The procedure for executing a court decision to write off debt

A court decision to collect a debt from an individual that is not executed voluntarily is transferred to bailiffs for forced collection. Execution of a court decision is carried out in accordance with the requirements of Federal Law dated October 2, 2007 N 229-FZ.

First of all, debt repayment will be carried out using funds in the accounts and deposits of individuals. If there is insufficient money in the accounts, repayment of the debt is carried out at the expense of other property of the debtor, which belongs to him by right of ownership.

Ways to change the amount of salary deduction

If the borrower has children or wants to resolve the issue of repayment out of court, then the case can be resolved on much more favorable terms:

- Changing the method of loan repayment.

The debtor's right is enshrined in Part 5, Art. 69 Federal Law “On Enforcement Proceedings”. According to the law, if the borrower wants to change the method of collection by deduction from salary, he must write a statement to the bailiffs. In particular, the court should be asked to pay attention to the debtor’s other property, which is also valuable.

- Resolving a dispute with the bank.

As practice shows, this does not always work. But on the other hand, it is more profitable for the bank to agree with the debtor on the monthly payment of a slightly smaller amount towards the debt than to open paperwork and spend money on litigation. If there is a way to negotiate directly, then that's even better.

- Arranging for installment payments.

The Federal Law “On Enforcement Proceedings” allows for the provision of installment plans to repay debt from the borrower’s salary or other property. To obtain it, you will need to write an application to the court asking for such an installment plan. If the court approves the petition, the debtor will be required to pay a monthly amount in accordance with the amendments to the installment order. This form of payment is especially relevant when the borrower has a minor child or dependents.

Author of the article

Why does the bailiff block a salary card?

The recovery applies to all bank accounts of an individual, including those opened for salary cards. The answer to the question: how much bailiffs can withdraw from wages is very simple in this case. The write-off will be made in the full amount of the debt. If there is not enough money in the account, the salary card will be blocked. It will not be possible to make expenditure transactions from it until the amount specified in the writ of execution is repaid in full.

What to do in this case? How to remove the block? How long will it take for the bailiff to give you your salary? People who find themselves in a similar situation need to understand that they can avoid such troubles by fully repaying debts under court decisions.

Common mistakes

Error: The accountant made deductions according to writs of execution from the employee’s salary before paying income tax to the budget.

Comment: The amounts of deductions under writs of execution are calculated after personal income tax is withheld from the salary.

Error: The accountant withheld funds under a writ of execution from the employee’s maternity benefits.

Comment: It is prohibited to make deductions from state child benefits, B&R benefits, one-time payments to pregnant women for early registration in gynecology, as well as one-time and regular payments for child support.

When are wages garnished?

The bailiff sends the employer a writ of execution to collect debts from the employee if at least one of the following conditions is met (Article 98 229-FZ):

- periodic payments are collected;

- the debt does not exceed 10,000 rubles;

- insufficiency of the debtor's property to repay the debt being collected.

The FSSP can obtain information about the debtor’s place of work from the debtor himself, as well as by sending requests to the Federal Tax Service and the Pension Fund. Each employer provides these regulatory authorities with information about the place of work and accrued income of each employee.

Distribution of alimony

Or, let’s say, in relation to an employee there are three decisions at once: for the maintenance of a spouse in the amount of 0.6 of the subsistence minimum for the working population, for the maintenance of a son (in the amount of 1/4 of monthly income) and for the maintenance of a daughter (in the amount of 1/6 of income monthly). As follows from Article 90 of the Family Code of the Russian Federation, amounts paid for the maintenance of a former spouse are also recognized as alimony. Consequently, in all three cases we are talking about alimony, but the “catch” is that the “ceiling” of deductions of 70% is provided specifically for child support. Thus, to satisfy claims regarding the employee’s spouse, no more than half of the earnings can be withheld.

At the same time, while establishing the order of satisfaction of demands for several writs of execution, the legislator did not separate child support from other alimony. This means that for the purposes of priority and distribution of money, penalties for all three writs of execution will relate to one priority – the first. Therefore, in this case, the rule of paragraph 3 of Article 111 of Law No. 229-FZ will apply: if the amount of money collected from the debtor is insufficient to satisfy the demands of one line in full, then they are satisfied in proportion to the amount due to each claimant specified in the writ of execution.

This means that the algorithm of actions in this case will be as follows. First, the amount of alimony for the maintenance of the spouse and both children must be withheld from the employee’s earnings up to 50% of the employee’s earnings. The amount thus withheld is distributed among all claimants in proportion to the amount due to each of them.

