Payments upon dismissal at one's own request

An employee has the right to resign at his own request (Article 80 of the Labor Code of the Russian Federation). The accountant must issue the final payment on his last day of work. In 1C: ZUP, a calculation note is generated according to the unified form T-61, but a document independently developed by the organization can also be filled out. It must contain the required details for the primary accounting document and be enshrined as an appendix in the company’s accounting policies.

The calculation includes two mandatory amounts of funds:

- salary for unpaid time until the termination of the employment relationship;

- compensation for unused vacation.

The law does not provide for any other payments upon dismissal of one's own free will for an employee. However, a company may, in its local documentation, provide for certain types of payments or compensation upon dismissal, including on this basis.

A situation is possible in which a person quits before the end of the year used to calculate vacation, i.e. part of the payment was used in advance. In such a situation, accrued vacation pay must be recalculated and overpaid funds must be withheld from the final calculation. However, their value cannot be more than 20% (Article 138 of the Labor Code of the Russian Federation). The employee can return the rest of the debt for unworked vacation days on a voluntary basis.

From the final payment, the employer has the right to withhold other amounts of debt, for example, unpaid advance payments or incorrect accruals. But he can do this only with the consent of the dismissed employee with the basis and amount of deduction (Article 137 of the Labor Code of the Russian Federation).

Taxes on payments

In accordance with Article 210 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), when determining the tax base for personal income tax, all income of an individual recognized as a payer of the specified tax, received by him both in cash and in kind, or the right to dispose of which he has, is taken into account. it arose, as well as income in the form of material benefits.

Based on paragraph 3 of Article 217 of the Tax Code of the Russian Federation, all types of compensation payments established by the legislation of the Russian Federation, legislative acts of the constituent entities of the Russian Federation, decisions of representative bodies of local self-government (within the limits established in accordance with the legislation of the Russian Federation) related, in particular , with the dismissal of employees, with the exception of compensation for unused vacation.

Thus, monetary compensation for unused vacation paid to an employee upon dismissal on the basis of paragraphs 6 and 7 of paragraph 3 of Article 217 of the Tax Code of the Russian Federation is subject to personal income tax in the generally established manner. Similar explanations are given in Letter of the Ministry of Finance of Russia dated April 18, 2012 No. 03-04-05/9-526.

In turn, monetary compensation for late payment of wages and other amounts due to the employee, provided for in Article 236 of the Labor Code of the Russian Federation, is exempt from taxation on the basis of paragraph 11 of paragraph 3 of Article 217 of the Tax Code of the Russian Federation.

A similar opinion was expressed in letters of the Ministry of Finance of Russia dated 02/28/2017 No. 03-04-05/11096, dated 01/23/2013 No. 03-04-05/4-54. From 01/01/2020, the grounds for taxation and tax exemption of these compensation payments will change, as indicated by Federal Law No. 147-FZ dated 06/17/2019 “On Amendments to Part Two of the Tax Code of the Russian Federation” (hereinafter referred to as Law No. 147-FZ) . The fact is that in Article 217 of the Tax Code of the Russian Federation, updated by Law No. 147-FZ, paragraph 1 and paragraph 3 will be combined into paragraph 1, and paragraph 3 will lose force. Meanwhile, this will not affect the taxation of compensation for unused vacation and delayed payments. The first will be taxed on the basis of paragraph 14 of paragraph 1 of Article 217 of the Tax Code of the Russian Federation as amended by Law No. 147-FZ, and the second will be exempt from taxation on the basis of paragraph 11 of paragraph 1 of Article 217 of the Tax Code of the Russian Federation.

An example of calculating the final amount of payments upon dismissal at one's own request

Incoming data:

- employee Ivanov V.K. resigns on September 13;

- total unpaid days - 10 days;

- the employee's salary is 20,000 rubles;

- bonus for length of service - 30%;

- in the region there is a regional coefficient of 1.15;

- The period for calculating vacation pay is from 01.07. until 31.06.;

- for the period 2019-2020, vacation was not used;

- average daily earnings - 975.61 rubles;

- The employee pays alimony in the amount of 25%.

We calculate wages:

20,000 / 21 * 10 = 9,523.81 rubles. - days worked

9,523.81 * 30% = 2,857.14 rubles. - bonus for experience

(9,523.81 + 2,857.14) * 1.15 = 14,238.09 rub. - salary taking into account the Republic of Kazakhstan

We calculate compensation for unused vacation:

from 01.07. to 13.09. The employee is entitled to compensation for 4.66 days.

4.66 * 975.61 = 4,546.34 rubles.

We calculate the total amount of accrued salary:

14,238.09 + 4,546.34 = 18,784.43 rubles.

We withhold personal income tax:

18,784.43 * 13% = 2,442 rubles.

We withhold alimony:

(18,784.43 - 2,442) * 25% = 4,085.61 rub.

We pay the employee the final payment:

18,784.43 - 2,442 - 4,085.61 = 12,256.82 rubles.

