Many large companies have separate divisions. In the process of activity, various situations arise when branches, representative offices and other “separate units” change their location. Such a change is subject to state registration and in order to make it, the organization must follow a certain procedure.

The process for making changes depends on the specific type of separate unit. One procedure applies for representative offices and branches, and another for other types of separate divisions. This procedure is regulated by the provisions of federal laws No. 14-FZ of 02/08/1998 “On Limited Liability Companies”, No. 129-FZ of 08/08/2001 “On State Registration of Legal Entities and Individual Entrepreneurs”, the Tax Code of the Russian Federation, as well as by-laws - by order of the Ministry of Finance Russia on the approval of Administrative Regulation No. 169n dated September 30, 2016. Let’s consider how the address of a separate division is changed, and the company’s procedure for doing so.

Representative offices and branches

To change the address of a representative office or branch, it is necessary to analyze the organization’s charter. If this document contains information about the address of such a separate division, then changes to the charter will be required. Let us recall that the current legislation does not oblige such information to be indicated in the charter of a legal entity, but practice shows that in many cases information about branches and their addresses is still available in this document. Therefore, changing the address of a separate division in such situations will require a procedure for amending the charter.

To do this, it is necessary to convene an extraordinary meeting of participants, at which a decision must be made to change the document. There are two options here:

- Exclusion from the charter of the clause on a separate division;

- Entering new information about the location.

The decision of the meeting is approved by the minutes, which, together with an application in form P13001 and with the new edition of the charter, are submitted to the tax office to register the changes.

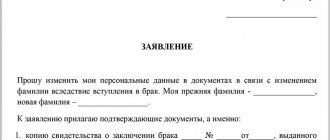

In a situation where the organization’s charter does not contain information about a branch or representative office, the procedure for making changes is somewhat different. The head of the organization must make an appropriate decision, on the basis of which an application on form P14001 is filled out. The application must be received by the tax office at the place of registration of the organization within three working days from the date of the decision. Let us note that if the charter of an organization or the regulations on a branch provide for a different procedure for making decisions regarding its activities, including decisions on its name, location and other issues, then the procedure specified in these documents must be observed, for example, a general meeting of participants was held.

Please note that currently there is no need for a separate division to additionally notify the tax authorities at its location about the changes being made. Information about this is received by them through departmental exchange.

Accounting and Finance

A message about a change in the address of a separate subdivision (SSU) in form N S-09-3-1 must be submitted only if the address of the SUB, which is not a branch or representative office, has changed.

This message must be sent to the Federal Tax Service at the location of the organization itself (head office) within three working days from the date of change of the address of the OP, i.e. from the day when the activities of the OP began at the new address of clause 6 of Art. 6.1, paragraphs. 3 p. 2 art. 23 Tax Code of the Russian Federation. This date may be indicated in the order of the head of the organization about the start of the activities of the OP at a new address.

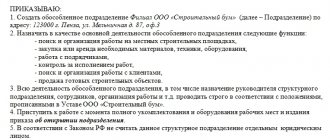

Example. Order on the start of activities of the OP at a new address

LLC "Alpha" ORDER on the start of activities of a separate division "Beta" at a new address

06/20/2019 N 48

From June 25, 2019, the activities of the separate division “Beta”:

- stop at the address Moscow region, Domodedovo, st. Lesnaya, 17;

- start at the address Moscow region, Balashikha, st. Sovetskaya, 18.

General Director Ivanov Ivanov I.I.

Example. Filling out a message about changing the address of a separate division (form S-09-3-1)

Alpha LLC is registered for tax purposes with the Federal Tax Service No. 22 in Moscow. The organization has a separate division “Beta” in the city of Domodedovo, Moscow region. The organization has been assigned a checkpoint:

- at the location of the organization - 772201001;

- at the location of OP "Beta" - 500945001.

Since June 25, 2019, OP “Beta” has been operating at a new address in Balashikha, Moscow region.

Message No. S-09-3-1 must be sent to the Federal Tax Service no later than June 28, 2019.

The branch or representative office will be deregistered at the old address and registered at the new one by the Federal Tax Service itself (based on the information you enter into the Unified State Register of Legal Entities).

