General provisions

Filing tax reports is the main responsibility of every taxpayer.

In addition to the fact that officials have developed and approved forms for each fiscal obligation, there is a separate deadline for submitting each type of reporting. If a company or entrepreneur delays the report - for example, forgets to send it to the Federal Tax Service, then they will issue a fine for late submission of income tax or VAT returns, 6-NDFL calculations or insurance premiums - for late reporting. The deadlines for submitting reports on fiscal obligations are approved by the Tax Code of the Russian Federation.

For each tax, fee or other payment, there are individual forms and reporting forms and deadlines within which information must be provided to the Federal Tax Service. If this is not done, the taxpayer will be punished - a fine will be issued. The reason for failure does not matter; punishment is avoided only in exceptional cases.

Use free access to instructions and samples from ConsultantPlus experts to correctly fill out and submit all declarations and other reports on time.

Results

For late submission of the declaration, there is a fine, the amount of which depends on the number of months of delay and the amount of tax due. Judicial practice on the issue of imposing a fine for late submission of a zero declaration is ambiguous, and officials believe that the absence of the amount of tax payable and the absence of arrears is not grounds for exemption from liability.

See also the material “Amounts of fines for failure to submit tax reports.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Amounts of fines

For all organizations and entrepreneurs, uniform provisions apply to penalties for failure to submit a tax return. Payers are fined in the amount of 5% of the amount of the unpaid fiscal obligation. Moreover, this 5% will be charged for each month of delay, full or incomplete. The total amount of the penalty does not exceed 30% of the amount of tax not paid on time, but the taxpayer will pay no less than 1000 rubles (Part 1 of Article 119 of the Tax Code of the Russian Federation, letter of the Ministry of Finance No. 03-02-08/47033 dated 08/14/2015).

Administrative fine for declaration

Violation of the deadlines for submitting a tax return is also an administrative offense under Art. 15.5 of the Code of Administrative Offenses of the Russian Federation, for which taxpayer officials may be brought to administrative liability in the form of a warning or a fine in the amount of 300 rubles. up to 500 rub. Such an official may be the head of the organization, the chief accountant or another person who is responsible for accounting and taxes.

As for individual entrepreneurs, Art. 15.5 of the Code of Administrative Offenses of the Russian Federation does not apply. They only pay a tax penalty under Art. 119 of the Tax Code of the Russian Federation (Articles 2.4, 15.3 of the Code of Administrative Offenses of the Russian Federation).

And don’t forget that an overdue declaration or DAM may block your account.

Read more in our section “Account blocking”.

Example of calculating a fine

Let us give the calculation of the fine for late filing of a declaration using the example of Ppt.ru LLC. The company submitted a VAT return report to the Federal Tax Service for the 4th quarter of 2022 late - 01/31/2022. Let us remind you that the deadline for submitting VAT documents for the 4th quarter of 2022 is until January 25, 2022.

The amount of value added tax according to the report for the 4th quarter amounted to 1,200,000 rubles. Only a third of the total amount was transferred to the budget late - 400,000 rubles (1,200,000 / 3). The date of payment to the Federal Tax Service is 01/25/2022.

Submission of VAT documents and payment were overdue by 6 days. The punishment is calculated as follows:

400,000 × 5% × 1 month. (one incomplete month of delay) = 20,000 rubles.

If Ppt.ru LLC had paid VAT on time, the tax authorities would have issued a fine for late filing of the VAT return in the amount of 1,000 rubles.

IMPORTANT!

If a company has not submitted income tax documentation for the reporting period (quarter, month), then the penalty for late filing of a tax return will be only 200 rubles. The grounds are enshrined in clause 1 of Art. 126 of the Tax Code of the Russian Federation, letter of the Federal Tax Service No. SA-4-7/16692 dated 08/22/2014.

For example, Ppt.ru LLC reported income tax for the 1st quarter of 2022 late - 05/20/2022. The date regulated at the legislative level is 04/28/2022.

