For the first time, people began to think about how much it costs them to create certain material goods during the period of the emergence of material production (9-6 thousand years BC). Thus, the understanding of cost appeared much earlier than the famous invention of the Italian mathematician Luca Pacioli in the form of double recording of business transactions.

In the modern world, cost is not only an economic indicator and a structural indicator, but also one of the institutional concepts of the economic discipline. In addition, cost estimation is a practical branch of financial management.

Like any scientific and practical paradigm, cost has an object, subject and method of research.

It’s worth noting right away that despite the stable phrase “methods of cost accounting and cost estimation,” cost accounting methods

and

the cost estimation methods

- due to the differences in their practical and intended purposes.

Cost accounting methods for costing purposes include:

- method of actual cost accounting and standard method (Standard cost)

- transverse

- process-by-process

- custom

The establishment of one of the last three methods is determined by the objects of direct

costs at a specific enterprise (redistributions, processes or orders).

As for overhead costs, to account for them during the period, it is possible to use pre-established standards or use an alternative approach in the form of the ABC method.

The ABC method (Activity-based costing, cost accounting by function) is designed to distribute costs to costing objects depending not on the conditional distribution base, which often distorts the cost, but on cost functions. In this case, functional cost carriers are determined for each group or cost item.

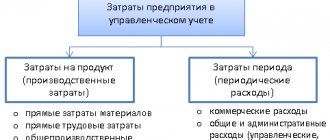

Cost estimation methods: Absorption costing and Direct costing are used to distribute accounted costs between sales volume and final balances of products (goods, works, services), thereby converting “collected and accounted costs” into cost price sold products.

Absorption costing involves assessing the balances of finished products based on the total amount of expenses, in contrast to direct costing, according to which only costs that are variable in relation to the volume of production are involved in the assessment of balances and the calculation of gross profit.

In practical activities, a combination of methods is used, for example, the standard cross-distribution method + direct costing, or: the actual process-by-process method (in this case, overhead costs are taken into account using the ABC method) + absorption costing, etc.

The legislation of the Russian Federation provides freedom of choice of methods for cost accounting and cost estimation, defining only the basic criteria and rules.

Many companies use the following regulations in their accounting and analytical activities:

- Basic provisions for planning, accounting and cost calculation (approved by the State Planning Committee of the USSR, the State Committee for Prices of the USSR, the Ministry of Finance of the USSR, the Central Statistical Office of the USSR on July 20, 1970)

- Order of the Ministry of Fuel and Energy of the Russian Federation dated November 17, 1998 N 371 (as amended on October 12, 1999) “On approval of the Instructions for planning, accounting and calculating production costs at oil refining petrochemical enterprises

and other industry standards.

Often, chief accountants and company managers have a logical question: how to choose methods for cost accounting and cost estimation from the point of view of usefulness, practicality and economic feasibility? The answer to this question lies in analyzing the features of not only accounting processes, but also planning processes at a particular enterprise.

Process-based costing method

The process-based costing method is used by organizations that mass-produce the same type of product or have a continuous production process. In this case, it is advisable to keep records of costs related to products produced during a certain period.

The process method is used in the coal industry, energy, and oil production.

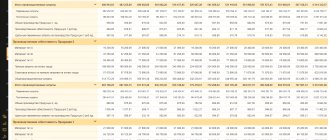

Features of the process-based calculation method are reflected in Figure 4.1.

Standard units of production are used to measure the number of products manufactured over a certain period. They allow you to convert incompletely completed products into conditionally finished products.

The process costing method assumes that material costs are incurred at the beginning of the production process, and processing costs (added costs) are distributed evenly throughout the production cycle.

- Accumulation of production costs by department, regardless of individual orders

- Write-off of expenses for a calendar period

- Opening separate analytical accounts “Work in progress” for each division

Figure 4.1 – Features of the process method

Production costs are allocated to work in progress and finished goods using the following methods:

- weighted average - allows you to average the costs of the reporting period with the costs of work in progress at the beginning of the period;

- FIFO – Closing work in process inventory is valued at production costs incurred during the accounting period (i.e., last costs).

Example 1. Initial data are given in table 4.1.

Table 4.1

Initial data

| Index | Meaning |

| Natural indicators, units. | |

| 1 Structure of natural indicators | |

| Units in work in progress at the beginning of the period with percentage of completion: | 5 400 |

| materials – 100%; | |

| added costs – 55% | |

| Units entered into processing | 14 600 |

| Total units | 20 000 |

| 2 Decoding of natural indicators by degree of completion | |

| Units completed processing, including: | 18 200 |

| units from work in progress at the beginning of the period | 5 400 |

| units started and completed by processing | 12 800 |

| Units in work in progress at the end of the period with percentage of completion: | 1 800 |

| materials – 100% | |

| added costs – 75% | |

| Total units | 20 000 |

| 3 Cost indicators, rub. | |

| Work in progress at the beginning of the period: | 20 000 |

| materials | 5 000 |

| added costs | 15 000 |

| Costs incurred in the current period: | 350 000 |

| materials | 120 000 |

| added costs | 230 000 |

| Total costs | 370 000 |

Distribute costs between finished products and work in progress using the following methods:

- weighted average;

- FIFO.

