Reasons for liquidation of the enterprise

The issue of liquidation can be raised both by the founders of the enterprise and by the controlling government bodies at the place of registration or business. That is, liquidation occurs either voluntarily or compulsorily. It is also possible for an enterprise to cease its activities during the bankruptcy process.

The reason for the forced liquidation of an enterprise is most often a systematic violation of the law. It occurs by a court decision, which is addressed by a government agency, whose representatives consider the violations to be sufficient to formalize the termination of the legal entity’s activities. In addition, there are special grounds - for example, exceeding the permissible number of company participants.

Liquidation by decision of the founders is carried out due to various circumstances. It may happen that the founders of the enterprise simply believe that the company has completely fulfilled its objectives. However, most often this happens due to financial problems. The initiative can come from both the center and their branches of the enterprise.

Dismissal procedure during liquidation

The entire staff, all employees, even those who are on sick leave or maternity leave, can be dismissed due to termination of operations. Each employee must be personally notified in writing two months in advance of the upcoming layoff. This is provided for in Art. 180 of the Labor Code of the Russian Federation as a certain guarantee for dismissed employees. The manager must arrange for such forms to be recorded with a receipt stamp as evidence of timely notification.

Also, according to this norm, the employer can dismiss the employee before the expiration of the specified period of two months, but only with his written consent. In this case, an additional compensation payment is made in the amount of the employee’s average earnings, calculated in proportion to the time remaining before the expiration of the notice period.

Otherwise, the dismissal procedure is no different from the usual one.

Taxes on payments to those dismissed during liquidation

Compensation payments to employees dismissed due to the liquidation of an organization are not subject to personal income tax. We are talking about severance pay, as well as the average monthly earnings paid for the 2nd and 3rd months without work. Social contributions are also not collected from these payments.

However, tax exemption is provided only if the total compensation does not exceed:

- 6 times the average earnings

- for workers who worked and were fired from organizations located in the Far North or equivalent areas; - 3 times the average salary

- for all other hired persons.

If the amount of severance pay exceeds the recipient’s average earnings, but contributions to the state budget are made only from the excess amount.

Important! Only those payments provided for by federal law are exempt from taxation. For compensation established by an employment contract or local regulations, personal income tax and social contributions are collected as usual.

Personal income tax is charged on compensation for unused vacation, but social contributions are not collected.

Features of dismissal during the liquidation of special groups of employees

For pregnant women and women on maternity leave (these are categories of workers who usually enjoy additional guarantees upon dismissal) no privileges are provided upon dismissal in the event that the enterprise ceases its activities. Labor legislation and judicial practice do not give any reason to believe that they have any advantages over the rest of the staff, which is quite logical, because the organization is being liquidated and ceases its activities completely. Management should inform employees that such women need to register with the social security authorities, since all payments in connection with pregnancy, childbirth, and child benefits will be assigned by this body, as well as paid. Payment of maternity payments must be made exactly within the period specified by law, no later than the last day of work.

Pensioners do not have additional benefits, unlike pre-retirees. As part of the pension reform, a rule has been approved that such citizens, having registered with the central pension center and in the absence of employment due to the fault of this organization, have the right to count on early assignment of maintenance from the state.

Part-time workers and seasonal workers, unlike the rest of the staff, do not have the right to count on compensation in full. They can only count on severance pay. Seasonal workers are generally warned according to the general rule, that is, 7 days in advance and are paid two weeks' wages. Severance pay is not paid to employees who have entered into a fixed-term contract (for a period of up to 60 days), and they are warned about the upcoming dismissal only 3 days in advance.

The employment relationship with the manager who is a member of the liquidation commission (or who is the sole liquidator) is terminated last, as well as with the employees involved in the liquidation. It is the liquidation commission or liquidator that are the governing bodies in the process of formalizing the termination of the enterprise’s activities. The bankruptcy process provides for other positions and governing bodies.

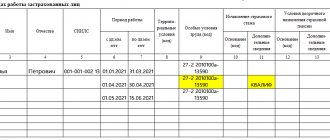

Documentation of dismissal of employees

The notice of the upcoming layoff is drawn up in any form, but it is necessary to convey the necessary information to the employee and receive a mark of familiarization with it. References to labor legislation are desirable. Familiarization with the documents and strict adherence to the procedure are mandatory, even if management believes that the state does not plan to challenge the administration's actions in court.

The order is drawn up in a unified or free form; it is necessary to display information about the dismissal, the grounds, and compensation made in connection with this. It is also recommended to comply with the rules of office work, indicate details of documents, positions, adherence to the general form and structure of the document, etc.

