Basic rules for issuing accountable money

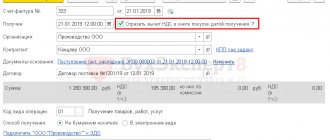

According to clause 6.3 of Directive 3210-U, the issuance of funds to an accountable person is registered with an expense cash order after he has previously drawn up a written application addressed to the head of the company or received an order from the manager on the need to issue the accountable amount.

In the application, the reporting employee argues for the need to issue the amount with a mandatory indication of its size and the deadline for providing the money. After a certain time, the employee must submit an advance report attaching primary documents proving the expenses incurred. From November 30, 2020, the organization can independently set the deadline for the accountable person to submit the advance report. The previous requirement that the JSC must be submitted no later than 3 working days after the expiration date for which the reports were issued, or from the date of return to work, has been cancelled.

What else has changed in reporting and cash transactions since November 30, 2020, see here.

The balance of the unused amount is credited to the cash register on the basis of a cash receipt order, and excess funds spent are issued to the employee on the basis of an expenditure cash order.

ConsultantPlus experts explained in detail what to do if an employee has not returned the accountable amount. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

For the main points about accountable amounts, see the article “Settlements with accountable persons - regulatory documents.”

How to record expenses for business needs

Household expenses

Household expenses usually mean the costs of purchasing office or household supplies, materials, gasoline at a gas station in a retail chain, paying for minor repairs, etc.

How to issue funds for business needs

When issuing money on account, remember that you cannot issue accountable funds to an employee who has not reported on previously issued amounts (clause 4.4 of the Regulations on the procedure for conducting cash transactions, approved by the Bank of Russia dated October 12, 2011 N 373-P).

Please note : from January 1, 2012, a new procedure for issuing accountable amounts is in effect. Now, in order to receive accountable funds, the employee must write an application each time. The head of the company on this application must write the amounts, terms for issuing accountable funds and put his signature and date. There is no longer any need to issue an order with a list of accountable persons.

For example, the statement might look like this:

| Give A.N. Ivanov 2,000 rubles for the report no later than three working days January 11, 2013 General Director Petrov General Director of Aktiv CJSC S.S. Petrov from the manager of the supply department A.N. Ivanova Statement I request you to provide funds to purchase a printer cartridge. | ||

| January 11, 2013 | Ivanov | /A.N. Ivanov/ |

The legislation does not establish any restrictions on the amounts given to employees on account.

However, by paying expenses, the accountable person acts on behalf of the organization. Consequently, the employee who received the money on account must comply with the maximum amount of cash payments (100,000 rubles under one agreement with one company or entrepreneur). This was established by the instruction of the Central Bank of the Russian Federation dated June 20, 2007 N 1843-U.

If an employee violates the established settlement limit, your firm may be fined.

The amount of the fine is from 40,000 to 50,000 rubles. The fine is imposed only on the company that paid in cash (that is, on the buyer). For the same violation, an administrative fine of 4,000 to 5,000 rubles may be imposed on the head of the company (Article 15.1 of the Code of Administrative Offenses of the Russian Federation).

How to record expenses for business needs

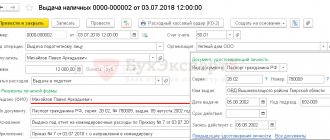

Issue cash to accountable persons from the cash register using a cash receipt order. In the cash receipt note, indicate the purpose for issuing funds (for example, to purchase office supplies).

Accounting for settlements with accountable persons is kept on account 71 “Settlements with accountable persons”. If you gave the employee money from the cash register on account, make the following entry:

Debit 71 Credit 50-1

— funds were issued to the employee against a report from the cash register.

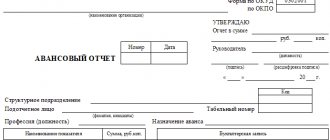

An employee who receives funds on account must account for them. To do this, he needs to submit an advance report to the accounting department in Form N AO-1 (with attached documents confirming expenses), and return unspent funds to the organization’s cash desk (amounts reasonably spent in excess of the issued accountable amount can be reimbursed to the employee).

If the expenses incurred are of a production nature, then the expenses are reflected in the credit of account 71 “Settlements with accountable persons” and the debit of the accounts of costs or valuables purchased by the accountable person.

