Analysis of invoice statuses in receipt and sales journals

Before submitting a VAT return, each accountant must make sure that all invoices are registered in the database, since information about them is uploaded to the Federal Tax Service as part of the declaration.

The completeness of registration of issued and received invoices can be checked using the receipt and sales journals using invoice statuses.

In this publication, we will look at an example of working with invoice statuses in the receipt and sales journals.

SF statuses in receipt and sales journals

SF statuses

In the document journals Receipt (acts, invoices) and Sales (acts, invoices) there is a column Invoice , which displays the statuses of invoices (invoices) registered in the program based on these documents. Statuses allow you to control the availability and implementation of trade unions in 1C.

The document journal Receipts (acts, invoices) is opened through the section Purchases - Purchases - Receipts (acts, invoices).

The document journal Sales (acts, invoices) is opened through the section Sales - Sales - Sales (acts, invoices).

The program analyzes the data in 1C and automatically assigns the status of SF:

- Conducted – on the basis of this document, the Federation Council is registered and carried out;

- Not required – the presence of a SF is not required for this operation;

- Absent – the operation requires the presence of an SF, but it is not registered on the basis of the document;

- Not carried out - the operation requires the presence of an SF, it is registered on the basis of a document, but has not been carried out.

Let's take a closer look at the behavior of some invoice statuses.

Status Not required

The status Not required can be assigned to an invoice if transactions for which an invoice is not generated are registered in 1C, for example:

- the principal transfers the goods to the commission agent for sale;

- sale of goods to VAT non-payers, when there is a written agreement not to issue an invoice.

Status Absent

The status Absent indicates that the operation requires the presence of an invoice, but it is not registered on the basis of the document.

To correct the error and register incoming SF you must:

- open the document Receipt (act, invoice) ;

- indicate the number and date of the Federation Council at the bottom of the document form;

- click the Register .

To correct the error and register the outgoing SF you must:

- open the document Sales (act, invoice) ;

- Click the Write invoice .

Absent is set for invoices in the document journal Receipts (acts, invoices) . But the presence of a SF is not required for operations and the correct SF status should be Not required .

What is the reason for the incorrect placement of the statuses of the Federation Council and what is a possible way out of this situation?

With a large number of documents, this behavior of the program significantly complicates the verification of the correctness of registration of the SF.

December 15 The Organization purchases goods from the supplier RivieraLine LLC. When concluding the contract, the supplier provided a notification that it applies the simplified tax system and does not draw up an SF.

In the document journal Receipts (acts, invoices) , the document from Riviera Line LLC for the Northern Fleet is set to the status Absent instead of the status Not required .

The incorrect behavior of the SF status is due to the fact that when creating an agreement with a counterparty, the Supplier submits VAT under the agreement .

Namely, by checking the Supplier submits VAT under the contract , the program determines whether an invoice is needed for this operation.

To eliminate the error in the agreement with Riviera Line LLC, you must uncheck this box.

If there are other documents in the program that were previously registered under this agreement, then 1C will not allow you to uncheck the box and will display an error message.

There are two ways to solve this problem.

Method No. 1

Create a new contract with the counterparty by unchecking the Supplier submits VAT under the contract , and transfer the documents to the new contract. This method is best used when:

- a small number of documents have been entered under this agreement;

- past closed periods are not affected.

Method number 2

Do not clear the checkbox in the contract The supplier submits VAT under the contract , agree with the presence of the status Absent , but in the Comment of the document Receipt (act, invoice) write the reason for the appearance of this status, for example: “The supplier applies the simplified tax system.”

In the document log Receipts (acts, invoices) in the Comment Absent will be displayed , i.e. The accountant will understand that the Absent is not related to the actual absence of the invoice.

Status Not carried out

SF status Not carried out indicates that the SF was registered on the basis of the document, but was not carried out.

To correct the error and carry out the SF, you must:

- open the document Receipt (act, invoice) or Sales (act, invoice) ;

- at the bottom of the document form follow the link Invoice;

- In the invoice that opens, click the More – Post button.

