It is known that according to Federal Law-402 “On Accounting”, individual entrepreneurs may not maintain accounting records (Article 6-2 (1) of the Federal Law). At the same time, many businessmen who have registered a business consider it necessary to timely reflect the indicators of their activities in accounting records. An entrepreneur can entrust accounting to a third party or take on the matter independently. In both cases, knowledge of how to start and set up accounting at the start is very important, including for monitoring the work of a third-party accountant. They will also be useful to the businessman himself, who has decided to master another profession in practice - an accounting employee.

an individual entrepreneur keep accounting records or not ?

Does an individual entrepreneur need accounting?

To answer the question posed, let’s take a closer look at the text of Federal Law-402. The mentioned Art. 6 declares:

- exemption from accounting for individual entrepreneurs;

- the need to keep records of NU indicators according to the type of business that has been chosen.

Does an individual entrepreneur need to formulate an accounting policy ?

Thus, tax accounting is necessary, with simultaneous exemption from accounting for individual entrepreneurs in any tax system.

Attention! An entrepreneur has the right to keep records of accounting indicators, but is not obliged to do so.

Properly organized accounting means the availability at any time of time of prompt and reliable information about the operation of the business, complete control over monetary and material resources.

In addition, often when organizing an individual entrepreneur, an entrepreneur starts small and then expands the business, transforming it into other forms (for example, registering an LLC), in which accounting is mandatory.

Question: An organization purchased a used car from an individual entrepreneur. The individual entrepreneur used the simplified tax system (“income”), did not keep accounting records, and the residual value was not formed. The individual entrepreneur is ready to provide documents on the purchase of the car and the period of use. For the purposes of calculating income tax, does an organization have the right to determine the useful life of a fixed asset independently based on the documents and information on the service life provided by the individual entrepreneur? View answer

How to connect EDI for individual entrepreneurs

To organize electronic document management, you will need to select an EDF system and operator, analyze office work, make changes to accounting policies and agree on the exchange of electronic documents with counterparties.

The method of organizing e-document flow is selected taking into account the number of documents being sent and the employees involved in the document flow:

- Web version. Suitable for small document flow: its use will simplify the transition to electronic document management, since it works in any browser and the interface resembles email.

- Module for the 1C accounting system. Integration of the EDF and 1C systems will allow you to work in a familiar system.

- Integration with other accounting systems.

Also, when choosing an EDI system, you should pay attention to the implementation conditions, set of options, tariffs, availability of roaming, and technical support operating hours.

We will help you choose a solution and connect to EDF

Submit your application

How to start and do everything right?

To maintain accounting records, the entrepreneur has many programs and electronic services at his disposal; in addition, accounting can also be kept in paper accounting registers. If an entrepreneur decides to save money and get down to business on his own from scratch, you need to understand that accounting will have to be kept continuously until the end of the year.

You should start with planning, while answering a number of questions, including those related to NU. This is natural, because traditionally tax indicators are based on accounting data:

- Which tax system is right for your business? It is necessary to make preliminary calculations of the income and expenses of the individual entrepreneur for the period.

- What reporting forms and where does the individual entrepreneur submit? Pay attention to the deadlines and do not miss them to avoid fines and unscheduled inspections.

- Will hired workers be involved? Keeping records of personnel and wages is a rather complex and time-consuming process. Employer reporting is the same for everyone.

Important! The type of accounting service is selected based on the taxation system and the scale of the individual entrepreneur’s activities. So, it is better for an entrepreneur using the OSNO, simplified tax system “income minus expenses” to use the services of special third-party companies, especially if the number of business transactions is large. Other modes of accounting allow you to do your own accounting.

Next, we proceed directly to the formation of a system for transmitting and processing accounting data, allowing us to take into account the characteristics of a particular business. The step-by-step process of setting up accounting from scratch includes the steps below.

Choice: simplified accounting or standard, ordinary

Most individual entrepreneurs at the start actually have the status of a small business entity. They can begin to conduct accounting in a simplified form (Article 6 of the Federal Law-402, Part 4).

Simplified accounting means (according to the text of the “Recommendations for accounting by small business entities”, pr. No. 64 n dated 12/21/98 of the Ministry of Finance; “Information” No. PZ-3/2015 of the Ministry of Finance):

- use of a limited number of synthetic accounting accounts;

- make simplified accounting records of business transactions;

- preparation of financial statements in a simplified form.

You can completely abandon the use of double entry.

Decide how to technically keep records for the chosen option

Options:

- independent record keeping on paper;

- independent accounting using electronic means, programs and services;

- transfer of authority to maintain accounting records to a third party company.

If accounting is carried out without double entry, they use the Income and Expense Book, which is filled out either in black ink on paper or, which is much more practical, in electronic form. Correcting errors in electronic format is not difficult, so it is better to use it. The simplest option is Excel and Word tables. Data on income and expenses of individual entrepreneurs are entered into KuDIR every day. At the end of the year, the Book should be printed, numbered and bound.

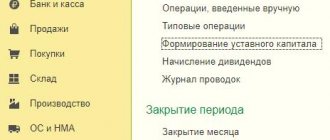

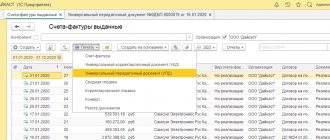

In many cases, it is more convenient to purchase the current version of an accounting program (for example, “1C”) and keep records in it. A “smart” program allows you to avoid many significant accounting errors that may arise in your work at the initial stage. This also applies to the option of using double entry and accounts.

When selecting a third-party company for accounting, it is advisable to compare prices for similar services, assess your own solvency and choose the best option.

Organize proper storage of all documents

Papers related to the individual entrepreneur’s business should be distributed into folders immediately after starting work:

- agreements with business partners;

- consumable primary documents;

- bank statements;

- strict reporting forms and cash register reporting;

- incoming documents from third parties, etc.

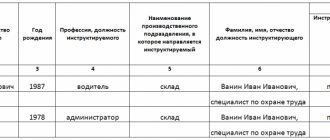

Pay special attention to personnel documentation and salary documents if there are employees.

In general, primary accounting documents are stored for 4 years if they are used in calculating taxes (Tax Code of the Russian Federation, Art. 23, clause 1, clause 8). At the same time, Federal Law 402 establishes a 5-year storage period for accounting documents (Article 29, paragraph 1). In this case, it is better to be guided by the maximum period.

What should primary documents contain?

According to the Federal Law on Accounting, the forms of primary documents must contain the following details (Article 9 of the Federal Law on Accounting):

- the name of this document;

- date of its preparation;

- name of the economic entity that compiled it;

- content of the fact of economic life;

- the value of the natural and (or) monetary measurement of the fact of economic life, indicating the units of measurement;

- the position of the person (or several persons) who made this transaction (operation) and the person responsible (or several responsible at once) for its execution or the position of the person who is responsible for the execution of this operation;

- signatures of the persons provided for in the previous paragraph (indicating the full name or other details necessary for their identification).

It is important to remember that, according to the current procedure, primary documents must be drawn up either upon completion of the transaction or immediately after that. In turn, the person who is responsible for preparing the “primary report” must promptly submit these documents for their accounting. At the same time, the person who is engaged in accounting is not responsible for these documents compiled by other persons.

The forms of primary accounting documents are approved by the head of the economic entity, but the form is approved by the person whose responsibilities include accounting.

The “primary report” can be drawn up either in paper form or electronically, provided there is an appropriate electronic signature.

Nuances and recommendations

Let us note a few more important nuances that an entrepreneur needs to remember when organizing accounting.

A separate folder is required for letters, requests, instructions and recommendations from government agencies and municipal authorities. Each document that is “worked out”, i.e. the necessary actions have been taken on it, it is advisable to mark it.

Check with the Federal Tax Service and Funds at least once a year regarding taxes in order to avoid unnecessary overpayments and debts. Properly organized accounting will serve as the basis for correcting possible errors.

Do not neglect the advice of competent specialists, consultants, business colleagues, and experienced accountants at the initial stage of organizing an accounting account. Keep track of changes in legislation affecting your business.

Briefly about the main thing

- An individual entrepreneur has the right to keep accounting records, but is exempt by law from the obligation to do so.

- The organization of accounting begins with an analysis of the financial capabilities of the individual entrepreneur, business development prospects, and the choice of the proposed accounting system. Next, you need to decide whether the individual entrepreneur will use a simplified accounting system or whether accounting is supposed to be conducted according to the usual, full scheme.

- A decision is made on choosing an accounting program, transferring authority to maintain accounting records to a third-party company, or purchasing paper primary documents and accounting registers, depending on the choice of method for maintaining accounting records.

- It is important, already at the initial stage of accounting work, to organize the correct storage of documents, with strict adherence to deadlines. Particular attention should be paid to storing accounting documents on wages if the individual entrepreneur has employees.

Advantages of EDI for individual entrepreneurs

The advantages of EDI attract medium and small businesses. Thanks to electronic record keeping, companies reduce costs, increase the overall efficiency of all processes and become more competitive in the market.

This is due to the fact that, unlike paperwork, EDI allows:

- Save money on printing, stationery, paper, forget about postal and courier services.

- Edit documents, prevent their duplication, track their status and deadlines for signing.

- Forget about the difficulties associated with sending original documents.

- Avoid errors by auto-checking formats and electronic signature certificates, quickly find the cause and correct data discrepancies.

- Store documents without the cost of maintaining an archive.

- It's easy to search for the files you need in a single system.

- Conduct transactions in the shortest possible time, quickly prepare primary and closing documents.

- No problem presenting documents at the request of regulatory authorities.

- Ensure minimal risk of damage or loss of files.

- Increase the speed of data entry into accounting systems.

- Increase data security - transfer occurs through a secure connection, and a specific number of users have access to files.

Paperless office work also increases employee productivity. With paper document management, employees spend up to half of their working time processing documents. With EDI, processes are accelerated, and files can be easily accessed even remotely.

Moreover, the EDI system can be integrated with 1C and other accounting programs. This will allow you to automatically fill out document forms, configure the posting of incoming files and further generate reports.

Discover all the possibilities of EDF for individual entrepreneurs with Diadoc

Connect

Who signs it on the customer’s side?

Not all company employees have the right to sign such documentation. If a private entrepreneur works alone, then only he has the right to sign. If he has a staff, then he is obliged to give them the right to sign documents. One-time permission to sign a deed or other paper is also practiced. For this purpose, a power of attorney is issued.

Important! When signing the act, all participants in the process must provide powers of attorney to confirm the authority to endorse the document.

If for each operation you do not draw up a new document confirming the completion of work or provision of services, then this will be a gross violation of the law. This may be regarded as concealing the company's income. Such actions are assessed by the tax service, and the organization may be subject to a large fine. Therefore, you should not take risks, but it is better to draw up and sign the document in advance.

Set of socks, Omsa socks

349 ₽ More details

Set of socks, Omsa socks

349 ₽ More details

Powerful chainsaws

Composition of primary documentation

There is a list of primary documents required for use in accounting:

| Name of the primary document | Unified form |

| Power of attorney | M2, M-2a |

| Material acceptance certificate | M-7 |

| Limit fence card | M-8 |

| Request-invoice | M-11 |

| Invoice for issue of materials to the side | M-15 |

| Receipt cash order | KO-1 |

| Account cash warrant | KO-2 |

| Cash book | KO-4 |

| Time sheet | T-12 |

| Payment statement | T-53 |

The primary accounting documents listed in the table are just a brief overview of all those used in the organization. Most primary registers are drawn up on unified forms, which are approved by the following regulations

- Resolution of the State Statistics Committee of the Russian Federation No. 1 of January 5, 2004. (accounting for wage transactions);

- Resolution of the State Statistics Committee of the Russian Federation No. 7 of January 21, 2003. (accounting for fixed assets);

- Resolution of the State Statistics Committee of Russia No. 88 of August 18, 1998. (cash transactions);

- Resolution of the State Statistics Committee of the Russian Federation No. 132 of December 25, 1998. (carrying out financial calculations using cash register);

- Resolution of the State Statistics Committee No. 71-a of October 30, 1997. as amended on January 21, 2003. (labor accounting), etc.