Solution

Regardless of the method of solving problems within the framework of process-by-process calculation, it is built according to the following scheme:

- counting equivalent units;

- calculation of costs per equivalent unit;

- allocation of costs between finished goods and work in progress (production report).

It must be remembered that calculations are carried out separately for the resources expended:

- materials;

- added costs.

Weighted average method

The calculation of equivalent units is presented in Table 4.2. The starting point when calculating the number of equivalent units is the percentage of completion: if the products are completed, then it is equal to 100%, and therefore, we use the specified number of products.

If we are talking about work in progress, then the specified quantity when calculating equivalent units is adjusted to the percentage of completion.

Table 4.2

Calculation of equivalent units

| Index | Materials | Added Costs |

| Units completed during the period | 18 200 | 18 200 |

| Units in work in progress at the end of the period: | ||

| materials – 100% | 1 800 | |

| added costs: 1800 x 0.75 | 1 350 | |

| Total equivalent units | 20 000 | 19 550 |

According to the weighted average method, costs consist of:

- costs of the previous period (i.e., work in progress at the beginning of the period);

- expenses of the current period.

The calculation of costs per equivalent unit is given in Table 4.3.

Table 4.3

Calculation of costs per equivalent unit

| Index | Materials | Added Costs | Total |

| Costs of the previous period, rub. | 5 000 | 15 000 | 20 000 |

| Costs of the current period, rub. | 120 000 | 230 000 | 350 000 |

| Total costs, rub. | 125 000 | 245 000 | 370 000 |

| Equivalent units | 20 000 | 19 550 | – |

| Costs per equivalent unit | 6,250 | 12,532 | 18,782 |

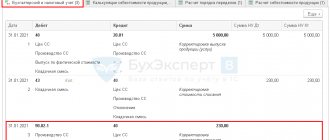

The production report (reflecting the division of costs between finished goods and work in process) is presented in Table 4.4.

Table 4.4

Production report using the weighted average method

| Index | Calculation | Amount, rub. |

| Costs by completed units, including: | 18,200 x 18,782 | 341 832 |

| – based on materials | 18,200 x 6,250 | 113 750 |

| – at added costs | 18,200 x 12,532 | 228 082 |

| Work in progress at the end of the period: | ||

| – based on materials (100% ready) | 1,800 x 6,250 | 11 250 |

| – at added costs (75% readiness) | 1,800 x 0.75 x 12,532 | 16 918 |

| – total costs for work in progress at the end of the period | 11 250 + 16 918 | 28 168 |

| Total costs | 341 832 + 28 168 | 370 000 |

FIFO method

The calculation of equivalent units is presented in Table 4.5.

Table 4.5

Calculation of equivalent units

| Index | Materials | Added Costs |

| Equivalent units required to complete work in progress at the beginning of the period: | ||

| materials | 0 | |

| added costs 5400 x (100 – 55) | 2 430 | |

| Units started and completed by processing in the reporting period (i.e. percentage of completion 100) | 12 800 | 12 800 |

| Equivalent units in work in progress at the end of the period: | ||

| materials – 100% | 1 800 | |

| added costs – 75%: 1800 x 0.75 | 1 350 | |

| Total equivalent units | 14 600 | 16 580 |

When calculating equivalent units in work in progress at the beginning of the reporting period, it is not the percentage of completion that is used, but, relatively speaking, the “percentage of incompleteness,” i.e., the degree of incompleteness of products (the degree of effort required to complete the products): 100% minus the percentage of completion. If the percentage of readiness for materials is 100, then 100% – 100% = 0, if for added costs the percentage of readiness is 55, then 100% – 55% = 45%.

When calculating equivalent units in work in progress at the end of the reporting period, the percentage of completion is used, as in the previous method.

In accordance with the FIFO method, costs are added up only from the costs of the current period.

Cost calculations per equivalent unit are given in Table 4.6.

Table 4.6

Calculation of costs per equivalent unit

| Index | Materials | Added Costs | Total |

| Costs of the current period, rub. | 120 000 | 230 000 | 350 000 |

| Equivalent units | 14 600 | 16 580 | – |

| Costs per equivalent unit, rub. | 8,2192 | 13,8721 | 22,0913 |

The production report (reflecting the division of costs between finished goods and work in process) is presented in Table 4.7.

Table 4.7

Production report using the FIFO method

| Index | Value, rub. | ||

| Materials | Added Costs | Total | |

| For finished products | |||

| Costs of the previous period | 5 000 | 15 000 | 20 000 |

| Current period costs incurred to complete work in progress at the beginning of the period | 0 | 2,430 x 13.8721 = 33,709.2 | 33 709,2 |

| Costs by units started and completed by processing | 12,800 x 8.2192 = 105,205.8 | 12,800 x 13.8721 = 177,562.9 | 282 768,7 |

| Total costs for finished products | 110 205,8 | 226 272,1 | 336 477,9 |

| For work in progress | |||

| Work in progress at the end of the period | 1,800 x 8.2192 = 14,794.6 | 1800 x 0.75 x 13.8721 = 18,727.3 | 33 521,9 |

| Total costs | 125 000 | 245 000 | 370 000 |

Obviously, there may be a certain error in calculations caused by rounding.