If the new address of the OP (including a branch or representative office) is under the jurisdiction of another Federal Tax Service, then within five working days from the date of submission of message N C-09-3-1 (entering information in the Unified State Register of Legal Entities) the OP will be assigned a new checkpoint, paragraph. 4 clause 7 of the Procedure for assigning a TIN, clause 2 of Art. 84 Tax Code of the Russian Federation.

It is necessary to report to the FSS about a change in the address of the OP only if it is registered with this fund.

Within 15 working days from the date of change of address, submit an application for registration of the OP at the new location of the subdivision to the FSS branch where the OP was registered before the change of address. 13 clause 2 art. 17 of Law No. 125-FZ, clause 26 of Order No. 202n, clauses. “c” clause 14 of the FSS Regulations.

In the application in the Information about the OP you must indicate:

- in paragraph 2 - the new address of the OP;

- in clause 8 - the extended registration number of the organization in the Social Insurance Fund (number with code OP).

There is no need to inform the Pension Fund about a change in the address of the OP.

Useful publications

- Deregistration of a separate division The procedure takes place in the following steps: Form S-09-3-2 must be submitted to the tax office (by order of the Federal Tax Service No....

- Head of a separate division Basics of the legal status of separate divisions Civil legislation regulates the legal status of two categories of separate divisions - representative offices ...

- Closing a separate division Reducing the staff of a separate division The first step to closing a separate division is informing employees in advance about the upcoming...

- Share of the tax base for a separate division calculation Calculation of the share of the tax base for a separate division from the AVERAGE NUMBER. Where? In the 1C Accounting program, maintaining...

- Changes in information in the Unified State Register of Legal Entities Information from the Unified State Register of Legal EntitiesIn the Unified State Register of Legal Entities, information about a legal entity (any) is presented in...

Other separate divisions

Changing the address of a separate division that does not belong to the category of branches or representative offices is simplified. To register a change, it is necessary for the head of the organization to issue an appropriate order. After this, a tax notification is submitted about the change of address of the separate division, in form C-09-3-1. This notification is sent within three days (from the date of the decision) to the tax office at the place of registration of the legal entity.

In this case, it is also not necessary to notify the tax authorities at the location of the separate division.

Changing a “separate” address

First, let's figure out what is considered a separate division and when it has tax registration.

Identification principles

As specialists from the main financial department indicated in letter No. 03-02-07/2-73 dated April 21, 2008, the Tax Code provides for two criteria, if present, a division is recognized as separate:

- the company carries out its activities through its division, territorially isolated from its location;

- creation of jobs at the place where this activity is carried out for a period of more than one month (clause 2 of article 11 of the Tax Code).

Thus, the financiers emphasized, the installation of at least one stationary workplace of a company outside its location is already recognized as the creation of a separate division, regardless of whether this fact is reflected in the constituent documents of the company or not.

Registration rules

Clauses 1 and 4 of Article 83 of the Tax Code oblige you to register for taxation at the location of a separate division of business entities. To do this, it is necessary to submit a corresponding application to the local inspectorate no later than one month from the date of creation of the “isolation”. A special form for such an application was approved by order of the Federal Tax Service dated December 1, 2006 No. SAE-3-09/ [email protected]

At the same time, if a company, for any of the reasons provided for by the Tax Code, is already registered with one of the inspectorates of the municipal district in the territory of which the division is opened, then there is no need to register such a “separate entity.” It is enough just to inform “your” tax authorities about its creation (clause 2 of article 23 of the Tax Code). However, this must also be done within a month and in a strictly established form, which was approved by order of the Federal Tax Service of Russia dated January 17, 2008 No. MM-3-09 / [email protected] Please note that the company is obliged to similarly notify controllers regarding each created unit, regardless of whether it is subject to registration or not.

A simplified procedure for tax accounting of organizations is also provided for cases when a company has several “separate entities” within the same municipal district, but in territories under the jurisdiction of different tax inspectorates. In this case, registration is carried out by auditors at the location of the unit that the norm itself chooses

So, within a month from the moment of creation of a separate division, the company must submit the following documents to the tax office:

- notification of the creation of a separate unit in form No. S-09-3, which is sent to the home inspectorate at the location of the parent organization;

- application for registration of a separate division in form No. 1-2-Accounting, sent to the auditors at the place of creation of the “separate division”.

