Why registration is important for individual entrepreneurs

Registration is important for any citizen of the country. Before registering an individual entrepreneur, a future individual entrepreneur must sort out his registration: it is desirable that it be at the address at which it is planned to carry out commercial activities. Individual entrepreneurs do not have a legal address according to Law N 129-FZ.

Individual entrepreneur registration

Lack of registration means the inability to register an individual entrepreneur. Registration of the entrepreneur’s place of residence is important due to the need to register an individual entrepreneur. Any type of residential premises is suitable for registration:

- House;

- Apartment;

- Dormitory;

- Residential premises for office purposes.

It is not at all necessary to be the legal owner of the housing space - it is enough to simply have a legal basis for residence. In the absence of permanent registration, temporary registration is allowed, but with the condition that the individual entrepreneur must actually live there for at least 6 months. For this purpose, a special verification procedure is carried out, which is chosen by the tax office.

Reference ! If an entrepreneur has simultaneous registration at two addresses, then reporting is still provided to the tax service at the official registration address.

What to do when changing the IP address

The main reason for changing official registration is the individual’s move to a new living space or move to another city. If an individual entrepreneur has changed his registration, what should he do? Should he go to the tax office, extra-budgetary funds and statistical authorities? No no need:

- Information about changes in registration is transmitted to the tax service by the Federal Migration Service within no more than 2 calendar weeks from the official date of re-registration;

- Next, the tax authorities enter information into the Unified State Register of Individual Entrepreneurs within 5 working days;

- They are deregistered with the Federal Tax Service Inspectorate at the old address and registered with the new Federal Tax Service Inspectorate (if the area of the old and new registration is the same, then the Federal Tax Service Inspectorate remains the old one);

- Changes are being made to the Social Insurance Fund, Rosstat and the Pension Fund.

Is it possible to open an individual entrepreneur in another city without registration - what is needed for this?

The FMS will not inform the entrepreneur about entering information. In this case, the individual entrepreneur must check the replacement of information on the websites of the authorities listed above on the fifteenth day after the change of registration. Changing the registration of an individual entrepreneur will be quick and unhindered if the entrepreneur has no debts.

Debts can often arise due to independent accounting, or the use of the services of remote accountants, who work only temporarily and are constantly changing. Due to the lack of a complete picture of accounting, they may make mistakes.

Important ! Migrants and refugees who have temporary residence permits but do not have citizenship must strictly monitor the validity of their visa/residence permit. After the expiration of their validity period, the FMS and the Federal Tax Service will liquidate the individual entrepreneurs within 5 working days.

Checking USRIP information

An individual entrepreneur can carry out his commercial activities at an address that does not coincide with his registration. But he will report to the Federal Tax Service at the place of registration (possibly via the Internet), if the individual entrepreneur is on a simplified or regular taxation system. If the taxation system is combined with “imputation” (UTII) or “patent” (PSN), then it is necessary to report both at the place of registration and at the place of actual activity. You can read about the intricacies of combining tax systems on the Consultant Plus service.

How to pay taxes and submit reports

It matters what tax system you are on.

OSNO, simplified tax system and unified agricultural tax

If you use OSNO, simplified tax system or unified agricultural tax, you previously paid all taxes and contributions to the old inspectorate, and now you will pay to the new one. You will also need to submit reports to the new inspection and funds.

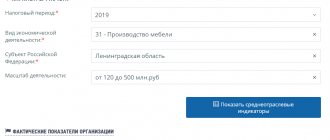

Attention! A new region may have a different tax rate. For example, in your region the standard rate for the simplified tax system “Income minus expenses” was 15%, but where you moved, it was reduced to 10%. You will pay the new rate even if your business remains in the same location in the region at your old place of residence.

Moreover, this new rate will apply to the entire calendar year in which you moved. Even if you moved in December, you will need to calculate taxes for the entire year at the new rate.

The Russian Ministry of Finance explains that for the entire year it is necessary to apply the rate that was in effect on the last day of the tax period (letter dated March 9, 2016 No. 03-11-11/13037). If the tax rate in the old place was higher, and you paid advance payments, then at the end of the year you need to recalculate at the new rate, and you may even have an overpayment.

If the rate was lower, on the contrary, you will have to recalculate the tax upward.

Find out in advance about the current rates in the new region so that you are not surprised that at the end of the year you need to pay a decent amount. In such cases, it may not be advisable to change your registration.

PSN

When applying the PSN, the entrepreneur registers with the tax office at the place of business and pays taxes there. In this case, if your business does not move, but remains in the same place, you will continue to pay tax to the Federal Tax Service where you registered under the PSN. But you will still be registered with the tax office and funds at your place of registration.

