In what cases is a subject recognized as a VAT payer under the simplified tax system?

In accordance with paragraph 3 of Article 346.11 of the Tax Code of the Russian Federation, organizations and individual entrepreneurs do not pay VAT on the simplified tax system. They do not have to present this tax to counterparties when selling goods and services, so they do not issue invoices. After all, this document serves as the basis for the seller to accept the amount of input VAT for deduction - it has no other functions.

There are cases when the duties of the VAT payer are imposed on the “simplified” person. Including if he:

- imports goods into the territory of the Russian Federation, with the exception of those listed in Article 150 of the Tax Code of the Russian Federation;

- recognized as a tax agent for VAT (a typical example is the rental of municipal premises);

- carries out transactions within the framework of a partnership agreement, trust management of property and some others.

Organization without VAT

An organization can operate without VAT if it switches to one of the special regimes.

This can be a simplification, imputation or unified agricultural tax. Usually the choice is in favor

one of the preferential regimes without VAT is due to the desire to reduce the tax burden and time costs for maintaining accounting records. Thus, the income tax rate is 20%, while the single tax under the simplified tax system is calculated at a rate of 6 or 15%, and in some regions there is a reduced rate.

Working without VAT is especially justified for small organizations, the main circle of clients of which are individuals. These are, for example, representatives of the retail trade sector or organizations providing personal services to the population (for example, hairdressers or apartment renovations).

If the counterparty asks to issue an invoice

Why do special regime officers issue invoices with the allocated amount of VAT? The most common reason is the request of the counterparty. The Tax Code does not prohibit this. That is, any entity using the simplified tax system has the right to decide independently whether to issue an invoice with VAT included. However, not every “simplified” person knows that by meeting his customers halfway, he assumes the responsibility of paying this tax.

Meanwhile, the law directly establishes the consequences of such a decision. Subclause 1 of clause 5 of Article 173 of the Tax Code of the Russian Federation states that if a person who is not a VAT payer issues an invoice to the buyer with the allocated amount of tax, he is obliged to pay it to the budget. This is confirmed by clarifications from the Ministry of Finance, for example, letter No. 03-07-14/7897 dated 02/09/2018.

What happens if the simplified taxation system payer ignores this requirement? The Federal Tax Service itself will contact him through a desk audit of his counterparty’s VAT declaration. And then you will have to pay not only VAT, but also fines and penalties. Judicial practice suggests that it will not be possible to challenge these additional charges.

If the seller is a VAT evader

Any transaction for the supply of goods or services is accompanied by the execution of a certain set of documents - contracts, specifications, invoices for payment, shipping forms (waybills, acts), invoices (invoices). If the supplier does not work with VAT, then he sends all these documents to the buyer without reflecting the amount of VAT, putting the counterparty’s mark “Without VAT” or a dash in the places designated for indicating the amount of tax.

In the text of the contract or invoice, it is advisable for the seller to indicate the basis giving him the right not to pay tax. This is important, since the reasons for VAT exemption may be different, but some of them oblige the seller to provide the buyer with an invoice. So, according to paragraph 5 of Art. 168 of the Tax Code of the Russian Federation, sellers who are exempt from VAT due to the fact that their revenue did not exceed 2 million rubles should draw up a tax return. for the last three months (Article 145 of the Tax Code of the Russian Federation) or participating in Skolkovo research projects (Article 145.1 of the Tax Code of the Russian Federation).

What about the deduction?

So, an invoice with a allocated VAT amount for the seller on the simplified tax system automatically means payment of tax. But can he deduct the amount of VAT that suppliers have allocated in their invoices? No, he can not. The fact is that only VAT payers have such a right (clause 1 of Article 171 of the Tax Code of the Russian Federation). However, the fact that a simplifier has paid tax does not make him a VAT payer. He issued the invoice on his own decision, so it turns out that he paid the tax voluntarily.

If the payer of the simplified tax system in this situation accepts input VAT as a deduction, the tax office will make an additional assessment, issue a fine and calculate penalties.