In addition, the application must be accompanied by duly certified copies of the certificate of registration with the inspection of the parent organization and documents confirming the creation of a separate division.

Moving problems

One could say that the Tax Code quite clearly spells out the procedure for registering separate divisions, if not for one “but”. The Main Tax Law does not contain a rule providing for the possibility of changing the location of an “isolated” person, and, accordingly, no special rules for tax registration at a new address.

In essence, this means that, for example, when concluding a new lease agreement for premises to carry out activities through a division at an address under the jurisdiction of another tax authority, the company must carry out the procedure of closing one “separate unit” and opening a new similar structure. Moreover, most likely, the company will have to do the same even if the division changes its address within the territory of the same tax office.

Thus, it turns out that the organization in this situation is obliged, firstly, to send two messages in form No. S-09-3 to the inspectorate at the location of the head office about the closure of one division and the opening of a new one. Secondly, she needs to submit an application to the tax authorities at the location of the former “isolated entity” for deregistration using form No. 1-4-Accounting, approved by order of the Federal Tax Service of December 1, 2006 No. SAE-3-09 / [ email protected] And finally, at the location of the newly created structure, submit to the auditors the already mentioned application for registration in form No. 1-2-Accounting and the accompanying set of documents. We should also not forget that the closure of a separate branch is a legal basis for inspectors to conduct an on-site tax audit. In particular, paragraph 5 of Article 84 states that tax authorities must deregister such a structure within 10 days from the date of submission of the corresponding application by the taxpayer, but not earlier than the end of the on-site audit, if one is carried out.

Prospects

To be fair, it should be noted that this problem did not go unnoticed by the Ministry of Finance. Thus, in the mentioned letter dated April 21, 2008 No. 03-02-07/2-73, financiers considered the issue of establishing a procedure for tax authorities to make changes to the information they have about the unit in the event that the “isolated” changes its location within the area under its jurisdiction the same tax inspectors. As often happens in our country, the cause of all the troubles turned out to be gaps in the legislation. In their opus, specialists from the main financial department indicated that, according to Russian laws, the location of the organization and its branches and representative offices is determined through the corresponding addresses. The address is also one of the identification features of other separate divisions of business entities. At the same time, experts from the Ministry of Finance complained, neither the Tax Code nor the Civil Code defines what should be understood by a change in the location of a branch, representative office or other “separate entity.” The tax legislation does not establish the procedure for registering company divisions with the tax authorities in connection with a change in their location.

At the same time, we must give the Ministry of Finance officials their due: they do not intend to leave everything as it is. Another thing is that, in their opinion, the proposal to simplify the procedure for accounting for “wandering individuals” requires additional refinement. In particular, they believe that it is necessary to simplify “transfers” from the territory of one inspection to the territory of another. Financiers propose to make the rules for changing the location of branches and representative offices similar to recording information about changes in the location of the parent organization.

S. Kotova , expert at the Federal Agency for Financial Information

| New generation berator PRACTICAL ENCYCLOPEDIA OF AN ACCOUNTANT What every accountant needs. The full scope of always up-to-date accounting and taxation rules. Connect berator |

Changing the address of a separate division within one tax office

The legislation clearly states that a change in the address of a legal entity or its separate divisions must be registered by an authorized government agency. Therefore, a change in the location of a separate division, even within the territory under the jurisdiction of one tax inspectorate, entails the need to notify the Federal Tax Service. This requirement also applies if the head office and a separate division fall under the competence of one territorial division of the tax service.

At the same time, in practice there are situations when such notification is not required. For example, information about a branch indicates only the building number, without indicating the specific premises where the branch is located. In this case, moving to a new premises within the same building does not entail the need to declare changes to the tax office.

Documents on changing the address of a separate division are submitted directly to the tax service division at the place of registration of the organization, or are sent there via telecommunication channels, or by registered mail.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The separate unit has changed its address. Algorithm of actions

Our company has opened a branch in Chelyabinsk.