When accountable persons purchase this or that property, make the following entry:

Debit 08 (07, 10, 41) Credit 71

— property acquired by the accountable person has been capitalized.

When purchasing valuables in retail trade, the employee must submit a sales receipt or invoice and a cash register receipt to the accounting department.

If the expenses of the accountable person are related to the needs of the main (auxiliary or servicing) production, then reflect the expenses by posting:

Debit 20 (23, 29) Credit 71

— the expenses of the accountable person necessary for the needs of the main (auxiliary, servicing) production are written off.

If funds are issued for expenses related to management activities, then make the following entry:

Debit 25 (26) Credit 71

— general production (general business) expenses were paid by accountable persons.

If funds are issued to cover expenses related to the sale of finished products or goods, make an entry:

Debit 44 Credit 71

— costs of accountable persons associated with the sale of finished products (goods) are included in sales expenses.

If the accountable person paid for non-production expenses (for example, expenses for sporting events, recreation, entertainment, etc.), make an entry in the accounts:

Debit 91-2 Credit 71

— expenses of the accountable person of a non-production nature are taken into account as part of other expenses.

The same posting is made if the expenses of the accountable person are related to the receipt of other income by the organization (for example, the employee paid for the repair of fixed assets leased by the organization).

Write off the amount of VAT on expenses or property paid by the accountable person using the following entries:

Debit 19 Credit 71 - the amount of VAT on expenses of accountable persons is taken into account;

Debit 68 subaccount “VAT Calculations” Credit 19 - tax deduction made.

Please note: VAT deduction is provided only if there is an invoice from the supplier of goods (works, services).

The amount of VAT on non-production expenses is not reimbursed from the budget. This amount is written off by posting:

Debit 91-2 Credit 19 - VAT on non-production expenses is written off.

If an employee has spent more than what was given to him from the cash register, then he must be reimbursed this amount.

Reflect this operation by writing:

Debit 71 Credit 50-1 - the employee was reimbursed for expenses exceeding the amount of money issued from the cash register.

If an employee returns unspent amounts to the organization’s cash desk, make an entry in the account: Debit 50-1 Credit 71

— funds not spent by the employee and returned to the organization’s cash desk are capitalized.

If the employee did not submit a report on the expenditure of funds and did not return the funds to the organization’s cash desk within the established time frame, make an entry in the accounting records:

Debit 94 Credit 71

— reflects the amount of unreturned funds.

In the future, the amount of unreturned funds may be withheld from the employee’s salary:

Debit 73 Credit 94

— the employee’s debt is reflected in the amount of the unreturned advance.

Debit 70 Credit 73

— the amount of unreturned funds is withheld from the employee’s salary.

If the debt of the reporting person is written off at the expense of the organization, this amount will have to be included in the employee’s income, subject to personal income tax (Article 209 of the Tax Code of the Russian Federation).

This means that the employee will have to withhold personal income tax, and on the amount of the written-off debt, insurance premiums and contributions for insurance against industrial accidents and occupational diseases will be charged.

Contributions must be accrued since the income was received by the employee as part of an employment relationship.

Household expenses

Household expenses usually mean the costs of purchasing office or household supplies, materials, gasoline at a gas station in a retail chain, paying for minor repairs, etc.

How to issue funds for business needs

When issuing money on account, remember that you cannot issue accountable funds to an employee who has not reported on previously issued amounts (clause 4.4 of the Regulations on the procedure for conducting cash transactions, approved by the Bank of Russia dated October 12, 2011 N 373-P).

Please note : from January 1, 2012, a new procedure for issuing accountable amounts is in effect. Now, in order to receive accountable funds, the employee must write an application each time. The head of the company on this application must write the amounts, terms for issuing accountable funds and put his signature and date. There is no longer any need to issue an order with a list of accountable persons.

For example, the statement might look like this:

| Give A.N. Ivanov 2,000 rubles for the report no later than three working days January 11, 2013 General Director Petrov General Director of Aktiv CJSC S.S. Petrov from the manager of the supply department A.N. Ivanova Statement I request you to provide funds to purchase a printer cartridge. | ||

| January 11, 2013 | Ivanov | /A.N. Ivanov/ |

The legislation does not establish any restrictions on the amounts given to employees on account.

However, by paying expenses, the accountable person acts on behalf of the organization. Consequently, the employee who received the money on account must comply with the maximum amount of cash payments (100,000 rubles under one agreement with one company or entrepreneur). This was established by the instruction of the Central Bank of the Russian Federation dated June 20, 2007 N 1843-U.

If an employee violates the established settlement limit, your firm may be fined.

The amount of the fine is from 40,000 to 50,000 rubles. The fine is imposed only on the company that paid in cash (that is, on the buyer). For the same violation, an administrative fine of 4,000 to 5,000 rubles may be imposed on the head of the company (Article 15.1 of the Code of Administrative Offenses of the Russian Federation).

How to record expenses for business needs

Issue cash to accountable persons from the cash register using a cash receipt order. In the cash receipt note, indicate the purpose for issuing funds (for example, to purchase office supplies).

Accounting for settlements with accountable persons is kept on account 71 “Settlements with accountable persons”. If you gave the employee money from the cash register on account, make the following entry:

Debit 71 Credit 50-1

— funds were issued to the employee against a report from the cash register.

An employee who receives funds on account must account for them. To do this, he needs to submit an advance report to the accounting department in Form N AO-1 (with attached documents confirming expenses), and return unspent funds to the organization’s cash desk (amounts reasonably spent in excess of the issued accountable amount can be reimbursed to the employee).

If the expenses incurred are of a production nature, then the expenses are reflected in the credit of account 71 “Settlements with accountable persons” and the debit of the accounts of costs or valuables purchased by the accountable person.

When accountable persons purchase this or that property, make the following entry:

Debit 08 (07, 10, 41) Credit 71

— property acquired by the accountable person has been capitalized.

When purchasing valuables in retail trade, the employee must submit a sales receipt or invoice and a cash register receipt to the accounting department.

If the expenses of the accountable person are related to the needs of the main (auxiliary or servicing) production, then reflect the expenses by posting:

Debit 20 (23, 29) Credit 71

— the expenses of the accountable person necessary for the needs of the main (auxiliary, servicing) production are written off.

If funds are issued for expenses related to management activities, then make the following entry:

Debit 25 (26) Credit 71

— general production (general business) expenses were paid by accountable persons.

If funds are issued to cover expenses related to the sale of finished products or goods, make an entry:

Debit 44 Credit 71

— costs of accountable persons associated with the sale of finished products (goods) are included in sales expenses.

If the accountable person paid for non-production expenses (for example, expenses for sporting events, recreation, entertainment, etc.), make an entry in the accounts:

Debit 91-2 Credit 71

— expenses of the accountable person of a non-production nature are taken into account as part of other expenses.

The same posting is made if the expenses of the accountable person are related to the receipt of other income by the organization (for example, the employee paid for the repair of fixed assets leased by the organization).

Write off the amount of VAT on expenses or property paid by the accountable person using the following entries:

Debit 19 Credit 71 - the amount of VAT on expenses of accountable persons is taken into account;

Debit 68 subaccount “VAT Calculations” Credit 19 - tax deduction made.

Please note: VAT deduction is provided only if there is an invoice from the supplier of goods (works, services).

The amount of VAT on non-production expenses is not reimbursed from the budget. This amount is written off by posting:

Debit 91-2 Credit 19 - VAT on non-production expenses is written off.

If an employee has spent more than what was given to him from the cash register, then he must be reimbursed this amount.

Reflect this operation by writing:

Debit 71 Credit 50-1 - the employee was reimbursed for expenses exceeding the amount of money issued from the cash register.

If an employee returns unspent amounts to the organization’s cash desk, make an entry in the account: Debit 50-1 Credit 71

— funds not spent by the employee and returned to the organization’s cash desk are capitalized.

If the employee did not submit a report on the expenditure of funds and did not return the funds to the organization’s cash desk within the established time frame, make an entry in the accounting records:

Debit 94 Credit 71

— reflects the amount of unreturned funds.

In the future, the amount of unreturned funds may be withheld from the employee’s salary:

Debit 73 Credit 94

— the employee’s debt is reflected in the amount of the unreturned advance.

Debit 70 Credit 73

— the amount of unreturned funds is withheld from the employee’s salary.

If the debt of the reporting person is written off at the expense of the organization, this amount will have to be included in the employee’s income, subject to personal income tax (Article 209 of the Tax Code of the Russian Federation).

This means that the employee will have to withhold personal income tax, and on the amount of the written-off debt, insurance premiums and contributions for insurance against industrial accidents and occupational diseases will be charged.

Contributions must be accrued since the income was received by the employee as part of an employment relationship.

Issuance for household needs: registration of correspondence on accounts

The issue for reporting purposes for business needs must be recorded by an accountant using a cash receipt order. The entire settlement mechanism involves the preparation of the following entries:

- Dt 71 Kt 50, 51 - accountable funds were issued from the cash register or by transfer from a current account to the employee’s bank card;

- Dt 10, 20, 26... Kt 71 - reflects the costs of the provided accountable amount aimed at purchasing materials, paying general production expenses, general business expenses, etc.;

- Dt 50, 51 Kt 71 - the balance of the unspent accountable amount is returned to the cash desk or to the current account;

- Dt 70 Kt 71 - the balance of the unspent accountable amount is withheld from the employee’s salary.

You can familiarize yourself with the analytical accounting of accountable amounts in the article “Maintaining analytical accounting of settlements with accountable persons.”

Business and other expenses incurred through accountable persons

Reflection in accounting of the issuance (return) of accountable amounts for business and other expenses.

| № | Debit | Credit | Contents of operation |

| Accounting entries when issuing money for reporting | |||

| 1 | 71 | 50-1 | Amounts of funds were issued from the organization's cash desk to employees for reporting, for business and other expenses |

| Accounting entries when transferring money for business and other expenses to employees’ bank cards | |||

| 1 | 71 | 51 | Advance payment for business needs is transferred to the bank card of the organization's employee |

| Accounting entries when returning unused accountable amounts | |||

| 1 | 50-1 | 71 | Unused amounts of money received by the organization’s employees, received by them on account, for business and other expenses were deposited (returned) to the cash register |

| Accounting entries when returning an overexpenditure of the accountable amount | |||

| 1 | 71 | 50-1 | The debt to employees for overexpenditure (according to settlement documents) of the accountable amount of funds from the organization’s cash desk was repaid |

Reflection in accounting of the write-off of expenses incurred by accountable persons when acquiring assets.

| № | Debit | Credit | Contents of operation |

| Accounting entries for the purchase of non-current assets with payment through accountable persons | |||

| 1 | 08 | 71 | The purchase price of the object is reflected (accrued), including VAT |

| 2 | 08 | 71 | Transport and procurement costs are reflected (accrued), including VAT |

| Accounting entries for the purchase of assets related to working capital with payment through accountable persons | |||

| 1 | 07, 10, 41, 15 | 71 | The purchase price of inventory items is reflected (accrued), including VAT |

| 2 | 07, 10, 41, 15 | 71 | Transport and procurement costs are reflected (accrued), including VAT, if they are included in the actual cost of purchasing inventory items |

| Accounting entries for the purchase of monetary documents (including VAT) with payment through accountable persons | |||

| 1 | 50-3 | 71 | The receipt of monetary documents to the organization's cash desk from accountable persons is reflected in the amount of actual costs for their acquisition (including VAT) |

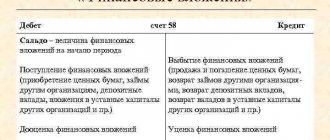

| Accounting entries when purchasing securities with payment of their full value in cash | |||

| 1 | 58 | 71 | The actual initial cost of securities accepted onto the organization's balance sheet is calculated. The cost of purchasing securities was paid through accountable persons |

| Accounting entries when reflecting the organization's expenses on assets received free of charge | |||

| 1 | 91-2 | 71 | The cost of expenses incurred by accountable persons, including VAT, on assets received free of charge is written off as other expenses of the organization |

Reflection in accounting of write-offs of expenses incurred by accountable persons when paying for work (services) of third-party organizations.

| № | Debit | Credit | Contents of operation |

| Accounting entries in industrial enterprises when reflecting work (services) of third-party organizations with payment through accountable persons | |||

| 1 | 20, 23, 25, 26, 29, 44 subaccount “Business expenses” | 71 | The cost of consumed work (services) with VAT, performed (provided) by third parties for industrial enterprises, has been written off (reflected) |

| Accounting entries in trade enterprises when reflecting work (services) of third-party organizations with payment through accountable persons | |||

| 1 | 44 subaccount “Distribution costs” | 71 | The cost of consumed work (services) with VAT, performed (provided) by third-party organizations for trade enterprises, has been written off (reflected) |

Reflection in accounting of entertainment expenses paid through accountable persons.

| № | Debit | Credit | Contents of operation |

| Accounting entries in a production organization | |||

| 1 | 26, 44 subaccount “Business expenses” | 71 | Representation expenses (expenses) paid through accountable persons are included in commercial (general business) expenses |

| Accounting entries in trade organization | |||

| 1 | 44 subaccount “Distribution costs” | 71 | Representation expenses (expenses) paid through accountable persons are reflected as part of distribution costs |

Reflection in accounting of write-offs of expenses incurred by accountable persons for transactions related to wages.

| № | Debit | Credit | Contents of operation |

| Accounting entries when paying wages to employees according to pay slips at the post office | |||

| 1 | 70 | 71 | The amount of wage payments according to pay slips at the post office was written off |

| Accounting entries for deductions from employees' wages based on writs of execution | |||

| 1 | 70 | 71 | The amount under writs of execution is withheld from the employee’s salary |

| Accounting entries when transferring deductions by postal order | |||

| 1 | 76 | 71 | The amount of the postal transfer of the accountable person (accountant) responsible for deductions by order of judicial authorities (other deductions) is reflected. |

Reflection in accounting of write-offs of expenses incurred by accountable persons for other transactions.

| № | Debit | Credit | Contents of operation |

| Accounting entries when reflecting services provided to correct defects in production with payment through accountable persons | |||

| 1 | 28 | 71 | The cost of consumed work (services) with VAT is written off for the costs of the current period (month) |

| Accounting entries when writing off transportation and procurement expenses of accountable persons in wholesale and retail trade as distribution costs | |||

| 1 | 44 subaccount “Distribution costs” | 71 | Costs including VAT for the procurement and delivery of goods to central warehouses (bases) are reflected (accrued), if they are included in the cost of sales in trade organizations |

| Accounting entries when writing off transportation and procurement costs, without settlement documents through accountable persons, for the shipment of products (goods) | |||

| 1 | 45 | 71 | The cost of transportation and procurement costs including VAT is included in the cost of shipped products (goods) |

| Accounting entries when repaying accounts payable through accountable persons | |||

| 1 | 60, 76 | 71 | The amount of the organization's accounts payable has been written off in whole or in part for settlements with accountable persons |

| Accounting entries when reflecting target expenses made through accountable persons | |||

| 1 | 86 | 71 | The cost of expenses financed through the intended use of funds has been accrued |

| Accounting entries when writing off expenses due to emergency circumstances with payment through accountable persons | |||

| 1 | 91-2 | 71 | Payment for emergency expenses was made through accountable persons of the organization |

| Accounting entries when selling securities externally through accountable persons | |||

| 1 | 91-2 | 71 | The expenses of accountable persons for the sale of securities are reflected as part of other expenses of the selling organization. The sale of securities is not the main activity of the organization |

| Accounting entries when reflecting deferred expenses made through accountable persons | |||

| 1 | 97 | 71 | The cost of incurred expenses of future periods including VAT has been accrued |

Nuances of reflecting accountable money in accounting

When reflecting transactions with accountable amounts in accounting, you must remember the following important points:

- The company must have an officially approved list of employees who have the right to receive funds on account.

- In order to correctly process settlements with accountable persons, an order must be issued that specifies the limit of accountable amounts and the procedure for their issuance and return.

- Advance reports drawn up with errors and corrections, as well as not supported by relevant expense documents, should not be accepted for accounting.

Check whether you are issuing money correctly on account and recording the calculation in accounting, using a Ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

You can read more about these and other rules in the article “Procedure for issuing advances to accountable persons (nuances).”

Results

Correct execution of advance reports and cash documents for the issuance and acceptance of accountable amounts guarantees competent accounting for account 71 “Settlements with accountable persons.”

The formation of transactions must be carried out in accordance with the chart of accounts current in the Russian Federation, and the mechanism for issuing and receiving accountable amounts - in accordance with the instructions of the Central Bank of the Russian Federation No. 3210-U. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.