In the Russian Federation, every year before April 15, legal entities need to confirm their main type of activity. A simple procedure must be performed in order for the Social Insurance Fund (SIF) to set the correct percentage of the contribution “for injuries”. About the process of determining and confirming the main type of activity, about the accompanying documents required by the FSS, as well as about who does not have to annually record the type of activity and what the consequences of delay in submitting data are in more detail in the article below.

The concept of the main activity

According to the ninth paragraph of the Rules for classifying types of economic activities as professional risk, approved by Government Decree No. 713 dated 01.12.05 (hereinafter referred to as the Rules ), the main type of economic activity (OVED) includes the activities of a commercial organization for which a large amount of revenue was received for the past reporting period. year.

This criterion is the main one when installing ATS, despite the fact that:

- The state register of a legal entity indicates another main activity.

- The state register does not indicate at all the type of activity that has become the main one in terms of income.

The rules help the Social Insurance Fund select and fix the rate for the company’s “injury” contribution.

Note! The rules for selecting and installing ATS for non-profit organizations differ significantly from the Rules for commercial ones.

Determining the main OKVED of the organization and filling out a certificate for the Social Insurance Fund

Each Russian organization, as a rule, has more than one OKVED code. Moreover, a legal entity has the right to engage in several areas at once from those indicated in the Unified State Register of Legal Entities. But in the application expected by Social Insurance, only one code is given. It is quite easy to determine. From the rules approved by Decree of the Government of the Russian Federation dated December 1, 2005 No. 713, it follows that the main type of activity of the organization is that which has the largest share in the total amount of income for the year. This indicator is determined using a special formula:

If there are several such directions, then you should choose the one that corresponds to the highest risk class.

In the confirmation certificate, policyholders indicate all types of activities from which they received income during the reporting period. But in the application you need to select the code that accounted for the largest amount of revenue over the past year.

Here, as an example, is a sample certificate confirming the main type of economic activity for 2022 and the application that is submitted to the Social Insurance Fund along with it. In the application we indicate only the main OKVED and the details of the insured organization.

In the certificate form, all the basic data of the organization are traditionally indicated first:

- full name;

- TIN;

- legal address;

- average number of employees;

- date of commencement of business activities;

- FULL NAME. manager and chief accountant.

The main part of the certificate is a table in which you must enter the amount of revenue excluding VAT for the year for each OKVED code and indicate the code itself according to the current classifier, and in line 10 provide the full name of the type of activity corresponding to this code. The sixth column of the report is filled out only by non-profit organizations.

And this is an example of filling out a certificate confirming the main type of activity of a conditional LLC:

Along with the certificate, the legal entity must submit to the Social Insurance Fund an explanation of the balance sheet for 2022. This is necessary to confirm the data specified in it. All documents are certified by the manager with his signature.

Who is recommended to confirm ATS?

The eleventh paragraph of the Rules states that all legal entities confirm the ATS once a year. An exception to the rules are newly founded companies - during the first year of economic activity they are exempt from the obligation to confirm the type of activity. More details are specified in paragraph 6 of the Procedure for confirming the main type of economic activity of the insurer for compulsory social insurance against accidents at work and occupational diseases - a legal entity, as well as the types of economic activities of the insurer's divisions, which are independent classification units, approved by order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2006 No. 55 (hereinafter referred to as the Procedure ).

Also, the eleventh paragraph of the Rules states that for branches of companies it is additionally necessary to confirm the VD if they have separate current accounts at their disposal and they independently make payments and benefits to employees. As for divisions without existing bank accounts, but which are involved in separate internal affairs, different from the main organization, and are established as separate units of economic activity on the basis of clause 7 of the Rules and clause 7 of the Procedure, then additional documents must also be submitted for them to the Social Insurance Fund.

Note! Individual entrepreneurs do not confirm the Department of Internal Affairs to set the “injury rate” for the wages of hired personnel. The main type of commercial activity of the individual entrepreneur is unchanged and is indicated in the Unified State Register of Entrepreneurs in the line “Type of information” as “Main”. The entrepreneur does not pay this fee for himself.

In the Unified State Register of Legal Entities, according to Part 3 of Article 14.25 of the Code of Administrative Offenses of the Russian Federation, the current main foreign economic activity must be displayed, otherwise the manager faces a fine of 5,000 rubles.

The principle of calculating the contribution percentage for private entrepreneurs differs from legal entities. The tariff is calculated based on the type of activity that is established as the main one in the state register, and not on the income received for the previous reporting year. ATS data is taken at the beginning of 2022 and recorded for 365 days, even if the ATS has changed.

What happens if you don’t submit confirmation?

Do companies have to regularly confirm their main activity if they carry on the same activity without changes? If an organization or entrepreneur does not submit an application and certificate, there will be no fine. But they still risk money, and here's why.

