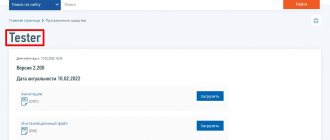

The Tester program checks tax and accounting files and is distributed free of charge. Typically, tax return files are generated in XML format by the Legal Entity Taxpayer program. “Tester” was developed in the branch of the Federal State Unitary Enterprise GNIVC of the Federal Tax Service of Russia in the Chuvash Republic.

On the website you can use “Tester”. The file size is about 30 Mb. Information about the latest version of Tester is posted in the “News about accounting programs” section and in the “Federal Tax Service” section.

Further in the description of the program you can find out how to install the Tester program, how to check tax returns and financial statements with its help.

Programs for checking the calculation of insurance premiums for 0 rubles. 0 kop.

How to check the calculation of insurance premiums in 2021-2022?

This question worries not only novice accountants, but also experienced professionals. The control ratios for checking calculations have been supplemented several times recently, so for successful completion of the calculation it is important to use up-to-date and preferably free checking programs. The Internet is replete with offers for free verification of insurance premium calculations. Are they all really free? What exactly is offered to policyholders - a full check of the calculation or a stripped-down version that does not allow them to see the details of the errors?

Would you like to receive exclusive information about how a desk audit of insurance premium calculations is carried out? Detailed explanations about this are given by 2nd class adviser to the State Civil Service of the Russian Federation E. S. Grigorenko. You can view them in ConsultantPlus, trial access to which can be obtained for free.

Among the truly absolutely free programs for checking the calculation of insurance premiums are the services of the Federal Tax Service. There are many such useful free services on the official website of this department.

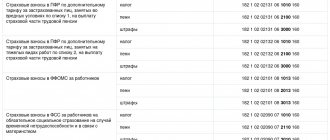

Taxpayers and policyholders hold in high esteem the free service for generating and checking “Taxpayer Legal Entity” reports. This program allows policyholders to:

- fill out the calculation of insurance premiums;

- check it for errors;

- do not worry about the relevance of its form;

- do not be afraid of incorrect electronic format.

Another available and free program for checking insurance premium calculations in 2021-2022 is the Tester program. It can be downloaded in the public domain on the Federal Tax Service website at the following link:

All offered services (both paid and free) for checking insurance calculations are based on more than 300 control ratios, with the help of which shortcomings, inconsistencies and discrepancies in calculation data are identified.

In addition to the programs of the Federal Tax Service, the calculation of insurance premiums can be checked in other ways - we will talk about them further.

Free check from the Pension Fund website

We will show you how to check SZV-M online on the Pension Fund website.

First, we go through a simple path on the official website of the Pension Fund: main page - menu - employers - software. You can immediately follow the link.

We get to the following page:

You can check the SZV-M report online for free and not with the only program developed by Pension Fund specialists. For example, we download the Check PFR program or the PD software program to check the SZV-M.

Go to the latest version of the SZV-M verification program and save the ZIP archive of the version:

We go into the archive saved on the computer and run the PD software installer:

The program is installed on your computer; you must follow the instructions of the installation wizard. Once the installation is complete, the program will launch.

To check the SZV-M form, it is necessary that the file with it be downloaded to your computer. As already mentioned, you can get such a file by creating it in one of the specialized programs.

Click the “File” button:

Select the file to check:

The verification process starts immediately:

As you can see, the program did not find any errors. The form is ready for submission to the Pension Fund:

The Check PFR program works in a similar way. It also needs to be installed on your computer and the file you saved in advance must be entered.

When do you need to pay money to check an insurance calculation?

Most companies and individual entrepreneurs prepare calculations for insurance premiums (as well as other tax reporting) electronically. This usually happens using a program used for accounting purposes.

The most well-known programs of this kind are products. The programs allow you to automate and keep tax and accounting records up to date, including the preparation of mandatory (regulated) reporting.

We will tell you how to automate accounting and generate reporting using 1C in these publications:

- “Maintaining separate accounting for VAT in 1C (nuances)”;

- “How to generate a SZV-M report in 1C (nuances)»;

- “The procedure for forming 6-NDFL in the 1C program”.

It provides its users with the opportunity to check the calculation of insurance premiums without any additional fees. However, a commercial product cannot have zero cost. Only those users who have already paid for access to the main accounting program can identify calculation errors for free using the 1C family program.

Other companies providing similar services have a similar approach.

What reports to submit to the Pension Fund of Russia

With the transfer of insurance premiums under the control of the Federal Tax Service, the list of reporting to the Pension Service has changed. Policyholders are now required to provide the following information:

- SZV-M - information about insured persons. The monthly form must be submitted no later than the 15th day of the month following the reporting month.

- Information about the length of service for all employees. An annual form in which the insurer sends information about the length of service of its employees and citizens working under civil or copyright contracts. You must report by March 1 of the following year.

- Information about the length of service of an individual. Formed at the individual request of TOPFR representatives. One of the forms of such reporting is SZV-K - information about the length of service of the insured person until December 31, 2001.