After this, you need to make additional withholding of child support so that the collection does not exceed 70% of earnings. The withheld amount is distributed only among the children in proportion to the amount due to each of them.

How much can a bailiff deduct from your salary?

How much percentage of the salary bailiffs withhold is given in each executive document. Or it will indicate the amount to be withheld in a fixed amount. The maximum possible amount of deduction from an employee’s salary is specified in Article 138 of the Labor Code of the Russian Federation. It states that in any case the employee must retain 50% of his earnings. In exceptional cases, the retention rate can reach 70%. Such situations include:

- deductions while serving correctional labor;

- collection of alimony;

- compensation for harm caused to life and health;

- compensation for damage caused by the crime.

Secrets of calculating deductions based on writs of execution. Restrictions on collections. ZUP 3.1

The first two secrets of calculating deductions based on writs of execution were revealed in the article Secrets of calculating deductions based on writs of execution. ZUP 3.1

It turns out that there are still secrets... We will reveal the secret of calculating in the ZUP deductions based on writs of execution, taking into account the restrictions on collections, using examples and pictures, based on ZUP.3.1.14.555.

The easy availability of all kinds of loans, and the inability to then pay off obligations, gives rise to a bunch of lawsuits and writs of execution... There are cases when an employee has 10 writs of execution, each of which is issued to withhold 30% of the salary... That is. Every month you need to withhold 300% of your salary... It's sad... But! According to the law, no more than 50% of the salary can be withheld from an employee under all writs of execution.

In Art. 138 of the Labor Code of the Russian Federation states that the total amount of all deductions for each salary payment cannot exceed 20%, and in cases provided for by federal laws, all deductions should not exceed 50% of the salary due to the employee. Deductions under writs of execution are the very cases provided for by federal laws.

When a penalty is withheld from a salary under several writs of execution, the employee must retain 50% of the salary (i.e., for all writs of execution, only 50% of the salary can be withheld from the employee. In this case, the salary means the amount of the accrued salary minus personal income tax). But there are exceptions: 70% of earnings can be withheld from an employee’s salary in the following cases: deductions from wages when collecting alimony for minor children, compensation for harm caused to the health of another person, compensation for harm to persons who suffered damage due to the death of the breadwinner, and compensation for damage caused by the crime.

In ZUP.3.1, a new functionality “Limitation of Collections” has appeared. Using this functionality allows you to limit the amount of deductions for all collections to certain limits, taking into account the order of collections. But how does this functionality work? What algorithm does the program use to limit deductions on writs of execution... there is nowhere to read about this... And it is sometimes simply impossible to reach the amounts calculated by the program by calculation... without knowing the algorithm. Here. Let's reveal this secret!

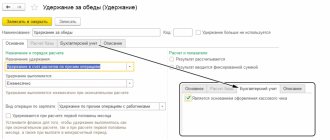

The “Limitation of collections” functionality is enabled in the “Settings” - “Payroll calculation” - V “Limit the amount of deductions to a percentage of wages” section.

After activating this setting:

— in the “Salary” Section the document “Restrictions on Collections” becomes available,

— in the deduction settings the attribute “Is a collection” will appear,

— in the document “Writ of Execution” the detail “Sequence of Collection” will appear:

The “Limitation of collections” functionality is valid for deductions that have the V flag “Is a collection” set.

For deductions with the purpose “Writ of Execution”, flag V “Is a collection” is set by default and is not available for editing.

For deductions with the purpose “Paying agent remuneration”, the “Is a collection” flag is not selected by default and is not available for editing.

For all other deductions with purposes other than “Writ of Execution” and “Paying Agent Remuneration”, flag V “Is a collection” is available for editing! Any of your deductions can be assigned to the system as a collection by setting the flag V “Is a collection”! And for such deductions the “Limitation of Collections” functionality will also be applied. Such other deductions are always limited to 20 percent of the salary (in the program code for other deductions = collections, a coefficient of 0.2 is indicated (which is equal to 20%)).

