What laws govern FSS inspections?

Employees of the Social Insurance Fund conduct desk and on-site inspections.

1. Within the framework of the Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against accidents at work and occupational diseases” (hereinafter referred to as Law No. 125-FZ). According to the provisions of this law, inspectors monitor the correctness of the calculation of contributions “for injuries”. As well as expenses incurred by the policyholder (sick leave due to an accident at work or occupational disease, payment for travel vouchers, etc.).

Fill out and submit 4‑FSS online using the current form

2. Within the framework of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity” (hereinafter referred to as Law No. 255-FZ). According to the provisions of this law, inspectors check the accuracy of the policyholder's expenses for the payment of insurance coverage (sick leave due to illness or injury, child care benefits, etc.). As for sick leave contributions, they are controlled not by the Social Insurance Fund, but by the tax inspectorates.

Calculate your salary and benefits taking into account the increase in the minimum wage in 2022 Calculate for free

ATTENTION

In 2022, benefits for sickness (except for the first three days), for pregnancy and childbirth, at the birth of a child, for caring for a child up to 1.5 years old, as well as in connection with an industrial accident and occupational disease, the FSS transfers directly to employees (see "Starting 2022, benefits will be paid directly from the Social Insurance Fund in all regions of Russia." The employer does not bear the cost of paying such benefits. However, until the end of 2022, laws No. 255-FZ and No. 125-FZ retain provisions that the Social Insurance Fund has the right to check such expenses.

From January 2022, new versions of these laws will come into force (amendments approved by Federal Law No. 126-FZ of April 30, 2021). Let's talk about the most important changes.

Procedure for conducting an on-site inspection

On-site inspections are characterized by strict adherence to the approved plan for monitoring the activities of policyholders. Inspection activities are carried out directly on the employer’s premises. In exceptional cases, if it is impossible for the inspected enterprise to provide employees of the executive bodies of the Social Insurance Fund with accommodation while they are working on documentation, the inspection can be carried out on the basis of the fund with the condition that all necessary documentation is supplied.

The inspection period is no more than 3 years. The frequency of inspections is maximum 1 time every 3 years.

REFERENCE! An exception to the frequency of inspection activities can be made for cases of reorganization or liquidation of an enterprise - an inspection is scheduled upon the occurrence of one of these events and does not correlate with the date of previous monitoring.

Duration – up to 2 months, and when monitoring performance indicators of separate units – up to 1 month.

What does the FSS check?

How it was under the credit system

Until 2022, in those regions that did not participate in the “direct payments” experiment, the so-called offset system was in effect. Its essence is as follows. Employers transferred contributions “for sick leave” and “for injuries” to the Social Insurance Fund. When insured events occurred, benefits were calculated and given to employees, and then their expenses were reimbursed from the fund. Namely, from the transferred contributions (see “Transition to a system of direct benefit payments in 2022: what an accountant needs to know”).

During inspections, inspectors, in particular, found out whether benefits were calculated correctly. If errors were found, they did not confirm the insured’s expenses for sick leave and other payments. As a result, additional contributions were assessed.

Work with electronic sick leave with a “complicated” salary with bonuses and coefficients

What happened with the direct payment system?

Since the beginning of 2022, all constituent entities of the Russian Federation, without exception, have switched to a system of direct payments. Employers still pay contributions for sick leave and injury. But the fund now transfers most benefits, including sick leave (except for payment for the first three days of illness). The money goes directly from the Social Insurance Fund to the insured person. As for the policyholder, he transfers to the fund the information necessary for the calculation and payment of benefits.

These innovations will affect inspections. According to the commented amendments, from January 2022, FSS inspectors will, among other things, analyze information received from employers. If it turns out that the information is unreliable and this results in an overpayment of benefits, the company or individual entrepreneur will be required to reimburse the fund for the excess amount transferred. In the event that the overpayment occurred due to the fault of the insured person himself, who provided incorrect information, then it will be he who will have to reimburse the excess expenses of the fund (new sub-clause 12, part 1, article 4.2 of Law No. 255-FZ, new sub-clause 9.1, clause 1, art. 18 of Law No. 125-FZ).

