The essence of the problem

The provision of human resources is a problem in all areas of activity.

Not only is it difficult to find a decent specialist, but also the main employee may be absent for a long time. For example, in the summer, when the busy holiday season begins, the enterprise begins to have widespread holidays and business becomes difficult. In addition, any employee can get sick. It's good if the cold ends in one or two weeks. But situations are different. There are many reasons for employees being absent from work. But the company's activities should not suffer. Therefore, it is important for the employer to take care of the duties of absentees. It is not enough to arbitrarily assign responsibilities to a subordinate; you need to pay for the work above the norm.

Rules of user conduct on the site

Article 149 of the Labor Code of the Russian Federation:

When performing work in conditions deviating from normal (when performing work of various qualifications, combining professions (positions), overtime work, working at night, weekends and non-working holidays and when performing work in other conditions deviating from normal), the employee is subject to appropriate payments provided for by labor legislation and other regulatory legal acts containing labor law norms, collective agreements, agreements, local regulations, and employment contracts. The amounts of payments established by a collective agreement, agreements, local regulations, employment contract cannot be lower than those established by labor legislation and other regulations containing labor law norms.

Article 150 of the Labor Code of the Russian Federation:

When an employee with a time wage performs work of various qualifications, his work is paid for work of a higher qualification.

When an employee with piecework wages performs work of various qualifications, his work is paid according to the rates of the work he performs.

In cases where, taking into account the nature of production, workers with piecework wages are entrusted with performing work that is charged below the grades assigned to them, the employer is obliged to pay them the difference between grades.

Article 151 of the Labor Code of the Russian Federation:

When combining professions (positions), expanding service areas, increasing the volume of work, or performing the duties of a temporarily absent employee without release from work specified in the employment contract, the employee is paid additionally.

The amount of additional payment is established by agreement of the parties to the employment contract, taking into account the content and (or) volume of additional work (Article 60.2 of this Code).

Article 152 of the Labor Code of the Russian Federation:

Overtime work is paid for the first two hours of work at least one and a half times the rate, for subsequent hours - at least twice the rate. Specific amounts of payment for overtime work may be determined by a collective agreement, local regulations or an employment contract. At the request of the employee, overtime work, instead of increased pay, can be compensated by providing additional rest time, but not less than the time worked overtime.

Part 2 of Article 95 of the Labor Code of the Russian Federation:

In continuously operating organizations and in certain types of work, where it is impossible to reduce the duration of work (shift) on a pre-holiday day, overtime is compensated by providing the employee with additional rest time or, with the employee’s consent, payment according to the standards established for overtime work.

Article 153 of the Labor Code of the Russian Federation:

Work on a weekend or a non-working holiday is paid at least double the amount:

- piece workers - no less than double piece rates;

- employees whose work is paid at daily and hourly tariff rates - in the amount of at least double the daily or hourly tariff rate;

- employees receiving a salary (official salary) - in the amount of at least a single daily or hourly rate (part of the salary (official salary) for a day or hour of work) in excess of the salary (official salary), if work on a day off or a non-working holiday was carried out on within the limits of the monthly working time standard, and in an amount of at least double the daily or hourly rate (part of the salary (official salary) for a day or hour of work) in excess of the salary (official salary), if the work was performed in excess of the monthly working time standard.

Specific amounts of payment for work on a day off or a non-working holiday may be established by a collective agreement, a local regulatory act adopted taking into account the opinion of the representative body of employees, or an employment contract.

At the request of an employee who worked on a day off or a non-working holiday, he may be given another day of rest. In this case, work on a weekend or a non-working holiday is paid in a single amount, and a day of rest is not subject to payment.

Remuneration for work on weekends and non-working holidays of creative workers of the media, cinematography organizations, television and video crews, theaters, theatrical and concert organizations, circuses and other persons involved in the creation and (or) performance (exhibition) of works, in accordance with lists of jobs, professions, positions of these workers, approved by the Government of the Russian Federation, taking into account the opinion of the Russian Tripartite Commission for the Regulation of Social and Labor Relations, can be determined on the basis of a collective agreement, a local regulatory act, or an employment contract.

