What is dismissal due to reduction

A reduction in the number or staff of an organization’s employees is one of the grounds on which an employer can terminate a contract on its own initiative (Clause 2 of Article 81 of the Labor Code of the Russian Federation).

It is worth distinguishing that in the first case, the company reduces the number of employees in one position (for example, instead of 8 lawyers there are 4 left), and in the second, certain categories of positions are completely excluded from the staffing table. Contrary to popular belief, the employer can make such a decision at any time without any justification or explanation to employees, the trade union or third parties, which is confirmed in the Resolution of the Plenum of the Armed Forces of the Russian Federation dated March 17, 2004 No. 2. Which is quite logical, since the issue of staff reduction concerns organization of activities within the enterprise and depends on the success of business. It is also not mandatory for company management to obtain the consent of a citizen or trade union. However, notifying the employee and obtaining the opinion of the trade union are one of the conditions for maintaining the legality of the dismissal procedure for staff reduction. In addition, payment of all compensation required by law is required.

Seasonal workers and conscripts

The legislation provides for specifics in the procedure for laying off seasonal workers and workers who have entered into a fixed-term employment contract of up to 2 months. Please note that for other employees with whom a fixed-term employment contract has been concluded for other reasons, the reduction procedure is similar to that provided for employees with whom an employment contract has been concluded for an indefinite period.

The specifics of laying off seasonal workers and workers with whom a fixed-term employment contract of up to 2 months has been concluded relate to the timing of delivery of notice and payment of benefits.

Thus, an employee engaged in seasonal work must be notified of his upcoming dismissal due to a reduction in the number or staff of the organization’s employees at least 7 calendar days in advance.

Accounting and tax accounting, employee settlements, reporting to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and Rosstat, currency accounting - all in one service.

To learn more

For employees who have entered into an employment contract for a period of up to 2 months, the period is even shorter - they must be notified of the upcoming layoff at least 3 calendar days in advance.

As for the payment of severance pay to these categories of employees upon dismissal under clause 2, part 1, art. 81 of the Labor Code of the Russian Federation, then for seasonal workers the amount of benefits is equal to the amount of two-week average earnings. And employees who have entered into an employment contract for a period of up to two months are not paid severance pay upon dismissal as a general rule, unless otherwise established by federal laws, a collective agreement or an employment contract.

Dismissal procedure: list of actions

Since the legislator seeks to protect the interests of workers as much as possible, the reduction procedure is quite strictly regulated. A certain algorithm must be followed:

- Issuance by the manager of an order to reduce staff and approval of a new staffing table or changes to be made to it.

- Notification of the employment service and trade union.

- Determining the circle of persons who have the right of priority to remain at work.

- Delivery of layoff notices to staff against signature.

- Offering laid-off employees free vacancies, that is, other jobs.

- Requesting the union's opinion on the dismissal of an employee who is a member of it.

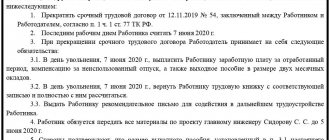

- Termination of the employment contract.

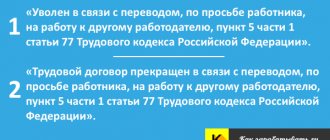

- On the day of dismissal due to staff reduction, a settlement is made with the employee, and a work book is issued with a note of dismissal due to staff reduction on the basis of clause 2 of Art. 81 Labor Code of the Russian Federation.

Common mistakes

If we talk about typical mistakes when abbreviating, these include:

- absence (non-delivery) of notice of reduction;

- dismissal of an employee before the two-month notice period;

- failure to notify employment authorities and the trade union (if any) within the established time limits;

- failure to offer vacancies when available.

When it comes to reducing the number of employees, a fairly common mistake is failure to conduct or incorrect assessment of the preemptive right (Article 179 of the Labor Code of the Russian Federation). For example, employers often have no criteria for assessing labor productivity and qualifications at all, or these criteria are recognized by the courts as subjective.

Step-by-step instruction

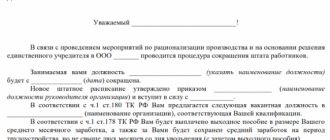

Step 1. Before issuing an order to reduce staff or number of employees, it is necessary to make such a decision in accordance with the procedure established in the organization. It is necessary to identify positions that are subject to reduction, make sure that the list of those being dismissed does not include citizens who cannot be dismissed on this basis, and identify persons who are granted benefits by law. It is necessary to take into account that employees with higher qualifications have a preferential right to retain their jobs. When deciding who exactly will be laid off, the presence of dependents, injury at work or occupational illness, and the presence of other breadwinners in the family are taken into account. The order must indicate which staffing units and in what quantity are subject to exclusion from the staffing table, the reason for making such a decision, describe in detail the upcoming reduction procedure, indicating all activities and the timing of their implementation, as well as provide a list of responsible persons at all stages. All responsible persons are familiarized with the order and signed.

Step 2. All notifications to interested parties are sent on time in the approved or recommended form. It is imperative that all notices be dated so that there is evidence that deadlines have been met. It is possible to dismiss employees before two months only with their written consent with the payment of additional compensation for average earnings according to the remaining time of work, according to the notice.

