What is primary documentation in accounting?

An example of a “primary document” in accounting is any document confirming transactions of a taxpayer. We are talking about transactions that are related to the economic activities of the organization and make economic sense.

All primary accounting documentation is described in Federal Law No. 402-FZ “On Accounting”. Documents must be collected and executed in accordance with this law in order to confirm expenses and prove to the Federal Tax Service the correctness of the calculation of the tax base.

The primary document must be drawn up at the time of the business transaction, since the document confirms its completion. Typically this is done by the supplier. The list of primary accounting documentation accompanying the transaction depends on the type of transaction and may differ. You need to be especially careful about the documents for transactions in which you are the buyer, since these are your expenses and you are more interested in the correct execution of documents than the supplier. The tax office may not credit the “primary” with errors.

General requirements for the preparation of primary documents

The basis for the posting is not only the document, but also the reality of the very fact of economic life.

Documents that document facts of economic life that did not take place, including those underlying imaginary and sham transactions, cannot be accepted for accounting (Article 9 of Federal Law No. 402-FZ of December 6, 2011).

For these purposes, imaginary accounting objects are understood as non-existent objects reflected in accounting only for appearance (including unrealized expenses, non-existent obligations, facts of economic life that did not take place).

Fictitious accounting objects are understood as objects reflected in accounting instead of another object in order to cover it up (including sham transactions).

The following do not apply to imaginary accounting objects: reserves and funds provided for by Russian legislation, as well as the costs of their creation.

note

Companies are not required to use unified forms of primary documents. Their forms must be determined by the head of the company, upon the recommendation of the official who is entrusted with the responsibility of keeping records (Clause 4 of Article 9 of the Federal Law of December 6, 2011 No. 402-FZ).

However, independently compiling primary documents is a voluminous and labor-intensive task. In addition, all unified forms of primary documents are already available in accounting programs. Therefore, your company can continue to use unified forms of primary documents on a voluntary basis.

In this case, it is better to mention this in the accounting policy, indicating that the company uses unified forms as primary documents.

Thus, Goskomstat has developed standard forms for recording:

- fixed assets and intangible assets;

- materials;

- cash transactions;

- transactions related to wages;

- inventory results.

In addition, Goskomstat has developed forms that take into account the specifics of individual industries. Thus, standard forms for accounting have currently been approved:

- trade operations (including the sale of goods on credit and under commission agreements);

- operations in public catering establishments;

- cash settlements with the population using cash registers;

- capital construction and repair and construction work;

- operation of construction machines and mechanisms;

- operations in road transport;

- agricultural products and raw materials.

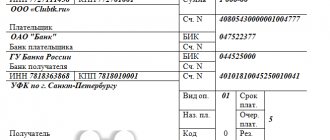

The forms of documents used for non-cash payments are approved by the Bank of Russia.

By printing the forms yourself, you can choose the format that is most convenient for you. There are no strict restrictions here. If necessary, you can also resize columns and rows.

note

Primary documents can be drawn up on paper and (or) electronically, using an electronic signature.

This is established by paragraph 5 of Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”.

For companies that want to use electronic document management in the primary sector, tax inspectors recommend using the formats of the acceptance certificate for works (services) and the TORG-12 consignment note approved by them. The Federal Tax Service of Russia published this message on its official website.

The format of these documents was approved by Order of the Federal Tax Service of Russia dated March 21, 2012 No. ММВ-7-6/ [email protected] As the inspectors explained, the use of these formats will allow companies not to print additional paper documents when submitting them to the inspectorate to confirm expenses. In addition, inspectors Fr.

If a company uses unified forms of primary documents, and a standard form is not provided for some fact of economic life, you can develop it yourself.

The main thing is that it contains all the necessary mandatory details.

At the same time, forms of primary documents established by authorized bodies in accordance with and on the basis of other federal laws (for example, cash documents) remain mandatory for use. This is indicated by the Russian Ministry of Finance in Information No. PZ-10/2012.

And according to tax authorities, when working with cash register systems, only standardized forms can be used. Taxpayers do not have the right to develop these forms on their own (letter of the Federal Tax Service of the Russian Federation dated June 23, 2014 No. ED-4-2 / [email protected] ).

The Ministry of Finance of Russia also recalls the prohibition to change the unified forms of documents introduced by authorized bodies on the basis of other federal laws in letter dated February 6, 2015 No. 07-01-12/4833.

Storage of primary documents

The primary product must be stored for at least 5 years. During this period, the Federal Tax Service may request documents from you or your counterparties at any day in order to conduct an inspection. Documents will also be needed in case of legal disputes.