Payments upon dismissal due to liquidation of the company

An employee may be dismissed due to the liquidation of the company (Article 81 of the Labor Code of the Russian Federation). In this case, the employer is obliged to notify the employee in writing no later than 2 months before termination of the employment contract.

Upon dismissal due to liquidation, the company must pay the employee:

- wages for unpaid time until the termination of the employment contract;

- compensation for unused vacation;

- severance pay in the amount of the average monthly salary;

- compensation in the amount of average monthly earnings until the end of a 2-month period if the employee quits on his own initiative before the expiration of this period;

- average monthly earnings for the period of employment (no more than 2 months from the date of dismissal).

All specified amounts, with the exception of the last one, must be paid by the employer upon final payment on the employee’s last day of work. Payment for the period of employment is paid only if the former employee writes an application and provides an appropriate decision from the employment service. At the same time, he must have unemployed status, that is, register with the employment center within 2 weeks from the date of dismissal.

The organization may provide in local documentation additional compensation payments and their amounts. It is necessary to take into account that for directors, their deputies and chief accountants of state or municipal institutions, the amount of such payments cannot be more than 3 times the average monthly salary.

For some categories of employees, there are special points for making final payments upon liquidation of a company:

- if the employment contract is concluded for a period of up to 2 months, severance pay is usually not paid;

- if a seasonal worker is dismissed, then the severance pay is equal to two weeks’ average earnings;

- If an external part-time worker is employed in his main job, he is not entitled to payments for the period of employment.

Severance pay is calculated using the following formula:

Salary for the previous year / number of days worked in the period * number of paid days

How to calculate average daily earnings

Average daily earnings for the 12 months before dismissal are needed to find out the amount of compensation for the remaining days of vacation. If an employee joined the organization less than a year ago, calculate the average salary from the moment he was hired (Government Decree No. 922 of December 24, 2007).

We add up the amounts of earnings for the required period: this includes income in cash and in kind - salary and additional payments, bonuses, allowances. The amount does not include sick leave, vacation pay and other payments, for the calculation of which average earnings have already been used.

Next, we determine the number of calendar days for the period and consider working months:

- if the employee worked a full month, we take the average number of calendar days in it - 29.3;

- if there were missed working days in a month (vacation or sick leave), then we find the number of days using the formula: (Number of calendar days of the month - Days of vacation or sick leave) * 29.3 / Number of calendar days of the month .

Now let’s find the average daily earnings using the formula: Amount of payments for the billing period / Calendar days for the billing period .

Example of calculating severance pay

Incoming data:

- employee Ivanov V.K. salary accrued for the previous year - 253,800 rubles;

- total working days in the period - 247 days;

- the number of working days during the vacation period is 20 days.

We calculate the average daily earnings:

247 - 20 = 227 - days worked

253,800 / 227 = 1,118.06 rubles. - average daily earnings

We calculate benefits for 3 months:

1,118.06 * 20 days = 22,361.20 rub. — severance pay for 1 month

1,118.06 * 21 days = 23,479.26 rub. - average monthly earnings for 2 months

1,118.06 * 22 days = 25,597.32 rub. - average monthly earnings for 3 months

Severance pay and average monthly earnings are not subject to personal income tax, since they relate to compensation payments. However, this rule applies only if payments do not exceed 3 times the average monthly salary (for regions of the Far North, 6 times the average monthly salary). Otherwise, personal income tax must be withheld and transferred from the excess amount.

Insurance contributions for severance pay and average monthly earnings are calculated in the same manner as when calculating personal income tax, that is, taking into account the limit established by law.

Important! Although compensation for leave upon dismissal is called compensation, personal income tax must be withheld from it, as well as insurance premiums must be charged.

Calculation of compensation for unused vacation

Comp. = Zcomp.*Dcomp.,

Where:

- Comp. - compensation;

- Dcomp. – compensated vacation days.

| Experience (months) | Compensation amount |

| more than 11 | full |

from 5.5 to 11, with

| |

| In other cases | proportional to operating time |

We determine compensation for Sinelnikov as of September 17, 2018.

The employee being made redundant is given 28 calendar days of vacation. Reception date: 12/10/2015. The employee rested at the expense of the employer from May 10 to June 6, 2016, from July 3 to July 30, 2022. From December 4 to December 8, 2016 (5 days) he took time off. From 12/10/2015 to 12/09/2017 – 2 years;

from 12/10/2017 to 09/09/2018 – 9 months;

from 09/10/2018 to 09/17/2018 – 8 days, we discard them: this is less than 15.

The number of days off equal to 14 or less per year is not excluded from the working time (we have 5).

Sinelnikov earned:

2*28 + 9*2.33 = 76.97 vacation days, rounded to 77.

56 days spent.

Unused days left:

77 – 56 = 21.

We calculate compensation (we take the previously received average daily earnings):

21*1824,73 = 38319,33.

Let’s make a full calculation: sum up the salary, severance pay and compensation:

28765 + 57870,34 + 38319,33 = 124954,67.

