Each Russian citizen is assigned an individual personal account number in the pension insurance system. Any foreign citizen legally residing in the Russian Federation can receive it. The number is used primarily to simplify the procedure for assigning a pension. If you are interested in finding out how to find out the date of issue of SNIOS by number, then read this article. We will tell you about all the possible ways to access this information - from simple to more complex.

How is a pension formed?

The size of a citizen’s pension directly depends on his income and length of work.

The calculation of pensions includes not only activities under employment contracts, but also work under civil contracts and periods of entrepreneurial activity. The key condition is the deduction of insurance contributions for the formation of a future pension. Pension points and the amount of pension are influenced by several indicators:

- The insurance period is the periods during which a citizen was an insured person in the pension system. These are not only years of labor activity, but also periods during which a citizen could not work: maternity leave, unemployed period (through the labor center), social activities, etc.

- Earnings amount. The amount of contributions towards the formation of a pension depends on the amount of wages. The more earnings, the higher the amount of deductions. For employed citizens, contributions are paid by the employer. Self-employed people and traders pay their own contributions.

- IPC value. This is the number of pension points accumulated over a lifetime. Points are awarded on an individual basis, depending on the insurance period, salary and grace periods.

- Preferential grounds. Working under special conditions allows you to apply for payments ahead of schedule. All types of benefits are enshrined at the legislative level (Law No. 400-FZ). For example, representatives of preferential professions (medics, teachers, law enforcement officers), workers of the Far North, mothers of disabled children and others retire earlier.

- Amount of additional contributions. Citizens have the right to contribute additional funds to the formation of their future pension. Additional contributions are paid by the employer (voluntarily or compulsorily - by law).

- Age of application for benefits. Retirement may be delayed. That is, apply not at the time of retirement age, but later. Additional points are awarded for each year of deferment. The amount of payments increases.

The region of residence also influences the size of pension benefits. For example, special territorial coefficients and premiums are provided for residents of the Far North. Similar surcharges, but in a much smaller volume, are provided in other regions.

Why check your pension savings?

All obligations to pay insurance coverage and provide reporting on the insurance period lie with the policyholder. But it is also important for citizens themselves to control savings. For example, the employer pays contributions only from the minimum salary, and transfers the rest of the salary in an envelope. This is a fairly common situation that has an extremely negative impact on the amount of your pension. A citizen is able to determine this on his own; it is enough to check his pension savings online using SNILS. If you have any questions, contact your employer for clarification.

In addition to problems with white and gray salaries, it happens that the employer submits incorrect information about the length of service to the Pension Fund. This will directly reduce points and the amount of your future pension. If the error is not corrected in a timely manner, you will have to confirm your experience in court.

And finally, monitoring your savings in the Pension Fund allows you to eliminate fraudulent activities with the funded part of your pension. Unscrupulous non-state pension funds fraudulently gain access to your savings. Getting your money back is quite problematic.

What information does the PF provide?

The question of future material security becomes relevant not only for those who are already planning to retire, but also for people whose savings are formed according to a new scheme: the main part and the funded one. By contacting the fund, you can always obtain all the information regarding your financial support in the future, namely:

- state of an account;

- seniority;

- the amount of payments accrued in favor of the person;

- insurance premiums;

- accumulated points;

- information about all employers for the entire period of employment.

Deposit "Maximum Income" Moscow Credit Bank, Person. No. 1978

up to 21%

per annum

from 1 thousand

up to 730 days

Make a contribution

To check your savings, you first need to find out which NPF you belong to. If you did not sign any agreements with commercial funds, then your savings remained in the Russian Pension Fund. If you transferred the savings portion from the Pension Fund to a commercial organization, then you should have a copy of the agreement with the fund’s details in your hands.

How to find out savings by SNILS number

There are several options available to check your pension points.

1. When contacting in person:

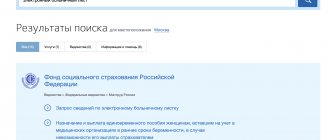

- to the territorial branch of the Pension Fund of Russia;

- “My Documents” office or MFC;

- territorial branch of the non-state pension fund to which the savings were transferred.

