Registration at a mass address is often associated with fly-by-night companies. And this has its own explanation.

In 2022, the Federal Tax Service noted a significant reduction in shell companies - up to 7.3%. Two years earlier, they accounted for 35.5% of the total number of registered companies. Experts explain these indicators not only by the introduction of automated control over VAT refunds, but also by amendments to Federal Law No. 129-FZ dated 08.08.2001, which opened up more opportunities for tax authorities to exclude organizations from the Unified State Register of Legal Entities.

The Letter of the Federal Tax Service of the Russian Federation dated February 11, 2010 No. 3-7-07/84 gives the following definition.

A company with a mark of unreliable data in the Unified State Register of Legal Entities is considered by tax authorities as a counterparty with whom it is dangerous to deal. Such a mark arises if a statement is submitted to the tax office about unreliable information by the head of the company or as a result of an inspection and identification by the Federal Tax Service of unreliable information - about the address, participants of the company, its director.

Mass address criteria

Order of the Federal Tax Service of the Russian Federation dated February 11, 2016 No. ММВ-7-14/ [email protected] provides that in order to recognize an address as a mass address, the fact of registration of five organizations at one address is sufficient. If such a fact is established by the tax authorities, then checking the information in the Unified State Register of Legal Entities for accuracy during the initial registration or change of address of a legal entity cannot be avoided.

The question often arises about registering an LLC or individual entrepreneur at the address of a large business center. Since it hosts many organizations, the address can be considered mass. The Letter of the Federal Tax Service of the Russian Federation dated January 31, 2014 N SA-4-14/ [email protected] contains a recommendation that details exactly how to register so as not to arouse suspicion.

Thus, in clause 14.2.05.60 of the Letter it is specified that in the documents submitted for state registration, when filling out the application, detailed elements of the address that is the location of the legal entity must be entered. We are talking about the address landmarks of the object: house (possession), building (building, etc.), apartment (office, etc.).

If the documents do not contain specific address elements, then this absence cannot indicate the presentation of documents reflecting the actual address of the company.

So, we can distinguish two key criteria for a mass address:

1. Many legal entities are registered at one address. At the same time, “many” can mean a different number, depending on the subject of the Russian Federation.

According to the Order of the Federal Tax Service of the Russian Federation dated December 29, 2006 N SAE-3-09/ [email protected] , each Department of the Federal Tax Service of Russia for a constituent entity of the Russian Federation issues its own minimum criterion for selecting a mass registration address. For this purpose, a corresponding administrative act is issued. For example, the same address is indicated during state registration as the last location of 10 or more legal entities, 5 or more legal entities, etc.

2. There is no connection with legal entities registered at the same address. This indicates that representatives of the legal entity are not located at a specific address, and correspondence is returned with the mark “the organization has left”, “after the expiration of the storage period” (Letters of the Ministry of Finance of the Russian Federation dated November 14, 2017 N 03-12-13/75024, N 03- 12-13/75027).

NEWFORMES.RF

In some cases, renting premises may not be practical. Purchasing a legal address frees you from the need to incur unnecessary expenses when the specifics of the business do not require a full-fledged office, and will also come in handy if the owner of the rented premises does not allow you to register an organization at your address. Some people prefer non-mass addresses for registration because they are not included in the database of mass addresses of the Federal Tax Service and, accordingly, there is no close attention to them from the tax authorities. On the other hand, you can save a considerable amount and purchase a mass address that has been verified by the registration of dozens of companies. In this article you will learn how to protect yourself when purchasing a legal address and how to check whether the address is mass.

- What is the address of mass registration of legal entities?

- When does an address become mass?

- Is it possible to register a company at a mass address?

- Is it worth paying extra for a non-mass address?

- What is the advantage of mass addresses?

- Why is a mass address dangerous?

- How to protect yourself when choosing a mass address?

- Mass address verification, mass address database.

What is the address of mass registration of legal entities?

Addresses of mass registration of legal entities (mass addresses) are addresses indicated during state registration as the location of several legal entities.

When does an address become mass?

As a rule, the Federal Tax Service's database of mass addresses includes any address at which ten or more companies are registered.

Is it possible to register a company at a mass address?

If the address at which you want to register a company is included in the list of mass addresses, this does not mean that you will be denied registration. When registering a legal entity, the decisive factor is confirmation by the owner of the premises of his contractual relationship with the tenant organization, and not the number of companies registered at this address. The main arguments when registering for a mass address will be: a copy of the certificate of ownership of the premises, a letter of guarantee from the owner of the premises and, in the event of an inspection by the Federal Tax Service, verbal confirmation from the owner of the premises about the intention to enter into a lease agreement with your organization.