Previously, storing documents required racks, folders and a lot of paper. Now, to free up space in the office and save time and money, transfer the primary archive to electronic form. Accounting services help organize documents and store scans of them in an electronic archive - this makes it easier to search for documents. In the service list, it is easier to track the shortage of primary goods, closure, payment and transaction documents. Electronic documents are certified with an electronic signature.

If a company does not have a primary document whose mandatory storage period has not yet expired, it will receive a fine of 10 to 30 thousand rubles. Another problem with loss of documents is the inability to take into account expenses to calculate the tax base. In this case, the tax office will charge additional tax, and the company will have to pay extra.

Required details

The list of mandatory details that the primary document must contain is established by paragraph 2 of Article 9 of the Law “On Accounting”:

- name of the document (form);

- date of document preparation;

- name of the organization on behalf of which the document was drawn up;

- content of a business transaction;

- business transaction meters (in physical and (or) monetary terms, indicating units of measurement);

- the names of the positions of the employees responsible for the execution of the business transaction and its registration and their personal signatures. In addition to the signatures of these persons, it is necessary to indicate their last names and initials, or other details that will help identify them.

In officially approved standard forms, all mandatory details are already provided.

If the accounting policy of an organization stipulates that unified forms are used as primary documents, but a form is not provided for some fact of economic life, the company can develop it independently.

There is no need to put a stamp on primary documents, since it is not a mandatory requirement. If the company uses standard forms of primary documents, in which a seal is already provided, then it is better to put it in order to fill out all the details of the document.

The types of electronic signatures used to sign accounting documents are established by federal accounting standards (Article 21 of the Law “On Accounting”. Such standards have not yet been adopted. Therefore, an organization can use any type of electronic signature provided for by the Federal Law of April 6, 2011. No. 63-FZ “On Electronic Signature" (hereinafter referred to as Law No. 63-FZ). Such clarifications are given in the letter of the Federal Tax Service of Russia dated May 19, 2016 No. SD-4-3/8904.

Currently, Law No. 63-FZ distinguishes three types of electronic signatures, which generally differ in the degree of security and complexity of obtaining:

- simple electronic signature;

- enhanced unqualified electronic signature;

- enhanced qualified electronic signature.

For accounting purposes, until a federal accounting standard has been adopted, electronic primary documents can be certified with any of the three types of signatures provided for by Law No. 63-FZ.

There are restrictions for tax accounting. Let's start with the last one on the list - enhanced qualified electronic signature. Information signed with such a signature is recognized as an electronic document equivalent to a paper document signed with a handwritten signature (Clause 1, Article 6 of Law No. 63-FZ).

In accordance with Article 252 of the Tax Code, expenses taken into account for profit tax purposes must be documented, in particular, by primary accounting documents (Article 313 of the Tax Code of the Russian Federation). The form of the primary document must contain the mandatory details established by paragraph 2 of Article 9 of the Law “On Accounting”. One of the mandatory details of the primary accounting document is the personal signature of the persons responsible for processing the transaction. The primary document compiled in electronic form is signed with an electronic signature.

This means that the “primary document”, drawn up in electronic form and signed with a qualified electronic signature, can confirm income tax expenses.

Electronic documents can also be signed with a simple electronic signature or an enhanced unqualified electronic signature, if this is provided for by the agreement between the participants in the electronic interaction. But in order to write off tax expenses on the basis of a primary document signed with a simple or unqualified signature, the agreement with the counterparty must stipulate the procedure for verifying the signature.

Regarding the signing of electronic invoices (clause 6 of Article 169 of the Tax Code of the Russian Federation), as well as when carrying out electronic interaction with tax authorities, it is necessary to use only an enhanced qualified electronic signature.

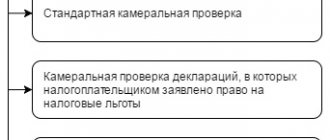

Primary documents are divided by business stage

All transactions of the company can be divided into three stages:

The first stage is an agreement on the terms of the transaction . The result will be an agreement and an invoice for payment.

The second stage is payment for the transaction . Primary documents confirming payment:

- Cash payments - cash receipt, receipt for cash receipt order, strict reporting form. Organizations rarely pay each other in cash, since the amount of payments through the cash register is limited to 100 thousand rubles. Employees usually receive advances or accountable money in cash.

- Electronic payments, including acquiring, payment systems or transfers from a current account - bank account statement.

The third stage is receiving products . Confirmation is required that the buyer has received the product or service, and the seller has received payment. Without supporting documents, the tax office will not allow you to include the funds spent in expenses. Receipt is confirmed:

- waybill;

- sales receipt;

- act of work performed or services rendered.

Names of primary documents in accounting

Previously, we learned about the existence of basic areas of accounting that are characteristic of all enterprises.