Selection of documents by invoice status

To make it easier for an accountant to work with document journals, 1C has implemented convenient selection mechanisms. Selection is a 1C mechanism that allows you to select documents from the general list that meet the specified criteria.

For example, an accountant can quickly compile a list of incoming documents for which incoming invoices were not registered in the program.

Let's consider options for quickly selecting documents by the status of invoices in 1C in the document journals Receipt (acts, invoices) and Sales (acts, invoices) .

Quick selection of documents based on the status of the Federation Council

To select documents according to the status of the Federation Council, you must:

- open the window for setting up the list of documents by clicking the More – Set up list button;

- on the Selection , click the Add new element and make the settings: Invoice – Equal to – select the status of the invoice by which you want to filter (for example, Absent or Not posted );

- Click the Finish editing .

When this setting is enabled, only those documents that meet the specified SF status value will be displayed in the document log.

Quick search for documents by SF status

Quick search is a 1C mechanism that allows you to quickly find the desired document in the journal by typing the first characters of the selection element.

To quickly search for documents by SF status:

- in the Quick search , start entering the status of the SF for which you want to make a selection (for example, Absent or Not carried out ).

The program analyzes all journal documents and selects those that contain the specified selection element.

Checking data on account analysis 68.2

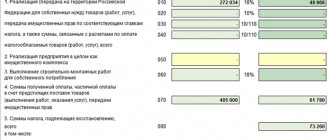

Generate an analysis of account 68.2 (VAT sub-account). By debit, this report shows VAT deductible and transferred to the budget, by credit - the amount of calculated VAT. Use table 2 with explanations for the analysis of account 68.2 according to the applicable lines in section 3 of the declaration:

table 2

| Cor. check | Dt | Explanations on Dt | Line in the declaration | CT | Explanations on CT | Line in the declaration |

| 68.2 | ||||||

| Balance at the beginning of the period | VAT refundable for the previous period | VAT payable for the previous period | ||||

| 19.1 | VAT on OS purchase | 120 | ||||

| 19.3 | VAT on the purchase of MPZ | VAT restored | 080 | |||

| 19.4 | VAT on purchase of services | |||||

| 19.5 | VAT paid at customs upon import | 150 | ||||

| 19.10 | VAT paid at customs when importing from the Customs Union (CU) | 160 | ||||

| 51, main account | Payment of VAT to the budget | VAT refund from the budget | ||||

| 76.AB | VAT on shipments on advances from buyers | 170 | VAT on buyer advances | 070 | ||

| 76.VA | VAT on advances paid to suppliers | 130 | Crediting VAT on advances to suppliers upon receipt of goods, works, and services from them | 080, 090 | ||

| 90.3 | VAT on sales | 010−042 | ||||

| 91.1 | VAT on other sales | |||||

| Period transactions | ||||||

| balance at the end of period | VAT recoverable | VAT payable |

See Table 3 for specific clarifications:

Table 3

| Line no. | Formulas for turnover |

| 010−040 | Dt 90.03 Kt 68.2 + Dt 91.1 Kt 68.2 |

| 080 | Dt 19(...) Kt 68.2 + Dt 76.VA Kt 68.2 |

| 120 | Dt 68.2 Kt 19 (subaccounts 1, 2, 3, 4, 7) − Dt 68.2 Kt 19 (by blocking method until confirmation 0%) when exporting to the Customs Union |

| 120 section 4 | Dt 68.2 Kt 19 (by blocking method until confirmation 0%) when exported to the vehicle |

Express check of VAT accounting

Checking VAT calculations using Express check

Analysis of VAT accounting status (Reports - Express check - Settings):

- Maintaining a sales book for VAT;

- Maintaining a VAT purchase book.

Express check: checking in a new way

Reports – Accounting analysis – Express check – Settings:

- Maintaining a sales book for value added tax;

- Maintaining a book of purchases for value added tax.

The verification system reports errors

and issues

warnings

.

Logic control

Logical control allows you to find errors inside the invoice (in sections 8-12). It can be used to check:

- Are the fields filled in correctly and do their values not contradict each other?