Is it worth paying extra for a non-mass address?

At the moment, the market is full of offers for the sale of legal addresses, while many organizations providing such services offer addresses at inflated prices, citing the fact that their address is not widespread. But you should understand that the non-mass address that you buy now may, after some time, turn into a mass address as a result of its subsequent use by new companies.

What is the advantage of mass addresses?

One of the main advantages of such addresses is their price. The price for mass addresses is tens of times lower than the cost of a legal address where no company has previously been registered and hundreds of times lower than the actual rental of premises. A large number of companies registered at one address, as a rule, indicates its reliability. This means that it has been audited by banks and the tax authority more than once.

Why is a mass address dangerous?

Initially, the database of mass registration addresses was created to combat fly-by-night companies. The Federal Tax Service pays especially close attention to companies registered at mass addresses. The consequence of such attention may be unscheduled inspections and even blocking of the account if the owner of the premises does not confirm the presence of the company at his address. When opening a current account, banks also show increased interest in companies that have mass addresses. To verify the real location of the company at the place of registration, bank employees conduct an on-site inspection. In this case, the owner of the mass address provides premises for inspection.

How to protect yourself when choosing a mass address?

To eliminate possible problems, it is worth enlisting the support of the owner of the premises in matters of interaction with the tax service and the bank. In case of an on-site inspection, the owner of the address provides premises for inspection and confirms the presence of a company at his address. Postal services must be provided, which involves receiving correspondence, storing it and transferring it to the actual address. If the tax inspectorate finds out that the letters it sends to the company’s legal address do not arrive, then the organization risks falling under suspicion, which will lead to unscheduled on-site inspections. An additional service can be the provision of a workplace, this means that the selling organization at a certain time or constantly allocates a workplace or a separate office. This service is aimed at creating the appearance that the location of the legal address coincides with the location of the executive body of the legal entity, which meets the requirements of the law.

If you are planning to register an LLC in Moscow or the Moscow region, use the services of our partner to find a suitable legal address. They will select the most convenient, profitable and trouble-free option for you in the shortest possible time.

Mass address verification, mass address database.

To check addresses for mass registration, the Federal Tax Service has opened a service that provides information about the addresses of mass registration of legal entities.

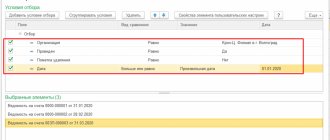

In order to check your address for mass registration, you must:

— fill out the request form presented above;

— send a request by clicking the “Find” button;

— if the address is mass, then the service will provide information about the number of legal entities registered at this address;

— if the address is not mass, the service will display the message “Information matching the search details was not found.”

Leave your comments and suggestions for improving this article in the comments.

The role of banks in the process of combating shell companies

Banks have also begun to check for signs of shell companies. Some even provide a service to verify the counterparty at the client bank. This option is usually a traffic light service that warns of the presence of suspicious information in red.

Since banks “joined” the practice of identifying shell companies, another threat has loomed over entrepreneurs and organizations - now their account may be blocked. For this, a sufficient reason is the transfer of money to dubious business partners who may be “located” in places of mass registration.

When to use bulk registration address

Cases in which a specific address is used when registering several organizations include the following:

- The organization has leased premises (retail space) in a shopping complex, business or office center.

- One founder may form several companies that will be registered at the same address. Of course, this fact may also alert regulatory authorities, since the presence of several companies registered by one person may raise doubts and questions from the Federal Tax Service regarding suspicions of tax evasion.

- During registration, a legal address was acquired. That is, the organization decided to save on renting premises. It may turn out that this address would also have been purchased by another company. This may also cause the effect of mass registration. Moreover, this option is considered the most dangerous for the company.

Thus, the “legal address of the company” means the place of residence of the director of the company, rented premises, a separate office, etc. This address should reflect the territorial location of objects that are directly related to the management of the company, either as property or under a lease agreement. In order to confirm your legal address during registration, you will need to provide the following documents:

- a copy of the lease agreement;

- a copy of the certificate of ownership of the premises;

- a copy of the internal passport of the Russian Federation reflecting the registration of the head of the company;

- a protocol or decision on the creation of a company, which contains the initials of the director.

Important! If a company does not legally own a legal address, then it can also cause a lot of problems for the company.

Risks of working with a counterparty with a mass address

For legal entities themselves, the use of a mass registration address may result in refusal of state registration or in making changes to the Unified State Register of Legal Entities when changing location or address. The Supreme Court, in Ruling No. 306-KG17-21112 dated January 23, 2018, confirmed that if the address of mass registration is indicated in the application for registration of changes in the constituent documents, then the tax authorities may refuse registration. According to the court, the location of a legal entity has significant legal significance, since it actually determines the place of fulfillment of obligations, the place of payment of taxes, the jurisdiction of disputes, as well as the possibility of exercising proper tax control. Based on this, the court considers that filing an application prepared with knowingly false information is equivalent to failure to submit such a document.

A transaction with a counterparty registered at a mass address may be regarded by the tax authorities as an attempt to obtain an unjustified tax benefit. Although the registration of a counterparty at a “mass” address in itself is not used by tax authorities as an independent basis for recognizing a tax benefit as unjustified.

This fact becomes one of the proofs of the counterparty’s dishonesty, combined with such signs as the counterparty’s lack of an official website, customer reviews, advertising in the media, as well as signs at the counterparty’s place of registration, etc. For more information about the signs of the counterparty’s dishonesty, read the article “Unfair play: 15 signs that your counterparty is deceiving you.”

If it is proven that you received an unjustified tax benefit, you face the following consequences:

- additional assessment of tax, penalties, collection of a fine - for non-payment of tax under Art. 122 NK RF;

- administrative fine - for gross violation of accounting (Article 15.11 of the Code of Administrative Offenses of the Russian Federation);

- criminal liability - for a significant amount of arrears (Article 198, Article 199.1 of the Criminal Code of the Russian Federation).

Why is mass address so bad?

The Federal Tax Service controls the cleanliness of registration addresses. Its employees collect lists of tenant companies from business center owners. In addition, an automatic VAT control system : inspectors have access to landlords’ sales books, and based on data from there, Federal Tax Service employees themselves compile databases of legal entities renting an office at a specific address from the Unified State Register of Legal Entities. In addition, inspectors send letters to taxpayers to the addresses specified during registration . If the addressee does not respond to the letter, the Federal Tax Service publishes information about this on its official website. Therefore, it would be wiser to register your business at the actual location of the management’s office, not excluding your home address. Otherwise, unpleasant consequences will not keep you waiting. Let's look at them in more detail:

The company will be excluded from the Unified State Register of Legal Entities . Three years ago, the Federal Tax Service decided that if false information about a company is entered into the Unified State Register of Legal Entities, then such a company will be excluded from the register after six months by the tax authorities’ own decision without trial in court.

Adding to the list of unreliable ones, after which potential partners will be afraid to cooperate with you. Indicators of bad faith of the counterparty are listed in the Order of the Federal Tax Service of the Russian Federation dated May 30, 2007 N MM-3-06 / [email protected] “On approval of the Concept of the planning system for on-site tax audits.” Among the criteria described there is the following: the company has chosen a place of “mass” registration for registration. Partnership with such a company increases interest on the part of the Federal Tax Service, and as a result, the likelihood of an on-site inspection, which, as we know, no entrepreneur will be happy about.

State registration may be denied. To register at an address, you will need to send a lease agreement or a letter of guarantee from the property owner to the tax office. When moving, the procedure will have to be repeated with a new address in order to register the changes in the Unified State Register of Legal Entities. Federal Tax Service employees will discover that the address is a mass one, and this will most likely cause a refusal of state registration of your company.

Let us note that in judicial practice on the issue of unreliability there are very different situations , including unusual ones. One company, for example, used video surveillance in its defense: recordings from a video camera showed that its legal address was reliable, because employees regularly appeared at work.

How to check an address for mass availability

You can check the address of the counterparty on the tax website, as well as using the Transparent Business service. The system searches by entered details (region, district, city, locality, street, house) and provides information about persons registered at the address.

You can also find out how many companies are registered at the counterparty’s address using the Kontur.Focus service. The check will also determine whether the director or founder is . Just enter the address in the search bar of the service.

What is a mass registration address?

The address of mass registration of legal entities means a concept applied to legal addresses at which more than 10 organizations are registered. In order for the registration of a company to be successful, a mandatory condition will be to check the address for mass registration. Today, such a phenomenon, when more than 10 companies are registered at an address, is private. Examples include business centers or office terminals.

Such a concept as a “mass registration address” appeared in 2006, when the Moscow Federal Tax Service sent a list of addresses to all Moscow banks where more than 10 organizations were registered. The purpose of this letter was to warn financial institutions to be more careful when opening accounts for companies registered at these addresses. That is, such a list was a kind of “black list”, the creation of which implied a fight against fly-by-night companies. However, this has also created problems for bona fide companies.

Important! In order for companies to avoid many problems, they should check the legal address during registration or re-registration, especially since this can currently be done on the official tax website using a special service that allows you to check the number of companies at certain addresses throughout the Russian Federation.