An application in form P14001 is filled out and submitted to the Federal Tax Service to make changes to the LLC.

Form and sample 2022, as well as recommendations for preparing the document. After state registration, information about the created LLC is entered into a special register - the Unified State Register of Legal Entities. During the course of business, information included in the official register may change, and this must be reported to the tax office. If the changes do not affect the text of the charter, then form P14001 is submitted, and if they change, then this is reported using form P13001.

From November 25, 2022, changes in information about an LLC must be reported using the new registration form P13014, which replaced the previously valid statements P13001 and P14001.

In what situations is form P14001 submitted?

Application P14001 is filled out and submitted for registration to the Federal Tax Service in the following situations:

- Change of the sole executive body (director or manager);

- Changing the legal address of the company, unless there is a change in the charter. For example, the charter indicates only the locality, and the new legal address of the LLC will be located in the same city.

- Removing and adding OKVED codes that do not contradict the interpretation of the charter. Usually the charter contains this or a similar phrase: “The company has the right to carry out any other types of activities that do not contradict the legislation of the Russian Federation.” If there is such a clause, the addition of other OKVED codes is consistent with the charter, so there is no need to change it. But if you initially indicated one type of activity (for example, trade), but you want to engage in construction, and there is no similar phrase in the text, then you will have to change the charter in form P13001.

- Withdrawal of a participant from the society.

- Transactions with shares in the authorized capital: sale, donation, inheritance.

- Correction of erroneous information entered into the Unified State Register of Legal Entities due to the fault of applicants or the tax inspectorate.

Why do you need to notify your counterparty of a change of address?

Notifying counterparties about a change of address is a common procedure that expresses the intention of a business entity to build trusting relationships with partners and not complicate their work in terms of finding out their correct contacts.

However, sending notices of a change of address to counterparties may also be subject to the provisions of agreements concluded with them. As a rule, such provisions are included in agreements with banks, since, in accordance with subparagraph. 1 clause 1 art. 7 of the Law “On Combating Income Laundering” dated August 7, 2001 No. 115-FZ, in order to identify the client, the bank is obliged to know his correct address.

Read about the procedure for identifying a client under 115-FZ here.

Read about some types of contracts in our articles:

- “How to draw up a long-term supply agreement?”;

- “Rental agreement upon delivery of equipment and fixed assets”.

If it turns out that the client is not at an address known to the bank, then the financial institution can legally stop servicing his account (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated April 27, 2010 No. 1307/10).

Application form

The application in form P14001 and instructions for filling it out were approved by order of the Federal Tax Service dated January 25, 2012 No. ММВ-7-6/ [email protected] The new form for 2022 is filled out taking into account minor changes in the order related to the transition to the OKVED-2 classifier.

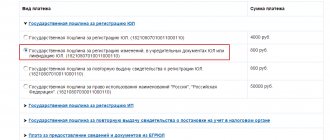

Application P14001 consists of 51 pages: a title page and application sheets, however, for each situation only the pages intended for this purpose are filled out. 16 categories of applicants indicated in sheet “P” can submit an application for making changes to the state register: director, notary, participant, executor of a will, etc. There is no state fee for filing P14001 for making changes.

download a free form to fill out on the tax office website or on our website, using the link below. Form 14001 is a so-called “fillable PDF”: download the file to your computer, open it in any program for viewing PDF files and fill it out (yes, you can fill it out and save changes!) according to our sample.

Filling out an application

The official instructions for filling out form P14001 are given in the order of the Federal Tax Service dated January 25, 2012 No. ММВ-7-6/ [email protected] In addition, on the website of the tax service there is a free program for preparing documents for state registration, including form P14001 in 2022. You cannot fill out form P14001 online on the Federal Tax Service website; you must install the program on your computer and follow its prompts.

The rules for filling out form P14001 when making changes to the Unified State Register of Legal Entities do not differ from the rules for filling out other registration forms (P11001, P13001, P21001, P24001 and others). This procedure is fully set out in the order; here we present only the basic requirements:

- You can fill out form P14001 manually (in block capital letters in black ink) or on a computer in Courier New font, height 18, also in black.

- Each page is printed on only one side of the sheet.

- Only completed sheets are numbered; unfilled sheets are not submitted for registration.

- In one application, you can report changes to the Unified State Register of Legal Entities for several positions (for example, a change of director and address of the LLC). It will not be possible to combine submitting changes and correcting errors in the registry, because in this case, the title page is filled out differently.

- Address elements must follow established abbreviation rules.

▼ Try our banking tariff calculator: Move the “sliders”, expand and select “Additional conditions” so that the Calculator will select the optimal offer for you to open a current account. Leave a request and the bank manager will call you back. ▼

Which pages in form 14001 must be filled out?

In all cases, the title page and page “P” with the applicant’s data are completed. There will be a different filling template for each case; we will tell you what other pages need to be filled out when changing various information.

- Change of general director of the LLC. Sheets “K” are filled out for both managers – the previous and the new. The applicant is the new director.

- Change of legal address of the company. The new address is indicated in sheet “B”, the form is signed by the current director of the LLC.

- Change of activity codes according to OKVED. The data is entered into sheet “N”, and if you only add codes, then page 1 is filled in, and if you only exclude, then page 2. If you simultaneously exclude and add OKVED codes, both pages of sheet “N” are filled in. You only need to select new codes from OKVED-2, even if the company was initially registered according to OKVED-1. The director reports changes in activities.

- Notarized sale of shares in LLC. One of the sheets for participants according to the category (Russian or foreign company, individual, subject of the Russian Federation) “B”, “G”, “D”, “E”. The applicant is the seller of the share.

- Withdrawal of a participant from the society. If the share of a retired participant is distributed within a month, then the same sheets are filled out as when selling a share, and information about the transfer of the share and its distribution is reflected in sheet “3”. In the case when the share is not distributed within this period, form P14001 is submitted twice: for the first time, sheets for the retired participant and sheet “Z”, and the second time – sheets for the participants-co-owners of the share and also sheet “Z”.

- Correction of erroneous information in the registry. In this case, the title page indicates the number of the registration entry that needs to be corrected. Other sheets depend on the nature of the error: sheet “A” on the name of the legal entity; sheet “B” if there is an error in the address; sheets “B”, “D”, “D”, “E” according to the category of the participant; sheet “K” for information about the director; sheet “P”, if the amount of the authorized capital is incorrectly indicated.

filling out in 2022 (New form P14001) it is more logical for each type of change in the LLC:

Get a free consultation ►

Step-by-step instruction

So, let’s determine how to fill out the application correctly: an example of filling out Form 14001 when changing the director (new form).

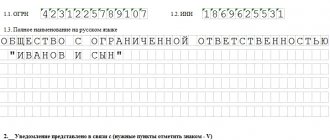

Step No. 1. We start by filling out the title page.

First, enter the OGRN and TIN, then the full name of the institution. Please note that we enter the name in Russian.

In the second part of the application title page, we determine the status of the information entered. If adjustments are being made for the first time, then put the number “1”. That is, the changes directly affect information about a legal entity. If you are correcting errors in an application submitted for registration earlier, then indicate the number “2”.

Step No. 2. Filling out sheet “K”.

Please note that Sheet “K” will have to be filled out for the old boss and separately for the new one. Enter information about the former manager:

- Indicate the status of the information. In this case, code “2” means termination of authority.

IMPORTANT!

Next, fill out section No. 2 of the application!

- We indicate your full name. former leader. We enter the middle name if available. We register the data as they are indicated in the Unified State Register of Legal Entities.

- We indicate the TIN of the employee whose authority has been removed.

Now we enter sample application 14001 when changing the director - information about the new management. Let us repeat that we are talking about a new boss - an individual. If the functions of managing the institution have been transferred to a manager or management company, then you will have to fill out sheets “L” and “M” accordingly.

Enter:

- Information code “1”—assignment of authority. For information: for example, if the headmistress got married and changed her last name, then enter code “3”. Otherwise, fill out the document in the general order. The same conditions apply if you fill out a sample form P14001 when changing the director of an LLC, JSC, NPO and other forms.

IMPORTANT!

Next, fill out section No. 3 of the application!

- FULL NAME. We enter the new manager in the appropriate cells. We check the information with your passport.

- We indicate the TIN.

- Date and place of birth of the newly appointed boss.

- Position - write down as specified in the local regulatory documents of the organization (staffing table, constituent documents, order of appointment to the position).

- Information about the identity document. In our case, this is a passport of a citizen of the Russian Federation (document code “21”). Next, enter the series and number, date of issue, authorized body and the code of its department.

Now we move on to filling out the second page of sheet “K” of the application. We enter data on the postal code and code of the subject of the Russian Federation. The address of residence in Russia (fields 3.6.1.3–3.6.1.5) does not need to be filled out if the new manager is registered in Moscow or St. Petersburg. For other regions, filling out is required.

Step No. 3. Fill out sheet “P” of the application.

Let's start filling out the last part of the document - these are four pages of sheet “P”. So, how to fill out sheet “P” of form P14001 if the applicant is a director.

First page. We indicate the applicant code. In our case, we enter code “01”, since when there is a change of director, the applicant is the new director. Next, we indicate the OGRN, INN and full name.

Second and third pages of the application. Here we indicate information about the new director. Enter information in the same way as filling out the first and second pages of sheet “K” about the new manager.

Fourth page of the application. It is filled out in the presence of a notary. In the fifth section, the new director indicates his full name. and puts his own signature. Section No. 6 is filled out by a notary.

Please note that if there has been a change of director in the LLC, the step-by-step instructions 2022 and sample form 14001 will be similar to the procedure presented above.