Note! The issuance of an invoice with a separate VAT is of decisive importance. If it is highlighted in the contract, in the invoice for payment, in other documents, then it does not mean anything.

Protective structures in the contract with the counterparty

Considering the active practice of tax authorities removing VAT deductions, it is understandable that companies want to protect themselves from financial losses by imposing on their suppliers the obligation to reimburse amounts commensurate with the VAT not accepted for deduction.

Does the current legislation provide such an opportunity? Yes, it does.

However, the first thing you need to understand: if the contract does not say anything about this, then the buyer has nothing to count on compensation (see, for example, Resolution of the Twentieth Arbitration Court of Appeal dated July 15, 2019 No. 20AP-2589/2019 in case No. A54-10209 /2018). Therefore, in order to be able to recover your losses from the counterparty, it is necessary to include appropriate conditions, so-called protective structures, in the contract.

The Civil Code of the Russian Federation has two articles suitable for this purpose - 406.1 and 431.2. Article 406.1 of the Civil Code of the Russian Federation gives the right to the parties to the relationship to draw up an agreement that contains the obligation of one party to compensate for the property losses of the other party that arise in the event of the occurrence of circumstances specified in such an agreement. In this case, the occurrence of these circumstances should not be associated with a violation of the obligation by the counterparty.

Another article is Art. 431.2 of the Civil Code of the Russian Federation - contains provisions that oblige the counterparty, who has provided false assurances about circumstances relevant to the conclusion of the contract, to compensate for losses or pay the penalty provided for in the contract.

We will not dwell in detail on the differences between these provisions; we will only note two fundamental points. The first is that Article 406.1 of the Civil Code of the Russian Federation deals with property losses, and Article 431.2 of the Civil Code of the Russian Federation deals with losses. The main difference between these concepts is that losses arise if there is a cause-and-effect relationship between the actions of the counterparty and the resulting consequences (losses). In this situation, the loss must have occurred because the supplier made false representations. And the occurrence of losses does not depend on the illegal actions of the counterparty; what matters here is the occurrence of a certain circumstance.

The second important point is that the circumstances in respect of which assurances are provided concern the past or relate to the present, that is, at the time the assurance is provided (clause 1 of Article 431.2 of the Civil Code of the Russian Federation). The circumstances that cause losses relate to the future (clause 1 of Article 406.1 of the Civil Code of the Russian Federation). The conclusions on these two points are confirmed by paragraph 15 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 24, 2016 No. 7.

In practice, the parties may use one of these rules or both of these articles simultaneously. It also happens that companies combine these two designs into one. For example, it states that:

- the supplier gives appropriate assurances (in particular, that it properly fulfills its obligations to pay taxes and fees, etc.);

- in the event of the unreliability of such representations, which resulted in a decision on additional VAT assessment being made against the buyer (as a result of the removal of the deduction), the supplier shall reimburse the amounts specified in this decision in relation to the episode of the transaction with him.

Analyzing judicial practice, we can say that the courts have no complaints about such agreements yet (resolution of the Fifteenth Arbitration Court of Appeal dated January 24, 2019 No. 15AP-20639/2018 in case No. A53-14535/2018). In addition, Articles 406.1 and 431.2 of the Civil Code of the Russian Federation do not contain any incompatible provisions that could cause serious problems when the two structures are superimposed.

Therefore, if the parties decide to use both of these mechanisms together, we do not see any obstacles to this.

What else will you have to do?

But the new responsibilities don't end there. You will have to file a VAT return - this is required by paragraph 5 of Article 174 of the Tax Code of the Russian Federation. This must be done the following month after the end of the quarter in which the invoice was issued. The deadline is the 25th.

Moreover, the VAT return can be sent exclusively in electronic form via telecommunications channels. To do this, you will have to create an electronic signature and enter into an agreement with an electronic document management operator. A paper report will not be accepted, and the organization or individual entrepreneur will receive a fine and other negative consequences for failure to submit it.