When registering with a tax organization or individual entrepreneur, they could declare more than one type of activity. These types of activities are recorded in the Unified State Register of Legal Entities/Individual Entrepreneurs. The tax office transmits this information to the Social Insurance Fund: social insurance knows what types of activities the company can conduct. He only knows what type of activity you are primarily engaged in, and whether anything has changed in the structure of your business over the past year.

Keep records, pay taxes and salaries, submit reports in the Kontur.Accounting web service! Get free access for 14 days

Therefore, if you do not submit supporting documents, FSS officials will turn to the list of your types of activities and assign you an insurance rate for the most dangerous of them - just to be on the safe side. This will be the highest rate of insurance premiums in case of injury for your types of activities, which are registered in the Unified State Register of Legal Entities / Unified State Register of Individual Entrepreneurs. Contributions at the assigned rate will have to be paid until the end of the year. Therefore, if during registration you indicated one type of activity and are engaged only in it, then the Social Insurance Fund will have no reason to set a higher professional risk class for the new year, and you will not face a tariff increase.

Another situation when you do not submit confirmation of your main type of activity and do not risk anything: if you are in fact engaged in the most dangerous activity of those that you notified the tax office about. In this case, the FSS will consider the list of your activities and set the rate of insurance premiums for injuries for the most dangerous and harmful type of activity. He would have done the same after reviewing the documents confirming this type of activity. Nothing changes.

Conclusion: if you do not confirm your main type of activity, there will be no fine, but you may be assigned the maximum possible rate of “unfortunate” contributions. There is no need to be afraid of this if you have one type of activity or the main one is the most dangerous of all your activities.

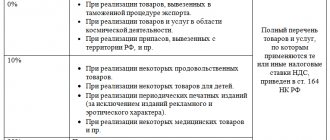

You can find out the occupational risk class of your activities in the table approved by Order of the Ministry of Labor No. 851N dated December 30, 2016 (as amended on November 10, 2021 No. 788). Each class of profrisk has its own tariff rate - from 0.2 to 8.5%.

| 1 class | 0,2% | 9th grade | 1% | 17th grade | 2,1% | 25th grade | 4,5% |

| 2nd grade | 0,3% | Grade 10 | 1,1% | 18th grade | 2,3% | 26th grade | 5% |

| 3rd grade | 0,4% | Grade 11 | 1,2% | 19th grade | 2,5% | 27th grade | 5,5% |

| 4th grade | 0,5% | 12th grade | 1,3% | 20th grade | 2,8% | 28th grade | 6,1% |

| 5th grade | 0,6% | 13th grade | 1,4% | 21st grade | 3,1% | 29th grade | 6,7% |

| 6th grade | 0,7% | 14th grade | 1,5% | 22nd grade | 3,4% | 30th grade | 7,4% |

| 7th grade | 0,8% | 15th grade | 1,7% | 23rd grade | 3,7% | 31st grade | 8,1% |

| 8th grade | 0,9% | 16th grade | 1,9% | 24th grade | 4,1% | 32nd grade | 8,5% |

Principle of determining ATS

The calculation of the OVED of commercial organizations occurs using reporting data for the previous year.

In order to calculate the share of revenue for each type of activity, the following indicators are taken from the balance sheet without VAT:

- Total sales revenue for the entire organization.

- Revenue separately for each company's income statement.

Activities with a larger share of revenue will be OVED. If the shares are equal, then the main one is the one with the larger profrisk class, as specified in paragraph 14 of the Rules.

Nonprofit organizations determine their ATO based on the number of personnel they employ. Thus, paragraph 9 of the Rules states that the type of activity will be the main one in which more workers were involved in the previous reporting year. Unfortunately, the Rules and Procedures do not indicate on what principle the internal affairs department is to be determined in the case of an equal number of employees involved in different internal affairs departments. In the event of such situations, accounting employees determine according to the example with commercial activities, which means they determine according to the highest class of professional risk.

Who must submit information about the type of activity to the Social Insurance Fund

For those who need to submit information on the type of activity to the Social Insurance Fund, see the diagram.

If the separate entity previously separately confirmed the type of activity and then ignored this obligation, it automatically be assigned the same tariff as the parent company.

If the company did not actually work , it is still advisable to submit a confirmation - with zero certificate. Data for the Social Insurance Fund are valid for 1 year . If the company did not submit information and resumed work within a year, then by the end of this year it will have to pay the highest possible tariff for all its OKVED at the time of renewal.

The individual entrepreneur applies a tariff corresponding to the main OKVED specified in his registration documents. If this OKVED changes, then the individual entrepreneur needs to make timely changes to the Unified State Register of Individual Entrepreneurs. After which the Federal Tax Service will transfer the information to the Social Insurance Fund, where individual entrepreneurs will set a new tariff for a new type of main activity.