Tax authorities will impose a fine of 200 rubles. Moreover, the amount of the penalty does not depend on the time of delay and the amount of the advance payment.

It is possible to mitigate the sanctions applied to the taxpayer; to do this, prepare an application to the Federal Tax Service.

Read more: “How to file a petition to reduce a fine to the tax office”

Blocking the organization's current account

The Federal Tax Service may block a current account if there is a delay in filing a VAT return, profit, property, payment of insurance premiums or calculation of 6-NDFL.

To be blocked, it is enough to fail to submit at least one declaration or calculation. Operations on the account will be suspended if the period of delay is more than 20 working days (clause 1, clause 3, article 76 of the Tax Code of the Russian Federation).

In this case, the tax authorities can notify the taxpayer about the possible blocking of the account due to failure to submit reports no later than 14 days before the actual blocking (Clause 3.3. Article 76 of the Tax Code of the Russian Federation). The notification can be seen in the taxpayer’s personal account on the Federal Tax Service website. But please note that a warning is not an obligation; the Federal Tax Service may not send a notification .

The account is unblocked only after the debt has been paid and the tax office has decided to unblock it.

How to fine for other reporting

If a company does not report on time for other types of fiscal reporting, then it faces the following sanctions:

| Base | Recovery amount |

| Failure to submit 6-NDFL calculation | 1000 rubles for each full and partial month of delay |

| Late submission of annual financial statements to the Federal Tax Service | 200 rubles for each form not submitted |

For failure to pay insurance premiums, the punishment is similar to general fines - 5% for full and partial months of delay. The total amount of the penalty will be no less than 1000 rubles and no more than 30% of the amount of tax payable.

The penalty for late submission of the 4-FSS report to Social Insurance is calculated as follows: 5% of the amount of insurance premiums accrued for payment for the last three months of the reporting period, for each full or partial month from the date of submission (Part 1 of Article 26.30 125-FZ dated July 24 .1998). The minimum amount of recovery is 1000 rubles, the maximum is 30% of the accrued amount of insurance premiums.

IMPORTANT!

Officially, there is no penalty for failure to submit the 2022 unified return on time: filing the UUD is a choice, not an obligation of the taxpayer. But Federal Tax Service inspectors believe this: the EUD replaces reporting on several taxes, and if the payer lately submitted or did not submit these reports or did not submit a simplified form, then he will be punished according to a single rule - from 5 to 30%, but not less than 1000 rubles for each failure to submit declaration. But representatives of the Ministry of Finance have a different position: taxpayers have the right, but not the obligation, to submit a UUD (letter of the Ministry of Finance No. 03-02-07/2-154 dated November 12, 2012). If taxable items are found on the payer, then clarification in the Unified Tax form cannot be submitted - you must report on all taxes. If the simplified declaration is not submitted, then no fine will be imposed for failure to submit it. But an organization or individual entrepreneur will be fined for all non-filed zero declarations - 1000 rubles for each (Part 1 of Article 119 of the Tax Code of the Russian Federation).

The penalty for failure to submit pension reports in the SZV-M form will be from 300 to 500 rubles per official (Part 1 of Article 15.33.2 of the Code of Administrative Offenses of the Russian Federation, clause 42 of the Instructions from Order of the Ministry of Labor of Russia No. 211n dated 04/22/2020). Plus, for each insured person from an overdue report, you will have to pay another 500 rubles (Article 17 27-FZ of 04/01/1996).

When declarations and calculations are considered not submitted

From July 1, 2022, new cases will appear in which the tax office will consider declarations and calculations unsubmitted.

Amendments to Art. 80 of the Tax Code of the Russian Federation is introduced by Federal Law No. 374-FZ of November 23, 2020. They will be valid for declarations and settlements submitted after July 1, 2021. Declarations and calculations will be considered unsubmitted if during a desk audit it turns out that they:

- signed by an unauthorized person (the director refused to sign and submit the declaration);

- signed by an individual who has been disqualified for an administrative offense and whose period of disqualification has not expired at the time of reporting;

- signed by the UKEP of an individual who, on the date of signing the document, is considered dead according to the registry office;

- signed by a person for whom a record of unreliability of information was made in the Unified State Register of Legal Entities before the date of filing the reports;

- represented by a legal entity in respect of which a record of the termination of the existence of the legal entity was made in the Unified State Register of Legal Entities;

- are presented in violation of a number of particularly important control ratios (hereinafter referred to as CR) for the DAM and VAT declaration.