The branch, on behalf of the enterprise, enters into contracts with clients for the provision of services, has its own current account, pays salaries to its employees and pays the corresponding taxes, and independently submits declarations on accrued salaries. Now, due to production reasons, there is a need to change the address of the branch, and this is a different area of the city and, accordingly, a different Federal Tax Service. What is the best way to carry out operations to register a branch at a new address, while maintaining the current account and contracts with clients? —————————

An enterprise is a branch of an organization located in another city. The legal address of the branch, which is indicated in the regulations on the branch and constituent documents, does not coincide with the actual address; in addition, due to the crisis, it was decided to rent a new office with a lower rent, but in the same administrative area. In connection with the above, the question arises: is it necessary and in what form to notify the tax authority, the Pension Fund of the Russian Federation, the Social Insurance Fund (after all, a branch can still change its office more than once)?

In accordance with paragraphs. "n" clause 1 art. 5 of the Federal Law of the Russian Federation dated 08.08.2001 No. 129-FZ “On state registration of legal entities and individual entrepreneurs” information about branches

and representative offices of a legal entity

are contained

in the unified state register of legal entities.

According to paragraph 5 of Art. 5 of the Federal Law of the Russian Federation dated 02/08/1998 No. 14-FZ “On Limited Liability Companies” charter

the company must contain information about its branches and representative offices.

Notifications of changes to the charter

of the company, information about its branches and representative offices is submitted to the body that carries out state registration of legal entities.

The specified changes in the company's charter come into force for third parties from the moment of notification of such changes to the body carrying out state registration of legal entities.

A similar rule is contained in paragraph 6 of Art. 5 of the Federal Law of the Russian Federation of December 26, 1995 No. 208-FZ “On Joint Stock Companies”

.

Art. 19 of Law No. 129-FZ

It has been established that in cases established by federal laws (Law on LLC, Law on JSC),

a legal entity submits to the registration authority

at its location

a notice

about amendments to the constituent documents, a decision to amend the constituent documents and changes.

When making changes to the constituent documents of a legal entity, the registering authority within a period of no more than five days

from the moment of receipt of the specified notification, makes a corresponding entry in the unified state register of legal entities, which is reported to the legal entity in writing.

At the same time, changes made to the constituent documents become effective for third parties from the moment the registration authority is notified of such changes.

On sheet A of the Notification form on amendments to the constituent documents of a legal entity

, which was approved by Decree of the Government of the Russian Federation dated June 19, 2002 No. 439,

the address (location) of a branch of

a legal entity on the territory of the Russian Federation is indicated, including postal code, subject of the Russian Federation, district, city, settlement, street (avenue, lane, etc.), house number (possession), building (building), apartment (office).

The Ministry of Finance of the Russian Federation in a letter dated April 21, 2008 No. 03-02-07/2-73 noted that in accordance with the legislation of the Russian Federation, the location of

The organization, its

separate divisions in the form of branches

and representative offices

are determined through the corresponding addresses

.

For tax accounting purposes, Art. 83

and

84 of the Tax Code of the Russian Federation

establishes the procedure for registering and deregistering an organization when the organization carries out activities in the Russian Federation through a separate division.

Let us remind you that Art. 11 Tax Code of the Russian Federation

recognizes as a separate division of an organization any division territorially isolated from it, at the location of which stationary workplaces are equipped.

Recognition of a separate division of an organization as such is carried out regardless of whether its creation is reflected or not reflected in the constituent or other organizational and administrative documents of the organization, and on the powers vested in the specified division.

At the same time, the Tax Code of the Russian Federation does not establish a procedure for recording separate divisions with tax authorities

organizations

due to changes in their locations

.

In addition, the Tax Code of the Russian Federation and the civil legislation of the Russian Federation do not define what is meant by a change in the location of a branch

, representative office or other separate division of the organization.

The Ministry of Finance notes that the Tax Code of the Russian Federation does not provide for the recognition of a division of an organization as separate without connection with a specific place of activity of the organization, territorially isolated from its location, and depending on the jurisdiction of the tax authorities of the territory in which this separate division is located, and also does not establish an accounting procedure in tax authorities of separate divisions of organizations in connection with a change in their location.

In this regard, the regulatory authorities believe that in the event of a change in the location of a separate division, the organization must carry out the procedure for closing and opening a separate division

.