List of documents for submission to the FSS

List of documents to confirm OVED for a legal entity:

- Policyholder's application.

- Confirmation certificate using the template.

- A copy of the explanatory note to the organization’s balance sheet for the past reporting period (according to the third paragraph of the Procedure - for everyone except small businesses).

A package of documents is submitted to the local authority of the Social Insurance Fund. Branches of organizations with their own bank accounts that make payments to hired personnel generate the same set of documents for submission to the Fund at their location (clause 8 of the Procedure).

In appendices No. 1 and No. 2 of order No. 55 of the Ministry of Health and Social Development of the Russian Federation you can find examples of applications and certificates.

What needs to be taken

The composition of the package of documents for informing the Social Insurance Fund about the main type of activity was approved by order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2006 No. 55.

Small businesses required to submit this data may submit 2 documents. Other reporting persons – 3 .

Application for confirmation of the main type of economic activity

The statement states:

- policyholder data;

- registration number in the Social Insurance Fund;

- OKVED code of the main type of activity (determined according to the methodology presented above). Moreover, the OKVED code must consist of at least 4 characters.

If during the initial calculation the group turned out to be more enlarged, then another analysis of the shares will have to be carried out.

EXAMPLE (CONTINUED)

OKVED for repair and finishing works 43.3 includes several subgroups. By analyzing work of this type performed in 2022, Dachny Dom LLC determined that it worked in accordance with OKVED 43.33 “Work on installing floor coverings and wall cladding.”

Help-calculation for the application

The certificate is a mandatory attachment to the application. It just needs to describe the calculations made to determine the main type of activity:

- income;

- other revenues and financing;

- shares of income received;

- number of personnel (for non-profit structures).

Explanatory note to accounting

Small businesses can submit a package to the Social Insurance Fund only consisting of an application and a calculation certificate. All others required to attach a copy of the explanatory note to the financial statements for the past year. In our case, this is 2022.

There is no specific form for the note , so it can be compiled arbitrarily .

The note must duplicate the same information that was included in the calculation certificate. For example:

If there is no explanatory note, there may be problems with the acceptance of other documents. Fund employees usually refuse to accept an application without an explanatory note and then set a maximum rate for contributions.

ATS confirmation process

Clause 3 of the Procedure allows you to submit a set of documents to government authorities at the place of registration of the legal entity and the location of the branch, both in paper and electronic form.

Methods for submitting documents online:

- In the organization’s personal account on the Social Insurance Fund website.

- Through specialized telecom operators.

- In your personal account of the Unified Portal of State Services.

Electronic document flow is carried out only after signing with an enhanced electronic signature.

Note! The electronic document management service “Kontur.Extern” generates and sends documents to the Foundation online. For easier use, the system has collected the above-mentioned documents into one form.

Deadlines for submitting documents

In 2022, the date for submitting the package of documents has not changed - until April 15 of the current year inclusive .

The company receives a message from the state fund about setting the basic rate of contributions “for injuries” within two weeks from the date of receipt of the package. Clause 4 of the Procedure states that the tariff is determined based on the professional risk class of the main type of activity.

Note: Thirty-two standard rates remain unchanged for the current 2022 year. The interest rate in the range of 0.2-8.5 is calculated on the amount of payments and remunerations paid in favor of individuals working under employment contracts of the Labor Code of the Russian Federation and civil contracts.

How and where to submit documents to employers

Send the application and confirmation certificate to the territorial office of the Social Insurance Fund at the place of registration on paper or in electronic format. In paper form, submit documents in person or through a representative directly to the Social Insurance Fund or send documents by mail.

Let's consider how to fill out a certificate confirming the main type of activity in the Social Insurance Fund in 2022 in electronic format. You can send an electronic confirmation using the government services website using an electronic digital signature (EDS) (pre-register your organization in your legal entity’s personal account on the portal). There is no such option directly on the Russian FSS website. Moreover, some branches do not have the ability to accept electronic documents, so sending confirmation through accounting services for reporting is currently impossible.

On the government services website, it is quite easy to confirm the main type of activity. To do this, fill in all required fields.

And then simply upload the required documents and submit them. After this, the application is assigned a unique number - and the policyholder’s obligation is fulfilled.

What are the consequences of not confirming ATS?

In case of failure to submit documents on time, the regulatory authority independently sets a tariff based on information from the Unified State Register of Legal Entities. The principle of choosing a tariff rate is fixed in paragraph thirteen of the Rules: the percentage of the rate is taken from the register of the foreign trade activity that has a higher class of professional risk. To make such a choice, the FSS does not need evidence of the reality of this type of activity, as established by the Supreme Court of the Russian Federation dated November 2, 2018 No. 308-KG18-17110.