Let's look at the CS separately.

Control ratios for RSV

If the rules specified in clause 7 of Art. are violated in the RSV. 431 of the Tax Code of the Russian Federation, the calculation will not be accepted. There is no news here, this procedure is still in effect now. Let us remind you that the DAM is considered unrepresented if:

- there are errors in the amounts of payments and other remuneration to individuals;

- the base for contributions to compulsory pension insurance and the amount of contributions is incorrectly calculated;

- the sums of the same indicators for all individuals do not correspond to the same indicators for the payer as a whole;

- The calculation contains inaccurate personal data.

Automatically check the RSV using control ratios and submit via the Internet

Control ratios for VAT

In Art. 174 of the Tax Code of the Russian Federation added clause 5.3, which states that the VAT declaration must comply with the Constitutional Code in order to be accepted. The draft order of the Federal Tax Service with the 14th Constitutional Court for verifying VAT returns was submitted to the federal portal of draft regulatory legal acts on March 16, 2022.

The list of KS is not new, they are regulated by letter dated 03.23.15 No. GD-4-3 / [email protected] and are implemented in many accounting systems. But previously, if they were not fulfilled, the tax office did not refuse to accept declarations.

| № | Control ratio | Decoding |

| 1 | R. 3. art. 200 gr. 3 = r. 3. art. 118 gr. 5 - Art. 190 gr. 3 | The final amount of tax payable to the budget under Section 3 must be equal to the total amount of calculated tax under Section 3 minus all deductions from Section 3 |

| 2 | Art. 040 rub. 1 = (Art. 200 R. 3 + Art. 130 R. 4 + Art. 160 R. 6) - (Art. 210 R. 3 + Art. 120 R. 4 + Art. 080 R. 5 + Art. 090 RUR 5 + RUR 170 6) | The amount of tax payable, which is reflected for each section of the declaration 3, 4 and 6, minus deductions for all sections 3, 4, 5 and 6, must be equal to the total amount payable, reflected in line 040 of section 1 |

| 3 | gr. 5 tbsp. 118 rub. 3 + amount of art. 050 and 130 rub. 6 + amount of art. 060 for all sheets of the river. 2 + amount of art. 050 rub. 4 + art. 080 rub. 4 = [st. 260 + art. 265 + art. 270] p. 9 + [st. 340 adj. 1 to r. 9 dVAT + art. 345 adj. 1 to r. 9 dVAT + art. 350 adj. 1 to r. 9 dVAT - Art. 050 adj. 1 to r. 9 - Art. 055 adj. 1 to r. 9 dVAT - Art. 060 adj. 1 to r. 9 dVAT] | The total amount of VAT under section 3 without taking into account deductions plus the amount paid as a tax agent on all sheets of section 2, and the amount of VAT reflected in section 4 must be compared with the reflected VAT on the sales book and the additional sheet of the sales book, if any. |

| 4 | Art. 190 rub. 3 + amount line 030 and 040 rub. 4 + art. 080 and 090 rub. 5 + art. 060 rub. 6 + art. 090 rub. 6 + art. 150 rub. 6 = st. 190 rub. 8 + [st. 190 adj. 1 to r. 8 - Art. 005 adj. 1 to r. 8] | The total amount of tax deductions under sections 3, 4, 5, 6 must be equal to the amount of VAT deductions in the purchase book and additional items. sheet to it |

| 5 | amount art. 180 rub. 8 = st. 190 on the last page p. 8 | The VAT amount for all invoices in the purchase ledger must be equal to the total VAT line in the purchase ledger |