Information letter of the Ministry of Finance of the Russian Federation No. PZ-10/2012 “Information of the Ministry of Finance of Russia N PZ-10/2012 “On the entry into force on January 1, 2013 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting” cancels mandatory maintenance of all primary accounting registers in the organization. An economic entity has the right to independently determine the list of “Mandatory primary documents”, securing it in its Accounting Policy.

Patent tax system (PTS)

This is a special regime that involves acquiring a permit to carry out activities at the tax office. The advantage of a patent is that the amount to be paid is determined immediately, and the entrepreneur can estimate the tax burden. In addition, in some cases a patent is more profitable than the simplified tax system.

The list of activities for which a patent can be used is determined by the authorities of the subject of the federation, in particular, these include retail trade, household and transport services. The subject of the federation also establishes the amount of potential income, on which the amount of tax to be paid depends. The tax amount is determined as the product of the rate and potential income.

The tax rate is 6%. According to the laws of the constituent entities of the federation, it can be reduced to 0% - these are the so-called tax holidays for first-time registered entrepreneurs in the production, scientific and social spheres. Also, according to the laws of the Republic of Crimea, the rate can be reduced to 4% for certain categories of taxpayers.

On the PSN, the entrepreneur is required to maintain an Income Book. This document reflects all the income of the entrepreneur from his activities. This is necessary so that the tax authorities have the opportunity to check whether income restrictions are being observed. In addition, the Income Accounting Book will allow you to restore data in the event that an entrepreneur loses the right to use a patent and it will be necessary to calculate taxes according to the general system.

A patent is purchased for a period of one month to a year. Short terms are beneficial for seasonal business - renting out housing in resort towns, selling New Year's souvenirs, etc.

Depending on the validity period of the patent, payment terms :

- if the patent term is from one to six months, the amount is paid in a lump sum until the patent expires;

- if the period is more than six months, the tax is paid as follows: a third of the tax during the first three months of the patent’s validity, the remaining amount until the end of the patent’s validity.

PSN is transparent for the taxpayer. The entrepreneur knows exactly how much money needs to be paid; there is no need to submit declarations. However, you still need to keep track of your income. The disadvantage of the patent system is that there is no way to use deductions and reduce the amount of tax.

What is a work completion certificate?

When the company has agreed to perform, and the customer wants to find a contractor, an agreement is concluded, and after the work process is completed, an act is drawn up that highlights the nuances of cooperation or the results of the work done. For example: a company needs to transport goods. To provide services, you must contact the logistics company and draw up an agreement.

Blank form

After the work is done, the performing company draws up an act of services provided, which is signed by the party accepting the cargo. It is under this act that physical or transport labor will be paid. If everything is fine, then the contractor issues an invoice, which is paid. That is, the act of completion of work is a double-sided accounting paper. It confirms the fact that the work has been completed or the service has been provided.

The form has a unified form. An individual entrepreneur has the right to develop his own version of the document. If it is drawn up with errors, the customer has the right not to pay the bills. There are other important drafting rules:

- Both parties must sign the paper. The surname and position of the employee who signs must be indicated;

- signatures are confirmed by the seal of the organization;

- The document is drawn up in two copies.

Note! The act comes in two forms - N-1 and N-2. If at least one of the points is not met or the filling contains errors/strikeouts/corrections, the act may be considered invalid.

How a document is generated in an accounting program

Are there any differences between the act of works and services?

Any work process implies material benefits. By result we mean that the customer will pay money for the work done. The service does not have material significance in the literal sense of the word. She is not material. It means creating something or performing a specific task. In accounting, these two positions have different entries and are reflected in the report in different columns. The work and service are prescribed in the contract, on the basis of which the document is left.

Rules for drawing up a contract