Fill out payment slips with current BCC, income codes and other mandatory details Fill in for free

Verified documents

During the inspection, inspectors may request the necessary documents from the person being inspected (Clause 1, Article 37 of Law No. 212-FZ). In accordance with paragraph 2 of Article 37 of Law No. 212-FZ, the requested documents are presented in the form of copies certified by the person being verified. Moreover, copies of documents are certified by the signature of the head of the company and its seal. But notarization of copies of documents is not allowed (Clause 3, Article 37 of Law No. 212-FZ). Of course, controllers can get acquainted with the original documents (clause 4 of article 37 of Law No. 212-FZ).

The law does not say what documents must be required from the person being inspected to conduct an inspection. It is also not stated what to pay attention to in the documents being studied. Therefore, funds are developing internal guidelines that contain an approximate list of requested documentation.

This list can be divided into two groups: general documents and special ones.

Procedure for reimbursement of benefits overpaid by the fund

The rules by which employers and insured persons will reimburse expenses incurred excessively by the fund are given in the new editions of Article 26.20 of Law No. 125-FZ and Article 4.7 of Law No. 255-FZ.

The following algorithm is provided:

- Based on the results of an on-site or desk inspection, inspectors make a decision on reimbursement of excessive expenses incurred.

- Within 5 working days from the date of the decision, it is handed over to the person in respect of whom it was made - the policyholder or the insured employee. The decision comes into force 10 working days after its delivery.

- Within 10 working days from the moment the decision came into force, the Social Insurance Fund sends a claim for compensation to the employer or insured person.

- To fulfill the request, 10 calendar days are allotted from the date of its receipt (unless a longer period is specified).

- If the requirement is not fulfilled, the FSS has the right to file an application for recovery in court. But there is a condition: in the general case, the total amount of expenses incurred excessively by the fund must exceed 3,000 rubles. In such a situation, the application is submitted to the court within 6 months after the end of the period allotted for the voluntary fulfillment of the claim for compensation.

- It is possible that the FSS will impose several demands on the same person. Then the period for going to court will depend on the total amount of unnecessary expenses incurred, which accrued within 3 years from the date of expiration of the earliest requirement. If this amount exceeds 3,000 rubles, the application can be filed with the court within 6 months from the date of excess. If such an amount does not exceed 3,000 rubles, the application can be submitted within 6 months from the date of expiration of the specified three-year period.

ATTENTION

How can the Social Insurance Fund convey to the employer (or the insured person) a decision on compensation for excessively incurred expenses and a claim for compensation?

There are three options. Hand over in person against signature, send by registered mail, or send in electronic form via the Internet. If a document is sent by mail, it is considered received after 6 working days from the date of sending. Receive requirements from the Federal Tax Service and send requested documents via the Internet

Procedure for conducting a desk audit

The place of the desk audit is the office of an employee of the executive body of the FSS. To initiate this type of verification activities, permission from the fund manager is not required. The inspection period is limited to a three-month period from the date of receipt of documentation on insured events or a report from the employer.

Cases when the policyholder is notified of a desk audit:

- Inconsistency between the information available to the fund and the information provided by the enterprise.

- Obvious errors were identified in the employer’s calculations.

- One or more paid insurance claims raises suspicions about the authenticity of the documentation.

If one of the grounds for notification appears, the employer is asked for clarification.

Enterprises are given no more than 5 days to provide explanatory documents and correct previously shown information.

To confirm that he is right, the employer can bring the inspecting employee extracts from the accounting and tax registers and attach additional supporting documents.

If an additional set of documents fails to convince the inspector, an offense is recorded. Based on the identified facts, an act is drawn up. If no errors or omissions were found in the policyholder’s documentation, there is no need to draw up a report. 3 months are allotted for verification.

What decisions does the FSS make based on the results of inspections?

Insurance against industrial accidents and occupational diseases

Now, based on the results of a desk or on-site inspection, inspectors have the right to decide whether to hold the insured accountable or to refuse to hold them accountable.

From January 2022, based on the results of the camera meeting, the FSS will also be able to make decisions (new clause 5.1 of Article 26.15 of Law No. 125-FZ):

- on refusal to assign and pay insurance coverage;

- on the cancellation of the decision on the appointment and payment of insurance coverage;

- for reimbursement of excessive expenses incurred.