In accordance with paragraph 1 of Art. 83 Tax Code of the Russian Federation

An organization that includes separate divisions located on the territory of the Russian Federation

is obliged to register

with the tax authority at the location of each of its separate divisions, if it is not registered with the tax authority at the location of this separate division on the grounds provided for by the Tax Code. RF.

Within one month from the date of termination of activity

organization through a separate division (closing a separate division), the organization is obliged to notify the tax authority at the location of the organization about this in writing.

Form No. S-09-3

“Notice on the creation (closing) of a separate division of an organization on the territory of the Russian Federation” was approved by order of the Federal Tax Service of the Russian Federation dated April 21, 2009 No. MM-7-6/ [email protected]

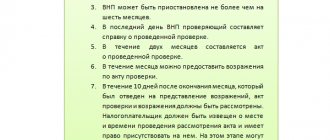

If an organization makes a decision to terminate the activities (closing) of its separate division, deregistration of the organization at the location of this separate division is carried out by the tax authority at the request of the taxpayer

within 10 days from the date of filing such an application, but not earlier than the end of the on-site tax audit if it is carried out (

clause 5 of Article 84 of the Tax Code of the Russian Federation

).

Consequently, the organization must submit an Application for deregistration of the Russian organization with the tax authority at the location of its separate division

on the territory of the Russian Federation

according to form No. 1-4-Accounting

, approved by order of the Federal Tax Service of the Russian Federation dated December 1, 2006 No. SAE-3-09/ [email protected]

Next, the organization must submit an Application for registration of a Russian organization with the tax authority at the location of its separate division

on the territory of the Russian Federation (

Form No. 1-2-Accounting

) within one month from the date of creation of a separate division to the tax authority at the location of this separate division, if the organization is not registered on the grounds provided for by the Tax Code of the Russian Federation with the tax authorities in the territory municipal formation in which a separate division has been created (

clause 4 of article 83 of the Tax Code of the Russian Federation

).

The Federal Tax Service of the Russian Federation believes that simultaneously with the Application

in one copy, copies of the certificate of registration with the tax authority of the organization at its location, certified in the prescribed manner, documents confirming the creation of a separate division. When an organization vests a separate division with the authority to pay taxes at its location, a document is submitted confirming the said authority (letter dated March 15, 2007 No. 09-2-03/ [email protected] ).

Let us remind you that all these rules apply if the organization is not registered

on the grounds provided for by the Tax Code of the Russian Federation, with the tax authorities in the territory of the municipality in which this separate division was created.

In other cases

registration of an organization with the tax authorities at the location of its separate divisions is carried out by the tax authorities

on the basis of messages in writing, that is, in form No. S-09-3

.

Moreover, if several separate divisions

organizations are located

in the same municipality in territories under the jurisdiction of different tax authorities

; registration of the organization can be carried out by the tax authority at the location of one of its separate divisions, determined by the organization independently.

According to paragraph 1 of Art.

83 of the Tax Code of the Russian Federation, organizations are subject to registration

with the tax authorities, respectively, at the location of the organization, the location of its separate divisions, as well as

at the location of the real estate and vehicles owned by them

.

Thus, if an organization is registered on at least one of the above grounds with the tax authority on the territory of a municipal entity, the organization’s registration with the tax authorities at the location of its separate divisions on the territory of this municipal entity is carried out by tax authorities only on the basis of messages in the form No. S-09-3

.

The Ministry of Finance of the Russian Federation believes that the procedure for making changes to the information available to the tax authority about a separate division of an organization in the event of a change in the organization’s place of activity (address) should be simplified, and in letter dated 05/08/2009 No. 03-02-07/1-236 reported that at present the Ministry of Finance of the Russian Federation, with the participation of the Federal Tax Service of the Russian Federation, has developed a draft order approving the procedure for registering organizations at the location of their separate divisions, which, in particular, provides for the possibility of registering an organization with the tax authorities at the location of its branch (representative office) ) on the basis of an application for registration, which is submitted by the organization to the registering tax authority, simultaneously with the submission of an application for amendments to the constituent documents of the legal entity in relation to the corresponding branch (representative office).

In addition, it is planned to prepare a draft federal law on amendments to the Tax Code of the Russian Federation in order to improve the accounting procedure for organizations and individuals with tax authorities. At the same time, it is intended to simplify the procedure for accounting with tax authorities of organizations at the location of their separate divisions.

