specialized companies , and several kilos of paper can simply be burned in the presence of a commission.

Expert commission: composition and functions

EC appears in the organization immediately after management decides to create an archive. The secretary of the EC is always an archivist, and the chairman is either a top manager to whom the clerks report (for example, the administrative director), or, as in our example, the director for general affairs. If one is not found - the general director himself, who signs the order to create a commission (Example 1). The same order can approve the regulations on the new collegial body and request a plan for its work. If the date of creation of the EC is not indicated in the order, it is considered that the commission operates from the date of signing the order.

1Not shown.

The EC is a collegial advisory body under the general director of the organization. “Collegial” means that the commission includes several officials from among the organization’s employees, “deliberative” - the officials do not make a decision, but only recommend to the general director to carry out this or that operation on documents and approve it.

A clerk or archivist knows management documents well, but in the organization’s archive there is also a huge layer of personnel records, accounting and tax reporting, and documents accompanying the organization’s core activities. Since these are independent documentation systems, only specialists can evaluate them. For this purpose, an expert commission is created - a meeting of competent (each in their own field) officials.

The main function of the EC in an organization that is not a source of acquisition of the state (municipal) archive is to organize the annual selection of files for storage and destruction.

In organizations that are sources of acquisition of the state archive, the functionality of the EC is broader: the commission actively interacts with the expert verification commission of the archival institution, submits to them for approval draft nomenclatures of files, archival inventories, and makes proposals for changing the storage periods of documents.

Regardless of the company’s field of activity, the EC must include:

• head of the HR department;

• chief accountant;

• head of the legal department;

• an official in the company's profile (production manager, construction manager, chief technologist, etc.), whose task is to evaluate documents on the main activities of the organization.

Each EC meeting is documented in minutes (Example 2).

Document retention periods

The general storage periods for documents are set out in the Tax Code of the Russian Federation and the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”.

According to Art. 23 of the Tax Code of the Russian Federation, all taxpayers are required to store their documents for four years. However, this rule applies exclusively to documents necessary for the calculation and payment of taxes. In addition, in Art. 23 of the Tax Code of the Russian Federation makes a reservation that a 4-year period is applied in cases where other terms are not established by law.

In this case, the 4-year period begins to run not from the date of preparation of the document, but from the end of the reporting (tax) period in which the document was last used to prepare tax reports or pay taxes (letter of the Ministry of Finance of the Russian Federation dated July 19, 2017 No. 03-07 -11/45829). As for depreciable fixed assets, the 4-year storage period for documents on such fixed assets should be counted from the moment depreciation is completed (letter of the Ministry of Finance of the Russian Federation dated February 12, 2016 No. 03-03-06/1/7604).

Therefore, we can say that 4 years is the mandatory minimum during which payers undertake to preserve documents used for tax purposes. But, in order to avoid various troubles with the Federal Tax Service, when establishing rules for storing documents, it is better to focus on longer periods.

For example, those established in Art. 29 of the Federal Law of December 6, 2011 No. 402-FZ. This article defines two main deadlines that apply to different types of documents.

Thus, for at least 5 years after the end of the reporting year (i.e., the year of compilation), the following must be stored:

- primary accounting documents (contracts, acts, invoices, receipts, invoices, advance reports, etc.);

- accounting registers (general ledger, order journals, inventory cards, etc.);

- accounting (financial) statements (balance sheets, profit and loss statements, intended use of funds, etc.);

- audit reports.

For at least 5 years after the year of last use, the following are stored for accounting purposes:

- accounting policy;

- standards of an economic entity;

- documents related to the organization and maintenance of accounting.

All the above terms are minimum. Specific storage periods for each document are contained in Order No. 558 of the Ministry of Culture of the Russian Federation dated August 25, 2010. It must be taken into account that different storage periods may apply for the same document.

For example, primary documents required for tax payment purposes must be stored for at least 4 years (Article 23 of the Tax Code of the Russian Federation). The same documents used for accounting purposes have been stored for at least 5 years (Article 29 of Federal Law No. 402-FZ dated December 6, 2011). Thus, if the legal acts establish different storage periods for the same document, then the storage period for the document must be determined according to the act that provides for a longer period.

If the value examination is carried out for the first time

The first assessment of value is always a large-scale event. It is necessary to review all the documents that have accumulated over the years of the organization’s existence. The expert commission must act consistently.

■ Step 1: select the documents for which the value assessment will be carried out.

At this stage of the examination, members of the EC do not participate. This is the area of responsibility of the archivist (clerk, secretary) and employees of the company’s structural divisions. They separate documents that were completed before the beginning of the current year from those that are still in progress.

■ Step 2: divide the documents by year. This stage is relevant during the first EC, when absolutely everything that has been completed in office work has to be reviewed.

The first thing to do to put things in order is to separate the documents by year. Perhaps the employees who were responsible for these documents have done this before. If not, you'll have to do it now. The archivist and department employees are still responsible; it is too early to involve EC members.

■ Step 3: we conduct an examination. At this stage, the main role in the examination is played by the members of the EC, who review the documents prepared for assessment and divided by year and make a verdict: whether they represent practical (scientific, historical) value or not. After this, the part of the documents that has received the status “may be destroyed” is checked by the archivist. He finds out whether the storage periods for these documents have expired.

■ Step 4: we formalize the results of the examination. The results of the examination of value are recorded, firstly, in the inventory of cases and documents, and secondly, in the act of allocating documents for destruction.

■ Step 5: we coordinate and approve inventories and acts. After the documents that record the results of the value assessment have been drawn up, a meeting of the expert commission is held. On it, members of the EC agree on the inventory and act, after which they are approved by the General Director.

■ Step 6: we prepare documents for storage and destruction. Those files and documents that remain in the organization are registered for storage. For those that are decided to be destroyed, a recycling process is organized.

Documents that cannot be recycled

As can be seen from the above, permanent storage , that is, indefinitely:

- annual tax reports;

- annual accounting balances;

- annual accounting reports.

Documents that confirm that the enterprise has paid all taxes to the state in full , and the correctness of deductions can be checked at any time.

A commission created at the enterprise must select documents that should be preserved permanently.

is compiled in ascending order from the beginning of the year to the end, and 4 copies of this list are signed by the head. Permanently stored papers are handed over to the state archive or stored in their own archive, while a person responsible for preservation is appointed by annually updated order.

Document destruction process

Document destruction is usually carried out in one of two ways: by burning or shredding. The latter is only provided that the documents cannot be restored. Documents should not be sent to the nearest landfill, torn into pieces, or used as drafts.

As a rule, special organizations are hired to destroy documents . Most often, these organizations offer shredding as a method of destruction, and the resulting waste can be immediately accepted as waste paper, thereby returning part of the cost of their services. At the request of the customer, the contractor can film the destruction process. Representatives of the customer organization may also be present when documents are destroyed.

A standard contract for the provision of services for a fee is drawn up with the organization that deals with the destruction of documents. The contractor will propose a standard form of the contract at the negotiation stage. All that is required of the archivist is to ensure that the contract contains a clause stating that the executor undertakes to ensure the confidentiality of the documents being destroyed, since among them there may be cases that contain personal data, commercial or other types of secrets. To avoid wasting time sorting classified and unclassified documents that will soon be nothing more than shavings, contractors ensure confidentiality by default.

You can destroy documents on your own if production capacity allows, for example, a furnace or industrial shredder is operating in the workshops of the enterprise. An attempt to get rid of documents using an ordinary office shredder is doomed to failure if the volume of papers exceeds one folder.

Reasons for destroying official papers

The main reason, if there are no force majeure circumstances, for the destruction of documents is considered to be the end of the storage period , which occurs by January 1 of the following year. In addition, the following circumstances may be the reason:

- damage due to fire, flooding;

- theft;

- exposure to an element that led to complete or partial damage (tsunami, mudflow, landslide, volcanic eruption, etc.).

Each of the reasons must be confirmed .

For example, if a crime occurred - breaking into an office premises and stealing papers, then law enforcement agencies must issue a certificate stating that such a fact actually took place.

In this case, important documents must be stored in cabinets with locks or in safes, and if the storage rules are violated, an administrative penalty (fine) will be imposed .

The same requirements apply to documents that have been burned or flooded - certificates from the relevant services and authorities will be required.

Document destruction act

The destruction of files from the moment of selection to sending to the shredder is documented in one document - an act on the allocation for destruction of archival documents that are not subject to storage. The form is approved by the Rules for organizing the storage, acquisition, recording and use of documents of the Archival Fund of the Russian Federation and other archival documents in government bodies, local governments and organizations in Appendix No. 21 (Example 3).

As can be seen from the example, the document destruction act conditionally consists of two parts. The first is a list of cases and documents allocated for destruction, the second informs about how exactly the documents were destroyed.

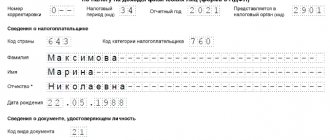

Let's go through the act and consider the basic rules for filling out its unified form.

The first part of the act: registration rules

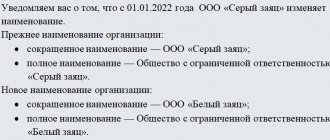

1. The name of the organization can be either full or short. The main thing is that the name stated in the act corresponds to the organization’s charter.

2. Acts on the destruction of documents must be registered, like other documents. The act is assigned a serial number according to the corresponding registration form. The date of the act must correspond to the date of its approval.

3. The act is approved by the general director.

4. Documents are selected for destruction on the basis of regulations establishing storage periods. And this is not only the 2010 List. We have included as an example an industry document containing retention periods to show what several such documents look like in the act.

5. Information about the documents being destroyed is summarized in a table.

• Each entry in the table is assigned a serial number.

• The group heading of the case is placed in the second column: “Invoices” or “Orders...”. In this case, there is no need to list things by storage unit. Moreover, if the same file is destroyed over several years at once, then it is enough to make only one entry in the act (see entry No. 3 in Example 3).

• The third column indicates the years for which documents are destroyed.

• The inventory, as already mentioned, is the main accounting document of the archive. If the documents being destroyed were included in the inventory, its number is indicated in the fourth column, and the serial numbers of the storage units being destroyed according to this inventory are indicated in the fifth column (see entry No. 1). Documents with five-year or shorter storage periods are not described, so dashes are placed in these columns (see entry No. 2). If this is the first destruction of documents in the organization, and the inventory has not yet been compiled, then both columns (fourth and fifth) can be removed from the table - there is nothing to add to them yet.

• The number of storage units to be destroyed is indicated for each case.

• The seventh column indicates the storage period for each file and a link to its source. Since the word “List” in the column heading means the 2010 List, the full or abbreviated name of the remaining sources will have to be placed in the table (see entry No. 4).

• The “Note” column is traditionally used for all kinds of notes. For example, that the case is electronic (see entry No. 5).

6. The following is a summary: the total number of storage units destroyed, total paper and electronic media, is written in numbers and in words.

7. The first part of the act is signed by the employee responsible for the archive and submitted to the expert commission for approval. Then a visa is issued with a link to the minutes of the EC meeting, which records the agreement.

It is advisable to submit the document destruction act for approval to the general director now, despite the fact that the second part of the act is still empty. The manager must know which documents will soon be destroyed. Moreover, it is he who makes the decision to destroy and records this in the approval stamp. Destruction of documents is an irreversible process. It is impossible to return papers after they have been recycled.

The second part of the act: design features

This part indicates exactly how and on what basis the documents were destroyed. The form of the destruction act approved by the 2015 Rules implies that the destruction is carried out by a contractor. Therefore, the second part indicates the weight of the documents (they will be accepted by weight, and not by pieces of storage units), registration data of the contract, and method of destruction.

If the organization destroys the documents itself, the record will look like that shown in Example 4.

Please note: documents were destroyed in the presence of officials - members of the EC. In this case, there is no need to draw up a separate act, but it is also impossible to destroy the papers without supervision.

If only paper documents are destroyed, then the phrase “on electronic media” is excluded from the act. O means that after the destruction of the documents, the archivist took up the inventories, the documents from which were sent for destruction, and made the appropriate notes (Example 5).

Please note: in the inventory, unlike the act of destruction, each storage unit is presented separately. They also receive notes separately. If documents were destroyed that were not in the inventory, or when drawing up the act, columns 4 and 5 of the table were excluded, no mark is placed in the inventory.

If there is no expert commission

It happens that there is no EC in the organization. For various reasons: officials (potential participants) do not see the need to create this collegial body, and they managed to convince the director of this, or the director himself does not consider it necessary. However, the secretary is tasked with organizing the destruction of the accumulated documents.

Thus, in the absence of an EC, the secretary, performing the task of destroying documents, acts exactly according to the algorithm described above, but in the act of destruction on the spot of the approval visa, he indicates the data not of the protocol, but of all officials with whom the act is approved. Documents cannot be destroyed without approval. However, even if the heads of the departments you need have a negative attitude towards archiving, they will reluctantly review the documents allocated for destruction. Because they know very well which documents from those that are under their control should be stored in the organization, and therefore should not be destroyed. And the secretary will kindly inform them about liability for violating legal requirements for storing documents.