And based on the results of the on-site inspection, also decisions (new subparagraph 3 and subparagraph 4, paragraph 8, article 26.20 of Law No. 125-FZ):

- on the cancellation of the decision on the appointment and payment of insurance coverage;

- for reimbursement of excessive expenses incurred.

Insurance in case of temporary disability and maternity

Now, based on the results of inspections (desk and on-site), the FSS may decide not to accept expenses for the payment of insurance coverage. From January 2022, inspectors will also be able to make the following types of decisions (new edition of Part 4, Article 4.7 of Law No. 255-FZ):

- on refusal to assign and pay insurance coverage (reimbursement of the insured's expenses);

- on the cancellation of the decision on the appointment and payment of insurance coverage (reimbursement of the insured's expenses);

- for reimbursement of excessive expenses incurred.

Determine the likelihood of an on-site tax audit and receive recommendations on the tax burden

What fines can FSS inspectors issue based on inspection results?

The grounds for holding policyholders liable and the amount of fines are specified in Articles 26.29, 26.30 of Law No. 125-FZ, Article 26.31 of Law No. 125-FZ (current and new editions) and in the new Article 15.2 of Law No. 255-FZ.

| Insurance against industrial accidents and occupational diseases | Insurance in case of temporary disability and maternity |

| Fines currently being imposed | |

| For non-payment or incomplete payment of contributions as a result of underestimation of the taxable base, other incorrect calculation - 20% of the amount of arrears on contributions, in case of deliberate underestimation - 40%. | FSS employees do not have the right to fine policyholders for non-payment of contributions and for failure to submit calculations of contributions (DAM). |

| For violation of the deadline for submitting the 4-FSS calculation - for each month of delay, 5% of the contributions accrued over the last 3 months, but not more than 30% and not less than 1,000 rubles. | |

| For failure to comply with the procedure for submitting 4-FSS calculations in the form of an electronic document - 200 rubles. | |

| For refusal to send documents during verification of the correctness of calculation of contributions - 200 rubles. for each document not submitted. | |

| Fines that will be added from 2022 | |

| For submitting false information and documents, or concealing them, resulting in excessive payment of benefits - 20% of the amount of excess expenses incurred by the fund, but not less than 1,000 rubles. and no more than 5,000 rubles. | For submitting false information and documents, or concealing them, resulting in excessive payment of benefits - 20% of excess expenses incurred by the fund, but not less than 1,000 rubles. and no more than 5,000 rubles. |

| For refusal to send documents during verification of the completeness and accuracy of the information submitted by the policyholder to the fund on the day the benefit was assigned - 200 rubles. for each undirected document | |

| For violation of the deadline for submitting information necessary for the assignment and payment of benefits - 5,000 rubles. | |

| For refusal to send documents during verification of the completeness and accuracy of the information submitted by the policyholder to the fund on the day the benefit was assigned - 200 rubles. for each undirected document. | |

Create electronic registers and submit them to the Social Insurance Fund via the Internet Submit for free

Who is at risk of being blacklisted?

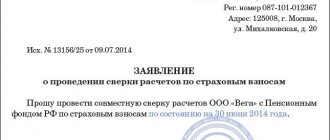

The letter from the Pension Fund of Russia and the Social Insurance Fund contains the selection criteria by which the sample was selected for the audit in 2011. The regulatory authorities are guided by these criteria:

- inconsistencies between calculations according to forms RSV-1 in the Pension Fund and 4-FSS in the Social Insurance Fund;

- the company has expenses financed by the Federal Social Insurance Fund of the Russian Federation (for example, temporary disability benefits at the expense of the Social Insurance Fund);

- reporting was not provided on time;

- the organization made a payment to the employee that is not subject to insurance contributions, for example, material assistance in a significant amount;

- application of benefits for the payment of insurance premiums;

- arrears in contributions for more than two reporting periods in a row;

- the amount of accrued insurance premiums decreased compared to the previous reporting period, but the number of employees remained the same;

- repeated provision of adjustments;

- The tax office can report to the Pension Fund about participation in schemes to minimize the amount of insurance premiums if it suspects this.

Thus, if the insurance premium payer meets most of the criteria, then it is likely that the Pension Fund and the Social Insurance Fund will want to “visit” him.

What fines can the court impose?

In addition, inspectors from the FSS can draw up a protocol on an administrative offense and take the case to court. If the guilt of an official of the organization is proven, he will be held accountable:

- for untimely notification to the Social Insurance Fund of information about opening (closing) a bank account (fine from 1,000 to 2,000 rubles; part 1 of article 15.33 of the Administrative Code);

- for failure to comply with the deadlines for submitting the 4-FSS report (fine from 300 to 500 rubles; part 2 of article 15.33 of the Administrative Code);

- for failure to submit documents and information to verify contributions “for injuries” or submission in incomplete or distorted form (fine from 300 to 500 rubles; part 3 of article 15.33 of the Administrative Code);

- for failure to provide documents and information to verify expenses for social insurance in case of temporary disability and in connection with maternity or submission in incomplete or distorted form (fine from 300 to 500 rubles; part 4 of article 15.33 of the Administrative Code).

Checking general documents

The list of general documents that need to be requested, checked and analyzed during the inspection is given in the Methodological recommendations for organizing on-site inspections of insurance premium payers, approved by order of the Pension Fund of Russia board of May 11, 2010 No. 127R. The list is quite impressive.

Constituent documents are necessary in order to determine whether the audited preferential activities (IT companies, organizations of disabled people, etc.) apply. Also, based on the constituent documents, controllers will study the procedure for paying dividends (they, as is known, are not subject to insurance contributions, since they are not related to either labor or civil law relations (Article 7 of Law No. 212-FZ)).

In addition, the name of the company and its address will be checked based on the constituent documents.

The accounting policy in force during the reporting period is necessary to establish a list of documents on the basis of which accounting is kept, as well as accounting and tax accounting registers. During an inspection, inspectors may request them.

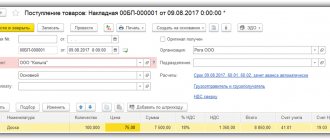

Calculations of accrued and paid insurance premiums for compulsory pension and health insurance for the period under review. Controllers will verify the information contained in the reports and also compare it with the available primary documents.

Special rules

Law No. 212-FZ does not say what specific documents will be required from the person being inspected to conduct an on-site inspection. However, it has been determined that fund employees have the right to request documents an unlimited number of times. While during tax on-site audits, officials cannot request documents that have already been submitted.

Books of accounting of income and expenses and business transactions for the audited period. As you know, “simplified workers” have been paying insurance premiums for compulsory insurance since 2010, so these register books will confirm the accrual and payment of remuneration to employees who have entered into employment or civil law contracts with an employer company that uses the simplified tax system.

The accounting statements of the payer of insurance premiums for the audited period are necessary to compare information about the company's debt to extra-budgetary funds reflected in the balance sheet and reports to the funds. Also, we should not forget that the financial statements include annual reports, explanatory notes to them, and audit reports. From these documents you can glean a lot of useful information about payments to staff along with accruals. For example, a component of information about related parties disclosed in the explanatory note to the financial statements in accordance with PBU 11/2008 “Information about related parties” is information on payments to key management personnel and accruals for these payments (clause 12 of PBU 11/2008) .

Accounting and tax registers for the audited period, including general ledgers, business transaction journals, order journals, statements, analytical cards. The controllers will request all of these documents, drawing a list of them from the accounting policy and relying on the standard document flow that is formed with the automated method of accounting. In these registers, auditors will study and analyze information in search of methods to avoid charging insurance premiums (“salary schemes”).

Employment contracts - first of all, dates of employment, as well as salaries, allowances and bonuses are checked. This information is necessary to verify the completeness of accrual and timely transfer of insurance premiums. If any payments are not specified in the employment contract, this is not a basis for avoiding the calculation of contributions. Please note that all payments made within the framework of labor relations are subject to insurance premiums (Article 7 of Law No. 212-FZ).

Civil agreements (contracts) with individuals that were in force during the audited period. In such contracts, in addition to the amounts of remuneration, the subject of the contract will be carefully studied: does it relate to contracts for the provision of services (performance of work) or to the transfer of property rights, for example, a lease agreement. If the subject of the agreement is the rental of a car with a crew, then the amount of remuneration must be divided into two parts: one part is the rental itself, and the second is the remuneration for the crew. If this is not done, then contributions will be accrued for the entire amount (letter of the Ministry of Health and Social Development of Russia dated March 12, 2010 No. 550-19).

In addition, controllers will look for an opportunity to reclassify a civil contract into an employment contract. This is possible if the subject of the contract is spelled out incorrectly. Namely: the contract was concluded not for the performance of a specific service (prepare financial statements, write a report, etc.), but for the performance of functions (keep accounting records, perform the duties of a press secretary, etc.). In accordance with subparagraph 2 of paragraph 3 of Article 9 of Law No. 212-FZ, payments made under civil contracts are not subject to insurance contributions payable to the Social Insurance Fund.

Sometimes, along with civil contracts, controllers require a list of all persons working on the basis of such contracts. It should be noted that the company is not obliged to maintain such a list. Therefore, the company does not face punishment for its absence. But if the enterprise performs a large volume of work or services on the basis of contract agreements, then it is better to have such a list. Based on the list, it is easy to independently monitor both the correctness of closing such contracts and the timeliness of accruals on them.

Dangerous moment

In practice, during inspections, funds may request documents that they either do not have the right to request or do not exist at all. For example, along with civil contracts, controllers require a list of all persons working on the basis of such contracts. The company is not required to maintain such a list. Therefore, the company does not face punishment for its absence. After all, inspectors do not have the right to demand the preparation of analytical tables and other documents that do not serve for the calculation and payment of contributions.

Acceptance certificates for completed work (rendered services) are necessary to confirm the amount of remuneration, as well as the date of delivery and acceptance of completed work (rendered services).

Bank and cash documents for the audited period: bank statements, instructions, orders, cash book, cashier-operator's journal, cashier's reports, X-reports, Z-reports, etc. In these documents, fund specialists will look for methods of avoiding official salaries . Studying the flow of funds through the current account and cash register is a way to identify transactions with “one-day” transactions. Working with such companies is a certificate of payment of salaries “in envelopes” with a corresponding reduction in insurance premiums.

Primary accounting documents confirming the facts of the enterprise’s economic activities. The list of documents is not specified and is therefore quite extensive. After all, almost all documents that are generated in the process of document flow in a company can be classified as primary documents. But here we must keep in mind that auditors can only require documents in the forms established by government bodies (subclause 1, clause 1, article 29 of Law No. 212-FZ).

As a rule, controllers are interested in documents on accountable amounts (advance reports with documents attached to them; travel certificates, tickets, hotel bills, cash register receipts, receipts, etc.). The purpose of checking these documents is to determine the completeness of the report for advances issued and try to calculate contributions for the difference. By analogy with tax audits, there is a very successful arbitration practice, which allows us to conclude that untimely reporting on accountable amounts does not lead to income for the employee (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 3, 2009 No. 11714/08).

There is a different approach to checking travel expenses. If local regulations establish living standards, then actual consumption is subject to verification. Only actual expenses are exempt from the calculation of insurance premiums, and not the norms approved by the company (letter of the Ministry of Health and Social Development of Russia dated November 11, 2010 No. 3416-19).

The general principle applies to daily allowances: they are not subject to insurance premiums in the amount approved by the company.

In addition to the documents listed in the Methodological Recommendations, fund specialists require personnel documents: work books and documents on personnel accounting and movement.

Work books are necessary to compare the dates of hiring, dismissal, transfer, promotion indicated in them with the dates entered in other personnel documents.

Important

Fund specialists, in addition to general documents, have the right to demand personnel documents: work books and documents on personnel accounting and movement. Work books are necessary to compare the dates of hiring, dismissal, transfer, promotion indicated in them with the dates entered in other personnel documents. Primary HR records are required to verify the dates of hiring, dismissal, payment of bonuses and salaries. Tax officials, conducting an on-site inspection under the Unified Social Tax, did not have such powers.

Primary documents for personnel records (form T-1 - employment order, form T-2 - personal card, form T-3 - staffing table, form T-5 and T-5a - transfer order, forms T-6 and T-6a - leave order, form T-8 - order to terminate the employment contract, form T-11 - order of promotion, form T-12 - report card, form T-49 - payroll), and other documents are required to verify the dates of hiring, dismissal, payment of bonuses and salaries. Sometimes, when checking personnel documents, orders are also discovered regarding employees with whom civil contracts have been drawn up. This fact indicates evasion of payment of insurance premiums in full.

The amounts of accrued payments and rewards in favor of individuals, as well as related insurance premiums, are kept in personal cards (clause 6 of Article 15 and subclause 2 of clause 2 of Article 28 of Law No. 122-FZ). Therefore, personal cards are also the object of study by inspectors. The joint letter of the Pension Fund of the Russian Federation dated January 26, 2010 No. AD-30-24/691, FSS of the Russian Federation dated January 14, 2010 No. 02-03-08/08-56P recommended the form of an individual accounting card for the amounts of accrued payments (other remunerations) and insurance contributions. But a company can also use a card whose form has been developed independently.

In any case, whatever documents the controllers require, they must match each other. Therefore, it is necessary to check for comparability and correctness of execution all documents that are involved in accounting for insurance premiums before starting the audit.

Comments: 10

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Gregory

12/13/2021 at 03:01 3 months the rehabilitation means have run out. It is not possible to reach the local Social Insurance Fund and the supplier of rehabilitation means, where you can go with a complaint.

Reply ↓ Anna Popovich

12/13/2021 at 20:50Dear Grigory, in accordance with clause 8 of the Rules (Resolution of the Government of the Russian Federation “On the procedure ..." dated August 16, 2012 No. 840), a complaint is filed at the place where the violation of the citizen’s rights occurred and the body that is responsible for the provision of a specific service: - if the actions of a local employee are complained fund departments - to the head of the department; - if the actions of the head of the local branch are appealed - to the regional branch of the FSS; - if the decision of the regional branch of the fund is appealed - to the FSS itself.

Reply ↓

08.18.2021 at 10:37

I am a teacher and have recovered from coronavirus. Am I entitled to payments and in what amount?

Reply ↓

- Anna Popovich

08/18/2021 at 23:23

Dear Gulshat, if you are a social worker, you can qualify for payment, in other cases - not. You can check the amount of the payment with your local government authority.

Reply ↓

01/29/2021 at 16:31

I am disabled, group 2, unemployed. (oncology). I need medications to care for my urostomy. I contacted the FSS through the MFC by email on 01/13/21. On 01/29/21 I came to the district Social Insurance Fund to resolve this issue, but I was told that my documents had not yet been reviewed and I would only receive medications for stoma care in March. They offered to buy at their own expense. This is 9000 per month. I have not yet received a disability pension. Tell me, within what period of time after my appeal to the social security authorities are they obliged to give me free drugs and will I be reimbursed for the funds for the purchase upon presentation of receipts?

Reply ↓

- Anna Popovich

01/29/2021 at 20:22

Dear Evgeniy, we recommend that you contact Roszdravnadzor: +7 to receive advice and resolve the issue of providing free medications.

Reply ↓

01/10/2021 at 12:01

Hello! I work in a hospital as a cleaner (nurse). I recovered from coronavirus. Are cleaners entitled to be paid?

Reply ↓

- Anna Popovich

01/11/2021 at 22:34

Dear Farida, the payment is due to medical workers in hospitals, specialized mobile ambulance teams, as well as their drivers, including employees of transport organizations involved in the work.

Reply ↓

10.19.2020 at 12:53

Am I entitled to payment for a work injury (dog bite), I work at a dog shelter. Municipal shelter.

Reply ↓

- Anna Popovich

10/21/2020 at 07:26

Dear Salavat, if the shelter has an agreement with an insurance organization and your case is included in this list, then you have the right to payments. In other cases, it is quite difficult to achieve payments, since the dog from the shelter does not have an owner who is responsible for it.

Reply ↓