However, pending the introduction of appropriate changes to part one of the Tax Code of the Russian Federation, tax authorities ensure registration of organizations at the location of their separate divisions based on a study of actual circumstances, guided by current legislation

Russian Federation.

That is, every time the branch address changes

the organization must carry out the procedure for closing and opening a separate unit.

In accordance with clause 19 of the Rules for maintaining a unified state register of legal entities and providing the information contained therein, approved by Decree of the Government of the Russian Federation of June 19, 2002 No. 438 (as amended on December 8, 2008), the registration authority

within a period of no more than 5 working days from the date of state registration of a legal entity and (or) making changes to the state register,

provides information

about the legal entity free of charge to the territorial bodies of the Federal Agency for Federal Property Management, territorial bodies of the Pension Fund of the Russian Federation, regional branches of the Social Insurance Fund of the Russian Federation , military commissariats, territorial compulsory health insurance funds and territorial bodies of the Federal State Statistics Service and in cases established by federal laws - to other bodies.

The specified information is provided in electronic form.

However, this does not mean

that, based on the information provided, the funds will independently re-register the organization in the event of a change in the location of the branch.

According to clause 6 of the Procedure for registering legal entities as insurers at the location of separate divisions

and individuals in the executive bodies of the Social Insurance Fund of the Russian Federation, approved by Resolution of the Federal Insurance Fund of the Russian Federation dated March 23, 2004 No. 27 (as amended on January 25, 2007),

in the event of a change in the location of a separate division

of a legal entity that is an insured, specified

the person submits an application for registration

as an insurer to the regional office of the Fund (branch of the regional office of the Fund)

at the new location

within a month from the date of such changes.

An organization that has separate divisions must notify the TFOMS in writing

(with a copy of the decision to liquidate a separate subdivision attached)

on changes in the information specified when registering

this organization in the territorial fund at the location of the separate subdivision, or when deregistering it, the territorial fund within 10 days from the date of making such changes in relation to these divisions in the Unified State Register of Legal Entities by the federal executive body carrying out state registration of legal entities and individual entrepreneurs (clause 18 of the

Rules for registration of policyholders in the territorial compulsory health insurance fund

for compulsory health insurance, approved by Decree of the Government of the Russian Federation of September 15, 2005 No. 570 ).

The situation with the Pension Fund of the Russian Federation is not entirely clear.

Clause 18 of the Procedure for registration and deregistration in the territorial bodies of the Pension Fund of the Russian Federation

insurers making payments to individuals, approved by Resolution of the Board of the Pension Fund of October 13, 2008 No. 296p, it is established that the deregistration of an organization at the location of a separate division if it makes a

decision to terminate the activities of its separate division

or a decision to switch to a centralized Payment of the unified social tax and insurance contributions for compulsory pension insurance is carried out by the territorial body of the Pension Fund of the Russian Federation at the location of the separate unit within 5 days from the date the organization submits the

following documents

:

– applications for deregistration of an organization at the location of a separate unit on the territory of the Russian Federation in the territorial body of the Pension Fund of Russia;

– copies of the decision (order, instruction) on termination of the activities of a separate division (liquidation, reorganization), decision (order, instruction) on the transition to centralized payment of the unified social tax and insurance contributions for compulsory pension insurance.

As we can see, we are talking here about terminating the activities of a separate unit, and not about changing its location.

Therefore, in this case, it is better for you to contact the territorial body of the Pension Fund of the Russian Federation with which your organization is registered for appropriate clarification.

If your organizations have ongoing contracts with counterparties, then if the branch address changes, you need to inform the counterparties about the change of address

.

You can conclude an additional agreement to the contract

, in which the section of the agreement “Addresses and details of the parties” is stated in a new edition.

Changing the branch address has no effect

on the branch's current account.

The score remains the same.

Separate unit or business trip?

According to Article 209 of the Labor Code of the Russian Federation, a workplace is a place where an employee must be or where he needs to arrive in connection with his work and which is directly or indirectly under the control of the employer.

According to clause 1 of Article 83 of the Tax Code of the Russian Federation, organizations that include separate divisions located on the territory of the Russian Federation are subject to registration with the tax authorities at the location of each of their separate divisions.