In enforcement proceedings, each penalty has its own priority. In Art. 111 of the Federal Law on Enforcement Proceedings No. 229-FZ defines the “Sequence of satisfying the claims of claimants”:

1. In the event that the amount of money collected from the debtor is insufficient to satisfy in full the requirements contained in the enforcement documents, the specified amount is distributed among the claimants who presented the enforcement documents on the day of distribution of the corresponding amount of money, in the following order:

1) first of all , claims for the collection of alimony, compensation for harm caused to health, compensation for harm in connection with the death of the breadwinner, compensation for damage caused by a crime, as well as claims for compensation for moral damage are satisfied;

2) secondly, the requirements for the payment of severance pay and wages of persons working (who worked) under an employment contract are satisfied, as well as for the payment of remuneration to the authors of the results of intellectual activity;

3) thirdly, the requirements for mandatory payments to the budget and extra-budgetary funds are satisfied;

4) fourthly, all other requirements are satisfied.

2. When distributing each sum of money collected from the debtor, the claims of each subsequent queue are satisfied after the claims of the previous queue are satisfied in full.

3. If the amount of money collected from the debtor is insufficient to satisfy the demands of one line in full, then they are satisfied in proportion to the amount due to each claimant specified in the writ of execution.

If the “Limitation of Collections” functionality is activated in the program, then in each document “Writ of Execution” it will be necessary to fill in the details “Sequence of Collection”.

If the “Withheld when calculating the first half of the month” flag is set in the deduction settings, then the calculation of such deduction will be performed not only during the final calculation of salaries (in the document “Calculation of salaries and contributions”), but also when calculating the first half of the month (in the document “Accruals for the first half of the month”), and when paid during the interpayment period (in the documents “Bonus”, “Vacation”, “One-time accrual”, “Dismissal”..., in which the payment method “In the interaccount period” is selected).

Moreover, in documents when calculating the first half of the month (in the document “Accruals for the first half of the month”), and in documents with accruals paid during the interpayment period (in the documents “Bonus”, “Vacation”, “One-time accrual”, “Dismissal” ..., in which the payment method “During the intersettlement period” is selected) - the Restriction withholding functionality is applied directly in the same document! Those. the program will calculate the withholding in accordance with the specified percentage/share/amount of withholding in the “Writ of Execution” document and will immediately apply the “Limitation of Collections” functionality itself, in accordance with the “Sequence of Collection” settings in the “Writ of Execution” document.

But during the final calculation of wages (in the document “Calculation of salaries and contributions”), the program calculates the full amount of deduction under the writ of execution, in accordance with the specified percentage/share/amount of deduction in the document “Writ of Execution”. And then the user needs to create a document “Limitation of Collections” (Section “Salary” - “Limitation of Collections”) - and in it the program will apply the “Limitation of Collections” functionality, in accordance with the settings “Sequence of Collections” in the document “Writ of Execution”, and will limit the amount of withholding under writs of execution (will reduce the amount of withholding under IL in the current month to the allowable amount, and the difference (what could not be withheld) will be recorded as debt).

If the user forgets to create a “Limitation of Collections” document, the program will deduct the full amount of deduction from the employee for each writ of execution!

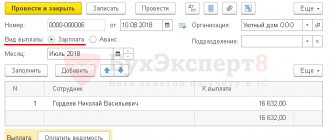

In the “Limitation of Collections” document, you need to indicate the “Month of accrual” and click the “Fill” button - the program itself will identify employees whose withholding amount exceeds the amounts established by law and will limit their deductions for writs of execution (as well as for other deductions=collections).

In the document “Limitation of Collections”:

— in the “Calculated” detail — the full amount of deduction under the writ of execution for the month is displayed, which is calculated during the final settlement (in the document “Calculation of salaries and contributions”).

— in the “Result” detail — the amount of withholding under the writ of execution, calculated taking into account the limitation of collection, is displayed. After posting the “Limitation of Collections” document, it is this amount of deduction that will be displayed on the employee’s payslip (and in all other reports containing data on deductions).

— in the “Debt” attribute — the difference between “Calculated” and “Result” is displayed (“Debt” = “Calculated” - “Result”). By this amount, the program will reduce the amount of deductions under writs of execution in the current month and record this amount as a debt in the accumulation register “Debt on deductions of individuals.”

When calculating salaries next month, in the document “Calculation of salaries and contributions”, the program will remember the amount of “Debt” generated and not withheld in the previous month, and will reflect the amount of debt on the “Deductions” tab in the “Debt” column and take this amount into account when calculating the amount deductions under a writ of execution - i.e. the program will calculate the full amount of deduction according to the writ of execution based on the accruals of the current month, then add “Debt” to the received amount - and this amount will be reflected in the “Result” column - this will be the amount of deduction according to IL, which we will see in the pay slip (until we create and we will carry out the document “Restrictions on Collection”).

And so on every subsequent month! (Each month a new debt amount will be calculated. It may decrease or increase).

Now let’s look at how the program makes this very limitation? By what algorithm?

Sequence of collection.

It is important to understand here that each writ of execution has a priority of collection: First stage, Second stage, Third stage or Fourth stage. We must first of all hold deductions under the First Stage writs of execution. If after this it is still possible to deduct from the employee (that is, if for the First stage less than 50% of the salary is withheld), then we begin to withhold deductions according to the writs of execution of the Second stage. If, after the deductions of the Second Stage, something can still be withheld, then we detain it according to the writs of execution of the Third Stage, and then the Fourth Stage. And only then other deductions = collections are withheld (not deductions based on writs of execution). BUT! For other deductions the limit is always 20%. Remember this!

Those. if an employee has deductions under the writs of execution of the First Stage and the Second Stage, then it may turn out that there is not enough money at all for deductions under the writs of execution of the Second Stage, and then the program will record the entire amount of deduction under the writs of execution of the Second Stage in “Debt”.

For example, an employee is assigned a deduction under IL No. 1 “First priority 50%” in the amount of 50%. And the employee was assigned a deduction under IL No. 2 of the “Fourth Stage” in the amount of 30%. In this case, the entire amount that can be withheld from the employee (and this is no more than 50% of the accrued salary) will relate to the deduction under IL No. 1 “First stage 50%” in the amount of 50%. The program will calculate the deduction for IL No. 2 of the “Fourth Stage” every month in the amount of 30% and transfer the entire amount of deduction to “Debt”. Every month the “debt” will increase. And this will happen until the deduction for IL No. 1 “First stage 50%” in the amount of 50% ends. Like this! And only then the program will begin to maintain a deduction for IL No. 2 of the “Fourth Phase” in the amount of 30%. Moreover, the program will withhold 30% of the current month’s accruals - like the current month’s deduction. And plus, the program will retain an amount of 20% of the current month’s accruals - as the amount of “debt” - reducing the “debt” every month. In total, every month 50% of the employee’s salary will be withheld - the maximum deduction established by law.

Acceptable percentages for limiting deductions under writs of execution.

Again. According to the law, no more than 50% of the salary can be withheld from an employee under all writs of execution.

But deductions under “First Stage” writs of execution may be limited to 50 percent and 70 percent. For this purpose, the program has created two types of “priority of collection”: “First priority (up to 50% of earnings)” and “First priority (up to 70% of earnings).”

You can withhold 70% of the salary when collecting:

- alimony for minor children,

- compensation for harm caused to the health of another person,

- compensation for damage to persons who suffered damage due to the death of the breadwinner,

- compensation for damage caused by the crime,

- while serving correctional labor.

Only for these deductions according to IL, you can withhold up to 70% of your earnings. In all other cases, the total amount of deduction for IL is limited to 50 percent.

Let's look at an example: How the program calculates the restriction on IL if an employee is assigned four writs of execution with different percentages of the restriction (the examples are not real, just to understand the calculation algorithm):

First IL No. 1: deduction of 60% of salary “First priority (up to 70% of earnings).”

Second IL No. 2: deduction of 55% of salary “First priority (up to 70% of earnings).”

Third IL No. 3: deduction of 45% of salary “First priority (up to 50% of earnings).”

Fourth IL No. 4: deduction of 40% of salary “First priority (up to 50% of earnings).”

The employee received a salary of RUB 100,000.00. Personal income tax 13,000.00 rub. Calculation base for IL = 100,000.00 - 13,000.00 = 87,000.00 rub.

Amount of deduction for IL No. 1 (excluding restrictions) = 87,000.00 * 60% = 52,200.00 rub.

Amount of deduction for IL No. 2 (excluding restrictions) = 87,000.00 * 55% = 47,850.00 rub.

Amount of deduction for IL No. 3 (excluding restrictions) = 87,000.00 * 45% = 39,150.00 rub.

Amount of deduction for IL No. 4 (excluding restrictions) = 87,000.00 * 40% = 34,800.00 rub.

Total amount of deduction for all four ILs = 52,200.00 + 47,850.00 + 39,150.00 + 34,800.00 = 174,000.00 rubles. This, of course, is more than the required 50% of the salary. And even more than 70% of the salary.

It is acceptable to withhold 50% of the salary = RUB 43,500.00.

But in our case, for two writs of execution, it is permissible to withhold 70% of the salary = 60,900.00 rubles.

Those. In total, a maximum of 70% of the salary can be withheld from an employee for all four writs of execution = RUB 60,900.00. But two writs of execution are limited to 50% and two more writs of execution are limited to 70%.

How will the program limit withholdings? The following describes the current algorithm from ZUP.3.1.14.555.

First, the program divides all deductions by Sequence. And for each priority, it separately begins to calculate and distribute the amounts of deductions. In our example, the priority of all four writs of execution is the same: First priority. This means that all four of these writs of execution will be calculated and distributed simultaneously.

Next, the program selects all allowable percentages

deductions based on writs of execution: in our example, we have two percent of allowable deductions:

— 70% for writs of execution No. 1 and No. 2.

— 50% for writs of execution No. 3 and No. 4.

For each allowable percentage of the limit (starting from the minimum), the program calculates the amount that can be withheld:

We start with the minimum acceptable retention percentage - 50%.

I was asked a question: why did they start calculating the retention limit at 50% and not at 70%? I don't know the exact answer. I can only guess. The fact is that the law says: “When distributing each sum of money collected from the debtor, the demands of each subsequent queue are satisfied after the demands of the previous queue are satisfied in full.”

We have four writs of execution of one stage “First stage”. If we start withholding amounts from writs of execution with the priority “First priority (up to 70% of earnings),” then it may turn out that there will no longer be enough amounts for the remaining writs of execution with the priority “First priority (up to 50% of earnings).” But all four writs of execution are the first stage! And we must withhold the amounts for each writ of execution of the First Stage. Therefore, we start with a minimum percentage of 50% and apply it immediately for all writs of execution of the First stage: both “First stage (up to 50% of earnings)” and “First stage (up to 70% of earnings)”.

Let's continue. We start with the minimum acceptable retention percentage - 50%.

Amount that can be withheld (50% of salary) = 87,000.00 * 50% = 43,500.00.

This amount can be withheld from all four writs of execution.

We need to distribute this amount of 43,500.00 to all four writs of execution, in proportion to the share of the full amount of each writ of execution in the total amount of the full amounts of deductions for all four writs of execution.

Full amount of deduction for IL No. 1 (excluding restrictions) = 87,000.00 * 60% = 52,200.00 rub.

Full amount of deduction for IL No. 2 (excluding restrictions) = 87,000.00 * 55% = 47,850.00 rub.

Full amount of deduction for IL No. 3 (excluding restrictions) = 87,000.00 * 45% = 39,150.00 rub.

Full amount of deduction under IL No. 4 (excluding restrictions) = 87,000.00 * 40% = 34,800.00 rub.

Total total withholding amount for all four ILs = 52,200.00 + 47,850.00 + 39,150.00 + 34,800.00 = 174,000.00 rubles.

Let's calculate the permissible withholding amount within 50% for each IL: distribute the amount 43,500.00:

Amount of deduction for IL No. 1 (50% limit) = 43,500.00 / 174,000.00 * 52,200.00 = 13,050.00 rub.

Amount of deduction for IL No. 2 (50% limit) = 43,500.00 / 174,000.00 * 47,850.00 = 11,962.50 rubles.

Amount of deduction for IL No. 3 (50% limit) = 43,500.00 / 174,000.00 * 39,150.00 = 9,787.50 rub.

Amount of deduction for IL No. 4 (50% limit) = 43,500.00 / 174,000.00 * 34,800.00 = 8,700.00 rub.

Total amount of withholding (50% limit) for all four ILs = 13,050.00 + 11,962.50 + 9,787.50 + 8,700.00 = 43,500.00. That's right!

Total. Of the allowable 60,900.00 (70% of salary deductions), we have already distributed 43,500.00.

17,400.00 remains to be distributed.

Now we move on to the next allowable percentage of the limitation - for us it is 70%.

Amount that can be withheld = 87,000.00 * 70% = 60,900.00.

As we wrote above, we have already distributed the amount of 43,500.00 above. This means that the amount left to distribute is 17,400.00.

This amount of 17,400.00 can be withheld only from two writs of execution (No. 1 and No. 2).

This amount of 17,400.00 is distributed over two writs of execution, in proportion to the share of the full amount of each writ of execution in the total amount of the full amounts of deductions for these two writs of execution.

Full amount of deduction for IL No. 1 (excluding restrictions) = 87,000.00 * 60% = 52,200.00 rub.

Full amount of deduction for IL No. 2 (excluding restrictions) = 87,000.00 * 55% = 47,850.00 rub.

Total total amount of deduction under writs of execution with the priority “First priority (up to 70% of earnings)” = 52,200.00 + 47,850.00 = 100,050.00 rub.

For each writ of execution, we calculate the permissible amount of deduction within 70%: we distribute the amount of 17,400.00:

Amount of deduction for IL No. 1 (70% limit) = 17,400.00 / 100,050.00 * 52,200.00 = 9,078.26 rubles.

Amount of deduction for IL No. 2 (70% limit) = 17,400.00 / 100,050.00 * 47,850.00 = 8,321.74 rubles.

Total amount of withholding (70% limit) for two ILs = 9,078.26 + 8,321.74 = 17,400.00

Total. Of the allowable 60,900.00 (70% of salary deductions), we distributed 43,500.00 + 17,400.00 = 60,900.00. That's right!

Now we calculate the “total amount of deduction taking into account the limitation” for each writ of execution:

Amount of deduction for IL No. 1 (taking into account the 70% limit) = 13,050.00 + 9,078.26 = 22,128.26 rubles.

Amount of deduction for IL No. 2 (taking into account the 70% limitation) = 11,962.50 + 8,321.74 = 20,284.24 rubles.

Amount of deduction for IL No. 3 (subject to the 50% limitation) = RUB 9,787.50.

Amount of deduction for IL No. 4 (subject to the 50% limitation) = RUB 8,700.00.

Total withheld for all IL = 22,128.26 + 20,284.24 + 9,787.50 + 8,700.00 = 60,900.00 rub. That's right!

Hooray! Happened!

If an employee is assigned deductions for writs of execution with different priorities, then first the entire calculation is made for writs of execution with the highest priority (the highest priority is First, the lowest priority is Fourth). If, after calculating the amounts of deductions for the highest priority, there is still an allowable amount of deduction left, then the calculation begins for the writs of execution of the next priority. The amount that remains from the amount of the maximum allowable deduction minus the amount of deductions calculated according to writs of execution with a higher priority is distributed.

Wow! It seems that these are all the secrets of the “limitation of deductions based on writs of execution”!

If you have any questions, write! Maybe you have your own special cases? Write! We'll figure it out! And don’t forget to give pluses! It costs you nothing! And I have a reward!

The employee received several enforcement documents

If a company receives several writs of execution for an employee, then a logical question arises for the accountant: how to properly make deductions. In this case, it is necessary to refer to Article 111 229-FZ, which establishes the order of repayment of claims. For individuals it will look like this:

- Alimony, compensation for harm to health and life, damage caused by a crime.

- Mandatory payments to the budget and extra-budgetary funds.

- Other requirements.

When enforcement documents are received for debt collection under the claims of one queue, they are executed in calendar order.

Which deductions do not fall under the new standard?

In some cases, the norms of Part 3.1 of Art. 99 Federal Law No. 229 dated 02.10.2007. According to them, the subsistence minimum cannot be maintained if the following amounts are withheld:

- alimony;

- for compensation for harm caused to human health (after the death of the breadwinner);

- for compensation for damage caused during the commission of a crime.

These types of deductions are allowed even when the debtor has an amount remaining that is less than the PM. Moreover, their value can reach 70% of earnings.

A clear example of retention without saving PM.

The debtor's salary is 25 thousand rubles. Every month alimony is withheld from him (70% of his earnings). As a result, he is left with 7,500 rubles. The rule on preserving PM does not apply here, even if you contact the bailiff.

For failure to maintain the amount of the monthly wage where it is required, the employer may be held administratively liable. If an employee who discovers such a violation files a complaint with the bailiffs, penalties will be applied to the employer under Part 3 of Art. 17.14 Code of Administrative Offences. The article implies a fine of 50–100 thousand rubles.

An employer who has not received the appropriate sheet from the bailiffs may withhold the amount from the debtor, taking into account 50 and 70%. Even if after this the debtor is left with an amount that does not reach the subsistence level. Under such circumstances, sanctions will not be applied to the employer.

ConsultantPlus experts explained step by step how to withhold amounts from employees’ income under executive documents and reflect these transactions in accounting. Get trial demo access to the K+ system and switch to the Ready-made solution for free.

How is money withheld from your salary?

The enforcement act is received by the debtor’s accounting department from the claimant or an official of the FSSP.

The claimant can send the document personally:

- to transfer periodic collections;

- if the amount of monetary penalties does not exceed 25,000 rubles

Note!

The claimant sends the enforcement act together with a written application addressed to the debtor's employer, indicating the details of the credit institution and the account number opened in his name.