There is also a main list of “Business Operations”, which is also typical for all enterprises. Any “Business Transaction” is documented with its own “Primary Document”. A few examples . The enterprise is engaged in the sale of Goods or Products - it issues primary documents called “Invoice (Rnk)” or “TORG-12” or “Sales of Goods” or “Sales Receipt” or “Invoice”.

And if the company is engaged in services, then the document may be called: “Act of provision.

If an enterprise receives money into its cash register, it makes a primary document called “Receipt Cash Order (PKO).” If money is issued from the cash register, then the document will be “Cash Expenditure Order (RKO)”

In the real life of an enterprise, it has been noticed that accountants for one type of event call primary documents differently, but the meaning remains the same. Synonyms are used, but the essence does not change. Very often this happens in primary documents when selling (selling) goods. I think you yourself noticed that I gave a lot of names for the selling company.

However, most documents have the same title. For example, cash register documents, PKO, RKO - they are not called anything else.

Primary documentation in accounting list of documents 2020

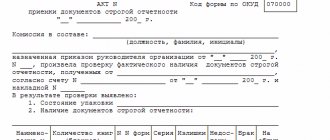

Transactions vary significantly from company to company. Despite this, there is a list of primary documentation that is required in accounting:

- Agreement.

- An invoice for payment.

- Payment documents: cash receipts, strict reporting forms.

- Packing list.

- Certificate of work performed or services provided.

- Invoice.

This list of transaction documents is not exhaustive; it can expand depending on the types of transactions and accounting features in the organization.

Approval of document flow in the organization

The main regulatory act that regulates accounting in an organization is Law No. 402-FZ of December 6, 2011.

Changes and amendments are regularly made to the law. Any fact of business activity is documented. For the smooth and proper functioning of the enterprise, the organization of document flow in accounting is required, its procedure is approved by the manager. The principles of working with primary information in accounting are regulated by the “Regulations on documents and document flow in accounting”, approved by order of the USSR Ministry of Finance No. 105 in July 1983. This regulatory act will lose force only in January 2022, in accordance with Order of the Ministry of Finance No. 184 of April 30, 2022. The regulation describes the requirements for primary documents, their storage periods and correction of errors.

According to Law 129-FZ (Article 6, paragraph 3), the system for the movement of official papers at the enterprise is approved in the accounting policy. This is confirmed in PBU 1/2008 “Accounting Policies”.

Formation of primary accounting documentation

The rules for maintaining primary documentation allow for its compilation using independently developed or unified forms (Article 9 No. 402-FZ). But remember that only a document containing all the necessary details has legal force:

- Document's name.

- Date of creation.

- The name of the organization or the name of the entrepreneur of the compiler.

- Contents of a document or business transaction.

- Natural and monetary indicators.

- Data of responsible persons.

- Signatures of the parties.

The primary forms that the organization uses are fixed in the accounting policies. In the process of work, there may be a need to update or supplement forms - this is also recorded in the accounting policy.

Let's look at the primary documents in more detail.

Agreement

When concluding a transaction, the parties enter into an agreement between themselves, which stipulates all the conditions and details of future business transactions: terms of shipment of goods, performance of work or provision of services, time for payment, payment method, etc.

Additionally, the contract records data on the subject of the transaction and the price. The rights and obligations of the parties also need to be spelled out to make it easier to resolve possible disputes in court.

It is optimal if each transaction is formalized in a separate agreement. But companies often enter into one general agreement with regular counterparties for a number of similar transactions at once. Draw up two copies of the agreement with seals and signatures of the parties on each.

A written form of agreement is not always necessary. For example, for a purchase and sale transaction, the document confirming the conclusion is a cash receipt or sales receipt.

An invoice for payment

An invoice is a document in which the seller sets the price for his services or goods.

The buyer agrees to the supplier's terms and conditions at the time of payment. The legislator does not establish the form of the invoice, so each company draws it up in its own way. The invoice specifies the terms of the transaction, terms, payment and delivery procedures, etc.

The signature of the director or chief accountant on this document is not required (Article 9 No. 402-FZ). But to avoid any questions from the tax authorities or counterparties, it is better not to neglect them. An invoice for payment does not provide an opportunity to present demands to the supplier - it only records the purchase price. The buyer retains the right to demand a refund in case of violation of the terms of the contract or illegal enrichment of the supplier.

Bill of lading or sales receipt

Sales receipts are issued in two cases: when selling goods by individuals or when selling to individuals.

Invoices, as a rule, are used by organizations to document the sale of goods and their further receipt by the buyer.

Like the contract, the invoice is drawn up in two copies. One remains with the supplier to confirm the transfer of goods, and the second is received by the buyer to confirm receipt.

The data in the delivery note and invoice must match.

The person who releases the goods puts his personal signature and the company seal on the delivery note. And the buyer also certifies the document with a signature and seal.