- Adjustments for past periods. Despite the fact that the administration and reporting of insurance coverage has been transferred to the Federal Tax Service, errors in the RSV-1 for 2016 and earlier periods will have to be corrected through the Pension Fund. After checking and accepting the adjustment, Pension Fund employees will independently notify the tax authorities about the changes.

- Information about additionally accrued insurance premiums and other information.

Trap for policyholders: free and paid services

Some websites invite insurance premium payers to use a free service to check insurance premium calculations. To check, you just need to upload a report in xml format into the program offered by the service.

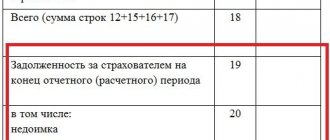

After checking it, the control result is issued. In any form? See the picture below:

It's good if there are no errors in your calculation. You will achieve your goal - make sure that after sending the report to the tax authorities there will be no claims. Everyone is happy: the service was provided, the report was checked, there were no errors.

If at least one control relationship is not met when checking a calculation, you will receive a warning that:

- errors were found in the calculation;

- not all control ratios converged;

- the calculation needs to be revised;

- If the errors are not corrected, the calculation will not pass the desk audit, you will have to submit explanations, pay a fine, and submit an updated calculation.

At this stage, a trap awaits you: the report has been checked, the presence of errors in it has been determined, but you do not know:

- how many control ratios did not converge;

- in which specific lines you made a mistake and how to make corrections.

It’s good if you are subscribers of a publication that offers this free service (for example, the magazines “Accounting for IP”, “Vmenenka”, “Uproshchenka”). Subscribers are offered an advantage when using the service - access to error details. If you are not one of the subscribers, you are not destined to find out:

- in what relationships the calculation does not converge;

- what is the cause of the error.

Moreover, no one will tell you what to do if a particular error is detected. To have access to all this useful information, you need to become a subscriber to the publication. This is a modern free-to-pay service.

Error codes when checking SZV-M

What errors the verification program detects and how it encodes them is indicated in the mentioned resolution of the Pension Fund Board of December 7, 2016 No. 1077p.

Gross errors prevent the submission of a report to the Pension Fund. Warnings may also be issued. For example, if an individual does not have a TIN, the program will pay attention to this and issue a warning, but will accept the report.

The following error and warning codes exist:

- 20 - warning in connection with the completion and correctness of the individual’s TIN;

- 30 - error in information about an individual: inconsistency or incomplete filling of full name, SNILS;

- 50 — the error is related to general flaws when filling out the form: incorrect format; inconsistency of full name or policyholder registration number; non-existent electronic signature; a period is indicated that goes beyond the scope of the SZV-M representation; a repeated form with the “original” type was submitted.

Results

A program for checking the unified calculation of insurance premiums is available (Tester program). Users of the free service “Legal Taxpayer” have the opportunity to monitor their calculations for errors without any additional payments in this program.

Many electronic accounting publications offer to check your calculations for free. But a detailed description of errors can only be obtained by being a subscriber to such a publication. For other users of the service, if the test result is negative, the program will issue a warning about the presence of errors without detailing them.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to check SZV-M without downloading programs to your computer

There are free online services that allow you to check the SZV-M form without downloading any programs to your computer. The verification is carried out by the same programs that are presented on the official website of the Pension Fund. For example, a free online check is available on the Konturn-extern website:

To do this, the file with SZV-M must also be generated in the proper format and saved on the computer. To check it, click the “Reports” button:

Select the required file:

You can also add several files to scan and scan them all at once. Click the “Check” button:

After the check is completed, a positive or negative result will be given:

Many specialized services for preparing and sending reports provide the opportunity to test their capabilities for free for some time. They usually contain built-in verification programs. It should be understood that their built-in programs are the same as those presented on the official website of the Pension Fund.

Checking 6-NDFL for the correctness of personal income tax transfers to the budget

Checking 6-NDFL for the correctness of personal income tax transfers to the budget includes checking the following indicators:

- in fields 110 and 140. In this case, the difference between lines 110 and 140 must exceed the amount of payments made to employees on the organization’s accounts relating to the corresponding period. The opposite means incomplete reflection of the amounts of income paid in the reporting period;

- in fields 160 and 190. The difference between lines 160 and 190 must be less than or equal to the personal income tax transferred to the budget. Failure to comply with this ratio means that the amount of tax may not be transferred to the budget;

- in field 021. The date in field 021 must correspond to or be later than the date of personal income tax transfer. If this rule is not followed, the deadline for paying personal income tax may be violated.

Also see:

Personal income tax payment dates: cheat sheet for 6-personal income tax

Other information to be verified

CheckPFR also now checks other types of reports:

- reporting on forms RSV-1, RSV-2 and RSV-3;

- individual accounting documents SZV-6-1, SZV-6-2, ADV-6-2, SZV-6-4, SPV-1, ADV-11;

- SZV-M described above.

The big advantage of using this program is that there are no costs. You just need to install it and learn how it works. The app is quite easy to use. In addition, for those who do not understand this at all, there is a manual for use. The downside is that updates need to be installed periodically. Therefore, most policyholders prefer to use services on the Internet - it is much faster and easier.

It is worth noting that it does not matter which method of checking SZV-M the organization chooses. In any case, they will help get rid of errors and, as a result, fines.