To obtain information you will have to present your passport and SNILS (insurance certificate). Otherwise, it is impossible to obtain information about pension savings. A citizen or his official representative by proxy has the right to do this.

2. Via the Internet:

- State Services portal;

- personal account on the Pension Fund website;

- personal account on the NPF website;

- Sberbank personal account.

Access to information will only be available after authorization. Logging into your personal account of any of the services is possible only under a personal account. Registration and official confirmation are required. For example, at the MFC, confirm your account on the State Services portal. The login and password to enter your Sberbank personal account will be issued at the branch or the nearest ATM.

In what cases is SNILS verification necessary?

Despite the fact that SNILS is issued by a government agency, in some cases it needs verification and control:

- When it is necessary to verify whether the information specified in the application form corresponds to the SNILS number. The human factor has not been canceled, and mistakes still sometimes happen, and the reliability of information when preparing documents is very important, especially if it concerns a personal account with pension savings. In this regard, after issuing an insurance certificate for compulsory pension insurance, it is better to check the correctness of the specified data.

- In the event of a change in personal data, since nowadays, when contacting any government body or institution, SNILS is almost always required, so the data must correspond to reality.

- If necessary.

- If a person wants to verify the regularity of pension contributions from his employer or receive an extract about their receipt to his personal account.

When do you need to find out if SNILS is ready?

If you have just submitted an application for a “green card”, then to save your own time it is better to first check the readiness of SNILS, and only then go for it. Modern technologies allow you to check this information online without leaving your home.

This is also possible in the case of drawing up a document for children, but for this you need to have information on how to find out whether SNILS is ready for a child via the Internet.

How to check savings on government services

The single portal “State Services” allows you to resolve almost all issues without visiting government agencies and departments. To find out the size of your pension online using SNILS at State Services, it is enough to order an extract on the status of the individual account of the insured person.

SNILS on the government services portal will be needed at the registration stage. Check the insurance certificate number in the citizen’s personal data section. The user does not fill in this information. It is entered automatically upon registration. Later, SNILS will be required to verify the correctness of the generated data.

Instructions on how to work on the portal:

- Log in to “Government Services” using your account.

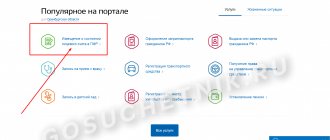

- In the “Popular on the portal” section, select “Notice on the status of a personal account in the Pension Fund of Russia”.

- Click the “Get service” button on the right side of the screen.

- We are waiting for the data to be generated. It will only take a couple of minutes.

- Print the completed information or save it in PDF format.

Study the information received. Pay special attention to the amounts of accrued wages and deductions made from employers. If there are disagreements or errors, you must contact the Pension Fund for advice.

IMPORTANT!

Check section 3 of your personal account statement at the Pension Fund. The name of the fund to which the funded part of the pension is transferred is reflected here. If you did not manage the funds, then VEB UK (ADVANCED) will be indicated in the statement.

If you did not transfer the funded part of your pension to a non-state pension fund, but section 3 of the statement indicates a non-state pension fund, then your savings were transferred fraudulently. It is necessary to resolve the issue with scammers; to do this, seek advice from the Pension Fund of Russia.

How to check savings on the website of the Pension Fund of the Russian Federation

Checking the amount of contributions for a future pension is implemented in the personal account of the Pension Fund. Special registration on the site is not required if you already have an account on the State Services portal. If you are not registered, then obtain a login and password from the territorial office of the Pension Fund of Russia.

When entering your personal account, the user immediately sees general indicators about pension savings, length of service and current insurer.

This information is not always sufficient for verification. For example, to check whether contributions are coming from your current employer, request a statement of your personal account. Instructions on how to find out the amount of pension savings according to SNILS in the PFR personal account:

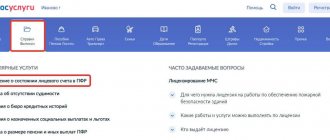

Step 1. Select the “Get information” section.