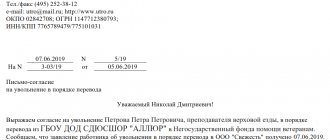

Payments upon dismissal due to reduction of staff or position

If an employee is dismissed due to a reduction in staff or position, the final payment is made in the same way as in the case of liquidation of the company. It must be remembered that the employer is obliged not only to notify the employee of the layoff, but also to provide him with a choice of suitable vacancies available in the organization.

In addition, the employer must take into account that some categories of employees cannot be dismissed due to staff reduction, for example, pregnant employees, women with children under 3 years of age, single mothers with children under 14 years of age, an employee on vacation or sick leave (Article 81 Labor Code of the Russian Federation).

When is compensation paid for unspent vacation?

Reimbursement is due for all unclaimed days (Part 1 of Article 127 of the Labor Code of the Russian Federation). For a year worked, a worker is entitled to 28 paid calendar days of rest, for a full month 28:12 = 2.33.

If a different duration of rest is established, you need to divide it by 12. The resulting fraction can be increased to a whole number (letter from the Ministry of Health and Social Development of the Russian Federation dated December 7, 2005).

If, after counting the number of years, months and days of unused rest, there are less than 15 days left, they are discarded. A quantity equal to or greater than 15 is counted as a whole month.

An employee's working year begins on the date of joining the organization.

The following are excluded from labor time (Part 2 of Article 121 of the Labor Code of the Russian Federation):

- absence without good reason;

- denial of access to work due to the fault of the employee;

- child care up to 1.5, 3 years old;

- unpaid absence with management permission exceeding two weeks per year.

These intervals shift the end of the year by the appropriate number of days.

Special Moments

When dismissing an employee, the following documents must be completed:

- dismissal order;

- work book with a record of dismissal on the appropriate grounds;

- calculation note;

- certificate 2-NDFL for the current year;

- certificate No. 182n for the current and two previous years (for calculating social benefits);

- forms SZV-M and SZV-STAZH about earnings and work experience.

If the employer does not pay the final payment to the employee on the day of dismissal or the day after the employee submits a request for such payment (if the employee is absent on the last day at work), he must pay compensation for the delay in salary. It is calculated as follows:

1/150 of the Central Bank key rate * amount of debt * number of days overdue

Delay fee

It should be recalled that in case of violation of the established deadline for payment of wages, vacation pay, dismissal payments and (or) other payments due to the employee, he bears financial responsibility (Article 236 of the Labor Code of the Russian Federation).

In this case, financial liability is established in the form of monetary compensation for each day of delay in payments due to the employee (in case of dismissal - wages, compensation for unused vacation), starting from the next day after the established payment deadline (after the day of dismissal) until the day of actual payment, inclusive. The obligation to pay the specified monetary compensation arises regardless of the employer’s fault.

The amount of compensation is established by a collective agreement, local regulation or employment contract and cannot be lower than 1/150 of the key rate of the Central Bank of the Russian Federation (hereinafter referred to as the Central Bank of the Russian Federation) in force at that time of the amounts not paid on time for each day of delay.

In case of incomplete payment of wages and (or) other payments due to the employee on time, the amount of compensation is calculated from the amounts actually not paid on time.

In cases of dismissal of employees on grounds that relate to disciplinary sanctions (Part 3 of Article 192 of the Labor Code of the Russian Federation), or termination of employment contracts with employees on the grounds established by the Labor Code of the Russian Federation, other federal laws, if this is related to the commission of guilty actions (inaction) by employees payment of severance pay, compensation and (or) assignment of any other payments to them in any form cannot be provided for by a collective agreement, employment contract, agreements and (or) other local regulations (Article 181.1 of the Labor Code of the Russian Federation).

In addition, on the basis of Article 234 of the Labor Code of the Russian Federation, the employer is obliged to compensate the employee for the earnings he did not receive in all cases of illegal deprivation of his opportunity to work. Such an obligation, in particular, arises if earnings are not received as a result of:

- delays by the employer in issuing a work book to the employee;

- entering into the work book an incorrect or non-compliant formulation of the reason for the dismissal of the employee.

Clause 35 of the Rules for maintaining and storing work books, producing work book forms and providing them to employers, approved by Decree of the Government of the Russian Federation of April 16, 2003 No. 225 “On work books”, it is established that if there is a delay in issuing a work book to an employee due to the fault of the employer, entering into a work book containing an incorrect or non-compliant formulation of the reason for dismissal of the employee, the employer is obliged to compensate the employee for the wages he did not receive for the entire period of delay.

The payment that an employer must make to a dismissed employee due to late issuance of a work book is also calculated based on average earnings, as follows from Article 139 of the Labor Code of the Russian Federation. This is confirmed by paragraph 62 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2 “On the application by the courts of the Russian Federation of the Labor Code of the Russian Federation.”

In this case, the day of dismissal (termination of the employment contract) is considered the day the work book is issued. On the new day of dismissal of the employee (termination of the employment contract), an order (instruction) of the employer is issued, and an entry is made in the work book. A previously made entry about the day of dismissal is considered invalid.