- Does the time of transactions correspond to the reporting period for which the declaration was drawn up;

- Are the details of the counterparty indicated correctly;

- Are transaction type codes used correctly?

How is logical control implemented in the service?

Correct filling of fields

For example, for import operations in the purchase book, instead of the invoice number, you need to indicate the details of the cargo customs declaration in the format XXXXXXXX/YYYYYY/ZZZZZZZ(/SS) , where:

- ХХХХХХХХ — customs post number;

- YYYYYY — date of registration of the customs declaration (day, month, last two digits of the year);

- ZZZZZZZ — serial number of the declaration;

- SS - the serial number of the goods indicated in column 32 of the main or additional sheet of the customs declaration (or from the list of goods, if a list of goods was used instead of additional sheets during declaration).

However, if the details are specified in the invoice format (No. 58 dated 08/02/2015), the service will notify you of the error: “The format of the seller’s invoice number is incorrect. Required format: XXXXXXXX/YYYYYY/ZZZZZZZ(/SS), (8 characters, 6 numbers, 7 symbols).”

Interconnectedness of filling out fields

The service checks that all necessary lines for each transaction are filled in: counterparty data, invoice details, VAT amount, etc. If any of the lines are missing, the service will indicate an error.

Correspondence of dates in invoices to the reporting period

If in the sales book for the 3rd quarter there is an invoice with a date for the 1st or 2nd quarter, VAT+ will indicate an error: “S/F date (indication of date) is not from the current tax period.”

However, the service knows when this is acceptable (for example, in the case of VAT restoration), and does not issue warnings in this case.

Counterparty details

The service finds errors in the TIN, even if it matches the format and contains the required number of characters. A transaction with such a counterparty will fall into the category “Counterparty with errors” (“TIN contains an error”).

Operation type codes

The procedure for applying codes for types of VAT transactions is regulated by the order of the Federal Tax Service dated 02/14/2012 No. ММВ-7-3/ [email protected] , and the letter of the Ministry of Finance and the Federal Tax Service of Russia dated 01/22/2015 No. GD-4-3/ [email protected] introduces additional codes .

However, in practice, choosing the right code can be difficult. For example, code 21 cannot be used in the purchase book, and code 22 cannot be used in the sales book. A cheat sheet prepared by a VAT+ expert will help you understand all the nuances. If an error does creep in, the service will indicate it.

How to Apply Ratios

Unlike other forms of reporting, the VAT return can be called self-sufficient. Therefore, all control relationships for it are of an intra-documentary nature. That is, the accountant needs to compare and contrast the indicators only indicated within this tax reporting form.

The control ratios for the VAT return have a tabular form and a traditional structure. It includes:

- serial number of the ratio;

- possible violation of the legislation of the Russian Federation (Tax Code of the Russian Federation) due to inconsistency of indicators;

- formulation of the violation according to the Tax Code of the Russian Federation;

- how the inspector will act if a non-compliance with the control ratios is detected.

Theory and practice

The norms of the Tax Code are becoming more and more unambiguous, and expenses are becoming clearer, you just need to justify them.

The method of preliminary determination of the tax result outlined in the article allows any manager not to wait with horror on the 20th and 28th days of the month after the end of the period, thinking how many fees will have to be paid to the budget. Now you can predict your tax budget for VAT and income tax. And be careful with optimization!

Dmitry Vasiliev, expert at Calculation magazine

All about income tax

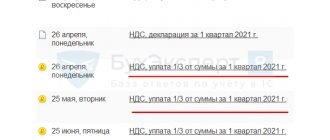

What to follow

In 2022, the form, electronic format and procedure for filling out the VAT return are still approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558. From the 4th quarter of 2022, changes were made by order of the Federal Tax Service dated August 19, 2020 No. ED-7-3/591.

This means that the control ratios in the VAT return given in the letter of the Federal Tax Service of Russia dated March 23, 2015 No. GD-4-3/4550 remain relevant in 2022. Please note that at the beginning of 2022, the latest edition of these ratios is dated 02/13/2020 No. SD-4-3/4921.