Step 2. Select the action option of interest - “Get information about the status of an individual personal account.” Here you will learn the principles of calculating a pension or plan your future pension using a special calculator.

Step 3. The statement will be sent by email, which is linked to your personal account account. This will happen within a few minutes.

Step 4. Check the received statement. If there are errors in the form or incorrect information is provided, contact the Pension Fund for clarification.

Briefly about SNILS

Let's consider SNILS from the point of view of the current legislation of the Russian Federation. This is a unique identifier, which, on the one hand, allows its owner to control his own pension contributions, and on the other hand, helps the Pension Fund control these contributions in a personalized accounting system.

The abbreviation SNILS stands for “individual personal account insurance number,” which, in turn, is a numeric code of eleven characters.

The document containing this code number is called an insurance certificate of compulsory pension insurance, is produced in the form of a light green plastic card, which contains some personal information about its owner and the authority that issued it.

Every person officially employed on the territory of the Russian Federation must issue a SNILS, this is due to the fact that by law employers are required to make pension contributions for each employee.

Checking SNILS will allow you to find out whether your employer is making pension contributions to your personal account in good faith.

at the request of the parents.

Read more detailed information about.

How to check savings through Sberbank

To enter your Sberbank personal account, you need a separate login and password. You can obtain the details at an ATM or at a bank service office. How to work with the Sberbank.Online service:

Step 1. Log in to the system using your username and password.

Step 2. To confirm security, an SMS with a code will be sent to your phone. Enter the code in the special field. Do not share your SMS number with anyone!

Step 3. After logging in, select the “Pension programs” section through the “Other” tab.

Step 4. Click the “Get statement” button.

Step 5. The system will offer to verify personal data. Please carefully check that all information about you is up to date. If everything is correct, submit your request.

Step 6. You must confirm sending the request via SMS. This service is free. Follow the instructions on the website.

After confirmation, the requested statement will be sent by email and will be available for downloading in your Sberbank personal account.

Other ways to check savings

There are other ways to get information about pension savings using SNILS. For example, through the website or office of a non-state pension fund. There are many services and applications on the Internet that provide similar services. Be careful, some services provide services for a fee.

If you are required to provide a phone number, the service fee will be debited from your balance. Use proven and free services: Gosuslugi, Pension Fund and Sberbank.Online.

Legislative regulation

When considering issues related to SNILS, you should refer to Federal Law 27 of 1996. Details of the application of the certificate are specified in the seventh article. In 2003, Federal Law 198 was adopted, supplementing and clarifying the concept of an insurance certificate.

Under certain circumstances, citizens need to find out the SNILS number. To do this, a person has the right to use online resources, but authorization on the Pension Fund website is required, as well as a personal visit to a branch of the Pension Fund.

The second option is more reliable when it is necessary to verify the authenticity of the card. The information described on where to look at the date of issue of SNILS is relevant for those who received the document before 2006. Modern certificates contain information about the moment the account was opened.

SNILS data is currently actively used in the provision of social and medical services in the Russian Federation. And by providing their data to employees of various institutions, citizens of the state naturally ask themselves the question of what can be learned from SNILS about a person in addition to current information on pension contributions.

What to do if errors are found or deductions are not received

Any doubts or shortcomings in the extract received cannot be ignored. For any questions, please contact the Pension Fund. Take your passport and SNILS with you.

Please note when working with electronic services:

- Data on wages and length of service are updated quarterly, but only after employers submit quarterly reports in the DAM form. The deadline for submitting calculations for insurance premiums is the 30th day of the month following the reporting month. Before this period, information is not uploaded to the extract from the Pension Fund.

- Data on points are recalculated quarterly and at the end of the year, after employers provide the annual reporting form SZV-STAZH.

- If technical work is underway on the site, then ask for information later or personally visit the MFC and Pension Fund.

- If you change your personal data, you must check that your details are up to date in the system.

Solve other problems personally at the MFC or Pension Fund.