At the same time, if the taxpayer has difficulties determining the place of registration with the tax authority, then the decision based on the data submitted by him is made by the tax authority (clause 9 of Article 83 of the Tax Code of the Russian Federation).

Tax authorities make this decision based on the documents submitted by the organization, on the basis of which it carries out the relevant activities:

- or at the location of the organization,

- or at the place where the organization operates.

As the Ministry of Finance notes in its Letter dated 08/02/2013 No. 03-02-07/1/31001:

“A separate unit is recognized as such regardless of the form of work organization, the specific employees performing a specific job, or the period of stay of a specific employee at a stationary workplace. »

At the same time, there is no definite answer to the question of whether it is necessary to create a separate division in the case of:

- long business trips for employees,

- providing services to customers in other regions,

- and so on.

the department does not give, referring to the above norms of the Tax Code of the Russian Federation.

Accordingly, if a company does not have its own clear position on the issue of the establishment of a separate division, it can contact its tax office, which will decide whether the division should be a separate division or not.

The Ministry of Finance adheres to a similar position when answering questions about the creation of separate divisions in the event of concluding employment contracts with remote workers.

So, in his Letter dated July 17, 2013. No. 03-02-07/1/27861 The Ministry of Finance writes the following:

“According to Art. 312.1 of the Labor Code of the Russian Federation, remote work is the performance of a labor function specified in an employment contract outside the location of the employer, its branch, representative office, other separate structural unit (including those located in another locality), outside a stationary workplace , territory or facility directly or indirectly under control of the employer, subject to the use of public information and telecommunication networks, including the Internet, to perform this job function and to carry out interaction between the employer and employee on issues related to its implementation.

The definition of remote work contains features that differ from the characteristic features of a separate division of the organization specified in paragraph 2 of Art. 11 of the Code.

In accordance with paragraph 9 of Art. 83 of the Code, if a taxpayer has difficulty determining the place of registration with the tax authority, a decision based on the information provided by him is made by the tax authority.

The taxpayer has the right to contact the tax authority at the location of the organization or the tax authority at the place where the organization operates, which makes this decision based on the documents submitted by the organization on the performance of remote work by its employees.”

The Ministry of Finance adheres to the same position in its Letter dated July 4, 2013. No. 03-02-07/1/25829.

In our opinion, no appeals to the tax authorities on this issue are necessary to draw a simple and obvious conclusion:

- Due to the fact that the labor function of a remote worker is performed outside a stationary workplace, which is under the control of the employer, the conclusion of an employment contract with a remote worker does not lead to the formation of a stationary workplace, which means that the employing company does not have a separate division, since it does not the requirements of clause 2 of article 11 of the Tax Code of the Russian Federation are met.

Changing the address of a separate division - the procedure for calculating income tax

Tax returns continue to be compiled for a separate division on an accrual basis from the beginning of the year

02/10/2020Russian Tax Portal

The answer was prepared by:

Expert of the Legal Consulting Service GARANT

auditor, member of RSA Elena Melnikova

The answer has passed quality control

The separate division changed its address in the middle of the year; the division was not closed. How to correctly calculate income tax for this division?

On this issue we take the following position:

Since in the situation under consideration there was a change in the location of the separate division, and not its closure or liquidation, tax returns continue to be compiled for the separate division on an accrual basis from the beginning of the year.

Justification for the position:

If an organization has separate divisions (hereinafter also referred to as OP), payment of income tax (including advance payments) is carried out in accordance with Art. 288 Tax Code of the Russian Federation.

Based on paragraph 1 of Art. 288 of the Tax Code of the Russian Federation, organizations that have an OP, calculate and pay the amounts of advance payments to the federal budget, as well as the amounts of tax calculated based on the results of the tax period, at their location without distributing the indicated amounts according to the OP.