| 6 | page 005 adj. 1 to r. 8 dVAT + amount art. 180 adj. 1 to r. 8 dVAT = art. 190 on the last page adj. 1 to r. 8 dVAT | The total amount of deductions for the purchase book (reflected in line 005 of the additional sheet of the purchase book) and the amount of VAT for all invoices in the additional sheet of the purchase book must be equal to the total VAT line in the additional sheet of the purchase book |

| 7 | amount art. 200 rub. 9 = st. 260 rub. 9 on last page | The amount of VAT at a rate of 20% on all invoices in the sales ledger must be equal to the final line for VAT at a rate of 20% in the sales ledger |

| 8 | amount art. 210 rub. 9 = st. 270 rub. 9 on last page | The 10% VAT on all invoices in the sales ledger must be equal to the 10% VAT total in the sales ledger. |

| 9 | amount art. 205 rub. 9 = st. 265 rub. 9 on last page | The amount of VAT at a rate of 18% on all invoices in the sales book must be equal to the final line of VAT at a rate of 18% in the sales book |

| 10 | Art. 050 adj. 1 to r. 9 dVAT + amount art. 280 adj. 1 to r. 9 dVAT = art. 340 adj. 1 to r. 9 dVAT | The total amount of VAT at a rate of 20% for the sales book (reflected in line 050 of the additional sheet of the sales book) and the amount of VAT for all invoices in the additional sheet of the sales book at a rate of 20% must be equal to the final VAT line in the additional sheet of the sales book |

| 11 | Art. 060 adj. 1 to r. 9 dVAT + amount art. 290 adj. 1 to r. 9 dVAT = art. 350 adj. 1 to r. 9 dVAT | The total amount of VAT at a rate of 10% for the sales book (reflected in line 050 of the additional sheet of the sales book) and the amount of VAT for all invoices in the additional sheet of the sales book at a rate of 10% must be equal to the final VAT line in the additional sheet of the sales book |

| 12 | Art. 055 adj. 1 to r. 9 dVAT + amount art. 285 adj. 1 to r. 9 dVAT = art. 345 adj. 1 to r. 9 dVAT | The total amount of VAT at a rate of 18% for the sales book (reflected in line 050 of the additional sheet of the sales book) and the amount of VAT for all invoices in the additional sheet of the sales book at a rate of 18% must be equal to the final VAT line in the additional sheet of the sales book |

| 13 | A payer using the simplified tax system has submitted a VAT return with section 12 completed, but the amount of tax payable under section 1 is missing | Organizations using the simplified tax system that issue invoices to customers with the allocated tax amount fill out sections 1 and 12 in the declaration (clause 3 of the Filling Out Procedure, approved by order of the Federal Tax Service dated October 29, 2014 No. ММВ-7-3/ [email protected] ). Quite often, taxpayers using the simplified tax system mistakenly fill out other sections or forget to reflect the amount payable on line 030 of section 1 of VAT. |

| 14 | The taxpayer of the simplified tax system submitted a VAT return in which section 8 was completed | To accept VAT as a deduction, you need to fulfill the basic conditions from clause 2 of Art. 171, art. 172 of the Tax Code of the Russian Federation. One of them: to be a VAT payer and not to apply exemption from this tax. Thus, taxpayers using the simplified tax system do not have the right to deduction and therefore do not fill out the purchase book |

These CS are a simple control for the final total indicators. In the declaration, you need to check the amount of tax deductions, restored VAT, calculated tax, the total amount of VAT payable (reimbursement) and the total indicators of the purchase and sales books.

Extern will warn you about violation of VAT control ratios and will not allow you to send a declaration with errors.

Try for free

In addition, from July 1, 2022, explanations at the request of the tax authority during a desk audit of the VAT return will not be considered submitted if they are sent to the tax authority not in the established format or on paper. Such changes have been made to Art. 88 Tax Code of the Russian Federation. Currently, only explanations on paper are considered unsubmitted.

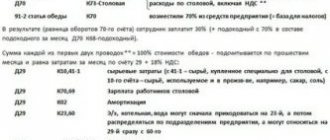

How to make transactions

Let us determine which entries will reflect the sanctions in accounting.

Here's how to charge a fine for late submission of accounting reports:

Debit 99 Credit 68.

Reflect the payment of the amount to the state budget with the following entry:

Debit 68 Credit 51.

If the penalty is imposed for failure to submit reports on insurance contributions, then reflect the transactions in the same way, but using account 69 “Calculations for social insurance and security” instead of 68. Note that sanctions for failure to submit reports in forms 4-FSS and SZV-M should be attributed to 69 accounting account.

IMPORTANT!

Reflection of the amounts of sanctions in accounting does not reduce the size of the tax base for fiscal obligations, fees and contributions.

Reflect accrued penalties on account 91, since these types of expenses cannot be attributed to accounting account 99. Penalties are not included in tax sanctions.

How to find out if admission has been refused

If the tax office detects at least one of the circumstances listed above, then no later than five days from the date of its establishment it will notify you that the declaration (calculation) is considered unsubmitted.

For DAM and VAT returns in which control ratios are not observed, the rules and deadlines are different. If the reports are submitted electronically, the tax office will notify you no later than the next working day after receipt. If you submitted the RSV on paper, then the tax office will have 10 days from the date of receipt. There are no other deadlines for a paper VAT return.

Having received such a notification, the taxpayer must, within five days (10 days if the notification is received on paper), submit a declaration or calculation in which the inconsistencies with the control ratios are eliminated. If you do it on time, the tax office will consider that you reported on the deadline in which you submitted the first report, which was recognized as unsubmitted.

Example. The organization sent the initial VAT return on July 26, 2022 (July 25 fell on a Sunday). On the same day, a notification was received that the declaration was declared unsubmitted for the unfulfilled CC. The company filed an amended initial return on July 28. The resubmitted declaration was accepted successfully. In this case, the date of submission of the primary declaration is considered to be July 26.

Non-payment of tax

This group also includes two types of violations:

1. Non-payment or payment of tax not in full (Article 122 of the Tax Code of the Russian Federation) due to errors in calculating the tax base or due to non-payments. In the most common cases, the fine is 20% of the underpaid amount (Clause 1 of Article 122 of the Tax Code of the Russian Federation).

IMPORTANT! There will be no fine if the correct amount of tax is indicated in the declaration, but the tax is not transferred to the budget on time (clause 19 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57). In this case, the tax office will only charge a penalty for late payment. Our calculator will help you calculate the amount of the penalty.

If the situation concerns an understatement of the base for transactions between interdependent persons, then they will be fined 40% of the underpaid tax - at least 30,000 rubles. (clause 1 of article 129.3 of the Tax Code of the Russian Federation). But it can be avoided if the company proves that the prices for such transactions corresponded to market prices (clause 2 of Article 129.3 of the Tax Code of the Russian Federation).

If a company does not take into account the income of a controlled foreign company in its profit, it will be assessed a fine in the amount of 20% of the underpaid tax - at least 100,000 rubles. (Article 129.5 of the Tax Code of the Russian Federation).

If the tax authorities prove a deliberate understatement of the tax base, then the culprit will be charged 40% of the underpaid tax (clause 3 of Article 122 of the Tax Code of the Russian Federation).

IMPORTANT! Company officials may face criminal liability if the amount of arrears is significant (Article 199, 199.1 of the Criminal Code of the Russian Federation).

From punishment under Art. 122 of the Tax Code of the Russian Federation, the law exempts a responsible participant in a consolidated group of taxpayers if the distortion occurred through the fault of one of its participants who reported incorrect facts for the preparation of reports (clause 4 of Article 122 of the Tax Code of the Russian Federation). In this case, the punishment under Art. 122 of the Tax Code of the Russian Federation will be incurred by the participant guilty of distorting data (Article 122.1 of the Tax Code of the Russian Federation).

2. If a taxpayer fails to pay income tax on time, he will be charged a penalty.

EXAMPLE of calculating penalties from ConsultantPlus: At the end of the year, the organization calculated income tax in the amount of: 45,000 rubles. for payment to the federal budget; 255,000 rub. for payment to the regional budget. For a complete example, see K+. It's free.

The calculated tax amounts were paid on April 30.

3. Failure by a tax agent to withhold and pay tax (Article 123 of the Tax Code of the Russian Federation). This applies to companies paying, for example, dividends. The fine is 20% of the tax amount.

Fines belonging to this group are assessed only on the amounts of taxes that were not paid at the time of the inspection (office or on-site). If the tax is paid before the audit, albeit late, then penalties are charged on the tax paid late. However, the issue of calculating fines does not apply to advance payments of income tax. Only penalties are charged on them.

For information on income tax on dividends, read the article “How to correctly calculate the tax on dividends?”

Get free trial access to the materials of the ConsultantPlus system and study expert comments on the legality of bringing to responsibility for non-payment of tax under Art. 122 and 123 of the Tax Code of the Russian Federation.

Filling out the simplified tax system declaration

The order of the Federal Tax Service of Russia dated December 25, 2020 No. ED-7-3/958 provides the complete procedure for filling out the simplified tax system declaration for 2022. The form can be found in the same document. It will also be relevant for reporting for 2021.

Please note that when filling out, all amounts are written in full rubles according to the standard rounding rule (over 0.5 kopecks inclusive - up, less - down). A document submitted in paper form cannot be corrected using strikethroughs or a proofreader.

The declaration form under the simplified tax system for 2022 is filled out as follows:

1. Title page (to be completed by all payers).

- At the top of the form, on each page, the TIN and KPP of the company (or individual entrepreneur), as well as the page number of the declaration, are written down.

- We enter the code for the period for which the tax is paid. Most often this will be the 34th calendar year. Next, the year for which the document is being drawn up is written down. In our case, this is 2022.

- The code of the inspection where the reports are submitted is entered, as well as the code of the place where the declaration is submitted (120 for individual entrepreneurs, 210 for a company).

- The legal entity's full name is disclosed in the declaration. The individual entrepreneur enters his last name, first name, patronymic (each word on a new line). Next we enter OKVED. It is taken from an extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs, which you can generate on the Federal Tax Service website.

- Lastly, at the top of the title page, the contact number and the number of pages of the declaration itself and supporting documents are entered.

- It is also necessary to fill out the section about the person confirming the accuracy of the data in the document. This is either the payer himself (number “1” in the corresponding field) or his authorized representative (number “2”). An individual entrepreneur does not re-register his full name. For an organization, as a rule, its head is indicated.

2. Section No. 1.1 (for the “income” system).

- In blocks 010, 030, 060, 090, enter the code OKTMO. If you were at your previous address and, accordingly, did not change the inspection, only the first of them is filled out. The rest are marked with a dash. OKTMO may occupy fewer cells than proposed in the declaration. An example of filling out the line in this case is “40336000—”.

- Simplified advance payment is made once a quarter. The tax paid by a company or individual entrepreneur for three months is indicated in line 020, for a period of six months - in line 040. At the same time, the advance sent to the budget for six months is reduced by the payment that has already been made for the first quarter.

- Line 050 has a numerical value if the difference between the advances accrued by the accountant for the half-year and for the first quarter is less than zero. For example, for the first three months the simplified payment amounted to 15,000 rubles. Over six months of operation, revenues fell compared to costs. As a result, the tax advance for six months amounted to only 10,000 rubles. In this case, line 050 indicates the amount to be reduced in the amount of 5,000 rubles.

- Line 070 shows the tax paid based on the results of nine months. The accrued advance is reduced by the funds already transferred. Line 080 is filled in similarly to line 050.

- Field 100 indicates the amount that will need to be paid at the end of the year minus all advances for the simplified tax. Line 110 will have a numerical value if advances exceed the tax calculated for the year.