Let's imagine the situation

The company, with a total staff of about 325 people, provides consulting and audit services. Due to the insignificant volumes of their activities, there is a catastrophic lack of funds for business development and expansion. At the same time, management has an extremely negative attitude towards the policy of attracting and using borrowed capital. For the above reasons, the company is standing still; it is not that it is “making ends meet”, but simply existing - but nothing more.

Is it appropriate in this situation to spend energy on cost accounting using the ABC method, following the example of other companies?

Given that the range of overhead cost items is small, and the range of services themselves is limited to a list of 7-10 items, most likely, the introduction of the ABC method will not affect the economic situation in this company.

Maybe then it’s worth using the order-by-order method of cost accounting, since the company’s activities are somehow connected with orders?

The use of the order-by-order method is advisable in a situation of long-term fulfillment of orders, when it is necessary to estimate the total costs and expenses for each order both within the reporting period and throughout the entire period of order fulfillment; and our company has an average service completion time of 10-20 days.

The company does not need to change the cost accounting method, but choose a cost estimation method that makes it possible to determine the break-even point in order to immediately direct funds to business development. In addition, it is imperative to plan the optimal set of services that provide the maximum contribution to coverage, and planning and accounting methods, as we know, cannot differ. Therefore, the company should start using the Direct Costing method.

Who is the process method suitable for?

The process method is common in the mining and manufacturing industries, that is, in companies where:

- the number of products is limited - one or a couple of items;

- product quality is fairly uniform;

- there is practically no work in progress;

- there are practically no stocks of finished products;

- calculation items are homogeneous;

- the production cycle is short.

The method is widely used in mining, gas, cement, plastics, flour, screws, bolts, electricity, coal, gas and oil industries. That is, where the nomenclature is homogeneous and the technological process is simple and short.

Second example

A large company in the metallurgical industry produces a certain type of product consisting of about 1000 product items. Production is labor-intensive, and in order to produce 1 unit of product it is necessary to carry out more than 200 stages of processing of products in several workshops (the compatibility of processing operations varies depending on the units of the nomenclature). Labor is automated, but many operations require live participation. Actual accounting of labor costs for each item is practically impossible. The way out of this situation is to use the standard cost accounting method, but, nevertheless, even with its application, a problem arises - how to normalize labor costs with such a number of processing operations with a certain degree of accuracy.

What can you recommend to such a company?

The company should think about introducing the direct cost accounting method using the ABC method, which the company will combine with Standard cost. Also, the company has the right to proceed from the requirements of the Basic Provisions for Planning, Accounting and Cost Calculation at Industrial Enterprises

and develop standards for direct labor costs only for main operations, and determine labor costs for other operations as a percentage of the main ones.

Here's another example

The production holding in its structure has 2 pharmaceutical enterprises and one food production plant. At the same time, semi-finished food products are in some cases used as raw materials for pharmaceutical production. A number of pharmaceutical production nomenclature are related to the state order system and are required to be produced as vital and necessary products. The other part of the product range constitutes a free assortment and should be planned or not planned for production, depending on the availability of free production capacity. During the month, adjustments to production and sales plans are possible for various objective reasons.

Everything described above is an individual feature of this production, which will influence the choice of cost accounting methods and cost estimation

.

Which cost estimation method is applicable in this situation?

If there are a large number of limiting factors in the formation of a production program, the method must exclude the influence of irrelevant costs to adequately assess the profitability of production. Since semi-fixed costs will remain unchanged for any production program, their influence must be eliminated. The chosen method should ensure the maximization of marginal profit. Of course, this is direct costing. But the standard cost accounting method is inappropriate in this case, since regular adjustments to the production program require not standard but actual direct costs. For accurate distribution of overhead costs and calculation of the total cost of production, the ABC method will be very useful.

Pros and cons of the process cost accounting method

The process method, like any other, has its drawbacks. We have collected all the pros and cons in a table.

| Advantages | Flaws |

| + the method is simple to calculate and understand; | — due to cost averaging, calculations may be inaccurate; |

| + collecting costs requires less effort; | — the more nomenclature, the more difficult it is to apply this method. |

| + cost flows can be easily tracked in accounting accounts. |

We recommend you the cloud service Kontur.Accounting. In our program you can easily keep track of the cost of any product. In addition, we give all newbies a free trial period of 14 days.

Let's sum it up

Each company must apply cost accounting and cost estimation methods that allow not only to reliably calculate the cost of a unit of production (goods, works, services), but also to provide reasonable and reliable information to users of financial statements about the property status and financial position of the organization.

Do you want to learn how to conduct high-quality financial analysis and discover new career prospects?

Register to watch a fragment of the training for free and evaluate the convenience of this training format!

Financial Analysis Courses

Test yourself. Which method is most often used to account for overhead costs?