Step 3. Before issuing a notice, you need to offer another job. Moreover, the legislation does not indicate that the proposed workplace must correspond to the previous one or the qualifications of the specialist. If you are being made redundant, you can also offer a low-paying job, lower in position, this is allowed. Of course, all notifications and refusals of offered work, which the employee also does not have to explain, are documented in writing. It is a mistake to think that in any case you can limit yourself to one sentence. If new vacancies suitable for health reasons appear within a two-month period, the employer is obliged to offer them to the dismissed employee.

Step 4. The notification to the employment service must indicate the positions, professions and specialties of the dismissed workers. In addition, you need to notify the employment service about their level of qualifications and the conditions of payment for each employee. The employment service must be notified of mass layoffs three months in advance. The employment service is obliged to inform the prosecutor's office about all enterprises that have not sent a notice of staff reduction.

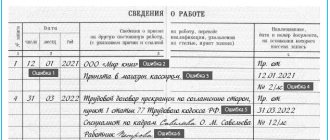

Step 5. Based on the general order, a specific order is issued for each employee with whom he gets acquainted with signature. The contract is terminated after the expiration of a two-month period (the period is counted from the next day after receipt of the notification) and after changes are made to the staffing table. Moreover, there should be no similar vacant positions left in the staffing table, otherwise the legality of the employer’s decision may be challenged. The order is issued in a unified form, the work book is drawn up in accordance with the Labor Code of the Russian Federation.

Step 6. Payment of compensation.

Material on the topic of the Armed Forces of the Russian Federation explained the features of assigning additional benefits when laying off a sample of an order to reduce a position

Order in form T-8

If an employee believes that his legal rights were violated and his dismissal was carried out in violation of current legislation, he can appeal the employer’s actions in court. To do this, he must apply to the district court with a demand for reinstatement at work and recovery of the average monthly salary for forced absence. In order for the application to be accepted, it must be submitted no later than a month after receiving a copy of the dismissal order or receiving the work book (Part 1, Article 392 of the Labor Code of the Russian Federation; Article 24 of the Code of Civil Procedure of the Russian Federation; Clause 3 of the Resolution of the Plenum of the Supreme Court of the Russian Federation of March 17. 2004 No. 2).

If the court finds the dismissal illegal, the applicant can be reinstated in his previous job or the average monthly salary for forced absence can be recovered in his favor and the entry in the employment record can be changed to “dismissal at his own request” (parts 3, 4 of article 394 of the Labor Code of the Russian Federation; paragraph 60 of the Resolution Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2).

Who should not be fired

To avoid negative consequences and fines, the employer must remember which employees, due to their special situation, cannot be laid off, in accordance with Article 261 of the Labor Code of the Russian Federation:

- pregnant women;

- workers with children under three years of age;

- single mothers with a disabled child who has not reached the age of majority;

- single mother with a child under 14 years old;

- other persons who raise such children without a mother.

Also, an employer cannot unilaterally dismiss an employee who is on sick leave or on vacation (Article 81 of the Labor Code of the Russian Federation).

Dismissal of an employee upon change of ownership

First of all, it is worth noting that a change of owner does not automatically terminate the employment contract with existing employees.

The categories of employees with whom the employment contract can be terminated and the periods during which dismissal can be effected are limited. To employees with whom employment relations can be terminated on the basis provided for in clause 4, part 1, art. 81 of the Labor Code of the Russian Federation (change of owner of the organization’s property), includes the head of the organization, his deputies and the chief accountant.

The period during which the new owner has the right to terminate the employment contract with the above-mentioned persons in connection with a change in the owner of the organization’s property must be no later than 3 months from the date his ownership rights arise.

A change in the owner of the organization’s property is not grounds for terminating employment contracts with other employees of the organization.

If the new owner decides to carry out a reduction, then starting this procedure is allowed only after state registration of the transfer of ownership.

Features of dismissal of pensioners, pre-retirees, part-time workers and other categories of workers

Pensioners are dismissed due to staff reduction in the same manner, with the same compensation being paid. The only controversial issue remains the payment of the third benefit, since a pensioner cannot register with the employment service and receive benefits, since he receives a pension. However, if there are circumstances worthy of attention, employment centers provide pensioners with the certificates necessary to receive the third benefit.

Rostrud recommended that employers separately consider the issue of providing pre-retirees with a preferential right to retain their jobs in case of staff reduction. This is logical, because if there is a suspicion of dismissal due to reaching the appropriate age, the administration may be held criminally liable.

The part-time worker is paid the average monthly salary for the second and third months only if he provides evidence in the form of an entry in the work book about dismissal from the main place of work before dismissal from the part-time job.

A seasonal employee is notified 7 days in advance of a planned dismissal, and is paid compensation in the amount of two weeks' average earnings. No other compensation is provided for them.

Northerners, or residents of the Far North, can qualify for average earnings for 4-6 months of unsuccessful employment if they provide the appropriate documents from the employment service, provided that they are registered within 30 days from the date of dismissal. The third allowance is issued even in the absence of registration.