There, at the Federal Tax Service Inspectorate at the place of business, you will pay personal income tax for employees, if you have them, and submit reports 2-NDFL and 6-NDFL (Clause 7, Article 226 of the Tax Code of the Russian Federation).

But insurance premiums for yourself and your employees will need to be transferred to the new tax office at your place of registration.

Example. Vasily has a patented store in Ufa. He bought a house in Kazan and registered there, but the store in Ufa remained. Vasily will transfer the fee for the patent and personal income tax from the salaries of sellers to the Ufa tax office, and submit reports 2-NDFL and 6-NDFL there. And insurance premiums for yourself and for employees - to the Kazan Federal Tax Service at the place of registration. You also need to submit reports on insurance premiums there.

But if Vasily’s business on a patent moves to another region, he will have to buy another patent from the new Federal Tax Service. But first you need to find out if there is a patent system for this type of activity.

Reports 6-NDFL and 2-NDFL for individual entrepreneurs with employees

When, after moving and changing the tax office to which you pay personal income tax for employees, the time comes to submit the first 6-personal income tax or 2-personal income tax, you will have to submit two copies of these reports (letter of the Federal Tax Service dated December 27, 2016 No. BS-4-11 / [email protected] ).

In the first copy, reflect only the income at the old place of accounting and with the old OKTMO, and in the second copy - the period attributable to the new Federal Tax Service and with the new OKTMO.

The procedure for transferring from one tax office to another

The question is “if an individual entrepreneur has changed his registration, do I need to notify the tax office?” excluded, since the tax office is notified by the migration service. The translation is carried out automatically. If an individual entrepreneur begins its expansion and opens new branches in other cities/towns, then there will be several Inspectors of the Federal Tax Service. For example, if an individual entrepreneur is initially registered in Novosibirsk, and then opens branches in Kemerovo, Surgut and the Tyumen region, then it is necessary to report to the Federal Tax Service Inspectorate corresponding to each branch.

I opened an individual entrepreneur - what next after registering with the tax office?

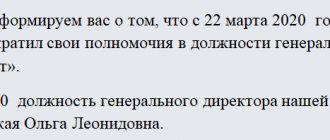

After registration, the tax service sends a notification. TIN and OGRN remain the same. It is recommended to notify the bank and counterparties of a change of registration. If an individual entrepreneur cannot wait for the maximum period for changing data in the Unified State Register of Individual Entrepreneurs, he can independently submit an application to the tax service.

The tax authority must be informed if, when changing registration, an individual entrepreneur wants to change the taxation system. Or submit an application to change the address of an individual entrepreneur to the tax authority, if you cannot wait for automatic registration. It will not be possible to choose different taxation systems for different branches.

Reference! If you need to re-register a car, you will need to inform the traffic police about this and pay for the replacement of the car’s state license plates, PTS and STS.

Checking new individual entrepreneur data in the registry

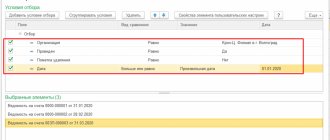

Any new information that an individual entrepreneur reports to the tax office must be checked for accuracy after it is entered into the Unified State Register of Individual Entrepreneurs. But it is the IP address that is not displayed in the extract from the register, which can be downloaded on the Federal Tax Service website, because this information falls under the Federal Law “On the Protection of Personal Data.” Therefore, you can check the data entered into the Unified State Register of Individual Entrepreneurs:

- Having received a new sheet of the Unified State Register of Individual Entrepreneurs 5 days after contacting the tax office. The Federal Tax Service will send it to you by email specified in form P24001.

- Having received documents in paper form. You can do this at the point of filing if you check the last sheet of Form No. P24001.

If the data was entered with errors due to the fault of the Federal Tax Service, then submit an application for correction in free form to the tax office. If the individual entrepreneur made a mistake, submit form P24001 again, indicating on page 001 in paragraph 2 that you are submitting an application in connection with the correction of errors.

When should I notify the tax authorities?

How to change the tax system for individual entrepreneurs and how often can this be done?

Recently, a change of place of residence of an individual entrepreneur, a transfer from one tax office to another, does not require the entrepreneur to contact the tax service. Even when moving to another city, deregistration and registration are carried out through the migration service. The FMS automatically sends new information to the Federal Tax Service within 10 working days from the date of change of registration. The entrepreneur is not obliged to notify either the old or the new tax service about this. This regime was introduced to facilitate these procedures for both entrepreneurs and the tax service itself.

Notification from the tax office

Procedure for registering a personal file:

- Re-registration of an entrepreneur’s personal file is completed by the entrepreneur independently.

- When changing registration, within 5 working days the entrepreneur must re-register with the tax office in order to subsequently send reports there about his activities.

- That is, re-registration will take no more than 1 week. Re-registration of an individual entrepreneur and personal file takes no more than 20 days in total.