3. Section No. 1.2 (for the “income minus expenses” system).

- In general, the procedure for entering information corresponds to filling out section 1.1. Lines 010-110 contain the same information: OKTMO code and the corresponding amounts of payments for the simplified tax.

- The difference for the “income minus expenses” scheme is the need to calculate the minimum tax (1% of all income for the year). The minimum tax at the end of the year is paid if it exceeds the tax calculated in the usual manner. In this case, this amount should be entered on line 120. Sometimes situations arise when the advance payments already transferred are greater than the minimum tax. Then the field is left empty.

4. In the second part of the declaration, you disclose the calculation of the tax that you pay at the end of the year.

5. Section No. 2.1.1 (for the “income” system).

- Line 102: the tax payer attribute is noted. There are two options here. You can have employees and act as a tax agent for personal income tax and pay contributions for them (number “1”). The second case (number “2”) concerns individual entrepreneurs who do not pay any remuneration to individuals.

- Lines 110-113 reveal the tax base - the income that you received on an accrual basis from the beginning of the year.

- The tax rate is entered in fields 120-123. Please note that for your region it may be different from that specified in the Tax Code. If this is the case, the applied rate must be justified in the field “Justification for the application of the tax rate established by the law of the constituent entity of the Russian Federation.”

- Lines 130-133 provide the calculation of advance payments and taxes. To do this, the rate is multiplied by the amount of income corresponding to the period.

- Simplifications in the “income” scheme reduce the tax on insurance premiums paid. These amounts are disclosed in fields 140-143. Companies or individual entrepreneurs with hired employees are allowed to reduce their simplified payments through contributions by no more than 50%. Please note that the form indicates only the amount that we deduct (no more than 50% of the simplified tax). If you are an individual entrepreneur and pay fixed contributions for yourself, then this limit does not affect you - you can reduce the tax on at least all contributions. In this case, the amounts indicated in lines 140-143 should not exceed the tax.

6. Section No. 2.1.2. To be completed only by those persons on the “income” chart who pay the trading fee. The introduction of this part of the declaration is due to the fact that persons contributing this fee to the budget can reduce the simplified tax by its amount.

7. Section No. 2.2 (for the “income minus expenses” system).

- In the first block 210-213, the income of the simplifier is indicated on an accrual basis.

- In the second part, lines 220-223 disclose expenses.

- Field 230 records the loss that was received in earlier periods. You can use it to reduce your tax base.

- Lines 240-243 calculate the tax base itself (income minus expenses). If you receive a loss, then this difference is noted on lines 250-253.

- Fields 260-263 indicate the rate at which the tax is determined in your region.

- Lines 270-273 disclose the amount of advance payments under the simplification and the tax itself for the year.

- Field 280 is required to calculate the minimum tax.

8. Section No. 3. Completed when the company receives charitable assistance or targeted funding. Here it is necessary to disclose how much of the funds received were used for their intended purpose. If there are no receipts of this type, the section is not filled out.

For many fields of the declaration there are hints - formulas that provide information on how to calculate the amount for a given line. You can download the simplified tax system declaration 2022 for free on the Federal Tax Service website.

Violations of accounting rules

A number of violations that lead to sanctions under Art. are directly related to income tax. 120 Tax Code of the Russian Federation. This refers to gross violations of the procedure for accounting for expenses, income and taxable items. These include (clause 3 of article 120 of the Tax Code of the Russian Federation):

- missing primary;

- lack of tax accounting registers;

- constant (more than one case during the year) errors in recording transactions in tax registers.

Even if there is no distortion of the tax base, the following may be punished:

- for 10,000 rubles. (Clause 1 of Article 120 of the Tax Code of the Russian Federation), if violations were present during one tax period (year);

- for 30,000 rub. (Clause 2 of Article 120 of the Tax Code of the Russian Federation), if they occur over more than one tax period (year).

If such violations lead to an underestimation of the tax base, the fine will be 20% of the underpaid tax - at least 40,000 rubles. (clause 3 of article 120 of the Tax Code of the Russian Federation).