Mass layoff

In order for an employer to understand whether he has a mass layoff, he should refer to industry and (or) territorial agreements. Part 1 of Art. speaks about this. 82 Labor Code of the Russian Federation.

So, for example, in Moscow, according to the Moscow tripartite agreement for 2016-2018 between the Moscow Government, Moscow trade union associations and Moscow employers' associations, the criteria for mass dismissal are considered to be the indicators of the number of dismissed employees of organizations registered in the city of Moscow, with a workforce of 15 or more people for a certain period of time:

- dismissal within 30 calendar days of more than 25% of the total number of employees;

- dismissal of employees in connection with the liquidation of an organization of any organizational and legal form;

- reduction in the number or staff of the organization's employees in the amount of:

- 0 or more people within 30 calendar days;

- 200 or more people within 60 calendar days;

- 500 or more people within 90 calendar days.

Calculation example

Ivanov I.I. worked as a manager for two years and was dismissed due to staff reduction on 01/01/2018. On January 10, he contacted the employment center and was registered, but could not find a job until 04/01/2018, that is, until that moment he retained his unemployed status. Ivanov I.I.’s work schedule was standard with a 5-day work week. Initial data: for 2022 Ivanov I.I. he worked 247 days, 28 calendar days and 19 working days he was on vacation: from 08/01/2017 to 08/28/2017. The salary of Ivanova I.I. was unchanged for the entire 2022 and amounted to 30,000 per month.

Formula for calculating severance pay by Ivanova I. upon dismissal due to staff reduction:

- actual shifts worked: 247 - 19 = 228;

- average salary per day: 331,428.57 / 228 =1453.63;

- amount for January: 1453.63 × 17 = 24,711.71;

- February amount: 26,165.34;

- amount for March: 31,979.86.

Ivanov would be entitled to benefits for the first month, that is, payment of compensation for January, even if he was employed. But benefits for February and March, if you start a new job during these months, would be calculated in proportion to the days of unemployment.

Additional guarantees

In addition, current legislation establishes another guarantee for employees - preservation of wages during the period of employment. According to Article 178 of the Labor Code of the Russian Federation, a dismissed employee retains his average monthly earnings for a period not exceeding two months. In exceptional cases, a salary can be issued for the third month of unsuccessful job search (if the citizen registered with the employment service within two weeks from the date of dismissal), but the employee must provide confirmation from the employment service that he applied to this body and was not employed.

Longer terms for maintaining the average wage are established for those who work in the Far North and equivalent territories. For such categories of workers, the paid period of employment can be up to six months after layoff (Article 318 of the Labor Code of the Russian Federation).

Guarantees and compensation

When an employment contract is terminated due to a reduction in the number or staff of the organization's employees, the dismissed employee is paid a severance pay in the amount of average monthly earnings. He also retains his average monthly salary for the period of employment, but not more than 2 months from the date of dismissal (including severance pay).

In exceptional cases, the average monthly salary will be retained by the employee for the third month from the date of dismissal by decision of the employment service body, provided that within two weeks after dismissal the employee applied to this body and was not employed by it.

It is worth noting that Art. 178 of the Labor Code of the Russian Federation establishes minimum guarantees. Thus, an employment contract or collective agreement may establish an increased amount of severance pay, with the exception of cases expressly provided for by law.

One cannot fail to say something about the “northern” workers. They retain their average monthly earnings for the period of employment, but not more than 3 months from the date of dismissal, including severance pay.

In exceptional cases, the average monthly salary is retained for the specified employees during the 4th, 5th and 6th months from the date of dismissal by decision of the employment service body, provided that within a month after dismissal the employee applied to this body and was not they are employed.

The procedure for calculating average earnings is established by Decree of the Government of the Russian Federation dated December 24, 2007 No. 922.

Retirement

Russian legislation also has such a concept as early retirement. According to Art. 32 Federal Law “On Employment...” dated April 19, 1991, persons have the right to apply for early retirement if the following conditions are met:

- at least 20 years of experience for women and 25 for men;

- age is 2 years less than the established retirement age;

- lack of employment opportunities for another job. This circumstance must be confirmed at the employment center.

When such persons are laid off, they have the right to retire early, but only with their consent. After employment or retirement, payments stop.

To whom compensation is not paid?

In Article 349.3 of the Labor Code of the Russian Federation, the legislator established a restriction on the provision of severance pay for managers, their deputies, chief accountants, as well as members of executive bodies:

- state corporations;

- organizations in whose authorized capital the share of participation of the Russian Federation is more than 50% of state extra-budgetary funds;

- state and municipal institutions.

However, if the payment of compensation is provided for in an employment or collective agreement, then it is still paid, but in a limited amount - no more than three average monthly salaries.

Responsibility for violation of payments

For violation by the employer of labor legislation and failure to pay statutory deductions on time, Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation provides for the following fines:

- for officials - from 10,000 to 20,000 rubles;

- for persons carrying out entrepreneurial activities without forming a legal entity - from 1000 to 5000 rubles;

- for legal entities - from 30,000 to 50,000 rubles.