Entries in the work book are made as follows:

The employment contract was terminated due to the liquidation of the organization, paragraph 1 of part one of Article 81 of the Labor Code of the Russian Federation.

Dismissal before expiration of 2 months

As a general rule, after the expiration of 2 months from the date of notification to personnel, the employer has the right to begin terminating employment contracts with employees. However, some persons may express a desire to leave before the expiration of this period, and the law does not limit workers in this right.

The opportunity to resign early is provided for in paragraph 3 of Art. 180 Labor Code of the Russian Federation. To terminate an employment relationship prematurely, a person submits an application for dismissal upon liquidation of the organization.

In practice, everything happens as follows:

- The employer sends notice of dismissal due to liquidation.

- The person who has decided to terminate the employment relationship prematurely writes a corresponding application and submits it for consideration by management.

- The director approves the early dismissal and issues an appropriate order.

- The calculation is carried out and an entry is made in the work book.

How to make an application?

What payments are due to employees upon liquidation of an enterprise?

The list of payments upon liquidation of an enterprise is contained in a number of articles of the Labor Code of the Russian Federation. These standards guarantee the dismissed employee the following amounts:

- wages for the period of work before termination of the employment contract, bonuses, allowances (Article 136 of the Labor Code of the Russian Federation);

- monetary compensation for vacation unused during employment before the liquidation of the organization (Article 127 of the Labor Code of the Russian Federation);

- severance pay in the amount of the average monthly salary (conditionally - salary, the calculation of the amount will be discussed below) (Article 178 of the Labor Code of the Russian Federation);

- wages maintained for the period of employment, but not more than two months from the date of dismissal (including severance pay). In certain cases, such compensation is retained by the employee for the third month from the date of dismissal. However, to do this, he needs to be unemployed at this time and receive an appropriate decision from the employment service body, provided that the employee contacted this body within two weeks after dismissal and was unable to find a new job. (Article 178 of the Labor Code of the Russian Federation);

- an additional payment in the form of compensation in the amount of wages in proportion to the time before the expiration of the notice period for dismissal, if the employer dismisses the employee with his consent before the expiration of the statutory notice period for termination of employment and liquidation of the company (Article 180 of the Labor Code of the Russian Federation);

- payments provided for by labor or collective agreements in the event of liquidation of a business and representing a kind of financial assistance to employees during the period of employment (Article 178 of the Labor Code of the Russian Federation).

The calculation period for points 1, 2, 5 and 6 is the last day of work of the reduced employee in the organization that is being liquidated and is obligated to pay the specified amounts. (Article 140 of the Labor Code of the Russian Federation).

Difficulties are usually caused by the calculation of payments listed in paragraphs 3 and 4 of the above list. Let's look at them in more detail.

Severance pay upon liquidation of an organization in the amount of the average salary, which is calculated in accordance with clause 9 of the Decree of the Government of the Russian Federation of December 24, 2007 N 922 “On the specifics of the procedure for calculating the average salary” according to the formula:

average daily earnings in rubles X number of working days in the first month after dismissal.

The number of working days is determined according to the organization’s work schedule for the corresponding period, which will begin on the first day after dismissal. For example, if an employee is fired on 06/06/2017, working days are counted from 06/07/2017 to 07/06/2017 (with a five-day working week - 21 working days).

How can you be fired and liquidated?

Laws No. 210-FZ and No. 203-FZ provide for a simplified procedure for dismissing an employee during liquidation.

So, in order not to wait until the employee spends 2-3 months trying to get a job, and then comes for the next benefit, it is allowed to replace with a one-time compensation in the amount of 2 average monthly earnings.

That is, all potentially employer-paid months of employment, including the third, can now be paid for immediately upon dismissal of the employee.

Lump-sum compensation paid to dismissed employees during the liquidation process eliminates the previously established obligation to wait for former employees to come for benefits and allows to continue .

Moreover, you can immediately pay the employee not only during a new liquidation, but also during the current one. At the same time, if one of the dismissed employees has already received benefits for the second month of employment, they can be used to offset the lump sum payment.

ConsultantPlus knows what other payments are due to employees upon dismissal due to liquidation:

When dismissing employees due to the liquidation of an enterprise (organization), make all standard payments upon dismissal (for example, pay wages). You should also pay compensation for unused vacation, but keep in mind the peculiarity...

View the complete solution in full.

KEEP IN MIND!

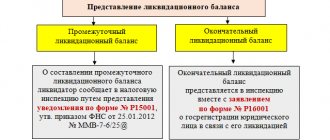

In the application for state registration of liquidation of the company from August 13, 2020, you must confirm that all payments provided for by labor legislation for dismissed employees have been made.

Features of calculating average daily earnings

There are features of calculating the average daily wage, in particular:

- if a person quits on the last day of the month, average earnings are calculated for the last 12 months, including the period of dismissal. This position is set out in the letter of Rostrud dated July 22, 2010 N 2184-6-1;

- if a person did not work for the entire billing period (was ill or was on maternity leave, etc.), then the billing period must be replaced by 12 calendar months preceding the last month when the person went to work. Reason: letter of the Ministry of Labor dated November 25, 2015 N 14-1/B-972.

After the first month from the date of dismissal, the employer does not make any payments to the laid-off employee.

Salary maintained during the period of employment

The payment specified in paragraph 4 is calculated at the end of the second month if the former employee presents the employer with a work book without an employment record and writes a statement. In this case, he needs to be paid wages for the period when he was unemployed. The employment period begins on the day following the day of dismissal and ends on the day preceding the day of new employment, or on the day of expiration of a two-month period from the date of dismissal, depending on which day came earlier (paragraph 2 of Article 14 of the Labor Code of the Russian Federation). In this case, the employee receives severance pay on the day of dismissal. Therefore, for the first non-working period, after its expiration, he will not receive anything, just as if he found a new job even a few days before the end of the second month. During this period of employment, wages are calculated including severance pay (paragraph 1 of Article 178 of the Labor Code of the Russian Federation) according to the formula:

average daily earnings X number of working days in the second month of employment before the day of hiring.

The amount of the average daily salary for this calculation is applied from the calculation given above for calculating severance pay. The number of working days is also determined according to the work schedule of the enterprise. For example, if an employee is fired on 06/06/2017, then the period for which he is entitled to compensation will begin on 07/07/2017 and end on 08/06/2017. If the employee is employed before the end of the second period, the days before being hired for a new job are taken into account.

To receive earnings for the third month, the former employee must bring a decision from the employment service about maintaining his average earnings. Such payment will be calculated in a manner similar to the previous compensation payment, in proportion to the days before hiring a new job.

Where are the guarantees?

Summarizing the consideration of the issue of guarantees for employees during the liquidation of an organization, it is necessary to note the following main points.

Firstly,

Current labor legislation does not provide any special guarantees against dismissal for certain categories of employees when the employer makes a decision to liquidate. In any case, employment contracts will be terminated with all employees.

Secondly,

the employee should know that he can be fired only after 2 months from the date of warning him about this in writing. If he expresses a desire to terminate the employment relationship before the expiration of this period, he has the right to demand payment of additional compensation, calculated according to the rules specified in Part 3 of Art. 180 Labor Code of the Russian Federation.

Third,

on the day of dismissal, the employer must issue the employee a work book and also make payments to him. As a general rule, an employee has the right to demand payment of wages for the period actually worked and unpaid, compensation for unused vacations, and severance pay. In addition, during the period of searching for a new job, for a period of not more than 2 months, the employee retains his average monthly earnings (including severance pay).

Sofya Danilova, expert at Consultant magazine

Stay up to date with the latest changes in accounting and taxation! Subscribe to Our news in Yandex Zen!

Subscribe

Salary for the period of employment and its taxation with personal income tax

Important: All compensation payments provided for by labor legislation are not subject to personal income tax and social contributions. Grounds: (clause 2, clause 1, article 20.2 of Law No. 125-FZ, article 217 of the Tax Code of the Russian Federation, article 422 of the Tax Code of the Russian Federation, letters from the Ministry of Finance: dated 03/17/2017 N 03-04-06/15529 and dated 05/23/2016 N 03-04-06/29283).

Features when paying compensation to employees during the liquidation of an organization exist for legal entities located in the Far North (Article 318 of the Labor Code of the Russian Federation). For employees of such organizations, compensation for dismissal due to liquidation is paid immediately for six months. The following order is provided:

- the first three periods without work are paid at the request of the former employee;

- the second three months without work - by decision of the employment service.

What options does an employer have in light of innovations?

As we have already noted, employees of a liquidated company will have de facto equal rights with employees dismissed, for example, due to staff reductions in existing companies.

In this regard, the employer may have two solutions regarding payments:

- first pay the employee the average monthly salary for the period of employment, as well as the due one-time compensation (for example, for unused vacation);

And subsequently pay the unemployed employee the average monthly salary for the second and third months after dismissal (subject to a decision from the employment service).

In this scenario, “liquidation” payments to employees will be extended over time (usually at least three months) and, as a result, the company will not be able to quickly liquidate.

- pay the employee a one-time severance pay in the amount of 2 times the average monthly salary.

In this scenario, the employer pays the employees ahead of schedule and, as a result, the liquidation of the company will take place in a shorter period of time.