Payment of advance payments, as well as tax amounts subject to credit to the revenue side of the budgets of the constituent entities of the Russian Federation, is made by Russian organizations at the location of the organization, as well as at the location of each of its OPs based on the share of profit attributable to these OPs, defined as the arithmetic average the share of the average number of employees (labor costs) and the share of the residual value of the depreciable property of this OP, respectively, in the average number of employees (labor costs) and the residual value of the depreciable property, determined in accordance with paragraph 1 of Art. 257 of the Tax Code of the Russian Federation, in general for the organization (clause 2 of Article 288 of the Tax Code of the Russian Federation, see also letters of the Ministry of Finance of Russia dated 01/23/2017 N 03-03-06/1/3007, dated 02/01/2016 N 03-07-11/4411 , dated 05/19/2016 N 03-01-11/28826).

In accordance with paragraph 1 of Art. 289 of the Tax Code of the Russian Federation, taxpayers, regardless of whether they have an obligation to pay tax and (or) advance payments for tax, the specifics of calculation and payment of tax, are required, at the end of each reporting and tax period, to submit the relevant tax documents to the tax authorities at the place of their location and the location of each OP declarations in the manner prescribed by this article.

The organization, which includes the OP, at the end of each reporting and tax period, submits to the tax authorities at its location a tax return for the organization as a whole, with distribution among separate divisions (clause 5 of Article 289 of the Tax Code of the Russian Federation).

Advance payments for income tax, calculated based on the results of the reporting period (first quarter, half-year, nine months of the calendar year), and income tax, calculated based on the results of the tax period, are paid to the budget of the constituent entity of the Russian Federation at the location of the EP no later than 28 calendar days after the end of the corresponding reporting period (for advance payments) and March 28 of the year following the expired tax period (Article 285, paragraph 4 of Article 288, paragraphs 3, 4 of Article 289 of the Tax Code of the Russian Federation).

Thus, at the end of each reporting period, corporate income tax is calculated based on the profit subject to taxation, calculated on an accrual basis from the beginning of the tax period to the end of the reporting period. The procedure for calculating tax does not depend on a change in the location of the organization and a change in the place of registration of the organization with the tax authority (letter of the Ministry of Finance of Russia dated March 15, 2018 N 03-02-07/1/16043).

The form, presentation format and procedure for filling out (hereinafter referred to as the Procedure) the tax return for corporate income tax are established by order of the Federal Tax Service of Russia dated October 19, 2016 N ММВ-7-3/ [email protected]

Paragraph 1 of clause 1.4 of the Procedure states that the organization, which includes OPs, at the end of each reporting and tax period submits to the tax authority at its location a Declaration drawn up for the organization as a whole with the distribution of profits among the OPs in accordance with Art. 289 Tax Code of the Russian Federation. The distribution of profits according to the OP is carried out in Appendix No. 5 to Sheet 02 of the declaration “Calculation of the distribution of advance payments and corporate income tax to the budget of a constituent entity of the Russian Federation by an organization that has separate divisions.”

At the same time, based on clause 4.1.5 of the Procedure, when submitting an income tax return after changing the location of a separate division, OKTMO at the new location of the organization should be indicated.

If the location of a separate division changes, the activities of the organization through the separate division do not cease and tax returns (including updated tax returns for previous reporting and tax periods) are submitted to the tax authority at the new location of this separate division, see letter of the Federal Tax Service of Russia dated November 20, 2015 N SD-4 -3/20373. The same letter states that if the location of a separate division of an organization changes, the tax authority at its previous location transfers documents to the tax authority at the new location of this separate division.

In relation to the situation under consideration, the letter of the Federal Tax Service of Russia dated March 18, 2011 N KE-4-3 / [email protected] explains that since when the location of a separate division changes, the activities of the organization through this separate division do not stop, then, accordingly, tax returns continue compiled for this separate division on an accrual basis from the beginning of the year. Payment of tax to the budget of a constituent entity of the Russian Federation after a change of location must be continued at the location of the separate division at the new address (see also letters of the Federal Tax Service of Russia for Moscow dated August 28, 2012 N 16-15/ [email protected] , Federal Tax Service of Russia dated August 31 .2015 N PA-4-6/15235, Information from the Federal Tax Service of Russia for the Vladimir Region dated September 30, 2015 “When the location of a separate unit changes, the checkpoint does not change”).

Thus, since in the situation under consideration there was a change in the location of the separate division, and not its liquidation, tax returns continue to be compiled for the separate division on an accrual basis from the beginning of the year.

Post: