How to fill out the form

The current UTII declaration form for filling out is approved by Appendix No. 1 to the order of the Federal Tax Service of Russia dated June 26, 2018 No. MMV-7-3/414.

The official name of the imputation report is “ Tax return for a single tax on imputed income for certain types of activities .”

The same order of the Federal Tax Service approved the procedure for filling out the UTII declaration (Appendix No. 3, hereinafter referred to as the Procedure).

Composition of the UTII declaration

The imputation report consists of (always fill out all sections):

| STRUCTURAL PART | NAME/WHAT IT REFLECTS |

| First sheet | Title |

| Section 1 | Amount of UTII to be paid to the budget (fill in last) |

| Section 2 | Tax calculation by type of activity |

| Section 3 | Calculation of UTII for the tax period |

| Section 4 | Calculation of expenses for the acquisition of a cash register that reduces tax for the tax period |

For the convenience and correctness of filling out the UTII declaration, the sequence of filling out its sections is important. The best way to do it is listed in ConsultantPlus:

We recommend filling out the declaration in the following sequence: first... (read more).

Next, we will consider the procedure for filling out each part of the UTII declaration. But first, general requirements for filing a declaration.

How to withdraw from UTII

If you have stopped running a business transferred to UTII, within 5 days submit an application to deregister as a UTII payer:

- application for individual entrepreneurs to withdraw from UTII (UTII form-4);

- application for an LLC to withdraw from UTII (form UTII-3).

Until you deregister, you will have to pay tax and report on UTII - there can be no zero reporting in this taxation system. If you do not stop your activities on UTII, but want to transfer to another taxation system, this can only be done from the beginning of the calendar year. To do this, within 5 working days from the beginning of the year you need to submit an application for withdrawal from UTII.

The article is current as of 02/05/2021

General rules for filling out the UTII declaration

All values of cost indicators are indicated in full rubles:

- less than 50 kopecks (0.5 units) - discarded;

- 50 kopecks (0.5 units) or more - rounded to the nearest ruble (whole unit).

The pages of the declaration have continuous numbering, starting from the title page, regardless of the presence (absence) and number of sections and sheets to be filled out.

The serial number of the page is written in the field specified for numbering from left to right, starting from the first (left) familiarity.

The page number indicator (the “Page” field) has 3 familiar places. For example:

- for the first page – 001;

- for the tenth page – 010.

When filling, use black ink.

Invalid:

- correcting errors by corrective or other similar means;

- double-sided printing of the declaration.

Each indicator corresponds to one field, consisting of a certain number of familiarities. Only one indicator is indicated in each field. The exception is a date or decimal fraction.

To indicate the date, use 3 fields separated by a dot in order.

- day - a field of two familiar places;

- month – a field of two familiar places;

- year - a field of four acquaintances.

That is:

| DD.MM.YYYY |

For decimal fractions, use 2 fields separated by a dot:

- the first one corresponds to the whole part of the decimal fraction;

- the second is the fractional part of the decimal.

The declaration fields are filled in with the values of text, numeric and code indicators from left to right, starting from the first (left) familiarity.

When filling out fields on a computer, numerical values are aligned to the right (last) space.

The text fields of the UTII declaration are filled in with CAPITAL PRINTED characters.

If any indicator is missing, a dash is placed in all familiar places in the corresponding field (a straight line in the middle of the familiar places along the entire length of the field).

If for any indicator it is not necessary to fill out all the information in the corresponding field, a dash is placed in the unfilled fields on the right side of the field. For example, when an organization indicates a 10-digit TIN in the “TIN” field out of 12 acquaintances, the indicator is filled out as follows - “5024002119–”.

When printing on a printer:

- it is acceptable to have no frames for familiar places and dashes for empty signs;

- the location and size of indicators should not change;

- font Courier New 16 - 18 points.

Sample of filling out UTII-1

The UTII-1 form is filled out and submitted to the Federal Tax Service only by enterprises. Individual entrepreneurs have their own UTII-2 form.

We draw your attention to the fact that when submitting an UTII-1 application , a representative of the enterprise must take with him to the Federal Tax Service a copy of the power of attorney regarding his powers, allowing him to act in the interests of the enterprise and represent it to the Federal Tax Service.

Form UTII-1 consists of two sheets.

The first page records the following data:

- TIN of the enterprise;

- enterprise checkpoint;

- Federal Tax Service code;

- confirmation of residence or non-residence of the enterprise (resident - put 1, non-resident - 2);

- Name;

- OGRN (if the enterprise is Russian);

- number of pages of the annex to the UTII-1 form (if any);

- start date of using UTII (HH.MM.YY).

If the form is submitted by the head of the enterprise, in the section “I confirm the accuracy and completeness of the information”, the following must be indicated:

- number 3;

- Full name of the head;

- TIN of the manager;

- contact phone number;

- date of filing the UTII-1 form ;

- manager's signature.

If the form is submitted by a proxy, the following must be indicated in this section:

- number 4;

- Full name of the authorized person;

- TIN of the authorized person;

- representative's telephone number;

- signature of the representative;

- date of submission of the form;

- details and name of the document confirming the authority of the representative.

The second page of the UTII-1 form includes the following data:

- TIN of the enterprise;

- enterprise checkpoint;

- information about the activities carried out and the places where they are carried out (type of activity and region code);

- signature (of the manager or representative) of the enterprise.

Filling out the title page

| PROPS | HOW TO FILL OUT |

| INN checkpoint | INN, as well as KPP, which is assigned to the organization as a single tax payer on imputed income by the tax authority to which you submit the declaration. Indicated at the top of each page. |

| Correction number | When submitting an initial declaration, enter “0–”; when submitting an updated declaration, indicate the adjustment number (for example, 1–, 2–, etc.). |

| Taxable period | For which you are submitting a declaration. Taken from Appendix No. 1 to the Procedure:

|

| Reporting year | For which you are submitting a declaration |

| Tax authority code | According to documents on registration with the tax authority |

| Code at the place of registration | This is the code for the place of submission of the declaration at the place of registration of the taxpayer. Taken from Appendix No. 3 to the Procedure:

|

| Taxpayer | The full name of the organization in accordance with its constituent documents (if there is a Latin transcription in the name, indicate it) or line by line the full last name, first name, patronymic of an individual entrepreneur |

| Reorganization (liquidation) form code | Taken from Appendix No. 2 to the Procedure:

|

| TIN/KPP of the reorganized organization | Accordingly, the TIN and KPP that were assigned to the organization before the reorganization by the tax authority at the place of registration as a UTII payer. |

| Contact phone number | In the format: country code, city code, number without spaces or symbols between numbers |

| Number of pages | On which the declaration was drawn up |

| Number of sheets | Supporting documents or copies thereof, incl. confirming the authority of the representative (in case of submission by the representative of the taxpayer) attached to the declaration. |

| I confirm the accuracy and completeness of the information specified in this declaration | Indicate:

When submitting a declaration by an organization, in the field “last name, first name, patronymic - line by line the full last name, first name, patronymic of the manager + personal signature and date of signing. When submitting an IP, the “last name, first name, patronymic” field is not filled in . Only a personal signature and the date of signing are affixed. When submitted by a representative-individual, in the field “last name, first name, patronymic” - line by line the full last name, first name, patronymic of the representative + personal signature and date of signing. When submitted by a representative-legal entity, in the field “last name, first name, patronymic” - line by line the full last name, first name, patronymic of the individual authorized in accordance with the document of this legal entity to confirm the accuracy and completeness of the declaration information. In the field “name of organization – representative of the taxpayer” indicate the name of the legal entity – representative of the taxpayer. Sign the person whose information is indicated in the “last name, first name, patronymic” field and the date of signing. In the field “Name of the document confirming the authority of the taxpayer’s representative” - the type of document confirming the authority of the representative. |

Do not touch the section “To be completed by a tax authority employee” : it is for the Federal Tax Service.

When submitting to the Federal Tax Service at the place of registration by the successor organization a declaration for the last tax period and updated declarations for the reorganized company (in the form of incorporation/merger/division/transformation):

- on the title page in the field “at place of registration (code)” – 215;

- in the upper part - TIN and KPP at the location of the successor organization;

- in the “Taxpayer” field – the name of the reorganized organization.

When filling out sections of the UTII declaration, pay attention to the tips and formulas that are in the names of the lines themselves.

What to do with reporting on UTII if an organization plans to close a separate division? How to proceed, see ConsultantPlus:

In this case, the organization is obliged to submit a declaration and pay tax for those periods when the organization was registered as a payer of UTII (see letter of the Ministry of Finance of Russia dated 04/06/2011 No. 03-11-11/83).

Read the complete solution.

Actions that complete work on UTII

The cancellation of UTII is associated with the termination of Ch. 26.3 of the Tax Code of the Russian Federation, dedicated to this regime (clause 8 of Article 5 of the Law of June 29, 2012 No. 97-FZ “On Amendments...”). That is, UTII ceases to be applied in accordance with changes in legislation, and this basis applies to all persons without exception who applied it, regardless of their will or desire.

Therefore, the imputed person does not need to do anything to notify the Federal Tax Service about the termination of the use of UTII. The Federal Tax Service will automatically deregister payers of this tax (clause 2 of the Federal Tax Service Letter No. SD-4-3/ [email protected] ).

Despite the abolition of the regime, for the last tax period under it (4th quarter of 2022) in 2022 it will be necessary to file a declaration and pay tax. There are no specific deadlines for implementation of these actions, therefore the dates of the last days remain the same for:

- filing a declaration – 01/20/2021;

- tax payment – 01/25/2021.

Both actions will need to be carried out to those tax authorities where the UTII payer was registered in this capacity (clause 3 of Letter No. SD-4-3/ [email protected] ).

Completing section 1

| LINE | HOW TO FILL OUT |

| Each block of lines 010 – 020 | On line 010 – OKTMO code of the municipality, inter-settlement territory, settlement that is part of the municipality at the place of business (place of registration of the UTII payer). Indicated in accordance with the All-Russian Classifier of Municipal Territories OK 033-2013. When filling out the OKTMO code, 11 acquaintance spaces are allocated. If the code has 8 characters, the empty spaces on the right are filled with dashes. For example, for an eight-digit OKTMO code 12445698, write the eleven-digit value “12445698—”. If there are not enough lines with code 010, you should fill out the required number of sheets in section 1. Indicate the code of the municipality in whose territory the reorganized company was registered as a UTII payer. |

| Line 020 | The amount of UTII payable for the tax period. See the formula in the UTII declaration form. |

Do not forget to put your signature and the date of signing this section in the line “I confirm the accuracy and completeness of the information specified on this page.”

What to change UTII to and how to do it

The terminated UTII regime, which was one of the special regimes, needs to be replaced by another regime. The ability to choose from other existing special regimes is limited by the taxpayer’s compliance with the requirements allowing their use (clause 1 of Letter No. SD-4-3/ [email protected] ):

- STS - the requirements for it in most respects coincide with those that took place under UTII;

- PSN - available to individual entrepreneurs when they obtain a patent to conduct types of activities allowed by this system;

- established by the Law of November 27, 2018 No. 422-FZ “On conducting an experiment...” for self-employed persons - it can begin to be used by individual entrepreneurs who do not hire workers.

An individual entrepreneur choosing a PSN must keep in mind that starting from 2022, a number of significant amendments will be made to the rules established in relation to this regime (clause 2 of Article 1, Article 3 of the Law of November 23, 2020 No. 373-FZ “On the Introduction changes..."):

- the lists of available and inaccessible activities are expanding;

- the right to specify the types of activities possible under PSN is assigned to the regions;

- temporary (until they are introduced by the region) rules for determining potential income are established;

- for 2022, a tax period of special length is established - equal to a month;

- additional grounds are introduced for reducing the amount of tax.

The choice made in favor of the simplified tax system or PSN must be notified to the tax authority (in person, through a representative, by mail, electronically or through a personal account), doing this within the usual time limits established by the Tax Code of the Russian Federation:

- No later than 12/31/2020 when switching to the simplified tax system (clause 4 of Letter No. SD-4-3/ [email protected] ) by sending to the Federal Tax Service at the location of the legal entity or place of residence of the individual entrepreneur a notification drawn up in form No. 26.2-1 (approved by the Order Federal Tax Service of Russia dated November 2, 2012 No. ММВ-7-3/ [email protected] ). To the same Federal Tax Service (and not at the place of business, as with UTII), you will need to submit a simplified taxation system declaration and pay tax payments (clause 10 of Letter No. SD-4-3/ [email protected] ).

- No later than December 17, 2020, when switching to the PSN (clause 11 of Letter No. SD-4-3 / [email protected] ), by sending an application for a patent to the Federal Tax Service.

The use of the regime introduced for the self-employed is considered to begin from the date of sending an application for registration as a self-employed person to the tax authority through the personal account (clauses 1, 2, 10 of Article 5 of Law No. 422-FZ).

The absence of a message about the choice of a special regime will lead to the establishment of a general taxation system (OSNO) for the former imputed person, in which the set of mandatory taxes is significantly expanded in comparison with the special regimes.

Special situations for compliance with the rules of transition to another regime will be when:

- UTII was combined with the simplified tax system and the use of the simplified tax system (including for income previously taxed by UTII) is planned to continue - in this case, notification of the transition to the simplified tax system is not required (clause 6 of Letter No. SD-4-3 / [email protected] );

- UTII was combined with the simplified tax system, but further application of the simplified tax system became impossible - in this case, the Federal Tax Service must be notified of the loss of the right to use the simplified tax system and the transition to another regime no later than 15 calendar days from the end of the reporting (tax) period in which the loss of the right occurred ( clause 5 of Letter No. SD-4-3/ [email protected] ).

Completing section 2

Fill out separately for each type of business activity. When conducting the same type of activity in several separately located places, section 2 of the UTII declaration is filled out separately for each place (each OKTMO code).

| LINE | HOW TO FILL OUT |

| 010 | Code of the type of business activity carried out by which you fill out this section in accordance with Appendix No. 5 to the Procedure:

|

| 020 | The full address of the place of conduct of the type of business activity indicated on page 010. The region code is indicated in accordance with Appendix No. 6 to the Procedure. See all codes in a separate file here. |

| 030 | Code according to OKTMO of a municipality, inter-settlement territory, settlement that is part of the municipality at the place of business (place of registration of the UTII payer) |

| 040 | The value of the basic profitability per unit of physical indicator per month for the corresponding type of business activity. Taken from clause 3 of Art. 346.29 Tax Code of the Russian Federation. |

| 050 | The value of the deflator coefficient K1 established for the calendar year. They are taken from the relevant order of the Ministry of Economic Development. |

| 060 | The value of the adjustment coefficient of basic profitability K2, which takes into account the totality of the features of doing business. They take it from local law. Values are rounded after the decimal point to the third decimal place inclusive. |

| 070 – 090: | Column 2 – the value of the physical indicator for the corresponding type of business activity in each month of the tax period. The values of physical indicators are indicated in whole units. Column 3 – the number of calendar days of business activity in the month of registration (deregistration) as a UTII payer. Calculate accordingly:

Column 4 – tax base (amount of imputed income) for each calendar month of the tax period. This is the product of lines 040, 050 and 060, as well as lines 070 or 080 or 090 of column 2. If during the tax period an organization or individual entrepreneur was registered (deregistered) as a UTII payer, the tax base for each calendar month of the tax period is determined as the product of lines 040, 050 and 060, as well as the corresponding indicators of lines 070 or 080 or 090 column 2 - 3, taking into account the number of calendar days of activity in the month of registration (deregistration) as a UTII payer. If during the tax period the payer did not register (was not deregistered) as a UTII payer with the tax authority to which the declaration was submitted, dashes are added in all lines 070 - 090 of column 3. |

| 100 | Tax base (amount of imputed income) for the tax period for the corresponding type of business activity at the specified address. This is the sum of lines 070 – 090, column 4. |

| 105 | The tax rate is 15% or the rate established by regulatory legal acts of representative bodies of municipal districts, city districts, laws of Moscow, St. Petersburg and Sevastopol. |

| 110 | The amount of UTII calculated for the tax period for the corresponding type of business activity at the specified address. This is line 100 × page 105 / 100. |

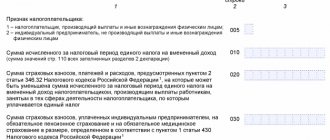

Completing Section 3

| LINE | HOW TO FILL OUT |

| 005 | The taxpayer's characteristics can be one of two:

|

| 010 | The amount of UTII calculated for the tax period. This is the sum of lines 110 of all completed sheets in section 2. |

| 020 | The amount of insurance premiums, payments and expenses (clause 2 of Article 346.32 of the Tax Code of the Russian Federation), by which the UTII calculated for the tax period can be reduced - if they are paid in favor of employees engaged in areas of activity on imputation The issue of reducing UTII for insurance premiums of individual entrepreneurs who do not make payments to individuals was considered in a letter from the Ministry of Finance of Russia, which is in the ConsultantPlus database: According to paragraph 3 of clause 2.1 of Article 346.32 of the Code, individual entrepreneurs who apply UTII and do not make payments and other remuneration to individuals have the right to reduce the amount of UTII by the amount of paid insurance premiums in a fixed amount without applying a limit of 50 percent of the amount of this tax. |

| 030 | The amount of insurance premiums paid by individual entrepreneurs for compulsory health insurance and compulsory medical insurance in the amount determined by clause 1 of Art. 430 Tax Code of the Russian Federation |

| 040 | Sum of all lines 050 of all completed sheets of section 4 |

| 050 | The indicator value cannot be less than 0. When submitting a declaration by an organization or individual entrepreneur making payments and other remuneration to individuals (page 005 is “1”), the value is determined as follows: Page 010 – (page 020 + page 030) – page 040 In this case, the difference between lines 010 and (020 + 030) cannot be less than 50% of the calculated UTII (p. 010). When submitting a declaration of individual entrepreneurs without employees (line 005 is equal to “2”), the value is determined as the difference between lines 010 and 030 and 040. In this case, the difference between lines 010 and 030 must be greater than or equal to zero. |

Completing section 4

| LINE | HOW TO FILL OUT |

| 010 | Name of the cash register model included by the Federal Tax Service in the Register of Cash Register Equipment |

| 020 | Serial number of the KKT model in accordance with the documents related to its purchase |

| 030 | CCP registration number assigned by the tax authority |

| 040 | Date of registration of the cash register with the tax authority |

| 050 | The amount of expenses incurred for the purchase of cash register equipment. Cannot exceed 18,000 rubles. |

If lines 010, 020, 030, 040 and 050 are insufficient, fill out the required number of sheets in section 4 of the UTII declaration.