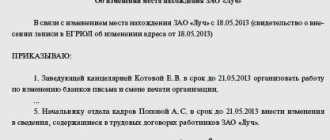

Note! Re-registration of changes in activity (for example, type of activity, current charter) of an individual entrepreneur when moving is carried out in the old Federal Tax Service.

General system, simplified and unified agricultural tax

An individual entrepreneur makes his task easier if, working on the simplified tax system, unified agricultural tax or general regime, he intends to take the business outside his region. In this case, no additional registration procedures are required. The taxes themselves and advance payments on them are paid at the place of residence of the individual entrepreneur. Tax reporting must also be submitted at your place of residence. The authorities of the region in which the businessman actually works do not control tax payments and the submission of reporting forms.

The simplified tax system assumes a reduced tax rate in some regions. The “working” rate for an entrepreneur will be the one that is valid in the region of registration of the individual entrepreneur, and not in the region where he does business. For business in a neighboring region, an individual entrepreneur can acquire, as an owner, non-residential buildings. In this case, he will have to register in accordance with Art. 83 Tax Code of the Russian Federation.

Re-registration with the Pension Fund of Russia

If an individual entrepreneur has changed his registration address, what should he do with the Pension Fund? The Pension Fund of Russia, like Rosstat, receives information about changes in data from the Federal Migration Service. In the Pension Fund of Russia, the registration number changes when moving only if the individual entrepreneur is the employer. If an individual entrepreneur does not have hired employees, then his number in the Pension Fund remains the same. The individual entrepreneur pays mandatory pension contributions to the Pension Fund at his new address. You can find out the address of the new Pension Fund in your personal account of the Federal Tax Service or simply by calling. But, as a rule, most entrepreneurs prefer to report electronically.

If you have not received a notification about re-registration and registration with the new Pension Fund, you need to contact the territorial body of the Pension Fund or the tax service.

Reference! There is no need to change the place of business activity to a new place of registration of the individual entrepreneur. You can work at the same address, you’ll just have to submit your reports to a different tax office.

What difficulties may arise

An individual entrepreneur has changed his registration address: what to do if the change of registration is refused?

Refusal to change your registration and difficulties in obtaining it arise, as a rule, due to unpaid taxes at the old place of registration. Therefore, before changing the address, it is necessary to order a reconciliation of payments from the tax office and check the compliance of the taxes paid with all accrued taxes. The old Federal Tax Service has the right to direct an inspection to the place of old or new registration of the individual entrepreneur. Such checks are aimed at confirming the actual existence of an individual entrepreneur.

The second difficulty is double payments. An individual entrepreneur is deregistered with the old Federal Tax Service only after being registered at a new address. Certificates of payment of state duties and mandatory payments at the old place of registration may remain in the status of transfer for several days, and then the payment may be calculated a second time at the new tax service. In such cases, it is necessary, if possible, to present a payment document confirming the previously made payment.

The Federal Tax Service

During the transfer of an individual business of an entrepreneur, there are obstacles to his activities. The more complex the registration data structure, the longer the transfer will take.

Note! If the individual entrepreneur had a license(s), then it must be reissued. This can be done in the old Federal Tax Service. State duty - from 600 rubles to 2,600 rubles in 2022, depending on the type of license and municipality where the entrepreneur is officially registered.

If the new place of registration is on the “black” list of the tax service, then the address cannot be changed. The blacklist of addresses is the addresses of fraudulent companies and shell companies that were used for illegal activities, or were used to move in order to hide debts from the tax service.

The most difficult thing is when a company moves to another country. Then changing the address of an individual entrepreneur will have much more subtleties, based on the laws of the two countries. If an individual entrepreneur has debts and the business structure is complex, it is better to contact a professional lawyer who will accompany the process.

What documents are needed to make changes to the Unified State Register of Individual Entrepreneurs?

To change data in the Unified State Register of Individual Entrepreneurs, you need to fill out an Application (form P24001). The Application form is filled out in block letters and additional sheets are attached to it. Their choice depends on what exactly has changed. For example, when changing your last name, first name, patronymic or birth information, fill out and attach sheet “A” of form P24001 to the application. Have your passport details changed? Fill out sheet "G". And when changing your place of residence, you need to fill out an additional sheet “B”. See detailed instructions on making changes to the Unified State Register of Individual Entrepreneurs.

In addition, the change of registration must be confirmed by a photocopy of the passport. It is better to make a photocopy of all completed pages, stitch them and number them, writing on the last page how many sheets were sewn. The Application must also be accompanied by a photocopy of the Taxpayer Identification Number (TIN) and the Certificate of State Registration of an Individual Entrepreneur.

The signature on the Application form P24001, as well as a photocopy of the passport, must be notarized. Any notary can do this, and the cost of his services will be within 1000 rubles.