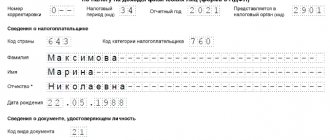

Payers of the simplified tax system who issued an invoice submit the following sections as part of the VAT return:

- Title page;

- Section 1. On line 030 you need to reflect the amount of tax payable to the budget;

- Section 12 for each invoice issued separately.

Is it possible to issue an invoice without VAT?

In some cases, VAT payers issue invoices without tax. For example, if they received an exemption under Article 145 of the Tax Code of the Russian Federation . In such invoices the entry “Excluding tax (VAT)” is made. Such a document does not entail the obligation to pay tax.

Does the payer of the simplified tax system have the right to issue an invoice without VAT? Judicial practice suggests that this will not help him. For example, this is indicated in the resolution of the Supreme Court of the Supreme Soviet of April 12, 2018 No. F02-1385/2018 in case No. A19-13739/2017. The bottom line is that the benefits provided for in Article 145 of the Tax Code of the Russian Federation do not apply to “simplified workers” . As well as other benefits for VAT payers.

Conclusions. There is no point in issuing invoices for a company or individual entrepreneur using the simplified tax system. If this is done, it is usually in order to please a large counterparty. But the benefits from such cooperation seem doubtful. After all, the tax invoiced must be paid to the budget. And at the end of the quarter, submit a VAT return to the Federal Tax Service in electronic form. Failure to fulfill the taxpayer's obligations will entail not only additional tax payment, but also penalties.

If the buyer (counterparty) is a VAT defaulter

Since the responsibility for documenting the transaction lies with the seller, the supplier paying VAT issues invoices and shipping documents to the buyer, fixing the rate and the amount of VAT, even in cases where his counterparty is not a VAT payer.

In this case, the seller - a VAT payer has the right not to transfer the SF to the buyer if he has concluded a corresponding written agreement with him (clause 1, clause 3, article 169 of the Tax Code of the Russian Federation). It is more convenient to reflect this fact in an additional agreement to the supply contract. The seller should record the transaction in the sales book, so he usually draws up one copy of the SF for himself, although he has the right to use details of other primary forms to reflect the fact of the transaction.

The buyer is obliged to pay the invoice taking into account the tax; he does not have the obligation to prepare tax reports. He needs to highlight the amount of tax in the total cost of delivery in payment documents, for example, in a payment order in the “Base of payment” field.

The buyer can take into account the VAT paid as follows:

- Include it in the cost of goods/services accepted for accounting (clause 3, clause 2, article 170 of the Tax Code of the Russian Federation). This method is acceptable for companies exempt from VAT on the basis of Art. 145 and 145.1 of the Tax Code of the Russian Federation, as well as UTII payers (Article 346.23 of the Tax Code of the Russian Federation).

- Including tax as part of expenses that reduce income is acceptable for “simplified” people in the “Revenues minus expenses” mode. In this case, upon receipt of the delivered goods at full cost including VAT, the buyer writes off this amount (clause 2 of Article 346.17 of the Tax Code of the Russian Federation): for fixed assets and intangible assets in equal shares from the moment the objects are put into operation;

- for goods for resale - as they are sold;

- for inventory items - when they are written off for production or sale.

Since VAT according to Ch. 26.2 of the Tax Code of the Russian Federation is considered an expense, then “simplified” in KUDiR it should be reflected for purchased goods separately (in a separate line) and confirmed by indicating the number of the payment document, invoice or invoice upon sale.

Example

Upon delivery of goods in the amount of 720,000 rubles, including VAT of 120,000 rubles. (as indicated in the documents accompanying the transaction), the “imputed” buyer accepted for accounting goods worth RUB 720,000. But in the payment order for payment for this product, he o.

If the counterparty works without VAT and pays in advance, then the seller, upon receipt of payment, draws up an advance SF in the usual manner, but in one copy - for himself. There is no need to send the SF to a buyer who does not report VAT.