Article 154 of the Labor Code of the Russian Federation:

Each hour of work at night is paid at an increased rate compared to work under normal conditions, but not lower than the amounts established by labor legislation and other regulatory legal acts containing labor law norms.

The minimum increases in wages for night work are established by the Government of the Russian Federation, taking into account the opinion of the Russian Tripartite Commission for the Regulation of Social and Labor Relations.

The specific amounts of increased wages for night work are established by a collective agreement, a local regulatory act adopted taking into account the opinion of the representative body of workers, and an employment contract.

Decree of the Government of the Russian Federation of July 22, 2008 N 554 “On the minimum amount of increase in wages for work at night”:

The minimum increase in wages for work at night (from 10 p.m. to 6 a.m.) is 20 percent of the hourly tariff rate (salary (official salary) calculated per hour of work) for each hour of work at night.

Explanation of the State Committee for Labor of the USSR, the Secretariat of the All-Union Central Council of Trade Unions “On the procedure for calculating hourly wage rates for employees whose work is paid at daily and monthly rates (salaries), to determine additional wages for work at night” (approved by the Resolution of the State Committee for Labor of the USSR, the Secretariat of the All-Union Central Council of Trade Unions dated December 27. 1972 N 383/35):

The State Committee of the USSR Council of Ministers on Labor and Wages and the Secretariat of the All-Union Central Council of Trade Unions explain:

Hourly tariff rates for determining additional wages for work at night are calculated:

workers whose work is paid at daily tariff rates, by dividing the daily rate by the corresponding length of the working day (in hours) established by law for this category of workers;

employees whose work is paid at monthly rates (salaries), by dividing the monthly rate (salary) by the number of working hours according to the calendar in a given month.

Part 2 of Article 290 of the Labor Code of the Russian Federation:

Employees who have entered into an employment contract for a period of up to two months may, within this period, be required, with their written consent, to work on weekends and non-working holidays.

Work on weekends and non-working holidays is compensated in cash at least double the amount.

Part 6 of Article 348.1 of the Labor Code of the Russian Federation:

Peculiarities of remuneration for athletes and coaches at night, on weekends and non-working holidays can be established by collective agreements, agreements, and local regulations.

Clauses 13, 16 and 24 of the Regulations “On the peculiarities of working hours and rest time for crew members (civilian personnel) of support vessels of the Armed Forces of the Russian Federation” (approved by Order of the Minister of Defense of the Russian Federation dated May 16, 2003 N 170):

13. On ships, it is allowed, in exceptional cases, for other employees to perform the duties of short-staffed crew members on running or berthing watches, and maintenance personnel, with payment for overtime working beyond normal working hours. At the same time, the fulfillment of the duties of the service personnel lacking in the staff is assigned only to persons belonging to the service personnel.

16. The conditions and amounts of remuneration for ship crew members involved during the operation of the ship to perform the duties of short-staffed workers in excess of normal working hours are established by an industry agreement and a collective agreement in accordance with the Labor Code of the Russian Federation.

24. In cases where it is impossible to provide crew members of ships with full days of rest, it is allowed, with the consent of the crew members of these ships, to pay for work on weekends and holidays in the amount provided for by the labor legislation of the Russian Federation.

Clause 17 of the Regulations “On the working time and rest time of employees of dining cars and employees of ship restaurants of sea and river transport, workers of bench cars and other similar trade and public catering enterprises” (approved by Resolution of the State Committee for Labor of the USSR, the Secretariat of the All-Union Central Council of Trade Unions dated 09.12.1964 N 431/25):

17. Payment to employees for additional days of rest (time off), not used by them during the period of mass transportation (navigation) and transferred to the autumn-winter (inter-navigation) period during a sharp reduction in the volume of work, is made based on the tariff rate (salary) on the day of provision time off without taking into account bonuses, which are paid in full at the end of the month for which they were accrued.

Clause 5 of the Regulations on the peculiarities of the working hours and rest time of crew members from among the civilian personnel of border patrol vessels and boats (approved by Order of the FSB of the Russian Federation dated 04/07/2007 N 161):

15. In cases where it is impossible for crew members to be given full rest days, with their consent, payment for work on weekends and holidays is allowed in the amount provided for by the labor legislation of the Russian Federation.

Show more

Categories of substitutions

In the activities of Russian organizations, three methods are most often used:

- A temporary transfer of a specialist to another job is arranged. In this case, the employee will not perform his direct duties. His responsibilities will include working at his new place of work. For example, during the vacation of the head of the quality control department, one of the specialists was transferred to his position. The specialist will be given an additional payment for substituting during the boss's vacation.

- Temporary combination of positions or professions. At the same time, during working hours the employee will perform his previous duties and assigned ones. For example, a payroll accountant will double as a cashier while a key employee is ill.

- Expanding service areas or increasing the scope of work. The employee undertakes to perform during the working day the duties corresponding to his main position, but to a significantly greater extent. For example, the organization has three personnel officers. During the vacation of one personnel employee, his duties can be divided between the two remaining specialists.

At the same time, it is important to properly arrange and pay for each option.

How to pay

During a temporary transfer, the employee is entitled to additional payment for the absent employee: according to the Labor Code, he must receive money for the work performed. Therefore, this method is usually used when replacing managers whose salaries are higher than those of ordinary employees.

In the case of combining positions, a person is given an additional payment for replacing him during the vacation of the boss or another employee. A specific additional payment for replacing a temporarily absent employee (Labor Code of the Russian Federation) is established by agreement of the parties (Article 151 of the Labor Code of the Russian Federation).

When increasing the volume of work or expanding the service area, the amount of additional payment and the amount of additional work are also determined by agreement of the parties.

Remuneration and registration of temporary transfer

A temporary transfer to another position is issued if the salary for the job being replaced is higher. The method is popular when filling leadership positions. When transferring to a higher-paid position, the salary for the new position is assigned. It is unlawful to indicate in personnel documentation the wording “with additional payment of the difference between salaries” and similar phrases.

For example, a personnel officer receives a salary of 30,000 rubles. And the head of the personnel department - 50,000 rubles. Consequently, when transferred to the position of head of the personnel department, a simple personnel officer will be assigned a salary of 50,000 rubles.

But a subordinate can be transferred to a position paid lower than at the main place of work. Then keep in mind that during a temporary transfer to another position, the level of remuneration cannot be lower than the average salary at the main place (Article 182 of the Labor Code of the Russian Federation).

When making a transfer, prepare the following personnel documents:

- Additional agreement to the employment contract. A transfer is not possible without the employee's consent. The additional agreement must specify the terms of payment. The amount is determined by agreement of the parties, but it cannot be lower than the average salary for the main position.

- Order for temporary transfer in form No. T-5.

- Job descriptions and responsibilities for the new position. It is permissible to specify responsibilities in an additional agreement for temporary transfer.

Sample order

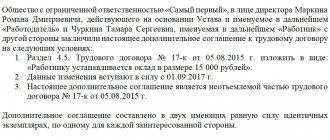

Sample additional agreement

Need to pay extra

During the absence of the director, someone must perform his duties. This, whatever one may say, is an additional burden (Article 151 of the Labor Code of the Russian Federation). Therefore, the replacement person is entitled to an additional payment for performing the duties of a director during the vacation (for a sample order on the transfer of powers of the general director, see the article “Appointment of an acting director: sample order 2018”).

The head of the organization may be absent from his workplace for one reason or another. Since the director is a key figure in the company, someone must perform his duties in his absence.

In general, the responsibilities of the general director, which is quite logical, are assigned to his deputy. However, if the position of deputy director is not provided for on staff, then the duties of the manager can be delegated to any employee of the company.

Let us note that the law does not provide for additional payment for the performance of the duties of a director by a deputy director if such functionality is provided for in his employment contract. It turns out that these are the usual duties of the employee, so he is not entitled to additional payments (Article 60.2 of the Labor Code of the Russian Federation, letter of the Ministry of Health and Social Development of Russia dated March 12, 2012 No. 22-2-897, appeal ruling of the Moscow Regional Court dated May 28, 2014 No. 33-11581/2014 ).

It is clear that additional payment for performing the duties of a branch director is made in the same manner as payment of remuneration for performing the work of the head of the parent organization.

Combining professions and increasing the volume of work

If the employer decides to increase the volume of work or assign responsibilities for filling another position to a subordinate, then three mandatory actions must be performed.

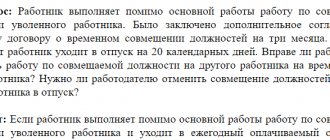

1. Offer additional work and obtain the employee’s written consent. Without official consent, an employee cannot be forced to work additionally. But there are exceptions. If the employment contract provides for the possibility of substitution, then special permission is required.

Sample proposal for additional work

2. Agree on the amount of payment. Labor legislation does not provide for restrictions on replacement pay. There is no minimum or maximum pay level. The amount of additional payment is determined by agreement.

3. Prepare personnel and administrative documents. Since the volume of work and remuneration are essential conditions of the labor relationship, it is necessary to consolidate the changes. Prepare an additional agreement to the employment contract. As well as an order to assign duties.

IMPORTANT!

During the period of replacement work, the employee is not relieved of his main duties.

Sample order on combining positions

Sample order to expand service areas

What does combining positions mean?

To perform the duties of a temporarily absent employee without release from work specified in the employment contract, the employee may be assigned additional work in either a different or the same profession (position). This is established by Article 60.2 of the Labor Code.

They are assigned additional work, in particular, by combining positions.

Combination of positions is the performance by an employee, with his written consent, of additional work in another position with the same employer, along with his main work in the position specified in the employment contract.

Such work is performed within the working hours established by the employment contract.

About the amount of additional payments for replacement

The amount of additional payment is not limited. The specific amount is established by agreement between the employer and the subordinate performer. It is permissible to establish an additional payment for replacement as a percentage of the official salary. Or fix the premium in absolute value - a fixed amount.

Example No. 1. Additional payment as a percentage.

In a small company, the director can replace personnel; the additional payment for the combination is set by the director himself. The replacement order establishes an additional payment of 10% of the director’s official salary for a fully worked month. Salary - 50,000 rubles. The month has been completely worked out.

Calculation: 50,000 × 10% = 5,000 rubles - the amount of additional payment for replacing the duties of a personnel officer.

Example No. 2. Additional payment in a fixed amount.

The accountant is given a bonus of 10,000 rubles for a fully worked month. For 15 days out of 21 working days, the amount of additional payment for replacement will be:

10,000 / 21 × 15 = 7142.86 rubles.

IMPORTANT!

The additional payment is subject to personal income tax and insurance premiums in the general manner. The amounts can be taken into account in the wage fund when calculating income tax.

Sample order

Sample additional agreement

Sample proposal for additional work

Sample order on combining positions

How is additional payment calculated for a temporarily absent employee?

In accordance with the Labor Code of the Russian Federation, additional payment for a temporarily absent employee is accrued by agreement of the parties - the employer and the employee assigned to perform additional work. Thus, the amount of the surcharge and the procedure for its calculation can be fixed in:

- employment contract;

- collective agreement;

- The procedure for remuneration, or other documents regulating the mechanism for calculating and calculating wages and other monetary remunerations at the enterprise.

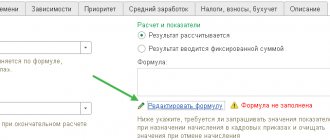

The amount of additional payment for performing the duties of a temporarily absent employee can be calculated either in a fixed form (the so-called “flat rate”) or as a percentage of the salary . Below we will look at the procedure for calculating surcharges for each method and look at an example.

Firm bet

At many enterprises, additional payment for a temporarily absent employee is calculated in a fixed form, namely in fixed monetary terms. In this case, the additional payment does not depend on the income of the absent or replacement employee, but is paid in the amount established by the employment/collective agreement.

In the case of an additional payment at a fixed rate, organizations use a gradational approach to determining the amount of payment in accordance with the complexity of the work performed, its volume, and level of responsibility. In other words, the amount of payment is set in different amounts, depending on the position of the replacing (absent) employee.

In addition, in large companies and large manufacturing enterprises with a complex and branched organizational structure, the amount of additional payment is fixed separately for each structural unit.