The resolution of the Arbitration Court of the Volga-Vyatka District dated 02/04/19 No. F01-6889/2018 provides an exception. The FSS can approve the percentage of contribution according to the Unified State Register of Legal Entities only when it does not have data on the organization’s internal affairs bodies. If the Fund received such information in other reporting documents, then fixing the rate in the Unified State Register of Legal Entities is prohibited.

To top it all off, if a legal entity submitted documents late, the budget organization is obliged to change the tariff rate previously established in the Unified State Register of Legal Entities - to fix a percentage that coincides with the percentage of the current OVED. These conditions were determined by the Judicial Collegium for Economic Disputes of the Supreme Court of the Russian Federation dated September 11, 2018 No. 309-KG18-7926 and dated November 12, 2018 No. 304-KG18-9969.

Liability of the policyholder

Late submission of the confirmation certificate does not threaten the policyholder with fines.

The organization will not be punished even if it does not submit this report. However, if the FSS does not receive confirmation of the type of activity from the policyholder, it will independently set the rate of insurance premiums. The FSS will analyze all types of activities indicated by the organization in the Unified State Register of Legal Entities and select the type with the highest risk class. The FSS sends notification of self-assignment of a tariff before May 1.

If the policyholder has one type of activity declared in the Unified State Register of Legal Entities or the risk classes for all types are the same, then failure to submit a confirmation certificate will not affect the tariff in any way.

Let's sum it up

It will not be difficult for an accounting employee to prepare documents to confirm the ATS. A simple calculation of the share of sales proceeds is carried out according to a generally available rule and will not take much time. Therefore, the main goal remains to submit the correct package of documents to the Social Insurance Funds on time in 2021, so that the legal entity avoids an increase in the interest rate “for injuries” and payment for it.

Download the confirmation certificate. certificates

Step-by-step filling instructions for state employees

First, determine the main area of economic activity of the organization over the past year. Why is this necessary? Often, budgetary institutions operate according to several types of OKVED. For example, preschool and general education in one organization (school-kindergarten). To determine the code to report on, determine the share for each area of economic activity in terms of income received (budget funding).

Determined by the formula:

For example, GBOU DOD SDYUSSHOR "ALLUR". Income for 2022 according to OKVED "Preschool education" - 10,000 rubles, according to OKVED "Primary education" - 21,000 rubles. Income according to OKVED "Supervision and care" (type of paid services) - 4,000 rubles. Total income - 35,000 rubles.

Share according to the “Preschool education” code: 10,000 / 35,000 × 100% = 28.5%.

Share according to the “Primary Education” code: 21,000 / 35,000 × 100% = 60%.

Share according to the “Childcare and supervision” code: 4000 / 35,000 × 100% = 11.5%.

Consequently, the main OKVED for the budgetary institution GBOU DOD SDUSSHOR "ALLUR" is "General education".

Let's move on to filling out the certificate.

Sample documents Activity confirmation form

Part, subject filling out enterprise(Part to be filled in by the undertaking)1. Name of the enterprise/Name of the undertaking_________________________________________________

2. Street address, postal code, city _________________________________________

Country:

3. Telephone number (including international prefix)______________

4. Fax number (including international prefix)_______________________

5. Email address/e-mailaddress: _________________________________________________________

I , undersigned :

6. Last name and first name: _______________________________________________________________

7. Position at the enterprise/Position in the undertaking: _______________________________________________

declare that the driver :

8. Last name and first name: _______________________________________________________________

9. Date of birth: (day/month/year): _______________________________________

10. Driver's license or identity card or passport number/Drivinglicenceoridentitycardorpassportnumber___________________________________________

11. Started working at the enterprise from (day/month/year)/ who has started to work at the undertaking on (day/month/year) during the period/for the period:

12. from (hour/day/month/year)/from (day/month/year): _____________________________________

13. by (hour/day/month/year)/to (day/month/year): _______________________________________

14. □ was on sick leave

15. □ was on annual leave)

16. □ was on vacation or on vacation/wasonleaveorrest

17. □ drove a vehicle not covered by the provisions of Regulation (EC) No 561/2006

or AETR / droveavehicleexemptedfromthescopeoftheRegulation(EC) 561/2006 ortheAETR

18. □ performed other work other than driving/wasperforminganyworkotherthandrivingofavehicle

19. □ was on hold/was available

20. Place: ___________________________ Date: _____________________________

Signature ___________________________

21. I, the undersigned, the driver, confirm that during the period specified above I have not driven a vehicle subject to the provisions of Regulation 561/2006 (EC) or AETR. (I, the driver, confirm that I have not been driving a vehicle falling under the scope of the (EC) Regulation 561/2006 or AETR during the period mentioned above).

22. Place: ______________________ Date: __________________________

Signature of the driver_____________________________________________

_________________________________________________________________________________________________

Note: from points 14-19 you must select (indicate) only one

In accordance with the European Agreement concerning the Work of Crews of Vehicles Engaged in International Road Transport.